Get the free Personal Asset Loan Application Form

Get, Create, Make and Sign personal asset loan application

Editing personal asset loan application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out personal asset loan application

How to fill out personal asset loan application

Who needs personal asset loan application?

Personal Asset Loan Application Form - How-to Guide

Understanding personal asset loans

Personal asset loans are secured loans that allow you to borrow against the value of an asset you own, such as a vehicle, property, or other valuable items. These loans differ from traditional unsecured loans, where the lender relies solely on your creditworthiness and income for approval. In this case, your asset acts as collateral, offering lenders a form of security and potentially resulting in lower interest rates.

One of the common uses for personal asset loans includes financing major expenses like home renovations, purchasing a vehicle, or consolidating higher-interest debts. The benefits of choosing a personal asset loan include access to larger amounts of money at more competitive rates, especially when compared to credit cards or personal loans.

Getting started with your personal asset loan application

The application process for a personal asset loan typically involves several key steps, starting with gathering the necessary documentation and understanding the lender's requirements. Preparing accordingly before starting your application will help expedite the process and ensure you have all required information at your fingertips.

Lenders assess applications based on several crucial factors, including your credit score, income stability, the type and value of the asset being leveraged, and your existing debts. Demonstrating strong financial health can significantly improve your chances of approval.

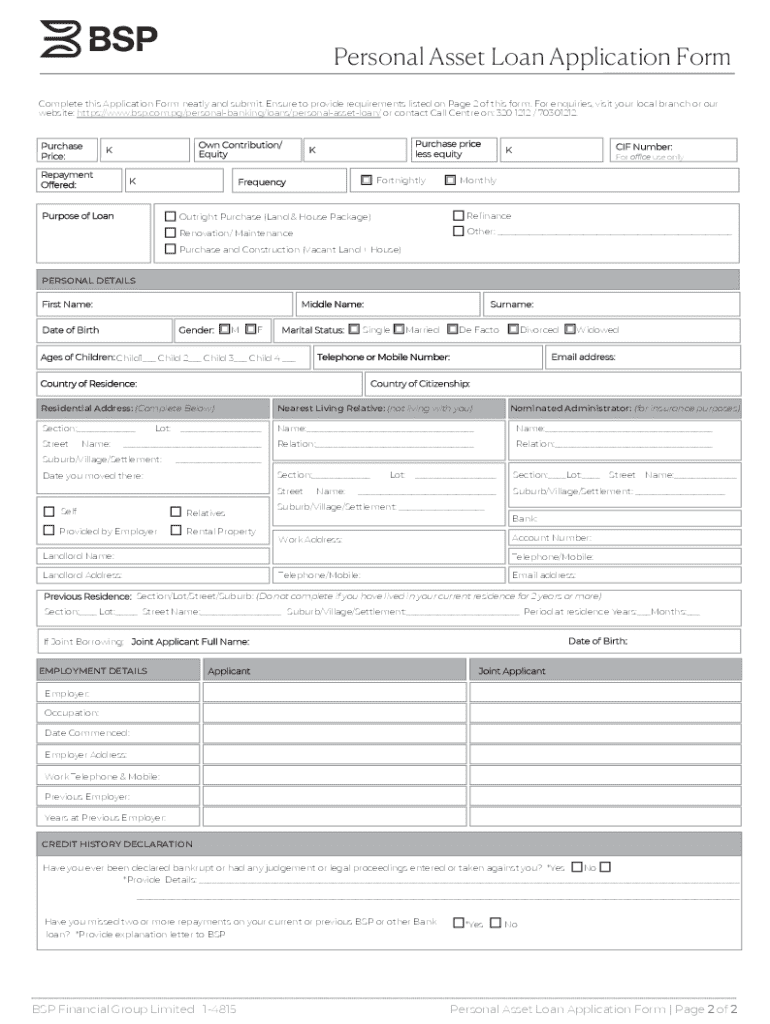

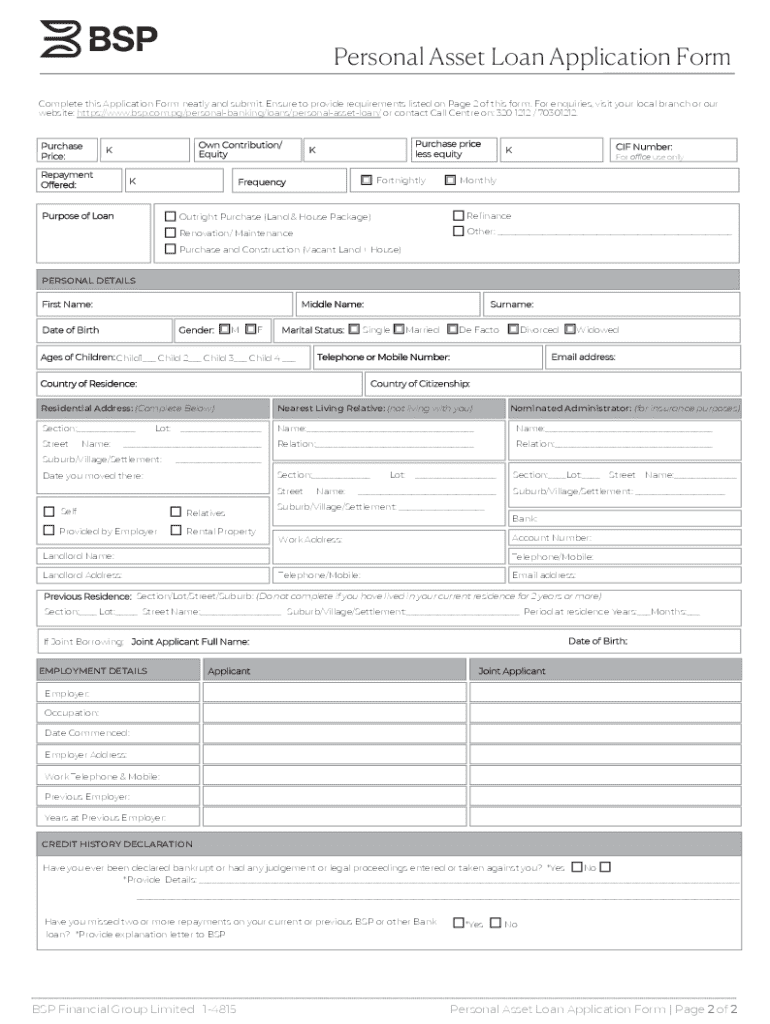

Required information for your application

Filling out the personal asset loan application form requires specific information. It is critical to provide accurate details across several sections, which will form the basis of your application. Personal details will typically include your full name, contact information, and Social Security number, which help lenders verify your identity.

Financial information is another crucial aspect. You will need to provide employment details, income verification, existing debts, and any other assets. Clearly outlining the description and value of the asset you intend to leverage for the loan will also be vital for the lender's assessment.

How to fill out the personal asset loan application form

When it's time to fill out the personal asset loan application form, you can seamlessly access the form through pdfFiller. This platform simplifies the process by allowing you to fill out and modify the document online.

Begin with entering your personal information in the designated fields. Accuracy is paramount, so double-check that all names and contact details are correct. Next, provide your financial information, ensuring that income figures are realistic and backed by documentation. Detailing your assets requires an honest appraisal; include a clear description and an estimated value. After completing these sections, review your application for any errors or omissions to avoid delays.

Utilizing pdfFiller features for a seamless experience

pdfFiller is equipped with numerous features that can enhance your experience while completing your personal asset loan application form. You can easily edit and customize your forms to fit your specific needs, which is incredibly beneficial if you need to make adjustments based on lender requirements.

