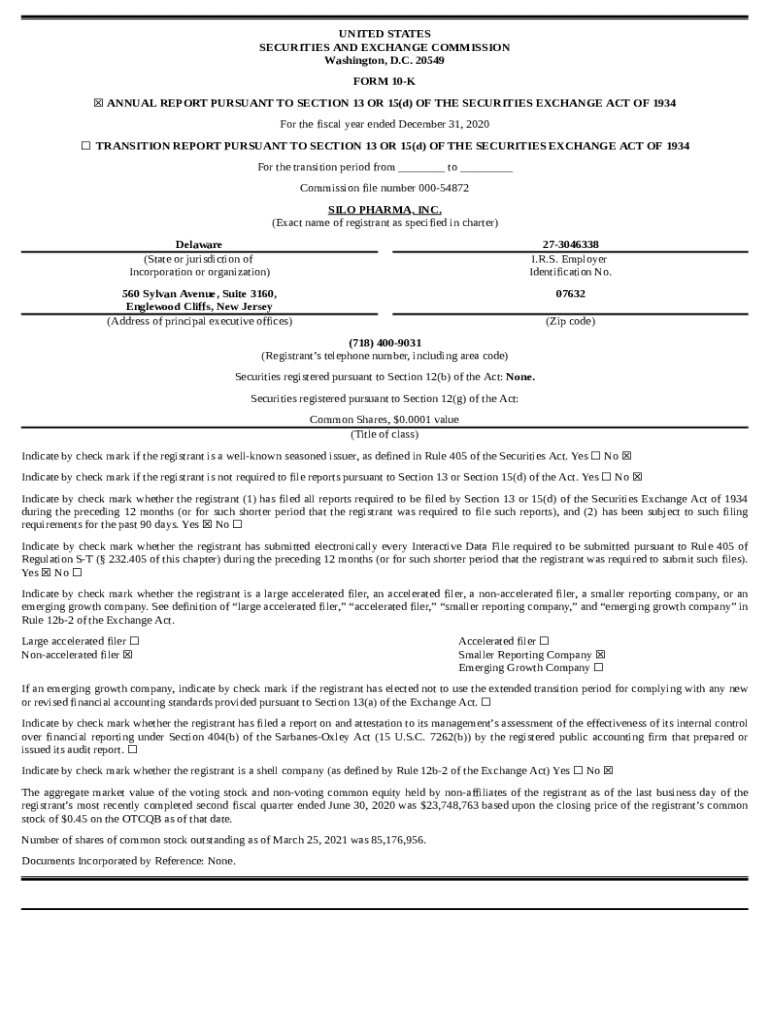

Get the free Form 10-k

Get, Create, Make and Sign form 10-k

Editing form 10-k online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 10-k

How to fill out form 10-k

Who needs form 10-k?

