Get the free Reconsideration of Value Request Form

Get, Create, Make and Sign reconsideration of value request

How to edit reconsideration of value request online

Uncompromising security for your PDF editing and eSignature needs

How to fill out reconsideration of value request

How to fill out reconsideration of value request

Who needs reconsideration of value request?

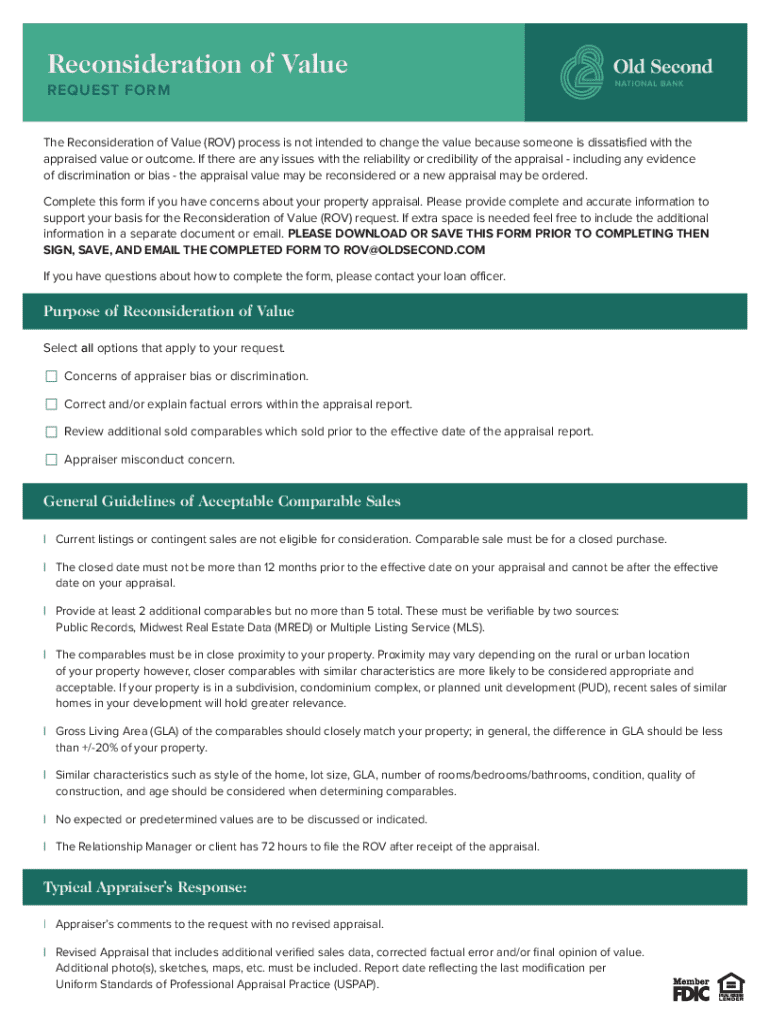

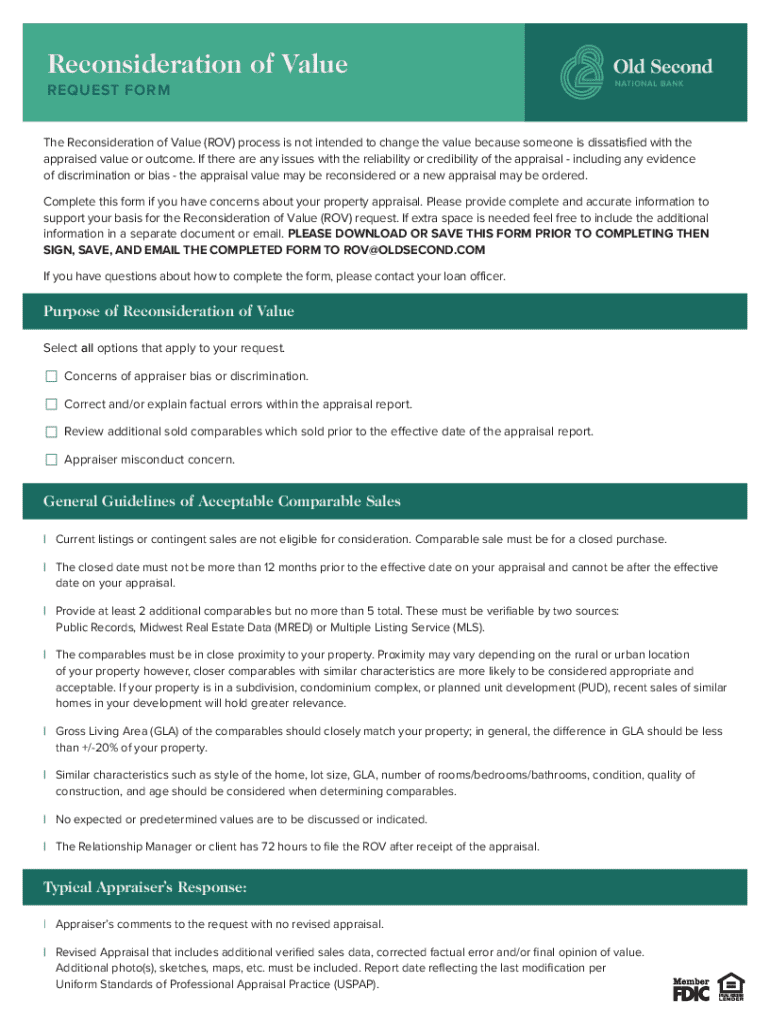

Comprehensive Guide to the Reconsideration of Value Request Form

Understanding the reconsideration of value request

A reconsideration of value request is a formal appeal process that property owners can utilize when they believe their property tax assessments are inaccurate. Essentially, this process allows property owners to contest the assessed value of their property as determined by local tax authorities. Filing this request is crucial for those seeking to lower their tax liability based on a reassessment that may not align with the current market value or condition of their property.

