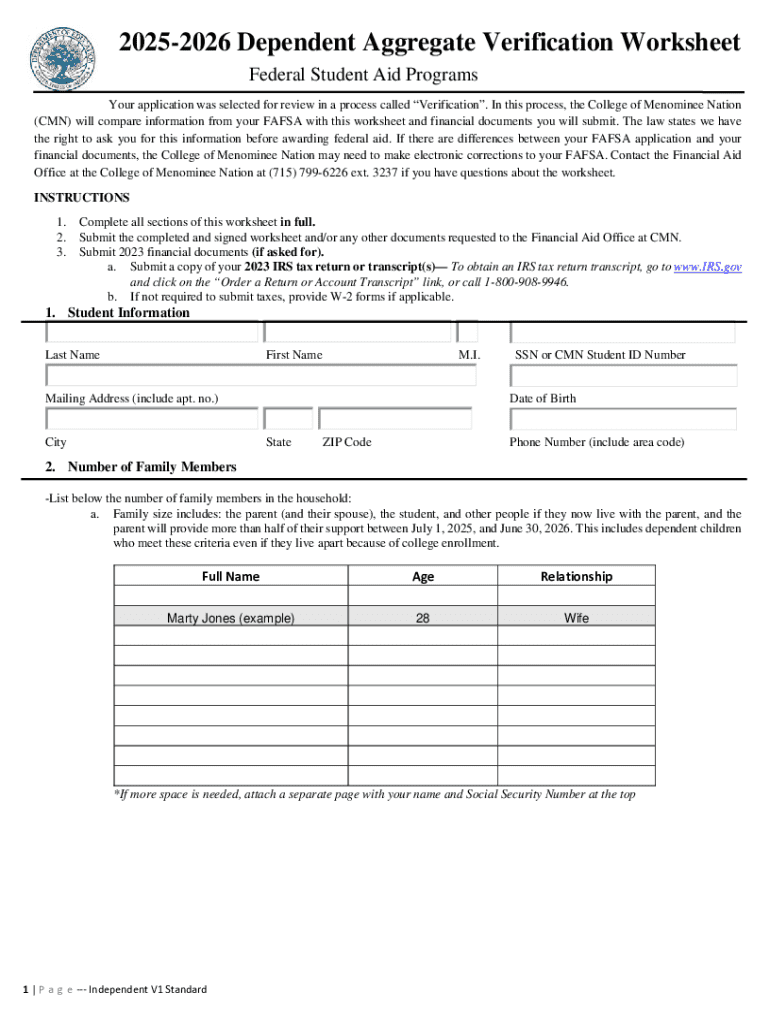

Get the free 2025-2026 Dependent Aggregate Verification Worksheet

Get, Create, Make and Sign 2025-2026 dependent aggregate verification

How to edit 2025-2026 dependent aggregate verification online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2025-2026 dependent aggregate verification

How to fill out 2025-2026 dependent aggregate verification

Who needs 2025-2026 dependent aggregate verification?

