Get the free Porac Retiree Medical Trust Portfolio Selection Form

Get, Create, Make and Sign porac retiree medical trust

How to edit porac retiree medical trust online

Uncompromising security for your PDF editing and eSignature needs

How to fill out porac retiree medical trust

How to fill out porac retiree medical trust

Who needs porac retiree medical trust?

Your Guide to the Porac Retiree Medical Trust Form

Understanding the Porac Retiree Medical Trust

The Porac Retiree Medical Trust (RMT) is a financial resource established to ensure that retirees from the Peace Officers Research Association of California (PORAC) have access to robust healthcare benefits. Its purpose is to provide an efficient and reliable means for managing healthcare expenses for retired law enforcement officers and their dependents.

The RMT offers crucial benefits, including coverage for medical, dental, and vision expenses, helping retirees manage costly healthcare needs as they age. With healthcare costs continuously rising, the RMT acts as a safety net, reinforcing the financial stability of its members during retirement.

This platform for retirees serves as a critical tool in retirement planning, allowing members to allocate resources toward healthcare without financial strain.

Eligibility and enrollment

To take advantage of the benefits provided by the Porac Retiree Medical Trust, potential members must meet specific eligibility criteria. Generally, eligible candidates include retired law enforcement officers who were active members of PORAC prior to retirement, as well as their dependents.

There may be special conditions or exceptions, particularly for members who retire early or under unique circumstances, which can also affect their eligibility status.

To enroll in the RMT, prospective members should complete the Porac retiree medical trust form thoroughly. A step-by-step approach is recommended, ensuring they meet enrollment deadlines and provide all required documentation for successful processing.

