Get the free Form 8937

Get, Create, Make and Sign form 8937

Editing form 8937 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 8937

How to fill out form 8937

Who needs form 8937?

Form 8937: How to Fill It Out and Manage Your Documents Effectively

Understanding Form 8937: Key Insights

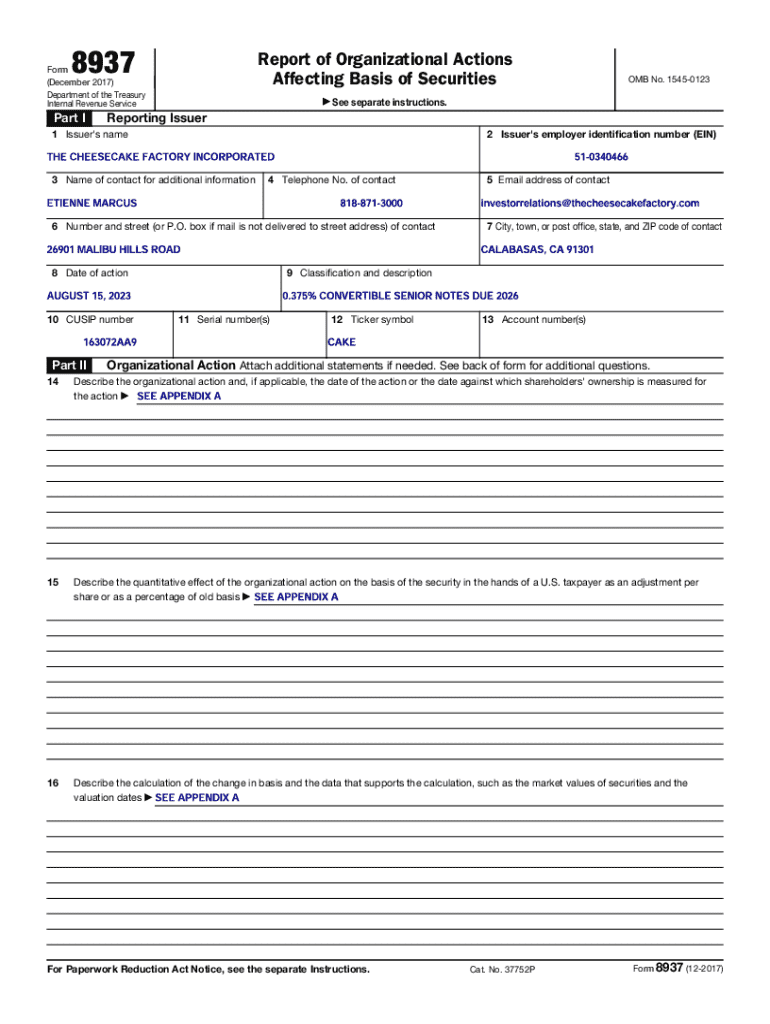

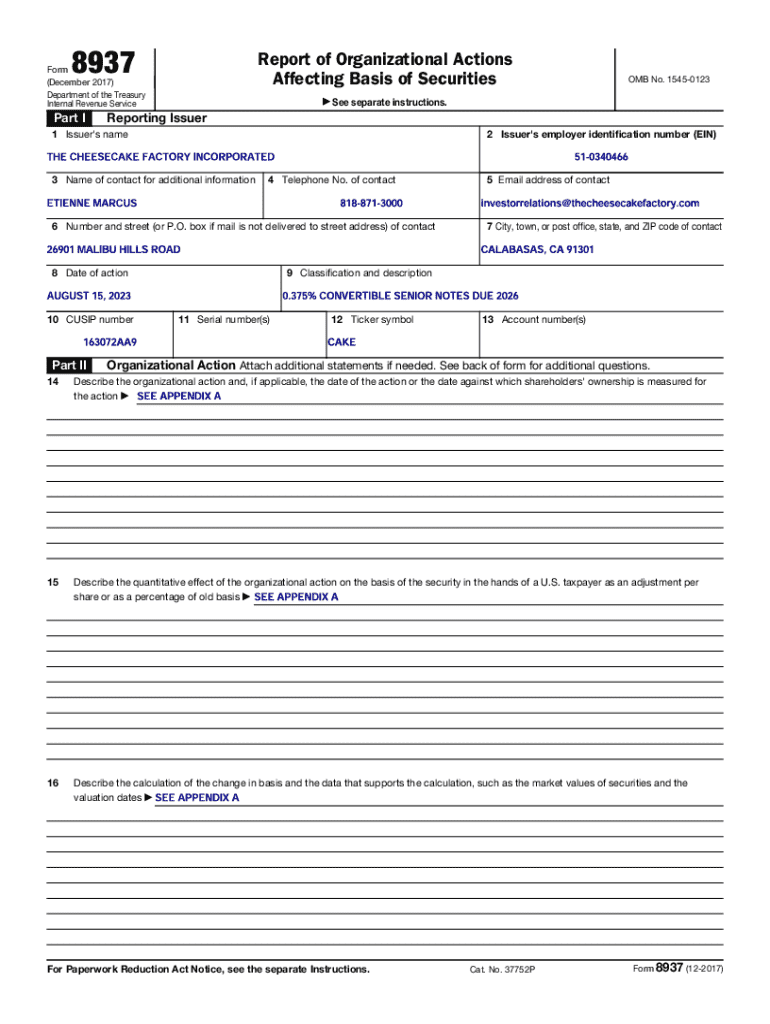

Form 8937, officially known as the 'Report of Organizational Actions Affecting Basis of Securities,' plays a crucial role in corporate finance and taxation. It is primarily used by entities that have made significant organizational changes affecting their security holders. The filing of Form 8937 helps ensure compliance with IRS regulations regarding the tax basis of securities, making it essential for maintaining accurate records.

