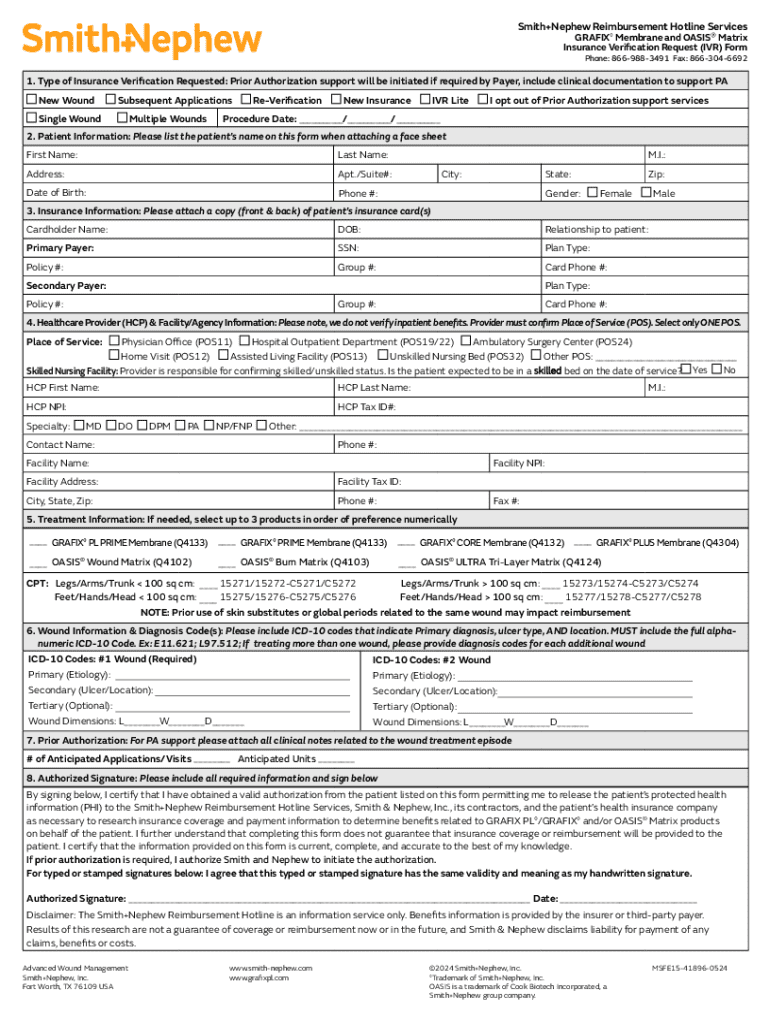

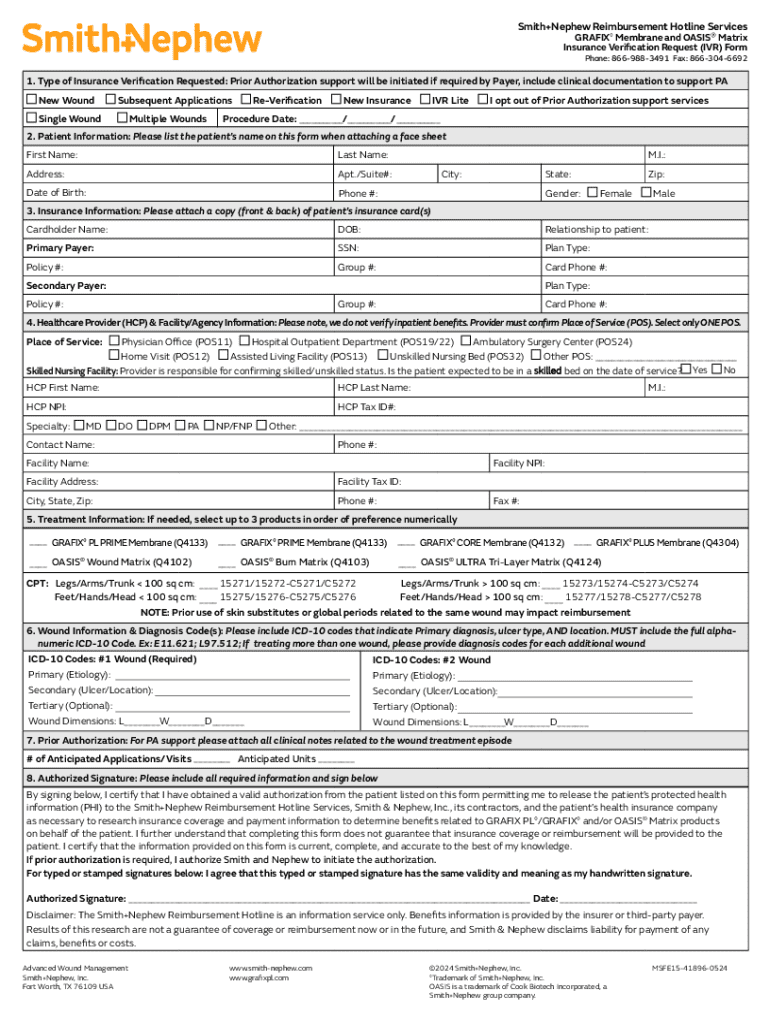

Get the free Insurance Verification Request (ivr) Form

Get, Create, Make and Sign insurance verification request ivr

Editing insurance verification request ivr online

Uncompromising security for your PDF editing and eSignature needs

How to fill out insurance verification request ivr

How to fill out insurance verification request ivr

Who needs insurance verification request ivr?

