Get the free Shut-in Gas Royalty Payment Form

Get, Create, Make and Sign shut-in gas royalty payment

Editing shut-in gas royalty payment online

Uncompromising security for your PDF editing and eSignature needs

How to fill out shut-in gas royalty payment

How to fill out shut-in gas royalty payment

Who needs shut-in gas royalty payment?

Shut-in gas royalty payment form: A comprehensive how-to guide

Understanding shut-in gas royalty payments

Shut-in gas refers to natural gas that is produced but temporarily not sold or delivered due to various operational or market conditions. When a well is not producing gas — whether due to maintenance, lack of demand, or other factors — it is considered shut-in. This situation can have significant financial implications for gas owners and the wider gas industry.

Royalty payments play a crucial role in ensuring that stakeholders, including landowners and drilling companies, receive their fair share of profit derived from gas production. These payments can significantly affect the cash flow and overall financial health of gas owners, impacting their ability to maintain operations and invest in future projects.

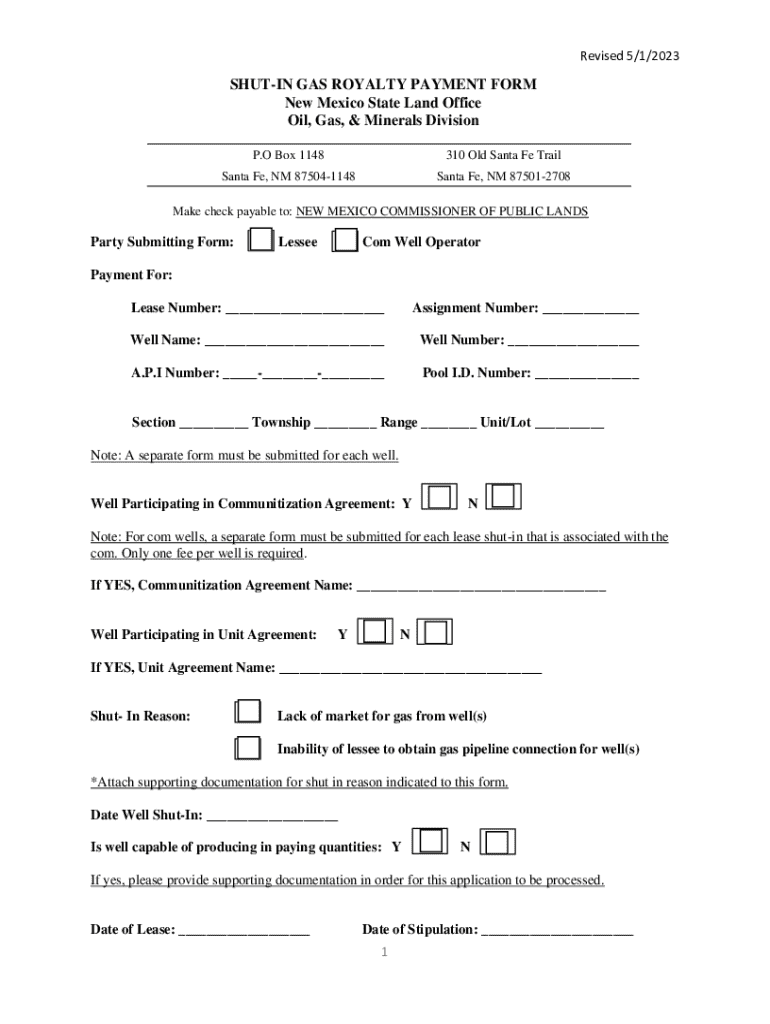

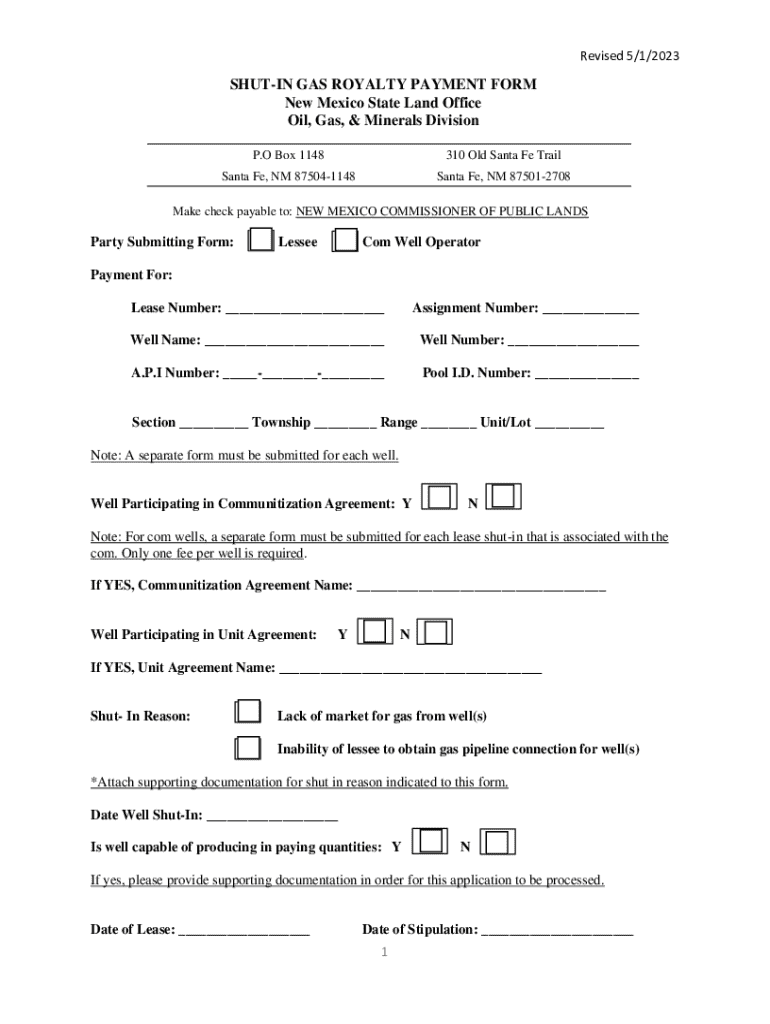

Key components of the shut-in gas royalty payment form

To accurately claim royalty payments for shut-in gas, it’s vital to correctly complete the shut-in gas royalty payment form. This document requires specific information to substantiate the claim, ensuring that all parties involved in the gas production process are fairly compensated.

The shut-in gas royalty payment form includes sections that gather essential details, such as the personal information of the payee and specific data about the shut-in well, including production history and the reason for the shut-in period.

Furthermore, sections detailing the royalty percentage claims and the periods during which production ceased are also included. An understanding of common terminology found on the form can assist in avoiding misinterpretations and ensure accurate reporting of information.

Step-by-step guide to completing the shut-in gas royalty payment form

Filling out the shut-in gas royalty payment form requires careful attention to detail. Before starting, a pre-preparation checklist can help streamline the process. This involves gathering necessary documents, such as proof of ownership and recent production reports, and verifying the current status of the well to ensure eligibility for royalty payments.

Once the documents are gathered, proceed with the detailed instructions for each section of the form. Begin by accurately filling in your personal details, taking care to match your documentation. Next, include comprehensive information about the shut-in well, specifying royalty percentage claims and production details.

Common mistakes include miscalculating royalty percentages or misidentifying well numbers. To avoid these errors, double-check your entries against original documents and consider consulting a colleague or professional if uncertain.

Editing and customizing your shut-in gas royalty payment form

Using digital document platforms like pdfFiller allows users to seamlessly edit and customize their shut-in gas royalty payment form. This includes functionalities such as adding or removing sections to tailor the document to specific needs, as well as inserting digital signatures for a professional touch.

Collaborating with colleagues can also become more manageable with pdfFiller. Users can invite others to review or assist with completing the form, while the platform tracks changes and comments to streamline group efforts effectively.

Signing and submitting the shut-in gas royalty payment form

Completing the shut-in gas royalty payment form is just the first step; signing and submitting it effectively is equally important. Understanding the eSigning process is crucial, as electronic signatures are widely accepted and legally binding in many jurisdictions. Familiarize yourself with the legal considerations to ensure compliance with regulations.

