Get the free Restricted Bequest to Grace Community Church for a Permanent Endowment

Get, Create, Make and Sign restricted bequest to grace

Editing restricted bequest to grace online

Uncompromising security for your PDF editing and eSignature needs

How to fill out restricted bequest to grace

How to fill out restricted bequest to grace

Who needs restricted bequest to grace?

A comprehensive guide to the restricted bequest to grace form

Understanding restricted bequests

A restricted bequest is a specific type of gift made through a will or trust where the donor places conditions on how the assets can be used after their death. Unlike unrestricted bequests, which allow beneficiaries the flexibility to utilize the assets at their discretion, restricted bequests require the funds or assets to be allocated toward a particular purpose. This form of giving plays a critical role in estate planning, as it ensures that the donor's intentions are honored beyond their lifetime.

The importance of restricted bequests in estate planning cannot be understated. They serve as a mechanism for individuals who wish to support specific causes, values, or organizations, ensuring that their financial legacy aligns with their personal beliefs. Common purposes for restricted bequests include funding scholarships, supporting specific programs at nonprofits, or contributing to particular projects within organizations.

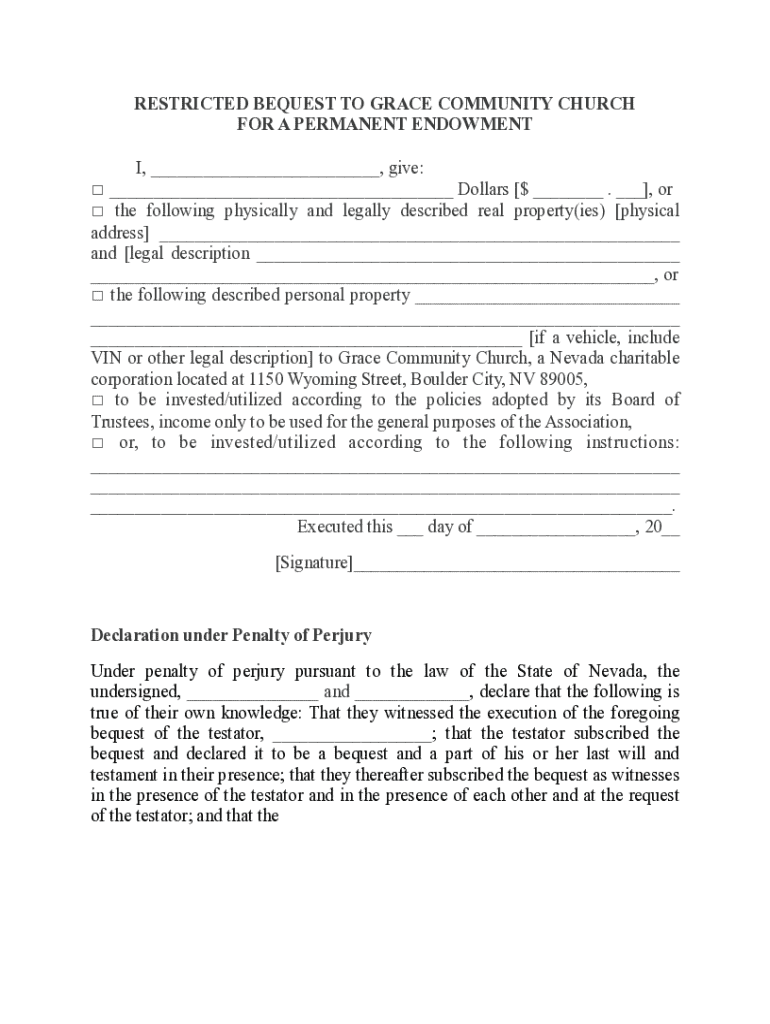

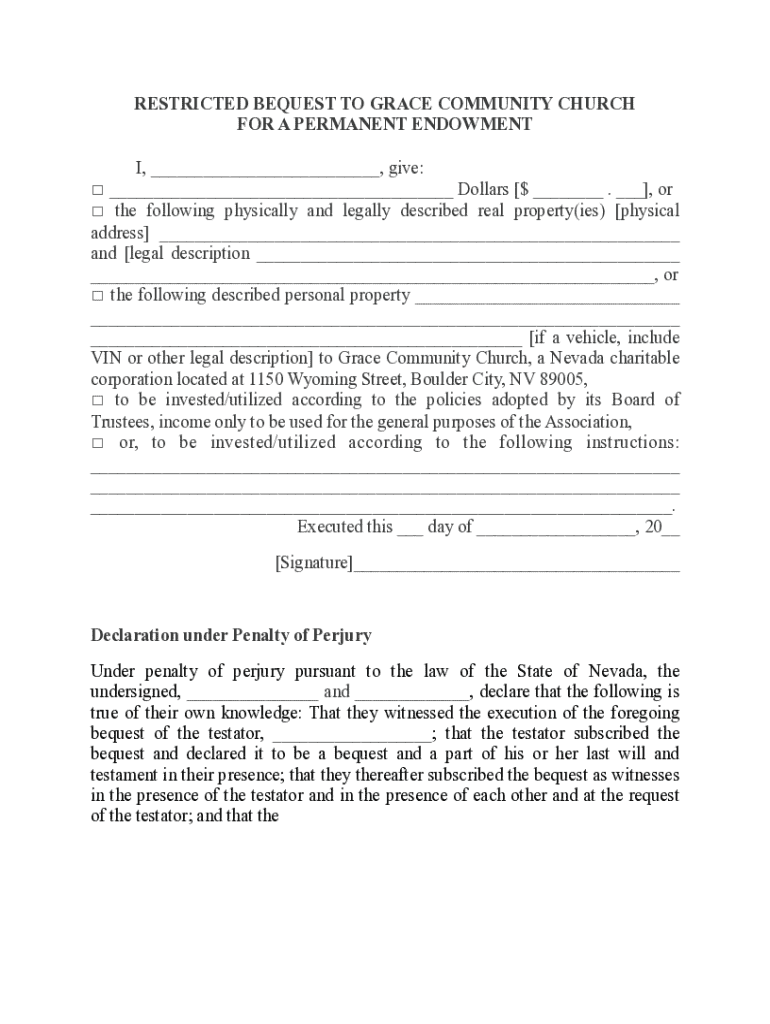

Overview of the grace form