2 Dependent Aggregate Verification Form: A Comprehensive Guide

Understanding the Dependent Aggregate Verification Form

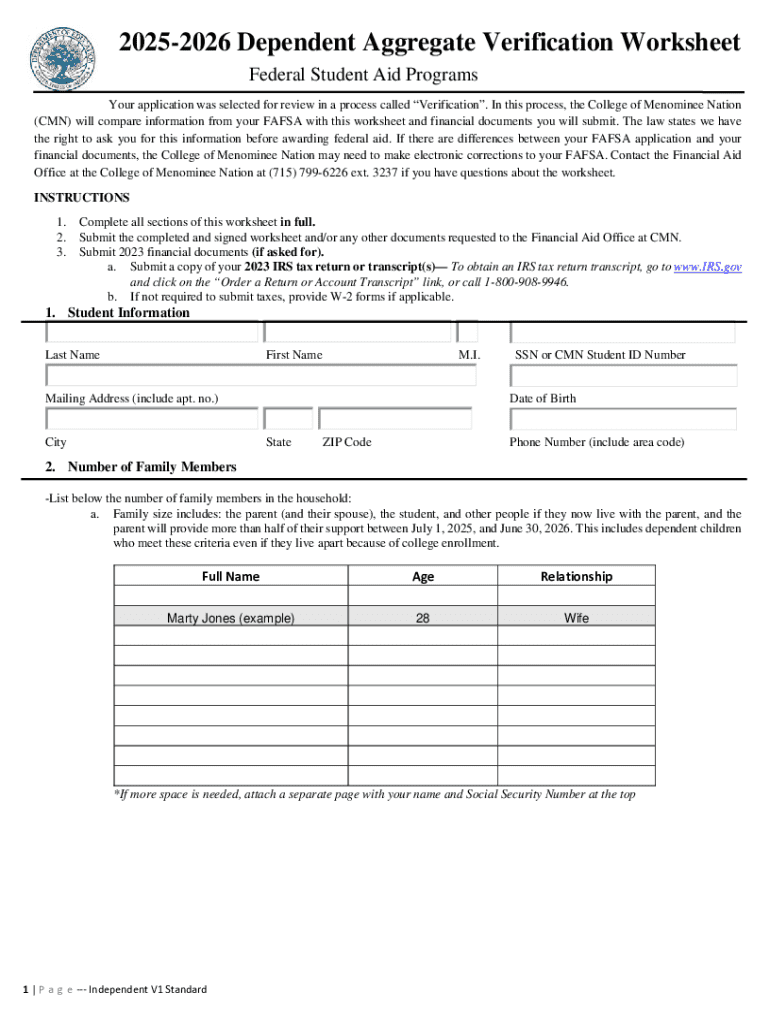

The 2 dependent aggregate verification form serves as a crucial document in the financial aid process for students applying for federal assistance. This form verifies the dependent student's financial information, ensuring that the data submitted in the FAFSA (Free Application for Federal Student Aid) is accurate and complete. When the federal government or educational institutions request this verification, it helps prevent errors in aid distribution due to discrepancies in reported income or family size.

For academic aid, this verification is particularly important, as it directly impacts a student's eligibility for grants, loans, and work-study opportunities. Without properly completed verification forms, students may miss out on financial aid that can significantly alleviate the burden of college expenses. Thus, understanding and properly managing this form is essential for all dependent students seeking financial help.

The target audience for this guide includes students, parents, and educational administrators. Students need to navigate these forms efficiently, while parents often assist in collecting documentation. Educational institutions must also be aware of the verification requirements to ensure compliance with federal guidelines and provide accurate assistance to their students.

Key updates for 2

With the release of the 2 dependent aggregate verification form, several key updates and changes aim to streamline the verification process. One major update is the newly established guidelines and policies surrounding the documentation required. These updates aim to simplify the submission process and ensure that students provide only the necessary information without overwhelming them with extraneous requests.

Additionally, the documents required for verification have also seen changes, particularly in how income verification is handled. Instead of requiring all forms of income documentation, schools may now ask for just the Income Tax Transcripts or W-2 forms for consistency. Important deadlines for submitting these forms have also been clearly outlined, making it easier for applicants to keep track of their submissions.

Eligibility criteria

Not every student is required to complete the 2 dependent aggregate verification form. Typically, students who have been selected for verification by their school or the federal government are the ones who need to complete this form. This selection is often random but can also be triggered by discrepancies in reported information or atypical data patterns on their FAFSA. Most importantly, students must verify both their and their parents' financial situations, emphasizing the importance of accurate parental information in this context.

The verification process is closely linked to the student’s dependency status, which considers various factors such as age, marital status, and whether the student has dependents themselves. Living arrangements also play a role; for instance, if a student lives with both parents, it’s critical to report the financial information of both parents accurately. Students unsure about their dependency status or the information required should consult with their financial aid office for clarification.

Completing the verification form

Filling out the 2 dependent aggregate verification form correctly is vital, as errors can lead to delays in financial aid disbursement. Here's a step-by-step guide to help streamline your completion process. First, you need to gather all necessary documentation, including tax forms and family size information. Pay close attention to detail while filling out the form; a simple mistake could lead to unnecessary complications. The form consists of several sections, each focused on different aspects of your financial situation.

Many students overlook common pitfalls, such as failing to include all parent income sources or neglecting to sign the form. To assist users further, interactive tools via pdfFiller offer templates and pre-filled fields, making it easier to manage document completion online efficiently.