When submitting, users will face a choice between digital and hard copy methods. Each has its best practices; for electronic submissions, ensure that the document is in a compatible format and properly named. Conversely, if opting to mail a hard copy, follow the correct mailing procedures to avoid delays.

Managing shut-in gas royalty payments with pdfFiller

Once your shut-in gas royalty payment form is completed, managing it effectively is paramount. pdfFiller provides users with tools to organize forms and documents efficiently, making retrieval easy when needed. Setting up reminders for filing deadlines can also help keep submissions on track and avoid pitfalls associated with late payments.

Tracking royalty payments becomes straightforward within pdfFiller. Users can monitor the status of their claims, ensuring transparency regarding payment schedules, and gather documentation in preparation for potential future audits.

Case studies and examples

Real-life applications of the shut-in gas royalty payment form demonstrate its significance within the gas industry. For instance, professionals have leveraged detailed and accurate submissions to receive timely royalty payments, showcasing successful methodologies in form completion.

By analyzing various approaches to filling out the forms, insights can be gained on common challenges faced and innovative solutions employed by industry professionals. These case studies serve as valuable learning tools for newcomers and seasoned veterans alike.

Frequently asked questions (FAQs)

Questions frequently arise regarding the shut-in gas royalty payment form. For instance, if your shut-in well is reopened, understanding the transition back to active status is crucial for future royalty claims. Additionally, knowing how often to complete these forms can vary based on operational status and contractual obligations.

Should you require assistance with claims, knowing whom to contact for help can alleviate stress and enhance clarity during the claims process, ensuring that all concerns are addressed promptly.

Staying informed: Relevant updates and changes in regulation

The gas industry is ever-evolving, and staying updated on changes in regulations affecting gas royalties is essential. Recent developments may influence how royalty payments are calculated or distributed. Engaging with resources like industry newsletters can help keep stakeholders informed about these changes.

For sustained learning, online workshops and webinars offer platforms to deepen understanding of new developments and best practices, ensuring that professionals are well-equipped to navigate shifts in the regulatory landscape.

User experiences and feedback

User testimonials offer insights into the benefits of utilizing pdfFiller for managing shut-in gas royalty payments, showcasing how the platform has simplified their experiences with document handling. Positive feedback often highlights the user-friendly nature of pdfFiller’s interface and the efficiency it provides in completing forms.

Sharing personal experiences with shut-in gas royalty payments can also provide guidance to others navigating similar processes, fostering a collaborative learning environment within the industry.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find shut-in gas royalty payment?

How do I edit shut-in gas royalty payment online?

How do I make edits in shut-in gas royalty payment without leaving Chrome?

What is shut-in gas royalty payment?

Who is required to file shut-in gas royalty payment?

How to fill out shut-in gas royalty payment?

What is the purpose of shut-in gas royalty payment?

What information must be reported on shut-in gas royalty payment?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.