Get the free Small Business Loan Application Form

Get, Create, Make and Sign small business loan application

Editing small business loan application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out small business loan application

How to fill out small business loan application

Who needs small business loan application?

Your Ultimate Guide to the Small Business Loan Application Form

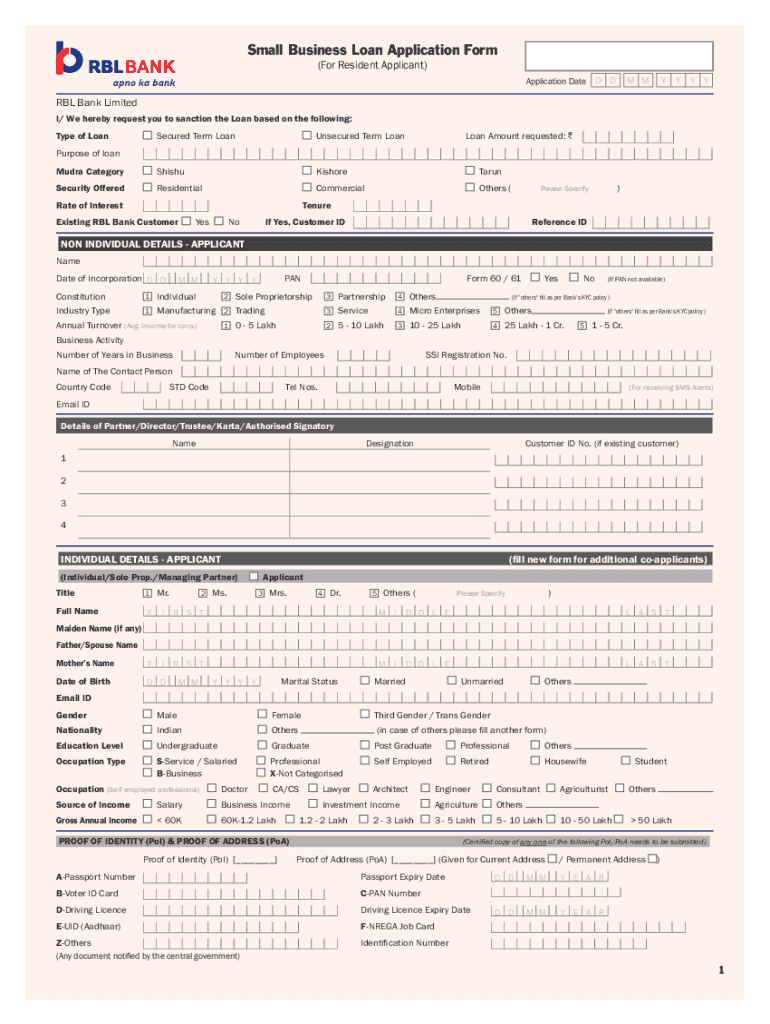

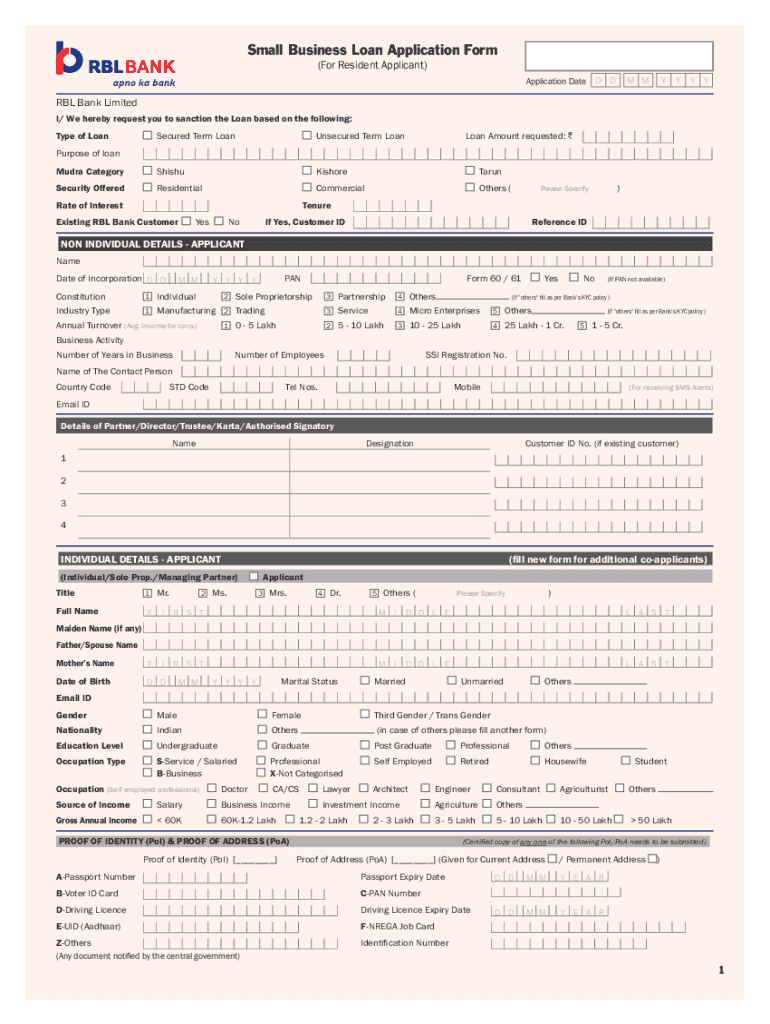

Understanding the small business loan application form

A small business loan application form is a vital document that serves as the first step in securing funding for your business. This form is your opportunity to present your business, its financial status, and your funding needs to potential lenders. Completing the application accurately and thoroughly is crucial for obtaining necessary capital, as lenders assess the information provided to determine your business's creditworthiness.

