Get the free All Risk Property Insurance Claim Form

Get, Create, Make and Sign all risk property insurance

How to edit all risk property insurance online

Uncompromising security for your PDF editing and eSignature needs

How to fill out all risk property insurance

How to fill out all risk property insurance

Who needs all risk property insurance?

Understanding all risk property insurance form: A comprehensive guide

Understanding all risk property insurance

All risk property insurance represents a unique form of coverage that offers protection against a wide array of potential hazards for both residential and commercial properties. This type of insurance is often favored by property owners looking for peace of mind when it comes to losses due to various risks.

Unlike basic or named perils coverage, which specifically lists covered risks, all risk insurance covers any cause of loss unless explicitly excluded in the policy. This means that policyholders enjoy broader protection—an essential advantage for those with high-value assets.

Key features of all risk property insurance include its comprehensive nature, which safeguards personal belongings, structure, and enhancements against most incidents. Common exclusions may encompass wear and tear, neglect, or specific high-risk perils such as flood or earthquake.

Types of coverage offered in all risk policies

All risk policies cater to varied needs through different types of coverage forms, primarily categorized into basic, broad, and special. Each form varies in its scope and limitations based on the needs and circumstances of the policyholder.

Basic form coverage generally protects against a limited set of risks. This includes common perils such as fire, theft, and vandalism—but explicitly excludes many losses, which might lead to unexpected gaps in protection.

Broad form coverage expands protections by offering a larger array of perils, including several not included in basic policies. It is particularly beneficial for homeowners wishing to secure more comprehensive coverage without the higher premiums of an all-encompassing policy.

Special form coverage, representing the epitome of all risk insurance, covers almost all types of loss except those specifically excluded in the policy details. This form is ideal for property owners who want absolute assurance regarding their investments.

Assessing your insurance needs

Determining the right insurance coverage form paramountly depends on your unique circumstances and assets. Factors to consider include the total value of property and possessions you wish to insure, alongside the location-specific risks such as natural disasters or crime rates prevalent in your area.

It's critical to assess potential business or personal liability concerns, as your insurance needs may vary significantly based on these elements. If you run a business from your property or frequently host guests, you may want additional coverage options that encompass liability.

Conducting a thorough situational analysis and risk assessment checklist can aid in determining which insurance coverage form is best aligned with your needs. This can often include a consultation with an industry practitioner for insights tailored to your scenario.

