Get the free Cash Management Improvement Act Agreement

Get, Create, Make and Sign cash management improvement act

Editing cash management improvement act online

Uncompromising security for your PDF editing and eSignature needs

How to fill out cash management improvement act

How to fill out cash management improvement act

Who needs cash management improvement act?

Cash Management Improvement Act Form - How-to Guide

Understanding the Cash Management Improvement Act (CMIA)

The Cash Management Improvement Act (CMIA) serves as a critical framework for managing cash between federal and state governments effectively. Established in 1990, the CMIA was designed to improve the efficiency of cash management practices at all levels of government while enhancing the coordination of cash flows. This initiative is essential for ensuring that federal and state agencies can minimize the costs associated with cash handling and increase the overall effectiveness of financial management.

The key objectives of the CMIA include reducing the time federal funds are held by states and encouraging states to improve their cash management systems. This not only benefits governmental organizations but also allows for better allocation of resources, ultimately promoting fiscal prudence. For individuals and teams involved in government finance, understanding the CMIA is vital to ensure compliance and optimize operational processes.

The impact of the CMIA extends to various cash management practices that shape the financial operations of both state and federal agencies. Its relevance cannot be overstated, as effective cash management can lead to significant savings and improved public services.

Key features of the Cash Management Improvement Act Form

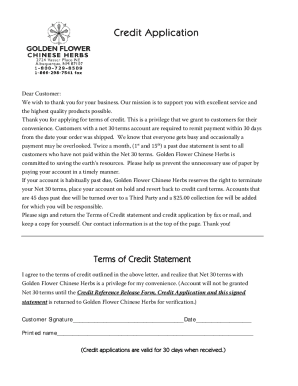

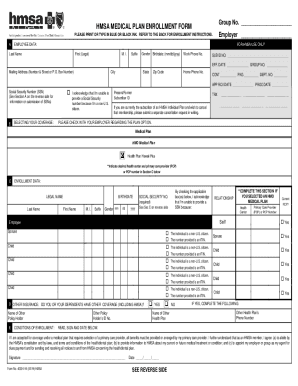

The Cash Management Improvement Act form is an essential tool for documenting and ensuring compliance with cash management requirements. The form includes several critical components that practitioners must understand to fill it out accurately. Required fields typically feature information concerning federal and state expenditures and receipts, along with details about cash balances and management activities.

Common terminologies used within the form, such as 'draws', 'cash balances', and 'federal fund expenditures', are vital for individuals or teams to grasp fully. Furthermore, interactive platforms like pdfFiller offer essential tools that simplify the form completion process. Features such as real-time collaboration allow multiple users to engage with the form simultaneously, ensuring that all necessary insights can be integrated without any hitches.

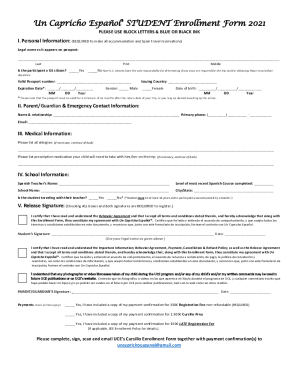

Step-by-step instructions for filling out the CMIA form

Before starting the completion of the CMIA form, it's crucial to prepare adequately. Gathering all necessary supporting documents, including ledgers and balance statements, will streamline the process. Accessing the form on pdfFiller is user-friendly: simply navigate to their platform and locate the CMIA form.

Once you're set up, follow these detailed filling instructions for an efficient completion:

After you have filled out all relevant fields, saving and exporting the completed form is straightforward. Options for saving in various formats ensure that you can share or archive your document securely while maintaining compliance with regulations.

Editing and managing your completed CMIA form

Once the CMIA form has been filled out, editing capabilities on platforms like pdfFiller allow you to make changes seamlessly. The editing tools enable you to adjust text, images, and signatures quickly, ensuring that your document is accurate and reflective of any updates or new information.

Collaboration becomes particularly easy as pdfFiller offers features for multiple users to provide feedback or edits. Best practices for document management suggest maintaining an organized structure for access to all your forms. Leveraging cloud capabilities empowers teams to access, edit, and share documents from anywhere, significantly enhancing remote teamwork.

Signing the CMIA form effortlessly

Signing the CMIA form is made simple through the eSigning options available on pdfFiller. Users can easily add electronic signatures, which not only saves time but also adheres to legal standards regarding digital documentation.

To eSign your document, follow this step-by-step guide:

For collaboration within the signing process, inviting additional parties to sign the CMIA form can be conducted through pdfFiller’s straightforward interface, allowing tracking of progress and completion in real-time.

Troubleshooting common issues

While filling out the CMIA form may seem straightforward, users can encounter common challenges. Familiarity with frequent pitfalls, such as missing signatures or incorrectly inputting data, can greatly enhance efficiency. Moreover, recognizing errors early facilitates smooth corrections before final submission.

If you come across difficulties, pdfFiller has resources designed to address these challenges. The FAQs section includes answers to typical inquiries that can guide users through common misunderstandings, ensuring the successful completion of the CMIA form.

Additional tips for CMIA compliance

To maintain compliance with CMIA guidelines, staying informed is crucial. Regular education sessions or updates from resources available on pdfFiller can help ensure all parties are aware of any changes affecting cash management practices.

Additionally, leveraging pdfFiller for ongoing document management, including yearly reviews to verify compliance with CMIA requirements and setting reminders for upcoming deadlines, can streamline your operational planning and keep your cash management practices on track.

Contacting support and expert assistance

Recognizing when to seek help is vital, especially when navigating complex forms like the CMIA. If confusion arises or unique scenarios unfold, reaching out for additional support becomes essential. pdfFiller offers various contact methods, including chat, email, and telephone support, ensuring that assistance is promptly available.

Additionally, accessing online resources and guides can provide in-depth answers to more detailed inquiries, further supplying you with the knowledge necessary to manage your cash management improvement effectively.

Spotlight on popular links and tools

A wealth of resources regarding the CMIA can be found online, particularly on government websites dedicated to cash management practices. These links often include regulatory updates and detailed guidelines that bolster your understanding of requirements.

On pdfFiller, users can also explore a variety of useful online tools, including templates and additional forms that can facilitate the completion of CMIA documentation and related requirements.

Navigating the annual CMIA report

The annual CMIA report provides a vital overview of cash management processes and their effectiveness over the reporting period. For stakeholders, understanding the importance of these reports directly affects financial planning and strategy, thus impacting outcomes across programs and initiatives.

By utilizing insights drawn from these reports, teams can refine their cash management strategies, leading to improved efficiencies and informed decision-making over time.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify cash management improvement act without leaving Google Drive?

How can I get cash management improvement act?

Can I edit cash management improvement act on an iOS device?

What is cash management improvement act?

Who is required to file cash management improvement act?

How to fill out cash management improvement act?

What is the purpose of cash management improvement act?

What information must be reported on cash management improvement act?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.