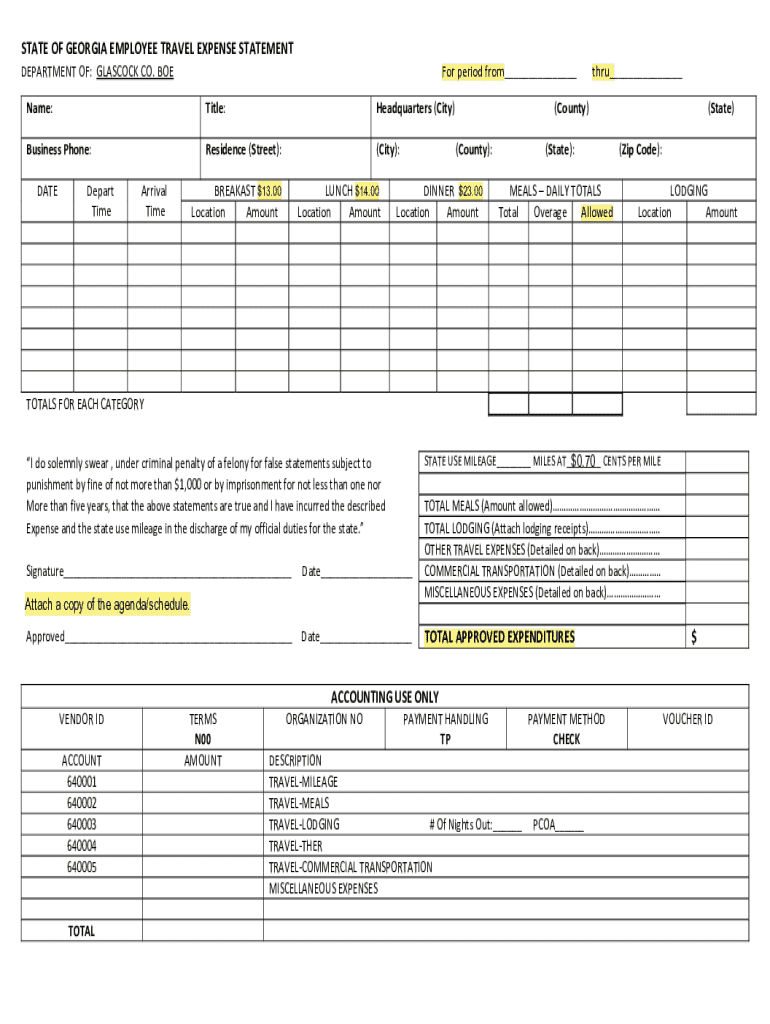

Get the free State of Georgia Employee Travel Expense Statement

Get, Create, Make and Sign state of georgia employee

Editing state of georgia employee online

Uncompromising security for your PDF editing and eSignature needs

How to fill out state of georgia employee

How to fill out state of georgia employee

Who needs state of georgia employee?

A comprehensive guide to the state of Georgia employee form

Overview of the state of Georgia employee form

The state of Georgia employee form serves as a pivotal document for both employers and employees, facilitating the proper collection and dissemination of essential information. These forms are designed to streamline communication between state agencies and their employees, ensuring compliance with various state regulations. Properly completed employee forms can significantly impact taxation, payroll processing, and human resource management.

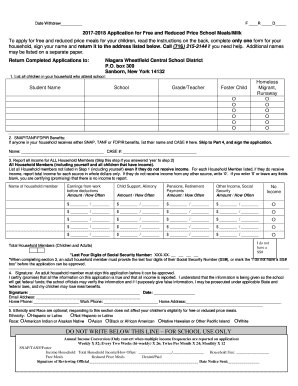

All employees working for the state of Georgia, whether full-time, part-time, or temporary, must complete these forms. This requirement also applies to contractors and seasonal workers, ensuring that everyone engaged in state employment meets regulatory standards. The forms encompass various regulations, including tax withholding, payroll distribution, and employee rights.

