Get the free Form 10-k

Get, Create, Make and Sign form 10-k

How to edit form 10-k online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 10-k

How to fill out form 10-k

Who needs form 10-k?

Form 10-K: A Comprehensive How-to Guide

Understanding Form 10-K

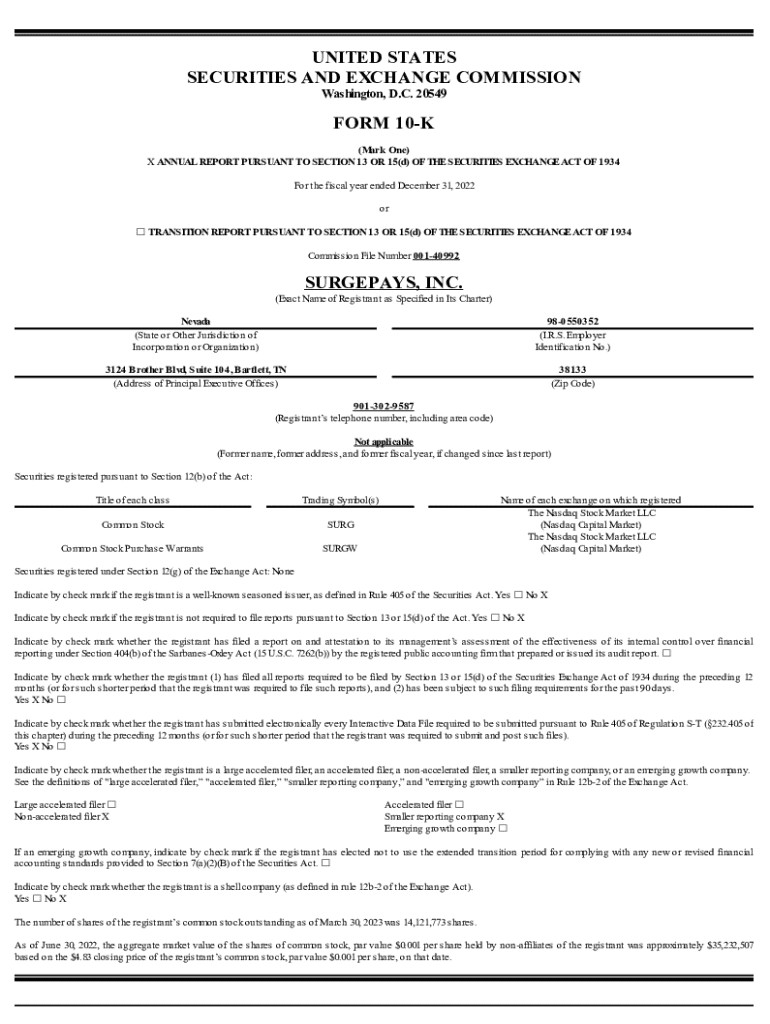

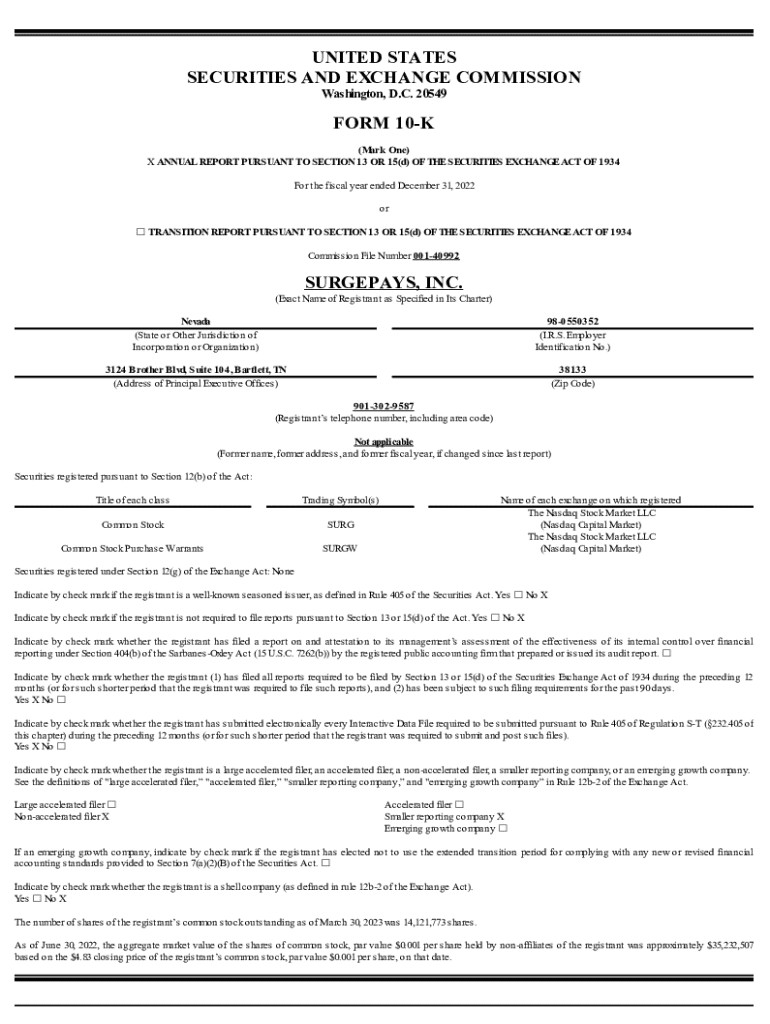

Form 10-K is a detailed annual report mandated by the U.S. Securities and Exchange Commission (SEC) for publicly traded companies. This form provides a comprehensive overview of a company's financial performance and business activities. Unlike regular financial reports, the 10-K presents a full narrative of the company’s history, risks, and operational outlook, making it a pivotal document for investors, analysts, and financial professionals.

