Get the free Reinstate Your Insurance Cover Form Mercer Mychoice

Get, Create, Make and Sign reinstate your insurance cover

How to edit reinstate your insurance cover online

Uncompromising security for your PDF editing and eSignature needs

How to fill out reinstate your insurance cover

How to fill out reinstate your insurance cover

Who needs reinstate your insurance cover?

Reinstate Your Insurance Cover Form: A Complete How-To Guide

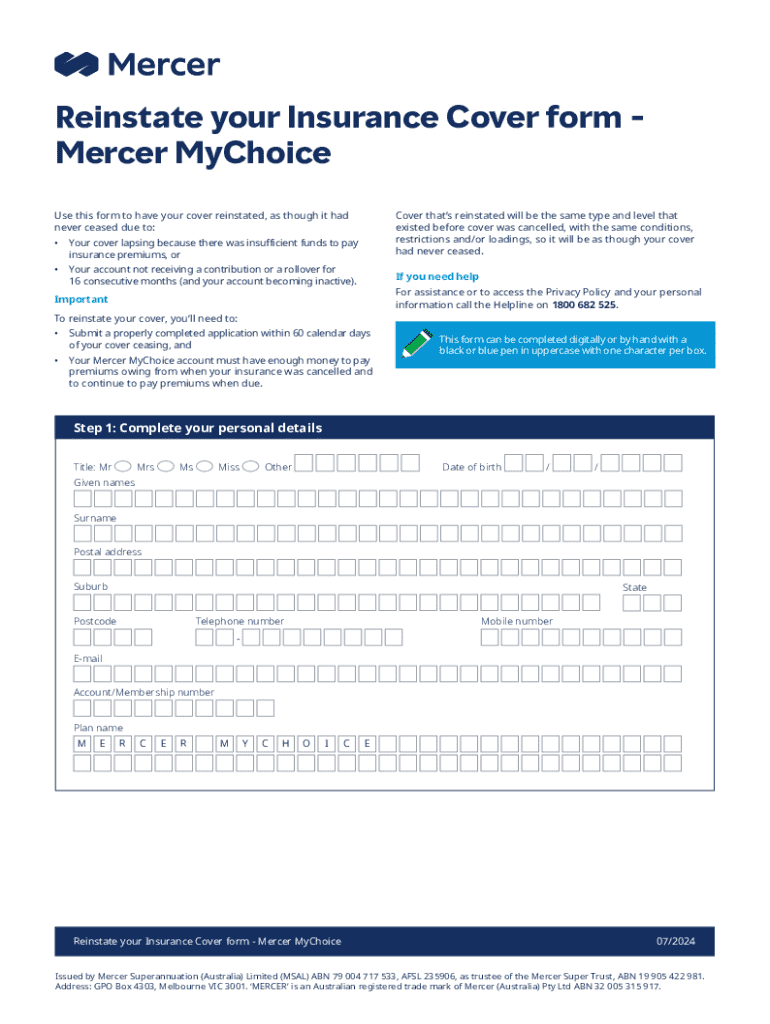

Understanding insurance coverage reinstate process

Reinstating insurance coverage is crucial for ensuring that you are protected against potential financial loss. Continuous coverage not only gives peace of mind but also helps in avoiding penalties or issues that could arise from lapses. When insurance coverage lapses, individuals may face challenges when trying to reinstate their policies, possibly leading to higher premiums or coverage gaps.

Common reasons for insurance coverage lapses include financial difficulties, forgetting renewal dates, or moving to a new residence. Understanding the importance of maintaining continuous coverage — especially in places with strict insurance requirements — can prevent unnecessary stress and financial strain.

Steps to reinstate your insurance cover

Reinstating your coverage requires a series of methodical steps. This ensures that you are properly addressing your needs while completing the required documentation effectively.

Step 1: Assess your current insurance needs

Begin by reviewing your existing policy. This gives insight into what coverages were previously included and highlights any changes in your personal circumstances that might necessitate different coverage options. For instance, if you’ve purchased a new car or made significant home improvements, you may need to adjust your policy accordingly.

After reviewing, determine what coverage requirements are most pertinent. Consider factors like liability limits, comprehensive coverage, and additional riders that may enhance your policy.

Step 2: Gather necessary documentation

Collecting necessary documentation is a critical process for reinstatement. You usually need the following:

Organizing these documents in a folder will facilitate a smoother filling-out process and ensure nothing is overlooked.

