Get the free 2025 Accommodations Tax Funds Request Application

Get, Create, Make and Sign 2025 accommodations tax funds

How to edit 2025 accommodations tax funds online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2025 accommodations tax funds

How to fill out 2025 accommodations tax funds

Who needs 2025 accommodations tax funds?

Comprehensive Guide to the 2025 Accommodations Tax Funds Form

Overview of the 2025 accommodations tax funds

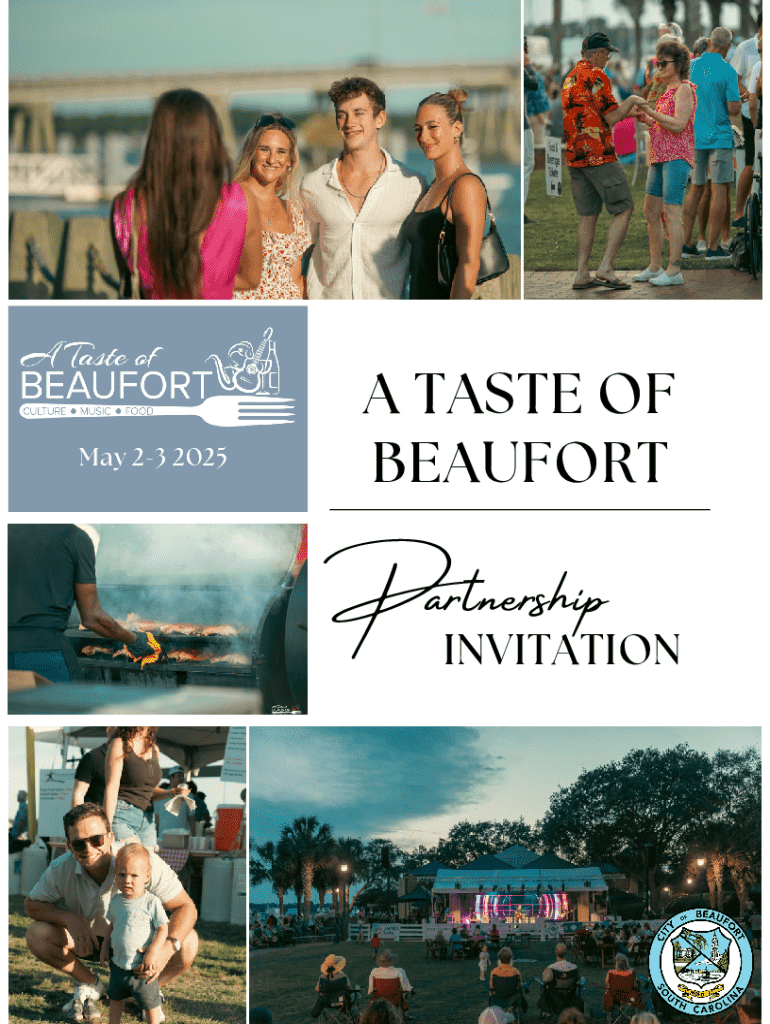

Accommodations Tax Funds serve as vital financial resources intended to bolster local tourism and community development initiatives. The funds are generated primarily from taxes collected on short-term lodging, such as hotels, motels, and rentals. These funds are allocated by local governments to support projects that enhance the visitor experience, promote regional attractions, and improve community infrastructure.

Eligibility for the 2025 accommodations tax funds requires that projects align with specific criteria set by the governing bodies, typically focusing on tourism promotion, infrastructure improvements, or cultural enrichment. Projects often funded through these resources include new visitor centers, cultural festivals, and restoration of historical sites, all aimed at increasing tourist traffic and enhancing the quality of life for residents.

Utilizing these funds offers significant benefits, including an increase in economic activity, job creation, and improved community facilities for both locals and visitors alike. Effectively invested, the accommodations tax funds can transform local economies, positioning areas as competitive travel destinations.

Important dates & deadlines

The timeline for submitting the 2025 accommodations tax funds application is crucial for potential applicants. Typically, the application period opens in early January, offering a window for submissions that closes in March. Key milestones, such as preliminary reviews and community forums, are scheduled throughout this period to ensure transparency and allow for public feedback.

Public meetings to discuss funding decisions and offer feedback will occur throughout April, allowing community input to shape the direction of the funded projects. Engaging with local leaders and stakeholders during these meetings can provide additional insights into the approval process.

Preparing your 2025 accommodations tax funds application

Preparing an application for the 2025 accommodations tax funds requires thorough understanding and organization. An applicant must gather the necessary documentation such as project proposals, budget estimates, and background information on the organization seeking funding. Common pitfalls to avoid include incomplete applications, unrealistic project budgets, and a lack of clearly defined project goals.

