Get the free 2025 Energy Efficiency Incentive Form

Get, Create, Make and Sign 2025 energy efficiency incentive

Editing 2025 energy efficiency incentive online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2025 energy efficiency incentive

How to fill out 2025 energy efficiency incentive

Who needs 2025 energy efficiency incentive?

2025 Energy Efficiency Incentive Form: Your Comprehensive Guide

Understanding the 2025 energy efficiency incentive program

The 2025 Energy Efficiency Incentive Program aims to significantly reduce energy consumption through various strategies and initiatives. Funded by federal and state programs, this initiative is designed to encourage both individuals and organizations to adopt energy-efficient practices. By participating, applicants not only contribute to environmental sustainability but also enjoy cost savings that can enhance their financial stability.

Key objectives of this program include decreasing overall energy usage, supporting new technologies for energy efficiency, and reducing greenhouse gas emissions. Furthermore, the program provides substantial benefits for participants, such as lower utility bills, increased property values through energy-efficient upgrades, and available monetary incentives to offset the costs of implementation.

Eligibility for the program varies based on the specific incentive and can include homeowners, renters, and businesses. Generally, participants must have made or be planning to make qualifying energy-efficient upgrades to their property.

Types of incentives available

The 2025 energy efficiency incentive form offers several types of incentives tailored to different upgrades. Residential improvements might include rebates for installing energy-efficient appliances, insulation materials, and smart technology systems. Understanding these incentives can help applicants identify exactly what they qualify for and how to maximize them.

The distinction between tax credits and rebates is crucial for applicants. Tax credits can directly reduce the amount of tax owed, providing a significant benefit in tax savings. On the other hand, rebates are often received as cash back after improvements are made. Depending on individual financial situations and upgrade selections, one may be more beneficial than the other.

Various technologies qualify for incentives, reflecting the diverse strategies available for improving energy efficiency. Qualification criteria are typically updated annually, emphasizing the importance of staying informed.

