Get the free Schedule 5

Get, Create, Make and Sign schedule 5

Editing schedule 5 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out schedule 5

How to fill out schedule 5

Who needs schedule 5?

Schedule 5 Form: A Comprehensive How-to Guide

Understanding Schedule 5 Form

The Schedule 5 Form serves as a vital document in various processes, particularly in tax reporting and legal compliance. This form, utilized across different sectors, primarily aids in the documentation of specific transactions, deductions, and revenue declarations. By offering a standardized method for reporting, the Schedule 5 Form promotes consistency and transparency in paperwork.

In financial contexts, it allows individuals and organizations to itemize deductions, ensuring they receive appropriate credits. For legal purposes, it secures necessary declarations that may be required in court or compliance audits. Thus, understanding its significance is essential for effective financial management.

Who needs to use the Schedule 5 form?

Several categories of individuals and entities utilize the Schedule 5 Form. Primarily, taxpayers who wish to claim deductions, particularly in business expenses and personal allowances, must fill out this document. This includes freelancers, small business owners, and larger corporations handling complex tax situations.

Additionally, professionals like accountants and tax consultants frequently handle this form on behalf of their clients. Teams within organizations may also collaborate on filling out this form, especially during the financial closing period each year.

Step-by-step guide to filling out the Schedule 5 form

Before diving into the filling process, preparing adequately is crucial. Ensuring you have all necessary documents at hand simplifies the process significantly. Gather tax documents, income statements, and previous tax returns to facilitate accurate reporting.

Using tools such as pdfFiller can enhance document management efficiency. With pdfFiller, you can securely store all your documents, allowing seamless access while filling out your Schedule 5 Form.

Detailed instructions for each section

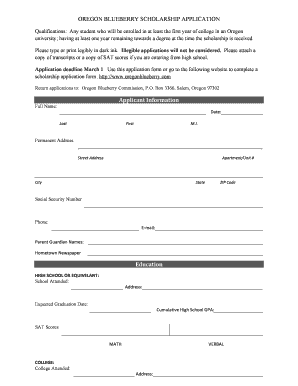

### Section A: Personal Information In this section, ensure you include your full name, address, and taxpayer identification number. Avoid leaving any fields blank, as this can lead to processing delays.

### Section B: Financial Details Accurate reporting is paramount in this section. List all relevant financial figures, including revenue, expenses, and deductions claimed. It's advisable to cross-reference these figures with your financial records for precision.

### Section C: Declaration Signing and dating the form acts as a legal commitment to the information presented. Ensure all information is true to the best of your knowledge to avoid penalties.

Common mistakes to avoid

Filing correctly is essential. Notable errors include miscalculating deductions, forgetting to sign the form, and providing outdated information. Always double-check entries and consider having another set of eyes review your form before submission.

Interactive tools to simplify the process

Using pdfFiller enhances the experience of filling out the Schedule 5 Form through its intuitive online editor. It allows users to edit PDF documents easily, empowering them to make necessary adjustments without any hassle.

The platform also enables real-time collaboration. You can invite team members to contribute, ensuring that all financial details are accurately presented without confusion.

eSigning and collaborating in real-time

Esigning using pdfFiller is straightforward. Once your Schedule 5 Form is completed, you can add your signature electronically, which saves time and enhances the process. To do this, simply select the eSignature option, and follow the prompts to sign your document.

If working within a team, pdfFiller allows for collaboration where multiple users can input data concurrently, making the process efficient and reducing misunderstandings.

Editing and managing your Schedule 5 Form

If you notice an error after submission, it’s essential to understand how to make corrections effectively. Depending on the regulations governing your area, modifications may require filing an amended form. Familiarize yourself with these regulations to ensure compliance.

Using pdfFiller's tools, you can easily carry out revisions on your previously submitted Schedule 5 Form. The platform offers various editing features to amend text, replace information, or even add new sections, making it a versatile choice for document management.

Storing and organizing your forms

Effective organization of your forms is crucial. Develop a systematic approach to digital filing, such as categorizing by year or document type. Using pdfFiller's cloud storage solutions makes this process easier and ensures your documents are accessible from anywhere.

Additionally, utilize tags or labels within pdfFiller to find documents quickly. This capability will save you significant time when retrieving important files later on.

Frequently asked questions about Schedule 5 forms

One common question revolves around the implications of filing the Schedule 5 Form late. Filing it past the deadline can result in penalties or interest charges. Staying aware of filing deadlines and compliance requirements can help avoid these issues.

Tracking the status of your filed form can typically be done through the tax authority's official website or customer service. Many jurisdictions provide online tracking tools for submitted documents.

Technical assistance with pdfFiller

When encountering technical issues with pdfFiller, users often have access to a help center that addresses common challenges. Whether it's problems with uploading, editing, or sharing documents, most questions can be answered with a quick search.

For more complex issues, pdfFiller offers customer support, which can provide tailored assistance based on your specific situation.

Advanced tips for utilizing the Schedule 5 form effectively

Leveraging pdfFiller's features can significantly streamline your form management process. For instance, creating templates of completed Schedule 5 Forms can save you time in future filings. This feature is especially useful for businesses that repeatedly fill out similar forms each year.

Automation of document workflows is another high-value feature. You can set reminders for deadlines or automate notifications to team members for collaborative sign-offs, ensuring that everyone remains in the loop.

Understanding compliance and legal aspects

Navigating compliance when using the Schedule 5 Form is paramount. Always stay updated on local tax regulations or legal requirements that impact your submissions. Organizations often consult with legal advisors to ensure all documentation adheres to the necessary standards.

Establishing best practices within your team regarding document completion and electronic submission minimizes the risk of errors and keeps your documents organized, reinforcing legal standards.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find schedule 5?

Can I create an electronic signature for signing my schedule 5 in Gmail?

How do I complete schedule 5 on an Android device?

What is schedule 5?

Who is required to file schedule 5?

How to fill out schedule 5?

What is the purpose of schedule 5?

What information must be reported on schedule 5?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.