Get the free State Properties Review Board

Get, Create, Make and Sign state properties review board

Editing state properties review board online

Uncompromising security for your PDF editing and eSignature needs

How to fill out state properties review board

How to fill out state properties review board

Who needs state properties review board?

State Properties Review Board Form: A How-to Guide

Overview of the State Properties Review Board (SPRB)

The State Properties Review Board (SPRB) plays a crucial role in managing and overseeing property tax assessments for various properties, including residential, commercial, and tax-exempt properties. Established to ensure a fair and systematic review process, the SPRB serves as a safeguard against inaccurate assessments and inconsistencies in tax-related decisions. Its operations impact property owners directly by providing them with an avenue to challenge assessments they believe are unjust, and it also aids local governments in maintaining accurate records and fair tax revenues.

The importance of the SPRB cannot be understated. It functions primarily to protect the rights of property owners while simultaneously upholding the tax base for local governments. Accurate property assessments are vital, affecting funding for local services such as schools, emergency services, and infrastructure. Understanding how the SPRB operates allows property owners and local authorities to navigate the complexities of property taxation with confidence.

Understanding the State Properties Review Board Form

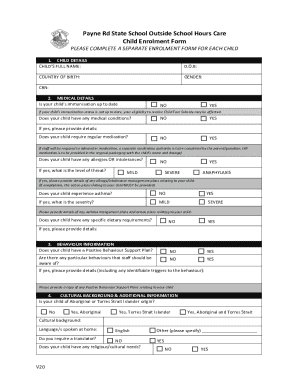

The State Properties Review Board Form is an official document that property owners must complete and submit to request a review of their property tax assessment. This form serves multiple purposes, including providing a standardized method for property owners to voice their concerns regarding assessments and gathering necessary information for the review process. It is essential for anyone who believes their property has been unfairly assessed.

The form covers various types of properties, including residential homes, commercial buildings, and tax-exempt properties like schools and churches. Familiarizing oneself with the specific requirements for each type of property is important for an accurate submission. Additionally, there are critical deadlines and submission timelines that must be adhered to in order to ensure your request is considered, typically set by local jurisdictions and varying by state.

Preparing to fill out the SPRB form

Before you start completing the SPRB Form, gathering all necessary documentation is a top priority. This preparation ensures that your submission is comprehensive and supported by relevant evidence. Key documents usually include current property tax statements, any previous assessments, and proof of ownership, such as deeds or transfer documents. Having these materials on hand will facilitate a smoother completion process.

It’s vital to avoid common pitfalls during this preparation phase. For example, failing to provide complete documentation or overlooking specific instructions can lead to delays or denials. Property owners should double-check that all information is current and accurately reflects the property's status. Taking the time upfront to ensure you have everything ready will pay off by reducing potential stress later in the process.

Step-by-step guide to completing the SPRB form

Completing the SPRB Form requires meticulous attention to detail. Here’s a breakdown of each section to help you navigate the form effectively.

Property identification

Begin by entering accurate property details. This includes the property address, parcel number, and ownership information. Ensure there are no typos or omissions, as incorrect information can complicate the review process.

Tax assessment information

In this section, you need to provide details about your property's assessed value, the date of the assessment, and any discrepancies you perceive. Understanding comparable properties and their assessments can strengthen your position.

Reason for review

Here, you’ll clarify why you are requesting a review. Common reasons include discrepancies in the assessed value, lack of adequate comps, or changes in property conditions. Strong justification is key.

Supporting evidence

Lastly, attach any relevant documents that substantiate your claims, such as photographs, comparables, or previous assessment documents. Remember, your evidence should be clear and well-organized to make a compelling case.

Tools for filling, editing, and signing the form via pdfFiller

pdfFiller enhances the process of managing the SPRB Form with a suite of user-friendly features. Whether you're starting from scratch or editing an existing document, pdfFiller’s intuitive interface allows you to easily navigate the form. You can add text, images, and notes directly in the PDF, making the process straightforward and efficient.

To eSign the SPRB Form securely, pdfFiller offers robust encryption and authentication methods, ensuring your submissions are both safe and legally binding. Collaborating with team members is also streamlined, as you can share documents for feedback and edits, facilitating a smooth submission process.

Submitting the SPRB form

Once your SPRB Form is completed, it’s time to submit it. There are several methods available for submission: online through the local government's portal, via mail, or in-person at designated offices. Each method has specific guidelines; thus, it is essential to choose one that aligns with your convenience and the urgency of your review.

To ensure successful submission, always check that you have signed the form and included any required supporting documents. After submitting, tracking your form's status and knowing when to follow up can be key to staying informed about the review timeline and any further actions required.

Review board process after submission

After you submit the SPRB Form, the review board will process your request. It typically involves several steps, starting with an initial review to determine whether a hearing is necessary. Depending on the complexity of your case, you may receive a decision quite quickly, or it may take several weeks. It’s important to familiarize yourself with what to expect during this period, including any potential hearings where you may need to present your case more formally.

During this time, remain proactive in following up on your submission status. This involves being available to respond to any requests for additional information from the SPRB, which could expedite the review process.

FAQs related to the SPRB form

Several commonly asked questions arise when dealing with the SPRB Form. For instance, many users wonder what to do if their submission is denied or how to appeal the decision. Others may ask about the specific criteria the board uses when evaluating claims or what types of documents are considered 'acceptable evidence.'

To provide clarity, it’s essential to disseminate information about these queries, addressing issues such as the timeline for reviews, the scope of available appeals, and the types of setbacks users may encounter while completing the form. Offering troubleshooting tips for common concerns can also facilitate a smoother experience for new users.

Resources for further assistance

For those seeking additional support, there are numerous resources available. Websites dedicated to property assessment and tax issues often provide access to related forms and materials. Contacting the SPRB directly can also yield specific information tailored to your inquiry. Professional consultants specializing in property taxes can be invaluable, helping individuals navigate complex situations for a better chance of success.

Utilizing pdfFiller for document management not only simplifies the SPRB Form process but enhances overall efficiency. With its online access, collaborative tools, and secure signing options, pdfFiller empowers users to manage their documents with ease.

Case studies and success stories

Real-life examples illustrate the effectiveness of using the SPRB Form. Many property owners have successfully reduced their property tax assessments by effectively utilizing supporting evidence and presenting their case clearly. Their testimonials underscore the importance of being thorough and organized when filling out the form. One notable success story includes a local business owner who managed to lower their assessment by 15% through detailed comparables.

Such success stories emphasize the power of utilizing the SPRB Form wisely and the benefits of being proactive in addressing tax assessments. These accounts not only serve as motivation but also provide practical examples of strategies that others can employ in their own submissions.

Conclusion and next steps

Navigating the State Properties Review Board Form can seem daunting, but with the right tools and knowledge, property owners can manage the process effectively. Utilizing pdfFiller greatly enhances this experience by providing a seamless platform for filling, editing, and managing your documents securely.

Stay informed about updates from the SPRB and consider continuous learning resources to deepen your understanding of property tax assessment processes. By engaging with these tools and resources, you’ll be well-equipped to tackle your next review with confidence.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit state properties review board from Google Drive?

How do I fill out the state properties review board form on my smartphone?

Can I edit state properties review board on an iOS device?

What is state properties review board?

Who is required to file state properties review board?

How to fill out state properties review board?

What is the purpose of state properties review board?

What information must be reported on state properties review board?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.