Understanding the Single Audit Questionnaire Document Template Form

Understanding the single audit questionnaire

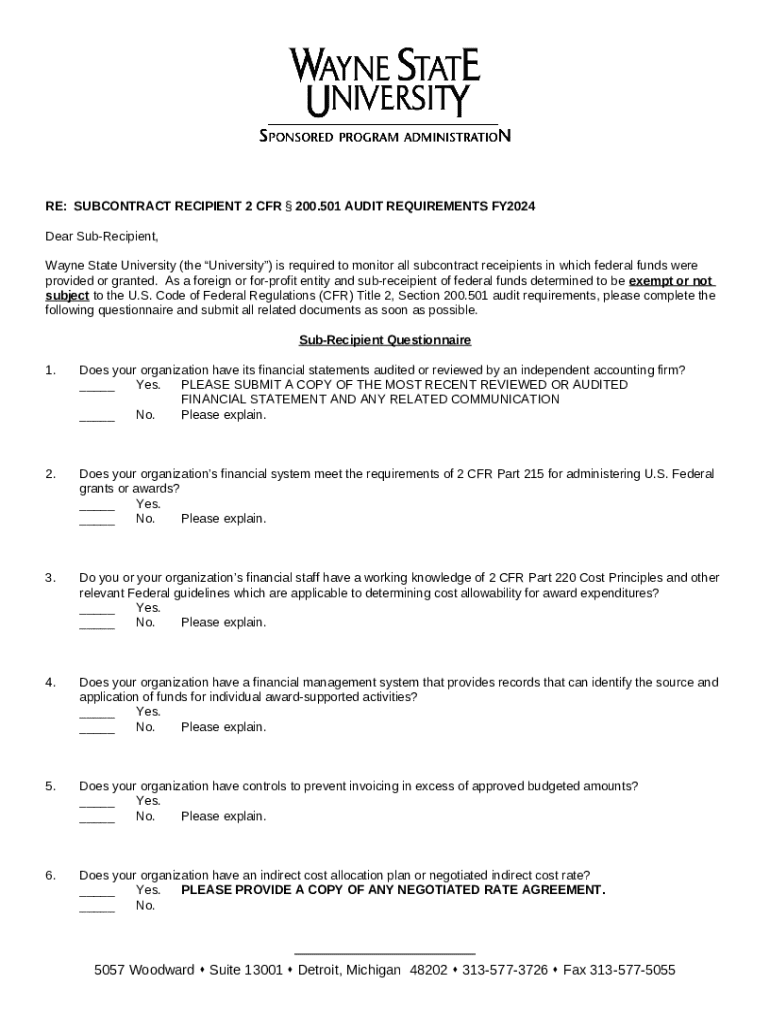

A Single Audit Questionnaire (SAQ) is a vital document utilized primarily by entities that receive federal funding. The purpose of this questionnaire is to evaluate compliance with federal requirements regarding financial management and program performance. Completing the SAQ accurately is crucial for ensuring fiscal accountability and transparency, thus reinforcing public trust in funded programs.

For state and local governments, as well as nonprofit organizations that expend federal funds, the Single Audit Questionnaire is not merely a formality. Rather, it serves as a systematic approach for auditors to gauge compliance and adequacy of internal controls over financial reporting. When effectively used, it contributes significantly to the oversight mechanisms that govern the use of public funds.

Who requires a single audit?

Several entities are mandated to undergo a Single Audit, specifically those that expend $750,000 or more in federal funds during the fiscal year. This requirement typically affects various state and local governments and nonprofit organizations that receive federal grants and contracts. Additionally, recipients of federal programs are held accountable for maintaining high standards of fiscal responsibility and compliance, with the Single Audit Questionnaire streamlining the process of meeting these expectations.

Understanding the federal programs and their respective oversight is crucial for entities subject to audits. For instance, programs administered by agencies such as the Department of Education or the Department of Health and Human Services might have specific compliance requirements that must be addressed in the SAQ. This hinges on the premise that effective financial management and programmatic accountability foster the overall integrity of federal funding.

Key components of the single audit questionnaire

The SAQ's architecture reflects its critical role in the audit process, as it gathers pertinent data necessary for assessing compliance. Key components typically encompass sections for administrative information, financial data, program-specific details, and self-assessments regarding internal controls and compliance with regulations. Collectively, this information provides auditors with a comprehensive view of a recipient’s fiscal operations and compliance status.

Information collection (IC) for audit preparation can often be extensive, comprising financial statements, grant agreements, and previous audit findings. The importance of accurate data collection cannot be overstated—as discrepancies or inaccuracies can lead to audit findings that might have far-reaching consequences, including financial penalties or the suspension of federal funding. Thus, organizations must invest time and resources into meticulous preparation for the completion of their Single Audit Questionnaire.