The platform allows for eSigning, facilitating a quicker approval process by eliminating the need for physical signatures. If you are part of a team, you can collaborate effectively with your colleagues, sharing documents and assisting with the completion of your application. With cloud-based document management, you ensure that your important files are accessible anytime and anywhere, providing peace of mind.

Submitting your application

Once you've completed your personal asset loan application form, it's time to submit it. pdfFiller provides a straightforward process for submission. You can choose to submit your application online directly through the lender's site or opt to deliver it in-branch, depending on your preference and the lender's capabilities.

After submitting, you should expect a confirmation indicating that your application has been received. This step is vital as it allows you to track the status of your application as it moves through the processing stage.

What to expect after submitting your application

After submitting your personal asset loan application, you may wonder what happens next. The loan processing timeline can vary based on the lender, the completeness of your application, and any additional verification required. Generally, it can take a few days to several weeks.

During this period, lenders may reach out to you for further information or clarification. It's essential to respond promptly to any queries to avoid delays in your application. Once approved, you'll receive specific loan terms outlining the repayment schedule, interest rates, and any other conditions.

Managing your personal asset loan documentation

Post-application, it's crucial to manage your personal asset loan documentation effectively. Using pdfFiller, you can keep track of your application status and any correspondence from your lender. The cloud-based functionality provides you with secure storage for your documents, ensuring that you can access them anytime, from anywhere.

If you need to edit or resend your application, pdfFiller makes it straightforward to do so. Simply access the document, make the necessary changes, and resubmit it promptly to get back on track.

Frequently asked questions about personal asset loans

When navigating the process of obtaining a personal asset loan, you might encounter several questions. These can range from concerns about application denial to understanding the associated fees. If your application is denied, it’s crucial to find out the reason and address it before reapplying.

Regarding fees, they can vary by lender, typically including origination fees and late payment penalties. Improving your chances of approval may involve enhancing your credit score, paying down existing debts, or providing a more valuable asset for collateral.

Support and customer service

If you require assistance with your personal asset loan application, contacting pdfFiller’s support team can provide you with the help you need. They are there to guide you through the platform's features and assist with any questions related to the application process or document management.

To reach out effectively, prepare specific questions so the representatives can provide detailed answers. Beyond pdfFiller, consider exploring resources for financial advice to understand better the nuances of personal asset loans and achieve your financial goals.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find personal asset loan application?

How do I edit personal asset loan application straight from my smartphone?

How do I edit personal asset loan application on an iOS device?

What is personal asset loan application?

Who is required to file personal asset loan application?

How to fill out personal asset loan application?

What is the purpose of personal asset loan application?

What information must be reported on personal asset loan application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.