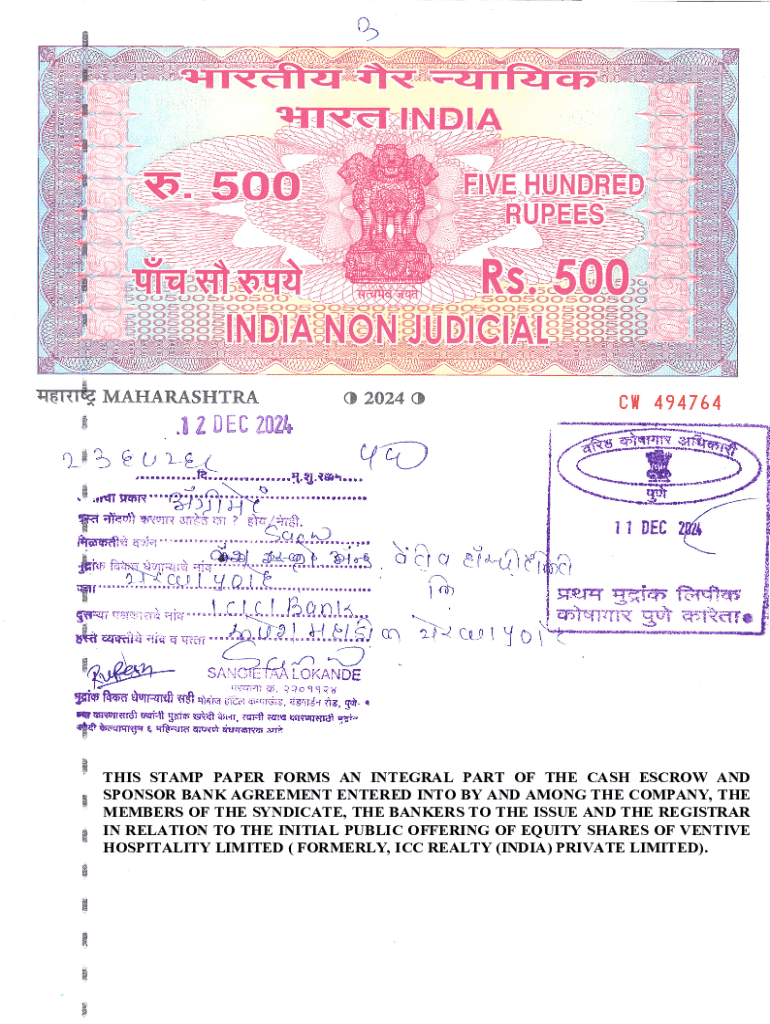

Get the free Cash Escrow and Sponsor Bank Agreement

Get, Create, Make and Sign cash escrow and sponsor

How to edit cash escrow and sponsor online

Uncompromising security for your PDF editing and eSignature needs

How to fill out cash escrow and sponsor

How to fill out cash escrow and sponsor

Who needs cash escrow and sponsor?

How to use a cash escrow and sponsor form

Understanding cash escrow: definition and purpose

Cash escrow refers to a financial arrangement where a third party temporarily holds funds on behalf of two parties involved in a transaction until certain conditions are met. This mechanism provides a layer of security for both the buyer and the seller, ensuring that neither party can access the funds until the agreed-upon terms are satisfied. Essentially, cash escrow serves as a neutral ground that protects all parties involved.

One primary use case for cash escrow includes real estate transactions. Here, buyers deposit earnest money into an escrow account, which is only released to the seller upon successful completion of the sale. Online marketplaces also often utilize cash escrow to safeguard buyers and sellers, particularly in high-value transactions. Business agreements, such as mergers and acquisitions, may employ cash escrow to manage payments contingent on the completion of certain milestones.

The importance of the sponsor form in cash escrow

A sponsor form is a critical document in the cash escrow process. It not only identifies the parties involved but also lays out the terms of the escrow arrangement. This form acts as a blueprint detailing how the funds will be handled and under what conditions they will be released.

Key components of a sponsor form include:

Setting up a cash escrow account

Setting up a cash escrow account involves several crucial steps. The process should be straightforward, especially when using a reputable service provider. Here’s how you can do it:

To create your cash escrow account, you need to provide personal identification and details regarding the transaction. This includes a description of what the funds are intended for, which helps ensure clarity and compliance throughout the process.

Filling out the cash escrow and sponsor form

Completing the cash escrow and sponsor form requires attention to detail to prevent issues down the line. Follow these step-by-step instructions to accurately fill out the form:

Common mistakes to avoid during this process include incomplete details and incorrect payment amounts. Double-check every section to ensure accuracy.

Editing and customizing your cash escrow and sponsor form

Customization of your cash escrow and sponsor form can enhance its effectiveness. Utilizing tools like pdfFiller makes this process fluid. Here's how you can edit PDF forms easily:

Best practices for customization include ensuring clarity and professionalism. Tailoring the form to meet specific transaction details can prevent misunderstandings later on.

Signing the cash escrow and sponsor form

The signature process is pivotal for the validity of the cash escrow and sponsor form. Electronic signatures have gained prominence for their legal compliance and convenience. They facilitate quick transactions without the need for physical presence.

To eSign using pdfFiller, follow these steps:

Collaboration and management of the escrow process

Effective collaboration during the escrow process ensures that all parties remain informed. Leveraging tools for team collaboration can enhance this experience.

Additionally, keeping track of escrow milestones, monitoring payment statuses, and setting up notification settings for updates contribute to a smoother transaction process.

Frequently asked questions (FAQs) about cash escrow and sponsor forms

As you navigate the cash escrow process, you may have questions. Here are some common FAQs:

Best practices for using cash escrow and sponsor forms

To ensure a smooth transaction process, consider these best practices:

Troubleshooting common issues with cash escrow forms

During the cash escrow process, you may encounter various issues. Understanding common problems and their solutions can help alleviate stress.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit cash escrow and sponsor from Google Drive?

How do I execute cash escrow and sponsor online?

Can I sign the cash escrow and sponsor electronically in Chrome?

What is cash escrow and sponsor?

Who is required to file cash escrow and sponsor?

How to fill out cash escrow and sponsor?

What is the purpose of cash escrow and sponsor?

What information must be reported on cash escrow and sponsor?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.