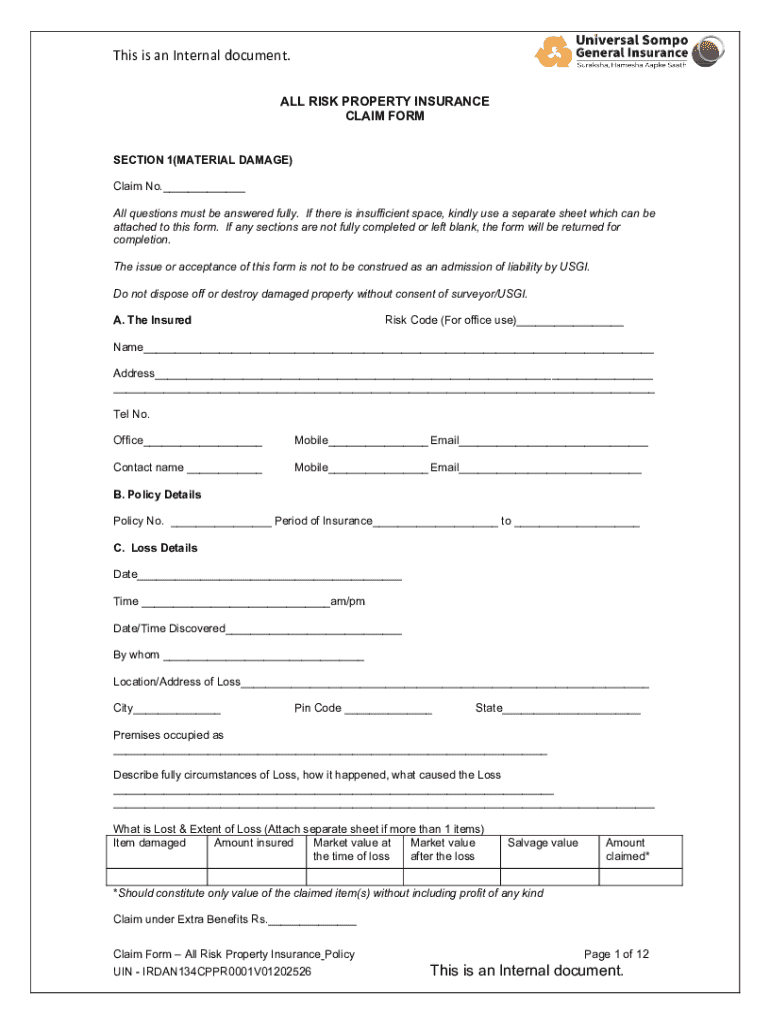

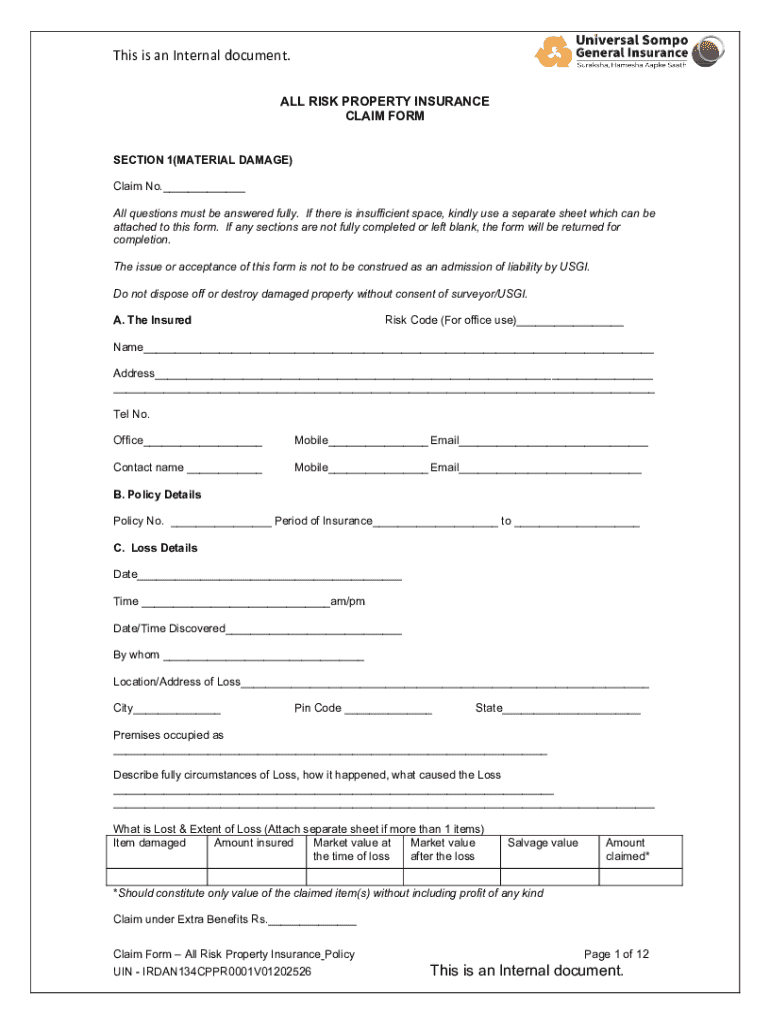

Filling out the all risk property insurance form

Completing the all risk property insurance form requires accuracy and attention to detail. Generally, the form is structured to gather essential information about the property, its value, ownership details, and specific coverage needs. Many forms distinguish sections for property descriptions, coverage choices, and additional endorsements.

Common mistakes when filling out this form include omitting vital property details or misrepresenting coverage needs which can lead to complications in claims processing. Ensuring comprehensive accuracy will safeguard your investment through the insurance process.

Submitting the form as a digital document through platforms like pdfFiller can streamline the process, allowing for ease in editing and ensuring all fields are correctly completed.

Managing and modifying your insurance coverage

Once secured, managing your all risk property insurance is crucial for ongoing protection. Making endorsements or adjustments to your policy can involve filling out additional forms or contacting your insurance agent directly. Be aware that maintaining an updated coverage policy can prevent future loss of protection.

Review your all risk policy regularly, especially when significant life events such as marriage, moving, or renovations occur that may impact your asset profile. Keeping abreast of these changes will ensure your coverage remains relevant to your current situation.

Digital solutions for managing your all risk property insurance

Embracing digital solutions like pdfFiller can significantly enhance how you manage your all risk property insurance documents. This platform offers seamless document management capabilities, allowing you to create, edit, and store forms in one place.

Cloud-based solutions enhance document flexibility. Users can leverage interactive tools for document editing, eSigning, and collaborate with team members in real-time to streamline the insurance process. A better management experience translates to less hassle and better organization.

Additional information on all risk property insurance

Familiarizing yourself with related terms and synonyms can deepen your understanding of the all risk property insurance landscape. Terms such as comprehensive coverage, perils coverage, and liability are critical as they all define aspects of your insurance needs.

Common questions regarding all risk policies often concern the specifics around claims processes. Some users might wonder how claims are adjusted based on the nature of the loss—information vital for ensuring fair treatment in case of an incident.

About pdfFiller

pdfFiller is a powerful platform for individuals and teams seeking effective document management solutions. Tailored specifically for insurance customers, pdfFiller provides functionalities that allow users to edit PDFs, eSign documents, and collaborate seamlessly from any location—reducing the time and complexity often associated with managing property insurance forms.

Numerous users have shared testimonials on how pdfFiller has streamlined their insurance management processes. By simplifying document handling, it empowers users to focus on what matters most—their coverage and assets.

Final insights on choosing all risk property insurance

Ultimately, when selecting an all risk property insurance policy, it's crucial to stay informed about the key factors related to your coverage. Weighing potential risks, understanding policy exclusions, and assessing coverage specifics all guide intelligent decision-making.

Future trends in all risk property insurance may point towards increased customization in policies and adaptive coverage models accommodating emerging risks. Staying attuned to these trends will empower property owners to secure tailored protection in a rapidly evolving landscape.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send all risk property insurance for eSignature?

Where do I find all risk property insurance?

How do I edit all risk property insurance online?

What is all risk property insurance?

Who is required to file all risk property insurance?

How to fill out all risk property insurance?

What is the purpose of all risk property insurance?

What information must be reported on all risk property insurance?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.