The significance of this request cannot be overstated, as it provides a platform for property owners to ensure that they are not overtaxed based on erroneous assessments. Understanding the intricacies of the process and the requirements involved is key to successfully navigating this appeal.

Who needs to file this form?

Property owners, whether individuals or businesses, who believe their property value has been assessed inaccurately should file a reconsideration of value request. This group includes homeowners, commercial property owners, and possibly renters in cases where the assessed property value affects their leasing costs.

Key stakeholders in this process include local tax assessors, appraisal experts, and potentially legal advisors. Each of these parties plays a critical role in ensuring that the appeal process is conducted fairly and transparently.

Steps to fill out the reconsideration of value request form

Filing a reconsideration of value request form may seem daunting, but by breaking it down into manageable steps, the process becomes much more accessible. Each request must include accurate and compelling documentation to bolster your appeal.

Gathering required documentation

Before filling out the request, ensuring you have all necessary documentation is essential. Common documents include:

Organizing and preparing these documents involves checking their validity and ensuring that they correlate to the claims you will make in the request. Consider labeling and keeping digital copies for simplicity.

Navigating the request form

Once you have gathered the necessary documentation, the next step is filling out the reconsideration of value request form. This form typically contains several key sections:

When filling out these sections, avoid common pitfalls like leaving sections blank or providing vague information. Instead, be precise and detailed to enhance your case.

Providing evidence

Equally as crucial as filling out the form is the evidence you provide to support your claim. Types of acceptable evidence include market analyses, appraisals, and comparative ownership costs. Present your case clearly and concisely, ensuring that each piece of evidence is directly relevant to the grounds for your reconsideration.

Consider using a narrative approach to outline how the evidence reflects the issues with the initial assessment. This will help reviewers understand the rationale behind your request.

Submitting your request

After completing the reconsideration of value request form, the next step is submitting it through the appropriate channels. Knowing your options for submission can streamline the process.

Understanding submission channels

You typically have multiple options for submitting your request, each with its advantages and drawbacks:

Choose the method that aligns best with your comfort level and the urgency of your request.

Tracking your submission

Once submitted, it’s crucial to track the status of your reconsideration of value request. This allows you to stay informed of any responses or additional requirements from the tax authority.

Use tracking numbers, if provided, or directly contact the agency to inquire about the progress of your request.

What happens after submission?

After you have submitted your reconsideration of value request form, the tax authorities will review your case. Understanding the review process is important.

Review process by authorities

The review typically involves a thorough evaluation of your documentation and the reasoning behind your request. Authorities will consider your evidence against the initial assessment, with a standard timeline for decisions that can vary significantly based on the jurisdiction and backlog of requests.

Expect to receive a response within a few weeks to a few months, depending on local processing times.

Potential outcomes and next steps

Once your request is reviewed, several outcomes are possible:

Each outcome will guide your next steps, whether it's evaluating your options for appeal or collecting more information.

FAQs about the reconsideration of value request

Understanding the finer details of the reconsideration of value request process is key to avoiding pitfalls and achieving your objectives.

Common questions and clarifications

Some frequently asked questions include the timing for filing requests and criteria for evidence. Addressing these common queries upfront can provide clarity to potential filers.

Troubleshooting common issues

Encountering issues during the process is not uncommon. Common problems could range from errors in documentation to delays in processing times. Solutions might include double-checking your paperwork, following up with relevant authorities, or seeking assistance from local real estate professionals.

Utilizing pdfFiller for your request form

pdfFiller is an invaluable tool for individuals and teams looking to streamline the reconsideration of value request form process. By using this platform, you can ensure that your documentation is well-organized and easy to manage.

Editing your ROV request form with pdfFiller

Editing and customizing your reconsideration of value request form through pdfFiller is straightforward. Simply upload the form, make any necessary adjustments, and save your changes securely. With user-friendly features, you will find it easy to input your information accurately.

Signing and collaborating on your documents

Signing the request form is made seamless through pdfFiller’s eSignature feature. You can easily collaborate with team members, allowing for efficient input gathering and ensuring everyone’s perspectives are considered in the request.

Managing your documents post-submission

After submission, pdfFiller offers tools to help you organize and store your documents. You can easily access the submitted forms for future reference and manage ongoing projects related to property assessments and tax filings.

Additional support and resources

For individuals looking for assistance throughout the reconsideration process, reaching out to customer support through pdfFiller is a fantastic option. Well-trained support staff can help you navigate any complexities of the software or documentation.

Staying updated on property tax trends

Keeping abreast of changes in property tax legislation or assessment practices is essential for future filings. Subscribing to newsletters or accessing property tax assessment resources can provide insights that help you make informed decisions going forward.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my reconsideration of value request directly from Gmail?

How do I edit reconsideration of value request online?

How do I complete reconsideration of value request on an Android device?

What is reconsideration of value request?

Who is required to file reconsideration of value request?

How to fill out reconsideration of value request?

What is the purpose of reconsideration of value request?

What information must be reported on reconsideration of value request?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.