Get the free Sec. 4. Submission of estimate of expenses and revenues ...

Get, Create, Make and Sign sec 4 submission of

How to edit sec 4 submission of online

Uncompromising security for your PDF editing and eSignature needs

How to fill out sec 4 submission of

How to fill out sec 4 submission of

Who needs sec 4 submission of?

Sec 4 submission of form: A comprehensive guide

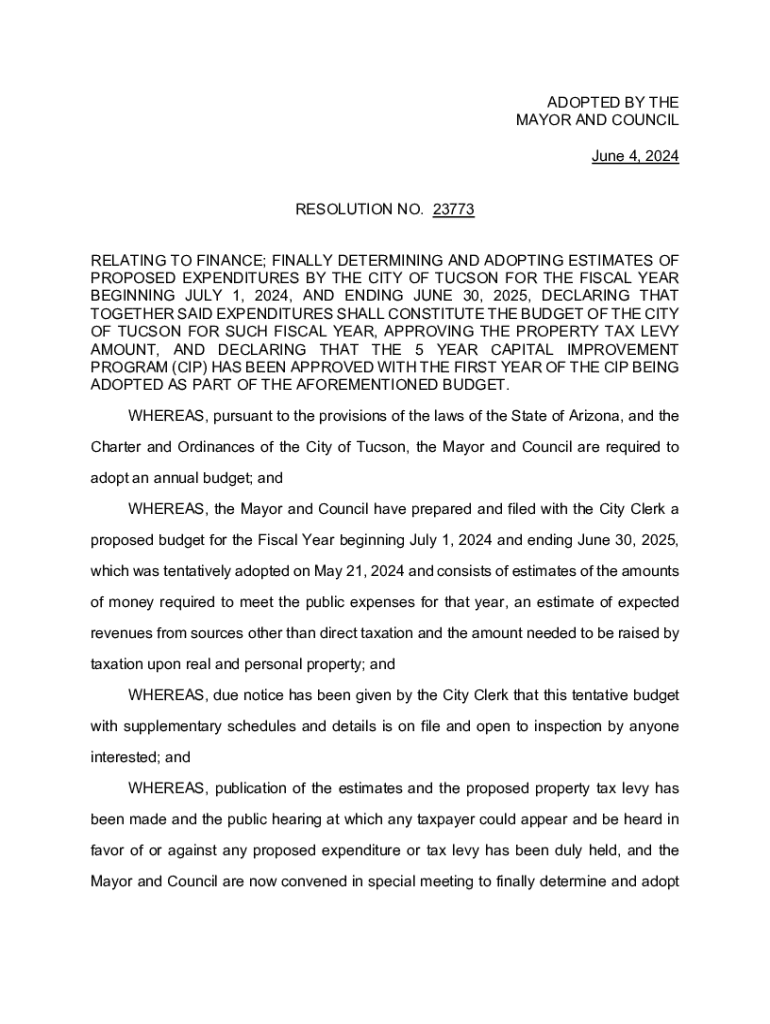

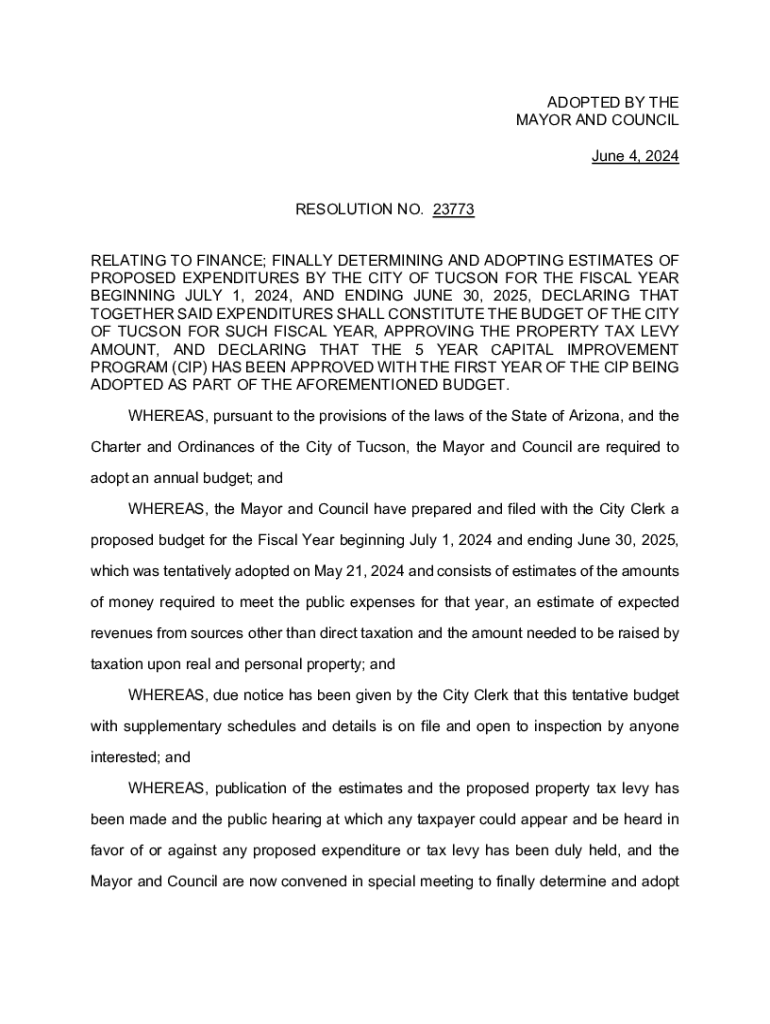

Understanding the SEC Form S-4

SEC Form S-4 is a vital document used in the realm of corporate transactions, specifically for registration under the Securities Act of 1933. The primary purpose of this form is to facilitate the process of securities offerings related to mergers, acquisitions, and other corporate restructurings. By providing a framework for companies to disclose critical information, the S-4 aims to ensure transparency and protect investors during these significant corporate changes.

Compliance with SEC regulations is not just a legal obligation but also a best practice that builds investors' trust. Entities that fail to adhere to these regulations risk penalties, including hefty fines or even litigation. The key stakeholders in the S-4 submission process include the company involved in the transaction, its legal advisors, investment bankers, and, of course, the SEC itself.

Who is required to submit Form S-4?

Entities that must file Form S-4 typically include public companies that plan on merging or acquiring other firms. Private companies pursuing a merger also fall under the requirements of this form, especially when considering an initial public offering or when their securities will be offered to the public. Certain specific situations trigger the need for submission, such as when a company restructures its capital, issues shares in exchange for assets, or engages in a business combination.

What information is included in an SEC Form S-4?