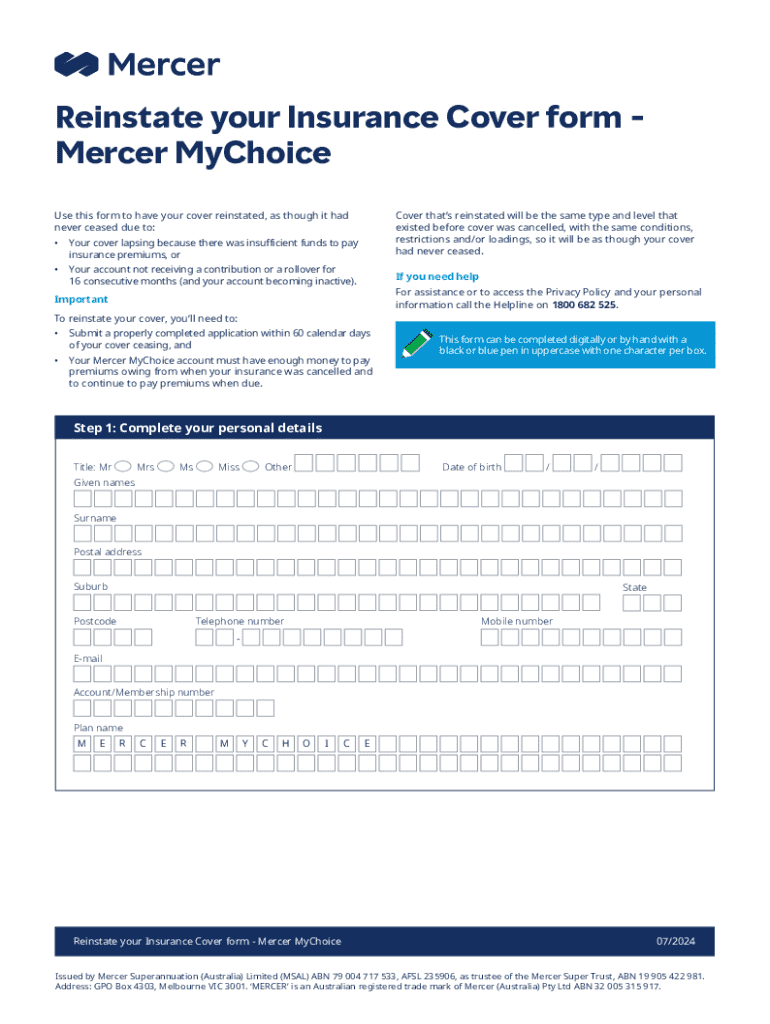

Step 3: Fill out the reinstate your insurance cover form

Filling out the form accurately is vital. Here's a detailed breakdown of its sections:

Double-checking the information filled out saves time and helps prevent delays in the reinstate process.

Step 4: Review your application

Before submitting your application, review it thoroughly. Common mistakes include incorrect policy numbers, missing signatures, or failure to provide the required documentation. Verifying the completeness of your application avoids unnecessary delays.

Submitting your insurance cover reinstate form

After completing and reviewing your form, the next step is submission. There are several methods to choose from:

Once submitted, expect a confirmation from your insurer. This confirmation typically includes a timeline for processing your application and what the next steps will be.

Post-submission considerations

After you submit your form, it’s essential to engage in follow-up actions. To check the status of your reinstatement, reach out to customer service, either through phone or email, for updates.

Managing your insurance policy is an ongoing task. Regularly updating your information on the pdfFiller platform can save you time and ensure you have the latest documentation readily available.

Strategies for preventing coverage lapses

To avoid lapses in your coverage, consider setting reminders for policy renewals. Utilizing calendar alerts can ensure you never miss a deadline. Timely payments are vital as well, so automate your billing if possible.

Additionally, benefitting from regular policy reviews can guarantee that your coverage remains aligned with your changing needs, ensuring you’re adequately protected at all times.

Best practices for maintaining your insurance coverage

Avoiding coverage lapses is a vital aspect of managing your financial security. Consider employing the following best practices:

By implementing these strategies, you create a more secure insurance experience while lowering the risk of reinstatement and lapses.

FAQs about reinstating insurance coverage

You may have questions about the reinstatement process. Here are some common queries:

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit reinstate your insurance cover online?

How do I make edits in reinstate your insurance cover without leaving Chrome?

How do I edit reinstate your insurance cover on an iOS device?

What is reinstate your insurance cover?

Who is required to file reinstate your insurance cover?

How to fill out reinstate your insurance cover?

What is the purpose of reinstate your insurance cover?

What information must be reported on reinstate your insurance cover?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.