Types of employee forms in Georgia

Georgia mandates several types of employee forms, each serving distinct purposes vital to the employment and payroll processes. Among these forms, the Employee Withholding Allowance Certificate (Form G-4) is the most crucial, guiding how much state income tax is withheld from an employee's paycheck. The Employment and Wage Verification Form is also widely used for confirming employment status and income for loans or rental applications.

Additional forms cater to specific circumstances. For instance, the New Hire Reporting Form is required within a certain period of hiring to assist in tracking newly employed individuals for child support purposes. The Employee Grievance Form provides a structured method for employees to report workplace issues, ensuring that their concerns are formally recognized and addressed.

Step-by-step instructions for completing the state of Georgia employee form

Completing the state of Georgia employee form requires attention to detail and an understanding of the information requested. The process can be broken down into structured sections.

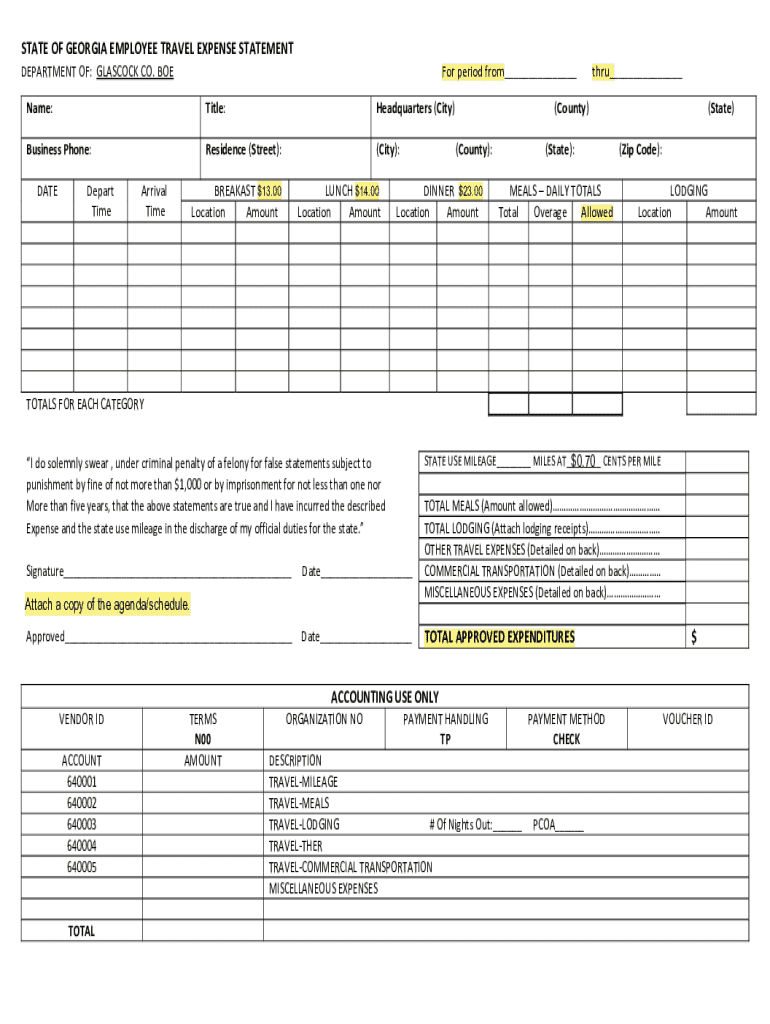

Section A: Basic information

In this section, you will provide your full name, contact information, job title, and start date. It’s crucial to ensure all details are accurate, as this information forms the foundation of your employment records.

Section B: Tax information

Here, you will need to complete the Employee Withholding Allowance Certificate (Form G-4). Determine the number of allowances you wish to claim, along with your exempt status. Each allowance generally reduces the amount of income subject to withholding.

Section : Direct deposit information

Providing your bank account details in this section will enable your employer to deposit your earnings directly into your account. Direct deposit is not only convenient but also increases the security of your funds, eliminating the risks associated with physical checks.

