Get the free 870-ricr-10-00-4

Get, Create, Make and Sign 870-ricr-10-00-4

Editing 870-ricr-10-00-4 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 870-ricr-10-00-4

How to fill out 870-ricr-10-00-4

Who needs 870-ricr-10-00-4?

A Comprehensive Guide to the 870-ricr-10-00-4 Form

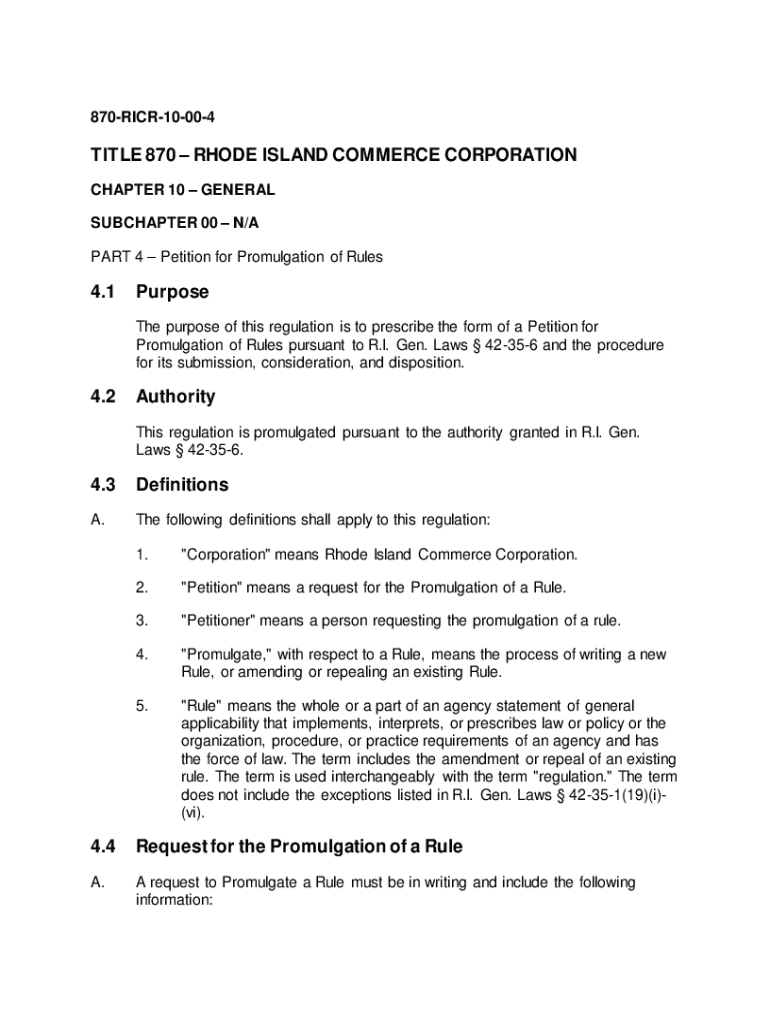

Overview of the 870-ricr-10-00-4 form

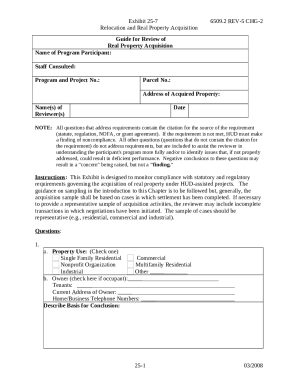

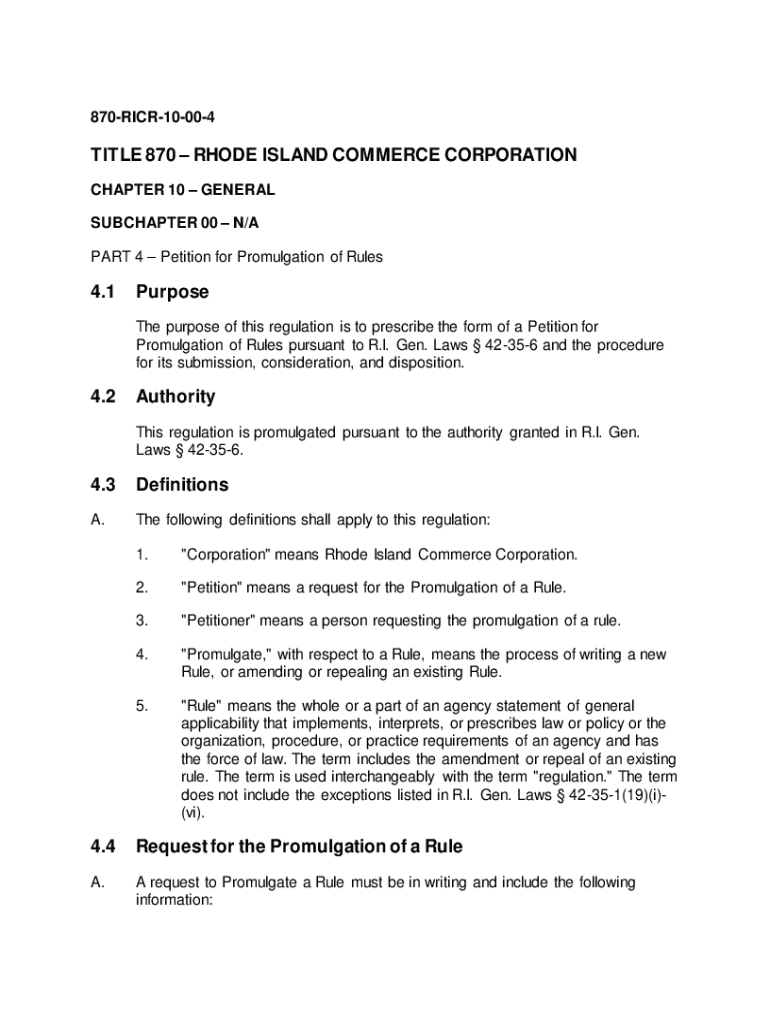

The 870-ricr-10-00-4 form is a critical document used in various administrative and legal contexts. This form is structured to facilitate comprehensive reporting and compliance with specific regulatory framework requirements. It plays a significant role in detailing personal and financial information required by governing bodies.

Primarily, the 870-ricr-10-00-4 form serves to streamline processes, maintain transparency, and support auditing objectives. Essential for both individuals and businesses, this form becomes critical during applications for permits, licenses, tax documentation, and legal compliance checks. Understanding its use can lead to better management of bureaucratic interactions.

Key features of the 870-ricr-10-00-4 form

The 870-ricr-10-00-4 form includes several interactive sections designed to collect essential data efficiently. Each section has specific fields for personal details and financial data, making it user-friendly while still demanding attention to detail. Some sections require checkboxes, while others prompt detailed numerical entries.