Form 10-K: A Comprehensive How-To Guide

Overview of Form 10-K

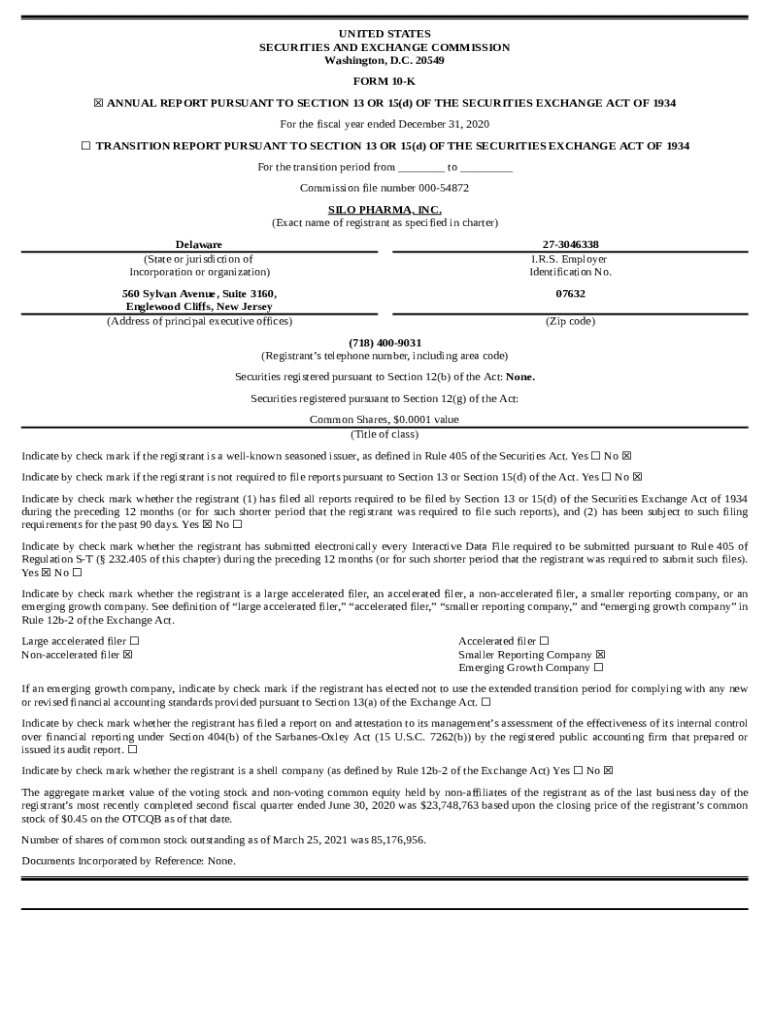

The Form 10-K is a crucial disclosure document that publicly traded companies in the United States must file annually with the Securities and Exchange Commission (SEC). This detailed report provides a comprehensive overview of a company’s financial performance, operations, and the potential risks it faces in its business environment. Importantly, it is designed to offer transparency and protect investors by providing essential information that can influence investment decisions.

Filing Form 10-K is not merely a regulatory requirement but serves a fundamental role in ensuring that potential and existing investors, analysts, and regulators are well-informed regarding the company’s activities and financial health. Key stakeholders, including shareholders, financial analysts, and regulatory bodies, rely on this document to understand the company's narrative, competitive edge, and risk landscape. The transparency offered by Form 10-K helps in mitigating the asymmetry of information that can potentially harm investors.

Structure of Form 10-K

The Form 10-K is meticulously structured into four main parts, each serving a distinct purpose, which helps in organizing the vast amount of information available to readers. Understanding this structure allows investors and analysts to efficiently locate the information relevant to their needs.

Key components within Form 10-K

Among the various components of the Form 10-K, Management’s Discussion and Analysis (MD&A) often stands out as it presents a narrative of the company's financial performance and operational results through the eyes of management. It contextualizes the raw numbers found in financial statements by discussing patterns, trends, and challenges faced over the reporting period, allowing stakeholders to gauge the company’s strategic positioning.

Financial statements form the backbone of the Form 10-K. These include the balance sheet, income statement, and cash flow statement, which provide snapshot views of a company’s fiscal health. Investors use these statements to assess profitability, liquidity, and solvency. Furthermore, the Risk Factors section helps stakeholders understand potential challenges and pitfalls the company may face. Identifying relevant risks entails analyzing both internal and external factors that may adversely impact operations, guiding investors in making informed decisions.

Filing deadlines for Form 10-K

The timelines for filing a Form 10-K vary according to the size of the company. Large accelerated filers must submit their Form 10-K within 60 days post fiscal year-end, followed by accelerated filers with a 75-day deadline, while non-accelerated filers have a 90-day window. Meeting these deadlines is vital; late submissions can undermine investor confidence and attract penalties from the SEC, leading to reputational damage alongside financial repercussions.

These deadlines not only ensure regulatory compliance but also keep the market well-informed, supporting the overall integrity of financial reporting in securities markets. Companies, therefore, must prioritize stringent internal processes to gather and compile necessary data well ahead of filing deadlines.