Essentially, this form provides detailed information about corporate actions, such as stock splits, dividends, or reorganizations, which can affect the tax basis of securities held by investors. Filing is crucial for accurate tax assessments, preventing misleading tax filings or potential penalties by the IRS.

Navigating the components of Form 8937

Form 8937 consists of several critical sections that require careful attention during completion. Each box corresponds to specific information that the IRS requires from the reporting entity. Understanding these components is essential for accurate filings and compliance.

The first part of the form typically includes reporting company information, which encompasses the company's name, address, and Employer Identification Number (EIN). Box 2 identifies the type of corporate action being reported, whether it’s a stock split, cash dividend, or another relevant organizational action.

The subsequent sections capture distribution details such as relevant dates and amounts and detail the tax treatment for those distributions. This thorough breakdown helps both the IRS and investors understand the specifics of the corporate action and its implications.

Preparing to fill out Form 8937

Before filling out Form 8937, gathering all necessary documentation is imperative. This includes transactional records related to the corporate actions occurring during the tax year. Financial statements and communication from the company about distributions should also be on hand.

Additionally, ensure you have your Tax Identification Number (TIN) and any other relevant identifiers of your organization readily available. Familiarity with the tax implications of the corporate actions being reported is vital, as this can influence how distributions are calculated and reported.

Step-by-step guide to completing Form 8937

Completing Form 8937 can be simplified into a series of steps. First, start by entering the company's information accurately in Box 1. Ensure the company name and EIN are correct to avoid complications.

Next, document the type of corporate action in Box 2. Depending on what has transpired—whether it’s a stock split, dividend, or other action—choose accordingly. Pay attention to the official descriptions provided by the IRS or your state's tax office, as the language can be specific.

Proceed to Box 3, where you will need to fill in detailed distribution dates and amounts. It’s crucial to provide precise figures to support tax calculations accurately. Finally, determine the tax treatment of these distributions in Box 4. Here, general guidelines apply, so consult an accountant if needed.

After filling out all sections, double-check your work for accuracy. Leverage technology such as pdfFiller to assist with these forms. The platform offers myriad tools that can further enhance accuracy and compliance.

Form 8937 best practices

To ensure compliance and accuracy in filing Form 8937, consider several best practices. First, maintain a proactive approach to deadlines. Delays in filing may attract penalties, so setting reminders can help. Regularly review corporate actions within your organization to stay prepared.

Double-checking data before submission cannot be overstated—it minimizes the risk of errors that could lead to complications later. Be mindful of common mistakes, including misreporting distribution amounts or incorrect classification of corporate actions. Engaging with tax professionals as needed is also a good practice for ensuring all bases are covered.

Editing and managing your Form 8937 with pdfFiller

pdfFiller offers an array of tools designed for effective document management, including Form 8937. Its user-friendly interface enables seamless editing of PDFs, allowing users to easily input data and make corrections as needed. The drag-and-drop feature promotes intuitive usage, making it accessible for individuals and teams without extensive technical fluency.

Digital signatures can be added effortlessly, ensuring that your form is compliant and secure. The collaboration features empower teams to work together efficiently, allowing multiple users to edit and provide input in real-time—this is particularly useful for teams handling complex financial documents.

Advanced features of pdfFiller for Form 8937

Beyond basic editing, pdfFiller offers advanced features that enhance document management, especially for Form 8937. Storing documents securely in the cloud allows easy access from anywhere at any time—ideal for remote teams or individuals who travel frequently.

Furthermore, pdfFiller integrates with various software solutions, streamlining administrative processes and ensuring that important documents are always synchronized and updated. This integration capability reduces friction between systems, allowing users to focus more on their outputs rather than administrative tasks.

FAQs about Form 8937

Mistakes can happen. If you find an error on your Form 8937 after submission, it is important to address it promptly. You can correct the mistake by filing an amended Form 8937. Seek guidance from a tax professional to ensure the correction complies with IRS guidelines.

Changes in tax law can significantly impact the filing of Form 8937. Therefore, staying informed and revisiting your form regularly can help adapt to any changes. For deeper assistance, consulting a tax professional can provide clarity as they are equipped with the knowledge to navigate any recent tax changes.

Real-life applications: case studies

Numerous organizations have streamlined their process for filing Form 8937 using pdfFiller. For instance, a mid-sized corporation improved its turnaround time for form submissions significantly by adopting pdfFiller, reducing errors and enhancing collaboration among compliance teams.

In contrast, companies relying on traditional filing methods often encountered issues such as lost paperwork and delayed submissions, leading to complications with the IRS. These case studies illustrate the stark differences in efficiency between traditional processes versus modern solutions provided by tools like pdfFiller.

Moving beyond Form 8937: your document management journey

Completing Form 8937 is only one step in a broader document management strategy. Organizations should explore additional forms that are necessary for tax compliance, such as Form 1099 or Form 5471. Transitioning to a comprehensive document management system can facilitate accurate tracking, filing, and storage of all essential documents.

Utilizing pdfFiller can aid this transition. By centralizing document management, users are equipped to handle all forms efficiently, which reduces stress and enhances overall productivity. The platform offers a holistic approach to document management, ensuring that users can focus on strategic tasks while leaving administration to technology.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my form 8937 in Gmail?

How do I fill out the form 8937 form on my smartphone?

How do I edit form 8937 on an iOS device?

What is form 8937?

Who is required to file form 8937?

How to fill out form 8937?

What is the purpose of form 8937?

What information must be reported on form 8937?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.