Section : Acknowledgments and signatures

Finally, you will need to sign the form, confirming that all information provided is true and complete. This section may require additional signatures from your supervisor or HR department.

Interactive tools for completing employee forms

Utilizing interactive tools can enhance the process of completing employee forms. pdfFiller’s online form editor, for instance, provides users with tools to edit forms, add fillable fields, and utilize checkboxes, streamlining completion and ensuring accuracy.

The platform also offers electronic signature capabilities, ensuring that documents are signed securely online. With built-in encryption and security protocols, users can rest assured that their data is safe when using digital signatures.

Tips for editing and managing your employee forms

When managing your employee forms on pdfFiller, several best practices can help you stay organized. First, utilize the 'Save' function frequently to prevent data loss, especially when filling out lengthy forms.

Make use of the version history feature to track changes and maintain records. This can be invaluable for referencing past information or confirming that changes have been made appropriately. Additionally, sharing forms with HR or colleagues can be smoothly accomplished through pdfFiller's built-in sharing functionalities.

Common mistakes to avoid when filling out employee forms

Filling out employee forms incorrectly can lead to various complications, so it's vital to avoid common pitfalls. One of the most frequent mistakes is omitting mandatory information, which can delay processing or lead to inaccurate payroll calculations.

Additionally, misunderstanding tax withholding options can result in over- or under-withholding of state taxes, negatively affecting your take-home pay. Lastly, remember to update your forms whenever there is a change in personal circumstances, such as marital status or a change in number of dependents.

FAQs about employee forms in Georgia

Employees often have questions regarding the frequency of updating forms. Generally, it's advisable to review forms annually or when a significant life change occurs. If you lose your completed form, it’s best to contact your HR department to obtain a replacement or guidance on how to properly resubmit the necessary information.

Security of personal information is also a common concern. Always store forms in a secure, encrypted location, and utilize the features offered by pdfFiller to enhance data protection.

Navigating support and resources

For comprehensive support, pdfFiller offers an array of resources to assist users in managing their employee forms. Their website has extensive documentation and tutorials that guide users through various functionalities of the platform.

Moreover, HR departments can provide essential assistance in understanding specific requirements related to forms. In case of technical difficulties, pdfFiller’s customer support team is readily accessible to assist with any issues you may encounter.

Special considerations for unique situations

Certain life changes may necessitate adjustments to your employee forms. For instance, marriage can lead to updates regarding tax withholding and benefits enrollment. Similarly, if you are an out-of-state employee, be aware of any tax implications associated with your residency—this is particularly vital for those transitioning into or out of Georgia.

Temporary employees should also understand that specific regulations might apply differently to them. Ensuring compliance with unique considerations will help safeguard your employment status and benefits.

Best practices for document management

Efficiently managing your employee forms involves staying organized and maintaining digital copies. Start by creating a dedicated folder on your device or in the cloud where all related documents can be stored securely. Regular maintenance, such as backing up important forms and making periodic audits, ensures compliance with all necessary regulations.

Make backup copies of essential forms to prevent loss of data due to technical failures. Implementing a regular review process can also help identify outdated information that needs to be updated.

Get started with pdfFiller

Getting started with pdfFiller is straightforward. Simply create an account to begin utilizing their features, including a full suite of templates specific to Georgia employee forms. This quick setup allows users to explore various functionalities, such as fillable forms and electronic signatures.

The cloud-based document management approach not only enhances accessibility but also simplifies collaboration with teammates or HR departments. With pdfFiller, managing employee forms becomes a seamless process, helping you focus on your work rather than paperwork.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get state of georgia employee?

How do I complete state of georgia employee online?

How do I edit state of georgia employee on an Android device?

What is state of georgia employee?

Who is required to file state of georgia employee?

How to fill out state of georgia employee?

What is the purpose of state of georgia employee?

What information must be reported on state of georgia employee?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.