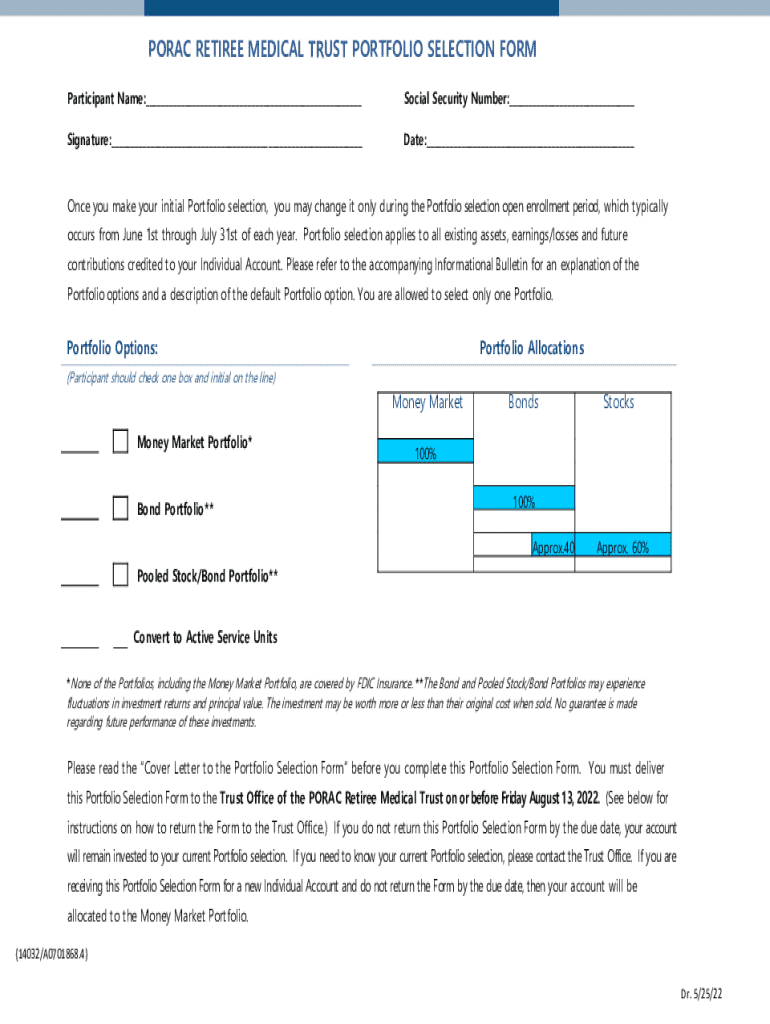

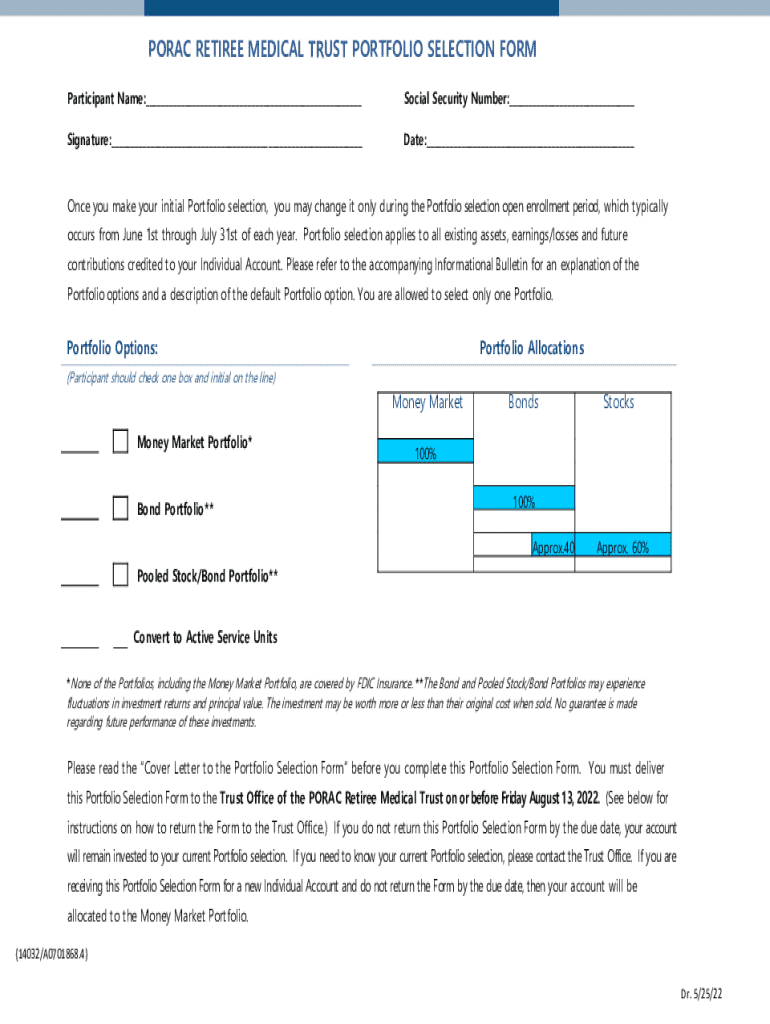

Filling out the Porac retiree medical trust form

Completing the Porac retiree medical trust form is a straightforward process, but attention to detail is essential. The form consists of several key sections, including personal information, employment history, and dependent details. Each section plays a vital role in determining your eligibility and coverage.

Common areas that often require special attention include verifying the accuracy of contact information and ensuring that all dependent relationships are clearly defined to avoid delays in processing.

For ease of use, pdfFiller can help in filling out the form by allowing users to edit and securely store the document. Following a detailed guide to complete each section can significantly enhance success in enrollment.

Managing your RMT account

Once enrolled, managing your RMT account becomes critical for maintaining your benefits. Accessing your RMT account online is simple. Users are required to create an account on the dedicated portal, where they can manage their healthcare benefits efficiently.

The online portal offers features like reviewing benefit coverage, checking claim status, and updating personal information. Keeping your contact details and beneficiary information updated is vital in ensuring seamless service.

The importance of maintaining accurate records cannot be overstated, as it aids in the swift handling of claims and other administrative needs.