Understanding the importance of the small business loan application form goes beyond filling in blanks; it involves demonstrating your business's potential and viability. A well-prepared application not only aids in securing the funding you need but also builds a foundation of trust with lenders. The stakes are high, as this document can significantly influence whether your business thrives or struggles due to lack of funds.

Typical requirements for application

Essential sections of the small business loan application form

Every small business loan application form consists of several essential sections that gather specific information from the applicant. Preparing these sections thoroughly increases the chances of loan approval and establishes a solid rapport with lenders.

Borrower information section

The borrower information section requires you to provide personal and business details. This includes your name, address, contact information, and business structure (sole proprietorship, partnership, LLC, etc.). It's crucial to fill this out accurately and honestly, as lenders will verify your information. Misrepresentation can lead to immediate disqualification.

Business description

In the business description section, you should outline your business's mission, your products or services, and an overview of the market you serve. Highlight your unique selling propositions (USPs) and market position, as this showcases to lenders why your business stands out and deserves financing.

Financial information

Financial information is a critical component of your loan application. You’ll typically need to provide profit and loss statements, balance sheets, and cash flow projections. These documents help convey your business's financial health and future viability, conveying to lenders whether you can repay the loan.

Loan details

Lastly, the loan details section involves specifying the amount you wish to borrow and its intended purpose. Whether buying equipment, expanding operations, or covering working capital, clarity in your reasons for seeking the loan can strengthen your case. Understanding the various loan types, such as term loans, lines of credit, or SBA loans, can also guide your application process.

Step-by-step guide to completing the application

Step 1: Gather required documents

Before you begin filling out the application form, gather all necessary documentation. You'll need financial records, a business plan, and any legal business documents. Having these on hand not only streamlines the process but also ensures you have accurate information to provide.

Step 2: Fill out the application form

When it comes to filling out the application form, pay attention to details in each section. Fill in every field as accurately as possible. A common mistake is leaving out requested information or making typographical errors, which can raise red flags for lenders.

Step 3: Review and edit the application

Once you have completed the application, take time to review and edit for any errors. Proofreading helps catch mistakes that could weaken your credibility. Utilize tools available through pdfFiller for document revision, ensuring that your application is polished before submission.

Step 4: Obtain necessary signatures

In some cases, especially with larger loans or multiple owners, you may need to obtain several signatures. ESignature options available through pdfFiller simplify this process, offering legally binding signatures that can be done online. Always check legal considerations surrounding signatures in the context of your application.

Step 5: Submit the application

After you have reviewed and signed your application, it’s time to submit it. Carefully consider when to submit it; timing can affect your application status. Whether submitting online or via paper, make sure to confirm that the lender receives your application and understand how to track its status.

Navigating the approval process

What to expect after submission

After your small business loan application form is submitted, expect a review period where lenders assess your application, which can take anywhere from a few days to several weeks. Be prepared for follow-up questions regarding your financial documents or business plan, as lenders may want to clarify certain aspects.

Preparing for interviews with lenders

Often, approval involves an interview where lenders will ask targeted questions. Prepare to discuss your business's financial health, future growth plans, and how you intend to use the funds. Clear and confident communication about your vision can enhance your chances of securing the loan.

Common variations and types of small business loan applications

SBA loan application

SBA loans often have specific requirements and forms that differ from standard bank loans. For instance, you may need to demonstrate how your business meets the SBA's criteria. This can include detailing how your business qualifies as a small business and presenting collateral if required by the lender.

Bank loan vs. alternative lenders

The application forms for bank loans and alternative lenders can significantly differ. Banks often require comprehensive financial documentation, while alternative lenders may have streamlined applications with less stringent requirements. Understanding these differences will help tailor your application to the lender's specific expectations.

Specific programs and grants

In addition to traditional loans, there are specific programs and grants available, such as the Community Advantage Program or International Trade Loans. Each has its own distinct application process, criteria, and benefits, making it crucial to assess which is best suited for your business’s needs.

Essential tips for a successful application

Crafting a successful small business loan application requires a thoughtful approach. One key component is a well-prepared business plan that demonstrates your strategy and potential for growth. Building a strong credit profile ahead of time also plays a crucial role in gaining lender trust.

Another strategy is networking and relationship-building with lenders. Attend business workshops and local networking events to establish rapport with the very lenders you might approach for funding. This local support can make a significant impact on how your application is received.

Assistance and resources available

Navigating your small business loan application can be daunting, but help is available. Utilizing platforms like pdfFiller allows you to refine your application with easy editing tools and collaborative options. Additionally, many local chambers of commerce offer workshops and resources aimed at guiding entrepreneurs through the loan process.

You can also find valuable insights through online forums and networks dedicated to small business owners, where shared experiences can provide guidance and support. Engaging in these communities often helps demystify the loan application process.

Conclusion for your small business loan application journey

Successfully navigating the small business loan application form is a multi-step process that requires careful preparation. From gathering the necessary documents to thoroughly completing each section of the form, diligent attention to detail is paramount. Utilizing tools like pdfFiller can streamline this journey, enabling seamless editing, collaboration, and management of your application.

By staying informed and leveraging available resources, you can bolster your chances of securing the funding your business requires. Remember, this experience is not just about filling out a form; it’s about telling your business's story and convincing lenders of its potential. With each application, you’re one step closer to turning your business aspirations into reality.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit small business loan application from Google Drive?

How do I complete small business loan application online?

Can I edit small business loan application on an iOS device?

What is small business loan application?

Who is required to file small business loan application?

How to fill out small business loan application?

What is the purpose of small business loan application?

What information must be reported on small business loan application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.