The SEC Form S-4 contains several essential components that detail the company's financial health and transaction specifics. Company information typically includes the business's name, address, and a description of its operations. Financial statements, including balance sheets and income statements, provide a snapshot of the company's economic condition. Moreover, the form necessitates insights related to the transaction itself, such as the mechanics of the merger or acquisition, sharing of expenses, and any necessary voting procedures.

In terms of disclosures, the SEC mandates the inclusion of risk factors associated with the transaction, as this helps investors assess the potential downsides. Management’s Discussion and Analysis (MD&A) is another critical element, offering management’s insights into the company’s financial condition and results of operations.

Common scenarios for filing Form S-4

Form S-4 becomes pertinent under various circumstances, most notably in mergers and acquisitions where two or more entities combine to form a new entity or where one entity acquires another. Additionally, it is relevant during the reorganization of a business structure, such as a spin-off or divestiture, where an existing business is split into separate entities.

Exchange offers and business combinations also warrant S-4 submissions, particularly when securities are exchanged in a transaction. Understanding these scenarios helps companies determine the necessity and timing of their S-4 filing.

Step-by-step guide to completing the Form S-4

Completing SEC Form S-4 requires meticulous attention to detail and comprehensive documentation. Begin by gathering all necessary documentation, including prior financial statements, articles of incorporation, and agreements pertinent to the transaction. This preliminary work is essential for ensuring that the form is filled out accurately and thoroughly.