Direct deposit for RMT benefits

Setting up direct deposit for your RMT benefits is advantageous as it ensures timely payments directly into your bank account. This method reduces the risk of lost or delayed checks, offering a seamless experience for accessing healthcare benefits.

To set up direct deposit, you'll need to provide your banking information on the RMT form. This step is crucial for ensuring your benefits are deposited efficiently.

If you need to modify your banking information later, guidelines provided through the RMT portal will ensure that these changes are secure and efficient.

Claims process

The claims process within the RMT is streamlined to facilitate the submission and resolution of healthcare-related expenses. Members can submit claims for various eligible healthcare services, including out-of-pocket costs for treatments, medications, and more.

Filing a claim requires careful documentation, as essential documents must accompany your claim submission. Familiarizing yourself with the types of claims you can submit will aid in a smoother claims process.

After submission, members can track their claim status online via the RMT portal, ensuring transparency and quick resolution of any issues that may arise.

Understanding covered medical expenses

The effectiveness of the Porac Retiree Medical Trust relies heavily on understanding which medical expenses are covered. The RMT encompasses a wide range of services, including hospitalization, outpatient care, preventive services, and medications, making it imperative for members to familiarize themselves with the specifics of their coverage.

While many essential services are covered, members should also be aware of exclusions and limitations associated with certain treatments. Knowing the details can help in planning healthcare finances effectively.

If a required service is not covered, members should explore alternatives like negotiating costs or seeking supplemental insurance to help with out-of-pocket costs.

Additional health benefits

Beyond basic medical coverage, the Porac Retiree Medical Trust also encompasses additional health benefits, including dental and vision care options. These supplementary services are crucial for retirees seeking comprehensive health management.

Enrollment for these benefits typically follows the same process as the primary RMT benefits, ensuring that eligible individuals can secure additional coverage.

Members are encouraged to evaluate their dental and vision needs as they transition into retirement and to consider enrolling in available supplemental insurance to further bolster their healthcare safety net.

Frequently asked questions (FAQs)

Potential members often have questions regarding enrollment, eligibility, and the claims process. Addressing common inquiries helps demystify the process and encourages correct steps to be taken.

Topics frequently explored include clarification on eligibility criteria, nuances of coverage, and the necessary steps to file a claim or make modifications to their account.

Having answers to these questions not only brings peace of mind but also guides retirees in managing their healthcare plans effectively.

Resources and support

For any questions or personalized support, members can reach out to RMT support services. Contacting them through official channels ensures that specific needs are met efficiently, allowing for tailored guidance based on individual circumstances.

Support is accessible via phone, email, or online chat, giving retirees multiple options to seek help whenever necessary.

Additionally, members can benefit from joining community forums where they can share experiences and advice, enhancing their understanding of the RMT.

Tools and interactive features for document management

pdfFiller is an invaluable tool for retirees managing their Porac retiree medical trust form. This cloud-based platform enhances the form filling experience by allowing for easy editing, signing, and secure storage of documents.

Key features of pdfFiller include the ability to collaborate on documents with family members or authorized individuals, making the management of healthcare documentation a more streamlined process.

Utilizing such tools not only simplifies the paperwork process but also provides peace of mind knowing that your important documents are safely backed up.

Preparing for future healthcare needs

Long-term planning for healthcare is crucial for anyone relying on the Porac retiree medical trust form. Strategies for maximizing RMT benefits include regular review of covered services, understanding any potential expansions to your coverage, and anticipating future healthcare costs.

By proactively managing your healthcare choices, members can ensure they’re obtaining the most value from the benefits available to them.

Ultimately, a well-considered approach to managing your healthcare will provide you and your loved ones with the security you need as you navigate retirement.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute porac retiree medical trust online?

How do I edit porac retiree medical trust in Chrome?

How can I fill out porac retiree medical trust on an iOS device?

What is porac retiree medical trust?

Who is required to file porac retiree medical trust?

How to fill out porac retiree medical trust?

What is the purpose of porac retiree medical trust?

What information must be reported on porac retiree medical trust?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.