How the 2025 energy efficiency incentive form works

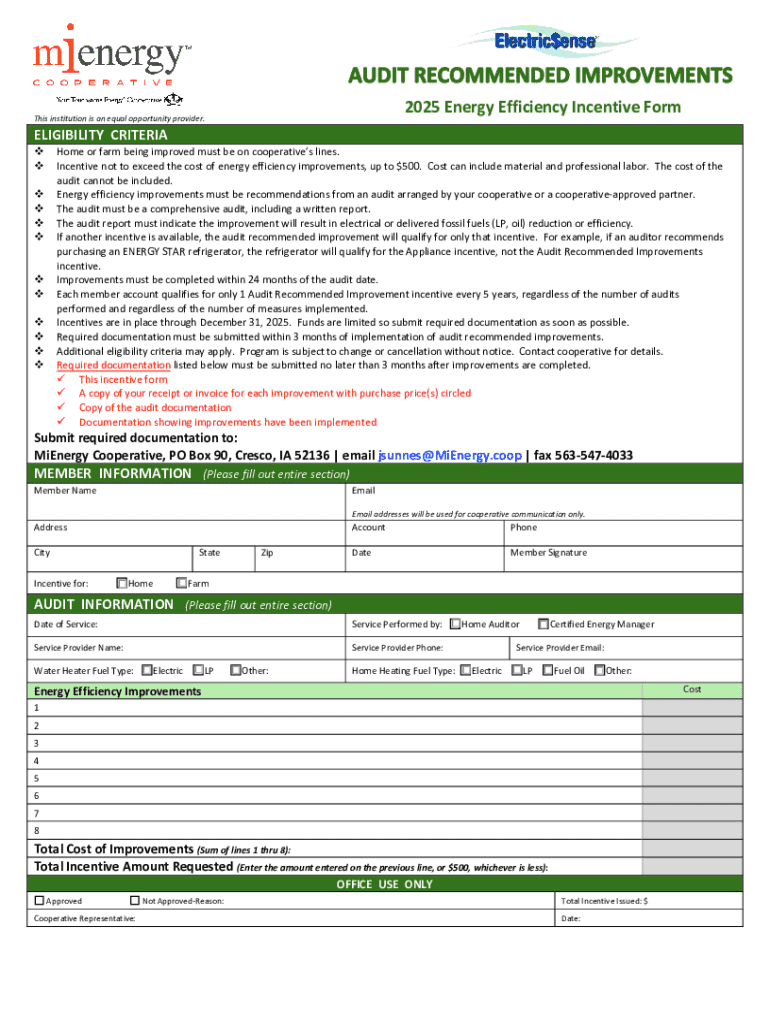

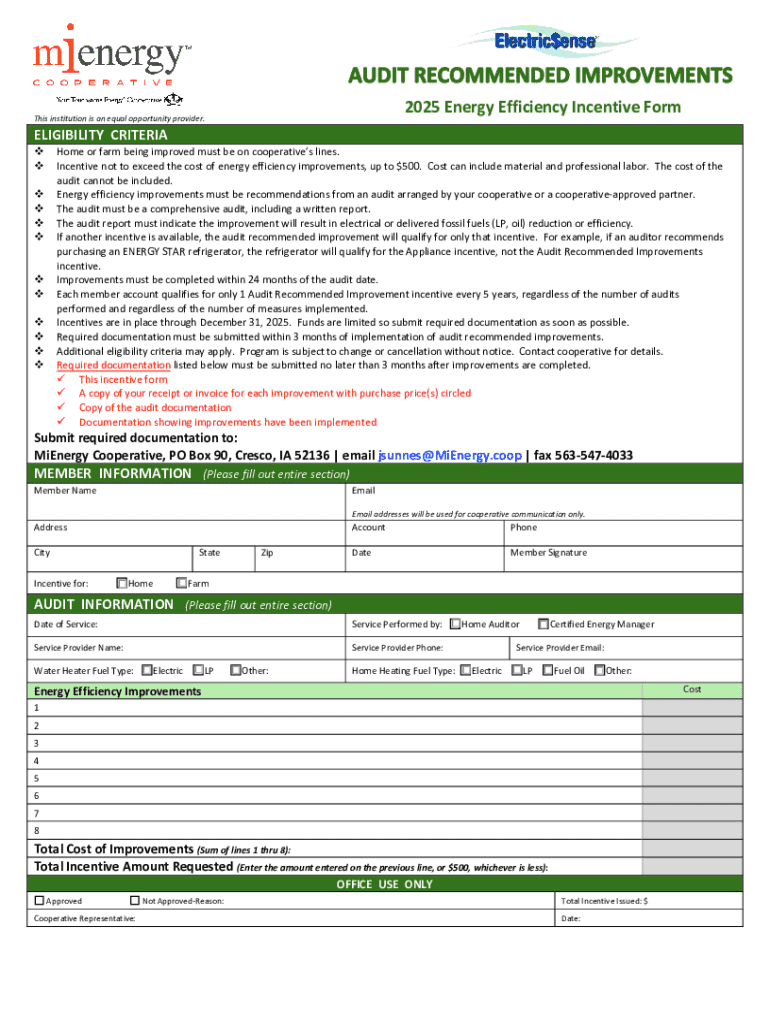

Filling out the 2025 energy efficiency incentive form is a straightforward process, but attention to detail is vital for a successful submission. The first step is obtaining the form, which can typically be downloaded from the official government website or processed through pdfFiller’s platform.

Once you have the form, prepare all required documentation to prove eligibility. Common documents include receipts for upgrades, proof of residence, and previous utility bills that illustrate your energy usage prior to the upgrades. Completing the form accurately is crucial; each section includes essential fields that require precise input. Applicants should also take care to follow any specific instructions provided.

A common pitfall is incomplete forms submission, which can lead to application rejection. Submitting your application within the specified deadlines is essential, as late submissions are often not considered for incentives.

Detailed insights into claiming incentives

To better illustrate the energy efficiency incentive program’s impact, consider examples of eligible upgrades. Energy-efficient heating and cooling systems, such as ENERGY STAR certified devices, not only help in reducing energy consumption but can also lead to up to 30% savings on energy bills.

Improving insulation and weatherization can save homeowners an average of 15% in annual energy costs by reducing heating and cooling demands. Additionally, installing energy-efficient windows and doors can cut heating costs by 7-15%, making them a wise investment for many households.

Beyond immediate cost savings, these upgrades significantly contribute to reducing carbon footprints. Each energy-efficient improvement made contributes to a larger movement towards a more sustainable future.

