Get the free Applying for a Business License

Get, Create, Make and Sign applying for a business

Editing applying for a business online

Uncompromising security for your PDF editing and eSignature needs

How to fill out applying for a business

How to fill out applying for a business

Who needs applying for a business?

Applying for a Business Form: A Comprehensive Guide

Understanding business forms

Business forms are essential documents that serve various purposes in the realm of entrepreneurship and commerce. Their primary function is not only operational but also regulatory, allowing businesses to function within the legal frameworks of their industry and locality.

There are several types of business forms that entrepreneurs may encounter, including sole proprietorships, partnerships, corporations, and limited liability companies (LLCs). Each of these forms comes with distinct legal implications, tax responsibilities, and compliance requirements. Choosing the appropriate business form is critical, as it can impact everything from liability to taxation.

Understanding the significance of these forms in the application process is vital. Properly filling out business forms ensures compliance with legal requirements, making it an essential step in establishing a business. Additionally, these forms facilitate operations by clarifying responsibilities and rights among stakeholders.

Preparing to apply

Before applying for a business form, it's crucial to assess your specific business needs. Identifying the right form to apply for will significantly influence the application process. Consider the nature of your business, its size, and the legal environment of your location, as these factors dictate the type of forms needed.

Gathering the necessary documentation is the next imperative step. Common documents required often include proof of identity, tax identification numbers, and any prior business licenses if applicable. Organizing your documentation can streamline the application process substantially.

Creating a checklist to ensure you have gathered all required documentation, and arranging them systematically, will save time and prevent unnecessary application delays.

Navigating business registration requirements

Registering your business involves navigating through federal, state, and local regulatory frameworks. Each level has specific requirements and processes that must be adhered to. Begin by visiting the official website of your state’s Secretary of State or equivalent authority to understand the nuances of registering your business form.

Identification of key regulatory agencies is also essential. For example, the Internal Revenue Service (IRS) for federal tax compliance, your state's Department of Revenue for state tax obligations, and local business licensing offices for obtaining necessary permits are pivotal in the registration process.

Understanding the expected timelines for registration is vital. Business form processing times can vary from a few days to several weeks, depending on the complexity of the application and the workloads of the involved agencies. Planning accordingly can ensure smoother operations as you await approval.