Acceptable documentation

To successfully complete the 2 dependent aggregate verification form, certain documentation must be provided. The key documents include income tax transcripts, W-2 forms, and verification of non-filing for those who did not file a federal tax return. Having these documents prepared and organized is essential for a smooth verification process.

In cases where traditional documentation may not be applicable—such as for individuals who have been confined or incarcerated—there are alternate documentation scenarios available. It's crucial for students with unique family situations, such as those facing parental separation or divorce, to document their current living arrangements and financial supports accurately.

Managing changes and updates

Keeping your information current is crucial when filling out the 2 dependent aggregate verification form. If there are changes in your financial situation or family circumstances, it’s vital to update your FAFSA as promptly as possible. These changes can include shifts in income or changes in your family's living arrangements, all of which could impact your financial aid eligibility.

Failing to submit required documentation on time or neglecting to report updates can lead to consequences, such as losing out on financial aid or delaying your aid package. Institutions have specific policies for handling updates, and students should familiarize themselves with these to avoid complications.

Verification items explained

The verification process includes several essential items that need to be thoroughly understood. One of the primary components is the Adjusted Gross Income (AGI), which reflects the total taxable income after adjustments. Family size documentation is another critical element, ensuring that the financial need is accurately assessed based on family circumstances. Furthermore, institutions may also account for unusual circumstances that affect the financial situation, such as high medical expenses or loss of income, which may warrant special consideration during the verification process.

Understanding these terms and how they influence your financial aid eligibility can significantly impact award amounts. Institutions often assess each case individually, taking into account any documented unusual circumstances to determine a fair financial aid package.

Subsidized and unsubsidized financial assistance programs

The verification process plays a crucial role in determining the types of financial assistance a student may qualify for, including both subsidized and unsubsidized programs. Subsidized loans are often granted based on a student's financial need, while unsubsidized loans are available regardless of need but accrue interest during the student's time in school. Properly completing the 2 dependent aggregate verification form is essential for determining eligibility for these programs.

Any discrepancies found during verification can affect the award amounts and types of aid received. By ensuring all information is accurate and complete, students can optimize their financial aid packages, potentially resulting in a lower overall cost of their education.

Policies and procedures

Understanding institutional policies surrounding the verification process is critical for both students and school administrators. Institutions have specific procedures to follow guiding how documentation is handled and what constitutes acceptable verification practices. Familiarizing yourself with these policies is essential to mitigate potential issues when submitting the 2 dependent aggregate verification form.

In the event of an aid denial due to verification issues, students should be aware of their rights to appeal. Each institution typically has a defined appeals process for students to contest decisions, which can include providing additional documentation or clarifying previously submitted information to ensure accurate evaluation.

Special scenarios

Certain unique cases may emerge during the verification process. For students with special circumstances—such as those who are unaccompanied homeless youth, or those facing parental separation or divorce—the verification process may look different. Institutions may have additional resources or flexibility in their verification requirements to ensure that aid is properly allocated, regardless of the student's difficult situation.

It's essential for affected students to communicate with their financial aid office to gain an understanding of how these circumstances can be addressed in the verification process. Clarity in this area may provide students avenues for receiving assistance that they otherwise would not qualify for due to standard dependency rules.

Frequently asked questions (FAQ)

The verification process can pose challenges for many students and their families, leading to several common questions. Students often inquire about the timeline for receiving aid notifications post-verification or what to do if they can’t provide certain documents. In dealing with common issues, it's important to remember that proactive communication with the financial aid office can clarify many uncertainties and resolve potential problems before they escalate.

Additionally, having the contact information for your school's financial aid office readily available can provide a valuable resource for addressing inquiries or troubleshooting specific concerns that arise throughout the verification process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send 2025-2026 dependent aggregate verification for eSignature?

How do I complete 2025-2026 dependent aggregate verification online?

How do I make changes in 2025-2026 dependent aggregate verification?

What is 2025-2026 dependent aggregate verification?

Who is required to file 2025-2026 dependent aggregate verification?

How to fill out 2025-2026 dependent aggregate verification?

What is the purpose of 2025-2026 dependent aggregate verification?

What information must be reported on 2025-2026 dependent aggregate verification?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.