Maximizing your energy efficiency incentives

Maximizing the benefits from the 2025 energy efficiency incentive form involves leveraging various available strategies. One effective approach includes stacking multiple incentives. For instance, combining state-level rebates with federal tax credits allows homeowners to amplify their savings potential.

Understanding appliance certifications and energy ratings also plays a crucial role in maximizing savings. Appliances marked with the ENERGY STAR label often qualify for significant rebates, as they indicate impressive efficiency levels. Timing your upgrades can also result in larger tax claims, especially if you make changes before the year’s end.

Getting a professional energy audit can also help you uncover additional upgrade alternatives you may not have considered. A certified energy auditor helps homeowners identify inefficiencies in their current systems, leading to more valuable upgrades.

Interactive tools for calculating potential savings

PdfFiller offers users specific calculators that simplify estimating potential savings and rebate eligibility efficiently. These interactive tools enable applicants to input different criteria related to energy-efficient upgrades and assess their possible savings based on previous data and averages.

For instance, applicants can use these calculators to determine what percentage of improvements qualifies for tax credits and optimize their claims efficiently. This not only facilitates the incentive process but also enhances user confidence in making data-driven decisions.

These tools are particularly beneficial for those new to the incentive process, offering a clear understanding of how specific choices impact potential returns.

Frequently asked questions about the 2025 energy efficiency incentive form

One common question individuals have is, 'What if I miss the filing deadline?' Unfortunately, missing the deadline could mean forgoing the associated incentives. However, applicants can register for notifications about future provisions or deadlines.

Another frequently asked concern is whether you can amend a submitted form if a mistake is realized post-submission. Most programs allow for amendments; however, it’s critical to inform the processing authority of changes as soon as possible.

Regarding processing timelines, recipients can expect to wait several weeks for their incentive claims to be reviewed and approved. Staying informed through official channels can enhance transparency about processing times.

Success stories: Real-world examples of incentive recipients

Numerous homeowners have greatly benefited from the 2025 energy efficiency incentive program. Case studies illustrate how individuals transformed their homes into energy-saving environments and significantly cut down costs.

For instance, one family upgraded their heating system to a high-efficiency furnace and replaced old windows with energy-efficient variants. They reported an annual savings of over $1,200 on their energy bills and received a sizable rebate that covered a large percentage of their upgrades.

Testimonials from these recipients highlight their positive experiences with the application process; many found using pdfFiller’s tools particularly conducive to completing forms accurately and efficiently.

Keeping informed on future changes and opportunities

As energy efficiency incentives evolve, staying updated on policy changes is vital. Upcoming federal and state guidelines can impact eligibility, incentive amounts, and types of qualifying upgrades. Engaging with local energy offices or organizations can help residents stay informed.

PdfFiller is committed to assisting users in navigating changes by providing updated forms as they become available, alongside resources to clarify new requirements. Regularly checking the platform can ensure that applicants don’t miss essential updates.

By being proactive, applicants can effectively maximize their participation in the incentive program and secure financial benefits for their energy-efficient upgrades.

Tools for managing your energy efficiency documents

Managing documentation for your 2025 energy efficiency incentive form can be daunting, but pdfFiller simplifies this process. Its cloud-based platform allows users to store, edit, and manage all required documents in one place, significantly reducing hassles associated with paperwork.

Users can easily edit their forms, electronically sign documents, and collaborate with team members on joint applications. These features are particularly beneficial for households undergoing collective upgrades or businesses filing for incentives that require multiple stakeholders.

By leveraging pdfFiller’s capabilities, applicants can streamline their document management process, lead to a smoother experience when applying for the 2025 energy efficiency incentives, and ultimately enhance the potential financial rewards from their energy-efficient upgrades.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send 2025 energy efficiency incentive to be eSigned by others?

How do I make changes in 2025 energy efficiency incentive?

How can I edit 2025 energy efficiency incentive on a smartphone?

What is 2025 energy efficiency incentive?

Who is required to file 2025 energy efficiency incentive?

How to fill out 2025 energy efficiency incentive?

What is the purpose of 2025 energy efficiency incentive?

What information must be reported on 2025 energy efficiency incentive?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.