The Restricted Bequest to Grace Form is a critical document designed to facilitate the creation of a legally binding restricted bequest. It formalizes the donor's intentions regarding how their assets should be utilized by the beneficiary, Grace. This form is especially beneficial for ensuring clarity and legal validity in outlining restrictions, thereby reducing the possibility of disputes or misunderstandings among heirs or beneficiaries.

Key features of the Grace Form include sections for detailing the donor’s personal information, the specific beneficiary, and the intended purposes of the gift. Additionally, it accommodates any specific restrictions, such as conditions surrounding the use of funds, ensuring the bequest aligns with the donor’s wishes.

Who should use the restricted bequest to grace form?

Individuals considering their estate planning have a significant stake in employing the Restricted Bequest to Grace Form. It allows them to communicate their intentions clearly and enables them to designate a legacy that reflects their values. This form can be pivotal for anyone looking to provide precise instructions for their assets after passing.

Nonprofits and charitable organizations often find this form invaluable. It assists organizations in formalizing donor contributions. Legal advisors and estate planners also benefit from utilizing this form, as it streamlines the process of creating bequests that meet legal requirements while respecting the donor's desires.

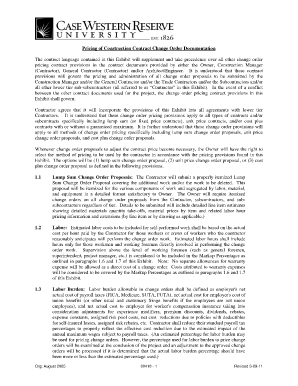

Step-by-step guide to filling out the grace form

Filling out the Restricted Bequest to Grace Form requires careful consideration and attention to detail. Start by gathering all required information, including personal data, details of the beneficiary, and the specific restrictions you wish to impose on the bequest.