When filling out the 2025 accommodations tax funds form, follow a structured approach. Begin with providing personal and organizational information, ensuring accuracy to avoid delays. Clearly outline project details such as objectives, targeted outcomes, and community impact. Lastly, present a comprehensive budget detailing anticipated costs, funding sources, and any matching funds or grants anticipated to secure.

Best practices for a successful application include clearly articulating the project’s benefits to the community and tourism enhancement. Address potential concerns proactively, responding to typical FAQs within your application narrative to demonstrate thorough preparation.

Managing your accommodations tax funds award

Once awarded the accommodations tax funds, the next steps involve effectively accessing and utilizing these funds. Recipients must follow a series of steps to claim the funds, including submitting the required documentation that verifies authorized usage of the grant. It is essential to maintain accurate financial records and project documentation for accountability purposes.

Tracking project progress is integral to demonstrate the effective use of these funds. Regular reporting, as stipulated by the funding agreement, is required to ensure transparency. Utilizing available tools and templates can assist in maintaining organized records, making it easier to compile progress reports for stakeholders.

Challenges may arise during fund management. Some common issues include budget overruns or unexpected project delays. Having a dedicated project management team can help navigate these challenges, and the contacts provided by the awarding body will assist with any unforeseen issues.

Resources for applicants

Several resources are available to assist applicants in the process of preparing their 2025 accommodations tax funds applications. Interactive tools, such as digital forms and comprehensive guidelines, are accessible through the official government website. These tools simplify the process of filling out the applications and help ensure all necessary information is included.

Workshops and training sessions often occur in the lead-up to the application deadline, offering potential applicants guidance on best practices and expert insights into the application process. Participating in these sessions can prove valuable in enhancing the quality of submissions.

Engaging with online communities and support groups can also foster collaboration among applicants, allowing experiences and success stories to be shared, ultimately refining application quality.

Additional information and regulations

Understanding the relevant laws and guidelines surrounding the 2025 accommodations tax funds is essential. The South Carolina Code of Laws outlines all regulations pertaining to accommodations tax, informing applicants of their responsibilities and the appropriate use of funds. Familiarizing oneself with these regulations can significantly influence the success of an application.

The South Carolina Tourism Expenditure Review Committee plays a critical role in overseeing the allocation of these funds. Their responsibilities include evaluating applications and ensuring funds are distributed according to established guidelines. Transparency reports and accountability measures are typically provided by the committee, illustrating how allocated funds are used and monitored closely.

Frequently asked questions (FAQs)

Applicants often have questions about the application processes for the 2025 accommodations tax funds. Common queries include what documents are required and how to effectively demonstrate project viability. Providing clarity on these processes in advance can reduce the volume of applications that need revisiting for missing information.

Specific questions revolve around grant awards, including how funding amounts are determined and the timeline for project funding. Addressing these concerns transparently in the guidelines can help ensure that applicants submit well-prepared applications reflective of the funding body’s expectations.

Tools for document management

Leveraging resources like pdfFiller can significantly enhance the efficiency of managing the 2025 accommodations tax funds form. With pdfFiller, users can seamlessly edit PDFs, eSign documents, and collaborate with team members from a single, cloud-based platform, greatly simplifying the submission process.

pdfFiller provides various features specifically designed to assist in creating, refining, and managing the accommodations tax funds form. These tools streamline workflows, allowing users to focus on crafting compelling narratives for their applications.

Contact information for further assistance

For those seeking additional support regarding the 2025 accommodations tax funds, knowing whom to reach out to can streamline the inquiry process. Key personnel often include designated staff members from local government offices who specialize in community funding and tourism promotion.

Moreover, subscribing to e-newsletters can provide timely updates about application processes and upcoming meetings. Engaging with local governmental resources ensures applicants remain informed about any changes in policy or funding availability.

Stay connected with resources and updates

Keeping abreast of developments related to the accommodations tax funds is essential for stakeholders and potential applicants. Regularly visiting the official websites that offer information about these funds allows individuals to stay informed about related topics and updates.

Engaging with community forums and social media groups provides additional channels for interaction and knowledge exchange among applicants. These platforms foster a sense of community and collaboration in navigating the funding landscape.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send 2025 accommodations tax funds for eSignature?

Can I edit 2025 accommodations tax funds on an iOS device?

How do I edit 2025 accommodations tax funds on an Android device?

What is 2025 accommodations tax funds?

Who is required to file 2025 accommodations tax funds?

How to fill out 2025 accommodations tax funds?

What is the purpose of 2025 accommodations tax funds?

What information must be reported on 2025 accommodations tax funds?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.