Insurance Verification Request IVR Form - How-to Guide Long-Read

Understanding the insurance verification request IVR process

An insurance verification request is a critical component in the healthcare industry. It verifies a patient’s eligibility for benefits and services before they receive medical treatment. Inaccuracies in this process can lead to billing issues, potential denials of care, and unsatisfactory patient experiences. Therefore, understanding the insurance verification request IVR (Interactive Voice Response) process is vital for both healthcare providers and patients.

Using an IVR system for insurance verification offers several advantages. To start, it significantly reduces the time spent on phone calls, enabling quick access to essential information. Secondly, automation reduces human error, which is often prevalent in manual processes. Finally, a streamlined IVR process enhances the patient experience by providing quicker responses, thereby improving overall satisfaction.

Preparing for the IVR submission

Before completing an insurance verification request IVR form, it’s essential to gather accurate information. Begin by collecting the patient’s personal details, which typically include their full name and date of birth. Additionally, you'll need to have policy-related information at hand, such as the insurance provider's name and the corresponding policy number, along with any contact details for follow-up.

Another key preparatory step is gaining a firm understanding of your insurance policy. This involves knowing the types of services that are covered and the eligibility criteria for verification. Familiarity with these terms can significantly ease the verification process and help prevent complications during the IVR submission.

Step-by-step guide to completing the insurance verification IVR form

The first step in the insurance verification process using an IVR system is accessing the IVR. This typically involves calling a specific phone number provided by the insurance company or healthcare provider. Once the call is initiated, listeners will encounter a menu. It's important to listen carefully to these options to navigate the system accurately.

Next, accurately input your information when prompted. A few tips include speaking slowly and clearly, as well as double-checking the details provided. Common pitfalls to avoid include providing outdated or incorrect details, which can lead to unnecessary delays. Once all your information is submitted, it’s crucial to confirm that your submission was received correctly. This can often be done by listening to the confirmation message at the end of the process.

Frequently asked questions (FAQs)

After submitting an insurance verification request IVR form, users often wonder about the next steps. Upon submission, insurance companies typically provide a timeline for response, which can vary depending on the complexity of the verification. It's crucial to remain patient but proactive — if you haven't received confirmation within the given timeframe, consider following up.

In cases where issues arise with verification, common problems include incorrect policy details or service codes. The best approach is to ensure all information is accurate. If verification is denied, review the reasons provided thoroughly, and if necessary, prepare to appeal the decision. Generally, assistive resources are available, including customer service contacts provided by your insurance provider.

Best practices for managing your insurance verification process

To effectively manage the insurance verification process, tracking your requests is essential. Utilizing the tracking tools available through pdfFiller can streamline this task. By creating a template for repeat submissions, you ensure consistency and accuracy in your requests, reducing the likelihood of errors.

Additionally, staying informed about any changes to your insurance policy is crucial. Regularly reviewing your policy documents can help you understand coverage nuances and eligibility criteria better. Ensure your information is updated in the IVR process as necessary, which can save time and add to the overall accuracy of your requests.

Utilizing pdfFiller for document management and submissions

pdfFiller simplifies the process of filling and modifying your insurance verification request IVR form digitally. Its user-friendly interface allows you to edit forms as needed, making it easy to keep your documentation up-to-date. The platform also enables electronic signatures, which not only speeds up the process but ensures your documents are securely signed.

Another excellent feature of pdfFiller is its collaboration tools. You can invite team members to assist in form management, ensuring that no detail is overlooked. This ensures a collective effort in achieving accuracy and efficiency, especially when dealing with complex insurance queries.

Understanding the follow-up process

Once your insurance verification request is reviewed, it's important to understand what types of responses you may receive from the insurance company. This can range from instant verification to follow-up inquiries seeking more details. Being prepared for these scenarios can save a significant amount of time and frustration.

In cases where verification is denied, familiarize yourself with the steps involved in responding or appealing the decision. Documenting all correspondence with the insurance provider is crucial, as this becomes an invaluable resource if disputes arise. Adopting best practices for documentation and follow-up ensures that you have a thorough record to refer to when needed.

Additional resources and tools

For users looking for assistance in completing their insurance verification request IVR forms, accessing useful PDFs and templates can be invaluable. These resources can help guide you through the necessary steps and provide insights that facilitate the process. Moreover, consider external support services dedicated to educating users about various insurance policies and the functioning of IVR systems.

Important contacts and helplines

Connecting with your insurance provider directly can streamline the verification process. Having the direct support numbers on hand will ensure that you can easily reach out when needed. Additionally, customer service contacts for pdfFiller can assist with any technical issues you may encounter while filling out or submitting your forms. Lastly, ensuring you have access to emergency contact options can be vital for urgent submissions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my insurance verification request ivr in Gmail?

Can I create an eSignature for the insurance verification request ivr in Gmail?

How do I edit insurance verification request ivr on an iOS device?

What is insurance verification request ivr?

Who is required to file insurance verification request ivr?

How to fill out insurance verification request ivr?

What is the purpose of insurance verification request ivr?

What information must be reported on insurance verification request ivr?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.