Detailed breakdown of the questionnaire sections

A well-structured SAQ comprises several key sections, starting with administrative information. This section typically includes the entity’s identification details, contact information, and data about the primary individuals responsible for financial oversight. Completing this section accurately is essential as it provides auditors with necessary context about the organization they will evaluate.

The financial data sections follow, often requiring organizations to present detailed budget comparisons and outline the sources of their funding. These sections grant auditors insight into how federal funds are utilized and whether they align with the stated budgets. Furthermore, program-specific information details federal programs the entity is involved with, linking budgetary allocations with the intended program outcomes. Lastly, compliance and internal control assessments are essential for evaluating the entity's adherence to federal regulations, helping to identify any areas at risk of non-compliance.

How to fill out the single audit questionnaire

Filling out the Single Audit Questionnaire can be daunting; however, by following a step-by-step approach, organizations can streamline the process. Begin by gathering necessary documents such as financial statements, previous audit reports, and grant agreements, which serve as foundational evidence during the questionnaire completion. Understanding what information is required for each section will diminish confusion and increase accuracy.

Each section should be approached methodically, ensuring clarity and thoroughness in answers. Common mistakes may include errors in data entry, such as misplaced decimal points or incorrect figures, which can lead to misinterpretation during the audit process. Another pitfall is misinterpreting guidelines, which can occur if the questionnaire is not read comprehensively. Organizations must aim to avoid these mistakes by double-checking entries and seeking clarifications when uncertain.

Tips for successful submission of your questionnaire

Timeliness is critical when submitting the Single Audit Questionnaire, as delays can postpone the audit process and affect funding timelines. To ensure timely submission, it's recommended to start preparing well in advance of any deadlines. Additionally, organizations should familiarize themselves with the format and submission guidelines specific to their federal program, as these can vary significantly.

Understanding the required signatures and documentation enhances compliance with submission guidelines. To facilitate team efforts, employing digital document management tools, such as pdfFiller, allows for efficient collaborative editing and reviewing of questionnaire responses. Utilizing these cloud-based solutions not only streamlines the process but also maintains version control, ensuring that the most up-to-date information is used throughout.

Reviewing the auditor checklist

Preparing documentation ahead of the audit is essential for a smooth review process. Common types of documents to collect include financial reports, compliance certifications, and correspondence from funding agencies. Auditors typically focus on areas such as budget adherence, allocation of federal funds, and the presence of effective internal controls. High-risk areas or discrepancies may act as red flags during the audit, prompting deeper investigation.

Entities must ensure their documentation is thorough and clearly presented to minimize complications during audits. Understanding which areas auditors focus on can guide organizations in preparing their SAQs proactively, thereby increasing the chances of a favorable audit outcome.

Managing your single audit questionnaire

Effective management of the Single Audit Questionnaire does not end with submission. Organizations should be prepared for potential edits and revisions post-submission, and tools like pdfFiller offer convenient options for making necessary updates quickly. Ensuring that departmental teams adhere to best practices in data management, including systematic storage and access controls, fortifies the compliance framework.

Appropriate document management systems help keep track of revisions and maintain access control, which is especially critical for sensitive financial information. Employing cloud-based tools facilitates collaboration while preserving accountability, making it easier to manage multiple versions of the questionnaire as needed.

Frequently asked questions (faqs)

Making a mistake on the Single Audit Questionnaire can be concerning, but many errors can be corrected through proper channels. If an organization identifies a mistake after submission, it’s crucial to address it promptly, potentially involving a request for an amendment or clarification with the auditors. Organizations must also establish a feedback loop to learn from mistakes and enhance future questionnaire accuracy.

Data security is a another significant concern, especially given the sensitive nature of the information being reported. Utilizing secure document management systems, like pdfFiller, ensures that files are stored in a protected environment, and user access controls can prevent unauthorized changes or access. Additionally, organizations should seek support resources, whether from audit experts or compliance officers, to assist with the SAQ process and offer clarifications on complex areas.

Related topics to explore

Understanding federal compliance requirements can provide a solid foundation for navigating the nuances of the Single Audit Questionnaire. Familiarity with applicable laws and regulations such as the Uniform Guidance allows entities to better prepare for audits. Furthermore, recognizing the auditors' roles in maintaining financial accountability underscores the importance of accurate auditing practices. By exploring these areas, organizations can position themselves for effective compliance and successful audits.

Overall, engaging comprehensively with the SAQ process and aligning internal practices with audit requirements strengthens not only compliance but also confidence in the management of federal funds, ensuring that organizations consciously uphold their financial responsibilities to stakeholders.