Completing the form accurately is crucial, as discrepancies can lead to processing delays or additional scrutiny. Moreover, understanding the required information entails knowing the deadlines associated with the form, which vary depending on the purpose for which it is being filed—be it annual reporting or application-related timeframes.

Step-by-step guide to completing the 870-ricr-10-00-4 form

Filling out the 870-ricr-10-00-4 form efficiently improves your chances of a successful outcome. The following guide walks you through the process step-by-step, ensuring that you are well-prepared.

1. Preparing to fill out the form

Before you start, gather all necessary documents, including identification, financial statements, and any other relevant records. Familiarize yourself with the format of the 870-ricr-10-00-4 form; it consists of multiple sections that need careful attention to detail. Being methodical in your preparation can mitigate errors.

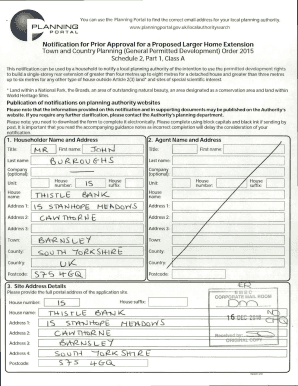

2. Filling out personal information

Begin by entering personal data such as your name, address, and contact information in the designated fields. Ensure accuracy as any misspelled names or incorrect addresses may lead to complications. Double-check each entry against your supporting documents.