The importance of the Form 10-K in financial reporting cannot be overstated. Its exhaustive details offer valuable insights into a company's operations, future prospects, and market risks, serving as a crucial tool for making informed investment decisions. Investors rely on the Form 10-K to gauge a company's financial health and to compare its performance against peers in the industry.

Key components of the Form 10-K include comprehensive financial statements, management's discussion, risk factors, and disclosures about legal proceedings. Each section plays a vital role in providing transparency and accountability, ensuring that stakeholders receive accurate and complete information about the company's financial standing.

Exploring the contents of Form 10-K

The Form 10-K comprises several main sections that provide distinct types of information about the company. Each section is structured to address different aspects of the company's operations and risk factors, ensuring a full understanding of its business model.

A detailed breakdown of the items included in the Form 10-K is as follows:

It's important to note additional insights such as Forward-Looking Statements, which are often included to project future performance. This section allows companies to discuss anticipated trends that may not be concluded within current data.

Finally, key highlights of a 10-K report can include changes in market position, substantial shifts in financial metrics, and significant content revisions from prior filings. Investors should focus on these highlights as indicators of a company's trajectory.

Filing deadlines and requirements

Filing a Form 10-K is subject to specific deadlines set by the SEC. Generally, large accelerated filers must submit their reports within 60 days after the end of the fiscal year, while accelerated filers have 75 days, and non-accelerated filers have 90 days. Adhering to these timelines is crucial for maintaining transparency and compliance with regulatory standards.

SEC filing requirements include the necessity for complete and accurate disclosure of financial statements, management discussions, and strategic insights. Companies need to ensure that these documents are reviewed and audited by certified public accountants to validate the accuracy of the reported information.

When preparing for filing, it is essential to manage the documentation process efficiently. This can involve setting internal deadlines preceding the official SEC deadline, detailing responsibilities among team members, and utilizing tools designed to streamline document preparation.

How to complete the Form 10-K

Completing the Form 10-K can be a complex process requiring careful attention to detail. A step-by-step guide for filling out Form 10-K includes the following crucial steps:

Best practices for document collaboration are paramount. Involving relevant team members in drafting and reviewing sections keeps the report comprehensive and accurate. This collaborative effort supports the multi-faceted nature of the information required in a 10-K report.

Utilizing PDF tools like pdfFiller for easy editing can enhance the efficiency of this process. For example, pdfFiller allows users to edit their Form 10-K details easily, eSign documents for authenticity, and collaborate seamlessly across teams, ensuring timely and accurate completion.

Analyzing and understanding your Form 10-K

Once the Form 10-K is completed and filed, it’s crucial for stakeholders to understand and analyze its contents effectively. Key metrics to look for in the financial statements include revenues, net income, and earnings per share. These figures provide immediate insight into the company’s financial performance.

Furthermore, understanding market risks and management's discussion and analysis (MD&A) is essential. The MD&A section offers insights into how management interprets the numbers, outlines strategic goals, and addresses broader market challenges or opportunities.

Identifying trends through historical 10-Ks can also provide valuable context. By analyzing past filings, stakeholders can discern patterns regarding financial performance, risk exposure, and management's response to market changes. This historical analysis arms investors with the knowledge to make better-informed decisions.

Related forms and resources

Navigating the world of SEC filings can be easier if one understands the related forms that accompany the Form 10-K. For instance, Form 10-Q provides quarterly updates and can be an excellent supplement to the annual insight provided in the 10-K.

To access Form 10-Ks, one can visit the SEC’s EDGAR system, where every publicly traded company posts its filings. The database allows users to search for specific companies, view their historical filings, and compare data across different reporting periods.

Further reading and case studies can enhance understanding of Form 10-K. Many financial institutions, educational platforms, and investment analysis companies provide resources for interpreting these filings, offering deeper insights into their importance.

FAQs about Form 10-K

A common question is: What is the purpose of Form 10-K? Essentially, the Form 10-K serves as a comprehensive source of information that reflects a company's performance and potential, enabling stakeholders to make reasoned decisions.

Another frequently asked question is: Who is required to file a Form 10-K? In general, all publicly traded companies in the U.S. are mandated to file this form annually as part of their accountability obligations to investors.

The structure of Form 10-K includes multiple sections detailing everything from business operations to financial statements. Effectively analyzing this extensive document can seem daunting, but focusing on key areas such as risk disclosures and financial data helps simplify the process.

Common mistakes to avoid when filing include neglecting to review previous filings for reference, overlooking critical deadlines, and failing to engage relevant stakeholders in the drafting process. Vigilance in these areas ensures compliance and enhances the quality of the report.

Conclusion: Mastering the Form 10-K

Mastering the completion and analysis of Form 10-K is an invaluable skill for both individuals and teams involved in financial reporting. Recapping the essential insights discussed throughout this guide ensures that stakeholders can approach the 10-K process with confidence.

Leveraging pdfFiller for efficient document management and collaboration adds substantial value to the process. With features allowing users to edit, sign, and manage documents securely, pdfFiller stands out as a premier tool for anyone looking to streamline their Form 10-K filing and ensure compliance with SEC requirements.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit form 10-k from Google Drive?

Where do I find form 10-k?

How do I edit form 10-k on an Android device?

What is form 10-k?

Who is required to file form 10-k?

How to fill out form 10-k?

What is the purpose of form 10-k?

What information must be reported on form 10-k?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.