The form consists of several sections that need to be filled out clearly. Section 1 gathers donor information, Section 2 designates the beneficiary, Section 3 outlines specific terms and restrictions, and Section 4 addresses witness and signature requirements.

To ensure accuracy, it’s crucial to avoid common mistakes such as missing signatures or not detailing the restrictions clearly. Additionally, consulting a legal advisor at this stage can help affirm the legal validity of your document.

Editing and customizing the grace form

pdfFiller provides robust editing tools to customize the Restricted Bequest to Grace Form according to your specifications. With its user-friendly interface, accessing your form on pdfFiller is simple and effective, allowing you to edit text, add signatures, and insert any required fields with ease.

The saving and version control features of pdfFiller facilitate easy management of document changes. You can keep track of edits and ensure that you always work with the latest version of the form.

eSigning the grace form

The use of electronic signatures in legal documents is growing due to its convenience and efficiency. pdfFiller’s eSignature feature allows you to sign the Restricted Bequest to Grace Form digitally, streamlining the process without the need for physical paperwork.

Best practices for collecting signatures include ensuring all parties have verified their identities and checking that everyone understands the document before signing. This not only promotes transparency but also protects the legal standing of the bequest.

Managing your restricted bequest document

Once your Restricted Bequest to Grace Form is complete, it’s essential to manage it effectively. pdfFiller offers cloud storage solutions that allow you to securely save your document while providing easy access from anywhere.

Organizing and retrieving your documents is straightforward with pdfFiller’s features. You can utilize collaboration tools for sharing your bequest document with legal advisors, which ensures all parties remain informed and engaged. Keeping track of updates or changes is equally straightforward, allowing you to modify the document as your circumstances or intentions evolve.

Legal considerations and recommendations

Consulting with a legal professional is paramount when dealing with restricted bequests. Laws regarding wills and bequests can vary significantly by state, and having an attorney review your Restricted Bequest to Grace Form will ensure compliance with local regulations.

Understanding state-specific laws related to bequests is crucial to avoid potential complications. Resources for finding legal assistance, such as state bar associations or legal aid websites, can be invaluable when navigating the legal landscape of estate planning.

Frequently asked questions (FAQs)

If you're new to the concept, you may have some questions about restricted bequests. Here are common inquiries answered:

Personal stories and successful implementations

Numerous individuals have successfully utilized restricted bequests to leave a lasting impact. For example, one case study involves a donor who established a scholarship fund for underprivileged youth through a restricted bequest. This act not only fulfilled their personal mission but also changed countless lives for the better.

Testimonials from pdfFiller users highlight the simplicity and efficiency of using the Grace Form. By allowing users to tailor their documents easily and ensuring that they can maintain legal compliance, users have expressed gratitude for the platform's versatility and user-friendly nature.

Exploring additional features on pdfFiller

pdfFiller not only streamlines the creation of the Restricted Bequest to Grace Form but also offers a broad array of related document templates. This extensive library can cater to various needs, from legal documents to business agreements.

Integrations with other software tools add enhanced functionality, making pdfFiller truly versatile. The benefits of this cloud-based solution for document management cannot be overstated, as it simplifies the process of creating, editing, and managing important documents from any device, at any time.

Get started with your restricted bequest to grace form

To take the steps toward securing your legacy, visit pdfFiller and create your account. The platform’s user-friendly design ensures that getting started is effortless, and its exclusive features for new users enhance your experience.

Explore the features available on pdfFiller and leverage them to craft your Restricted Bequest to Grace Form today, protecting your intentions for tomorrow.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify restricted bequest to grace without leaving Google Drive?

How can I send restricted bequest to grace to be eSigned by others?

Can I sign the restricted bequest to grace electronically in Chrome?

What is restricted bequest to grace?

Who is required to file restricted bequest to grace?

How to fill out restricted bequest to grace?

What is the purpose of restricted bequest to grace?

What information must be reported on restricted bequest to grace?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.