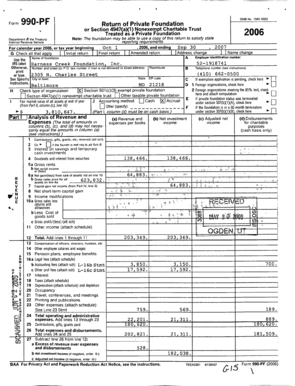

3. Detailing financial information

Next, address the sections concerning financial details. This could include income, expenses, and any relevant financial history. Utilize calculators if necessary and verify that your numbers align with supporting documents to avoid discrepancies. Pay careful attention to rounding errors and formatting to ensure the submission is clean and clear.

4. Reviewing and finalizing your entries

Once all fields are filled, take the time to review each section thoroughly. Create a checklist to ensure consistency and completeness of the submitted information. This process is vital as clarity in your form can lead to a smooth processing experience.

Editing and modifying the 870-ricr-10-00-4 form

Making changes to the 870-ricr-10-00-4 form can be straightforward, especially with tools provided by pdfFiller. The platform allows you to edit your form seamlessly, offering various features like text boxes, annotations, and form field manipulation that simplify the entire editing process.

With pdfFiller, mistakes can be corrected easily and documents can be adjusted in real-time. Whether it's adding new information or modifying existing entries, the intuitive interface supports efficient management of your documents, ensuring your form is always up to date.

Signing the 870-ricr-10-00-4 form

Electronic signatures streamline the signing process for the 870-ricr-10-00-4 form. With pdfFiller, you can easily add your signature through a guided process, ensuring both legality and convenience.

Using electronic signatures is compliant with various legal frameworks and is accepted by agencies that require the 870-ricr-10-00-4 form. By following the steps to add your signature in pdfFiller, you’re ensuring that your submission meets all necessary compliance regulations.

Submitting the 870-ricr-10-00-4 form

After completing and signing your form, the next step is submission. There are several methods available: online submission typically provides faster processing, while mailing the form could take longer. In-person submission may be required by some agencies depending on the nature of the form.

To ensure your submission is timely and accurate, prepare for deadlines outlined by the submitting agency. After your form is submitted, keep records of your submission and any reference numbers for tracking purposes, allowing you to follow up if necessary.

Frequently asked questions about the 870-ricr-10-00-4 form

As users navigate the nuances of the 870-ricr-10-00-4 form, several common concerns arise. Frequently asked questions often pertain to errors in submission, guidelines for filling certain sections, or how to access the form. Understanding these queries can simplify your experience.

To handle any uncertainties, it is recommended to consult resources made available by agencies or reliable document management platforms like pdfFiller, which can guide users with specific inquiries regarding the 870-ricr-10-00-4 form.

Best practices for managing forms with pdfFiller

To ensure efficient document management, utilize the cloud-based features of pdfFiller for storage and organization. Keeping your forms accessible is paramount to effective workflows, particularly for teams who require collaboration on forms like the 870-ricr-10-00-4.

Leverage templates for frequent submissions to save time and reduce redundancy. By establishing a centralized location for your forms, users can ensure everyone has access to the latest versions, fostering collaborative efforts and minimizing miscommunication.

Conclusion

Mastering the 870-ricr-10-00-4 form is essential for effective administrative compliance and reporting. By understanding its structure and employing tools like pdfFiller, users can streamline their document management processes significantly.

As you navigate your requirements, remember that leveraging pdfFiller empowers you to manage documents efficiently, ensuring accuracy, compliance, and ease of access.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit 870-ricr-10-00-4 in Chrome?

How do I fill out 870-ricr-10-00-4 using my mobile device?

How do I edit 870-ricr-10-00-4 on an iOS device?

What is 870-ricr-10-00-4?

Who is required to file 870-ricr-10-00-4?

How to fill out 870-ricr-10-00-4?

What is the purpose of 870-ricr-10-00-4?

What information must be reported on 870-ricr-10-00-4?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.