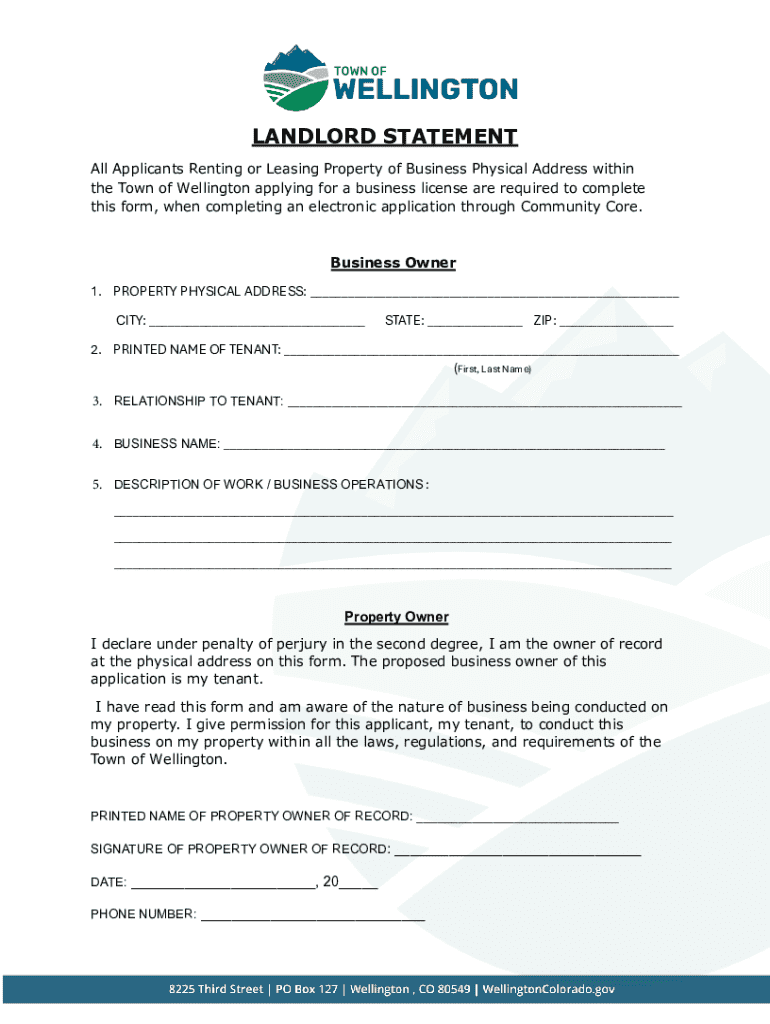

Filling out the application form

Completing application forms accurately is paramount in avoiding unnecessary delays. Common mistakes include misinformation or leaving sections blank. Before submitting the form, verify every detail, cross-check names, dates, and essential facts.

Using pdfFiller tools may simplify the completion process. Their platform allows users to edit and sign PDFs with ease. This can be particularly helpful when making last-minute adjustments or ensuring that every detail aligns with regulatory standards.

For specific forms, such as a Business License Application or a Trademark Application, following structured guidelines can greatly lessen the probability of errors. Familiarizing yourself with each form's specific requirements will enhance your chances of acceptance.

Submitting your application

Once the application is complete, deciding on the submission method is the next step. Most agencies now offer both online and physical submission options. Each has its own advantages; online submissions can be faster and often provide an immediate confirmation, while physical submissions offer a tangible receipt of your application.

Tracking your application status can usually be done through the agency's website or by contacting relevant offices. Inquire whether they provide online tracking or a direct contact number to check your application's progress.

Understanding the application fees and payment options is equally important. Ensure you are aware of any costs associated with the forms you are submitting and the various acceptable payment methods.

After application submission

After submission, it's crucial to anticipate what happens next. Review periods vary widely; businesses might receive approval, request for additional information, or outright rejection. Being prepared will help you respond quickly, whether it's clarifying details or providing further documentation.

In case of rejections or requests for additional information, understanding best practices for resubmission can enhance your chances of approval on the second attempt. Equip yourself with all requested documents and double-check the reasons for the initial rejection before resubmitting.

Maintaining a calm demeanor and being prepared can significantly smooth out any bumps you encounter in this phase of the process.

Managing your business forms post-submission

Once your application is submitted, managing your business forms becomes integral to ongoing compliance and operational efficiency. Effective document management practices will safeguard your important files and ensure you are prepared for any audits or business evaluations that may arise.

Best practices for document management include using a cloud-based platform like pdfFiller, which offers the capability to organize, edit, and e-sign documents securely. Staying organized not only enhances efficiency but also provides peace of mind.

Monitoring updates on regulatory changes is equally critical. Keeping abreast of new requirements could prevent compliance issues and foster sustainable business practices.

Frequently asked questions (FAQs)

While applying for a business form, common issues can often arise, including incomplete documentation or misinterpretations of requirements. Utilizing resources like pdfFiller can mitigate these challenges through structured guidelines and user support.

If you encounter challenges during the application process, consider reaching out to professional services or consulting with experienced entrepreneurs in your networking circles. This can often provide valuable insights and assistance.

Enhancing efficiency with pdfFiller

pdfFiller empowers users to seamlessly edit PDFs, eSign, collaborate, and manage documents from a single, cloud-based platform. Its user-friendly features simplify the application process for business forms—yielding faster submissions and greater accuracy.

The range of functionalities offered by pdfFiller is designed to meet the needs of individuals and teams seeking a comprehensive, access-from-anywhere document solution. Access to tutorials, webinars, and customer support further enhances the user experience.

Leveraging these resources can greatly enhance your efficiency and streamline the business form application process, ensuring you stay organized and compliant in your entrepreneurial endeavors.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find applying for a business?

How do I fill out applying for a business using my mobile device?

Can I edit applying for a business on an Android device?

What is applying for a business?

Who is required to file applying for a business?

How to fill out applying for a business?

What is the purpose of applying for a business?

What information must be reported on applying for a business?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.