How to obtain and analyze Form 10-K filings

Locating a Form 10-K is a straightforward process thanks to the SEC's EDGAR database, available to the public. Users can access the database online and search for a specific company's filings by entering its name or Central Index Key (CIK) number. Once located, users can analyze the filing based on the structured format provided, allowing for an efficient review of key sections.

For effective analysis, leveraging tools that facilitate better document management, such as pdfFiller, can streamline the review process. Users can easily edit, annotate, and share documents online. Using pdfFiller not only enhances document management but also supports collaboration among team members working on company analysis.

Common pitfalls and challenges

While preparing the Form 10-K, companies commonly misinterpret data or fail to address all required disclosures. It's critical to avoid omitting risk factors or failing to clearly articulate management’s discussion. Incomplete or inaccurate information can lead to significant consequences, including regulatory scrutiny and damaged credibility.

Companies should implement robust review and compliance processes to prevent such pitfalls. Additionally, employing professionals skilled in financial document preparation can help mitigate misunderstandings and discrepancies from arising during the filing process.

Frequently asked questions (FAQ)

Understanding the nuances of Form 10-K comes with its fair share of questions. Common queries include the format of filing, which adheres to specific guidelines set by the SEC. While larger companies must follow stricter reporting formats, smaller companies may use slightly different formats depending on their registration status.

The Form 10-K is filed annually, but it’s crucial for firms to be aware of the SEC's review process, which can prompt companies to effectively disclose pertinent information, leading to continuous improvement in corporate governance and public reporting practices.

Important considerations for stakeholders

Form 10-K serves as a vital tool for stakeholders, particularly investors and analysts seeking to make informed investment decisions. This document contains more than just numbers; it communicates the management's philosophy and provides insights into governance structures, making it indispensable for evaluating risks and opportunities.

Moreover, stakeholders should pay attention to the regulatory environment surrounding Form 10-K. The ongoing changes in standards and disclosure requirements necessitate that stakeholders remain vigilant and engaged with developments in financial reporting to understand the implications for corporate governance and investment transparency.

Tools for effective management and editing of Form 10-K

Employing cloud-based solutions like pdfFiller enhances the ability to manage, edit, and sign Form 10-K filings. This platform allows users to seamlessly collaborate on documents, enabling them to track changes and ensure all team members are aligned with the filing’s requirements. By leveraging features that support e-signing and document sharing, companies can efficiently prepare and submit their Form 10-K.

Overall, transitioning to a streamlined platform like pdfFiller brings additional benefits through better document organization, creating a more effective approach to handling essential filings like the Form 10-K.

Related forms and documents

Understanding Form 10-K expands to include related filings such as Form 10-Q and Form 8-K. Form 10-Q serves as a quarterly report, offering less detail than Form 10-K but requiring more frequent updates on financial performance. Meanwhile, Form 8-K reports significant events that could affect shareholders in real-time, such as changes in management or financial disruptions.

These documents provide ongoing insights into a company’s financial and operational position, making them essential to complementing the information provided in Form 10-K. Familiarity with these related forms empowers stakeholders to maintain a holistic view of a company's status and actions.

Summary of key takeaways

A successful Form 10-K filing hinges on clear, accurate reporting and thorough analysis of the company’s business environment and financial performance. Stakeholders must recognize the significance of the MD&A section and the financial statements while being mindful of the importance of meeting filing deadlines to maintain integrity in public reporting.

By recognizing common pitfalls and leveraging tools available, such as pdfFiller, companies can streamline their reporting processes and enhance collaboration among team members, ensuring that their Form 10-K effectively communicates their business narrative to investors and the broader market.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send form 10-k to be eSigned by others?

How do I execute form 10-k online?

Can I edit form 10-k on an Android device?

What is form 10-k?

Who is required to file form 10-k?

How to fill out form 10-k?

What is the purpose of form 10-k?

What information must be reported on form 10-k?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.