Next, proceed to complete each section of the form meticulously. This includes filling in company details, summarizing financial records, and detailing the specifics of the transaction. To enhance the precision of data reporting, consider consulting with financial and legal advisors, who can offer expert insights into complex areas. It’s common to overlook minor details, which can lead to significant delays or even rejections, so being vigilant about these aspects is critical.

Reviewing and filing your S-4 submission

Before submitting your Form S-4 to the SEC, conducting a thorough internal review is paramount. This internal audit involves cross-referencing the document with each supporting piece of paperwork to ensure compliance and accuracy. Engaging legal and financial advisors is equally vital, as they provide an additional layer of expertise to identify potential issues and ensure that everything aligns with SEC regulations.

Once ready, the submission must be made electronically to the SEC, utilizing their EDGAR system. Post-submission, tracking your submission status becomes essential, as companies may receive automated confirmations or, in some cases, SEC comments requiring responses. Prompt attention to these items can facilitate smoother interactions with regulatory entities.

After the submission: What happens next?

After your S-4 submission, companies should be prepared for potential SEC comments, which are part of the review process. Responding to and addressing these comments is crucial for ensuring timely approval of your filing. Companies should have a plan in place for managing post-submission questions from the SEC, indicating a proactive approach to compliance and transparency.

Once approved, companies can take the vital next steps to proceed with their transactions, whether finalizing a merger or issuing new securities. Understanding the timeline and implications of this stage can enhance strategic decision-making.

Tools and resources for effective S-4 submission

Utilizing technology can significantly simplify the process of preparing and submitting Form S-4. Platforms like pdfFiller offer comprehensive solutions for document management, allowing users to edit and customize their forms easily. With features such as eSigning, users can facilitate quicker approvals, streamlining the submission process.

Moreover, various online calculators and checklists can aid in ensuring all necessary components of the S-4 are completed and compliant with SEC regulations. These tools not only enhance accuracy but also improve efficiency and ease of use.

Key considerations for future filings

As entities prepare for future S-4 filings, staying informed about regulatory changes becomes critical. The SEC evolves continuously, and being aware of these modifications can safeguard against compliance issues. Furthermore, maintaining document version control helps ensure that the most up-to-date information is presented, reflecting any changes in the transaction landscape.

Incorporating best practices for storing and managing SEC filings is also pivotal. This approach not only aids in easy retrieval of documents but also ensures that all stakeholders can collaborate effectively. Such organizational strategies ultimately bolster compliance and promote smoother processes.

FAQs about SEC Form S-4

Navigating the complexities of SEC Form S-4 can give rise to several questions, particularly from new filers. Commonly asked questions often revolve around the specific requirements for submission, timelines, and how to address potential SEC feedback efficiently. Understanding these dynamics can mitigate risks during the filing process, allowing companies to focus on their transactional goals without getting bogged down by regulatory hurdles.

Investors and corporations alike seek clarity on potential risks associated with the S-4 filing process, particularly in understanding the limitations of liability and how to accurately present risk factors to stakeholders. Having detailed responses to these key questions not only aids in the filing process but also enhances overall investor relations.

About pdfFiller: Empowering your document management

pdfFiller provides comprehensive solutions that facilitate document creation, editing, and management, ensuring seamless collaboration across teams. Users can easily navigate the process of creating SEC Form S-4, enhancing their ability to comply with regulatory requirements in a streamlined manner.

By empowering users with tools for effective workflow management and providing eSigning capabilities, pdfFiller enables organizations to operate more efficiently. Its robust platform is trusted by many professionals, with numerous testimonials attesting to its ability to simplify complex document processes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in sec 4 submission of without leaving Chrome?

Can I create an electronic signature for the sec 4 submission of in Chrome?

Can I create an eSignature for the sec 4 submission of in Gmail?

What is sec 4 submission of?

Who is required to file sec 4 submission of?

How to fill out sec 4 submission of?

What is the purpose of sec 4 submission of?

What information must be reported on sec 4 submission of?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.