Get the free Ss-008

Get, Create, Make and Sign ss-008

How to edit ss-008 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out ss-008

How to fill out ss-008

Who needs ss-008?

SS-008 Form: A Comprehensive How-To Guide

Overview of the SS-008 Form

The SS-008 Form, formally known as the 'Status of Workers' form, plays a crucial role in tax matters for both individuals and businesses. This form is primarily used to request a determination from the IRS regarding the proper classification of a worker as either an employee or an independent contractor. Understanding the SS-008 Form is essential not only for compliance but also for managing tax obligations accurately.

The importance of the SS-008 Form cannot be overstated, especially given the complexities surrounding worker classifications. Misclassification can lead to severe tax liabilities and penalties for businesses. Therefore, knowing when and how to use this form is vital for anyone involved in hiring or engaging workers.

Eligibility and filing requirements

Anyone can file the SS-008 Form, but feasibility depends on specific circumstances. Individuals with income derived from various sources, as well as businesses needing to clarify their workers’ classifications, must consider filing this form. For example, businesses engaged in the gig economy often use the SS-008 Form to ensure compliance with IRS guidelines.

Eligibility criteria include the nature of the work and the relationship between the worker and the employer. The form specifically covers situations requiring a determination of worker classification under tax regulations.

How to obtain the SS-008 Form

The SS-008 Form can be easily accessed online through the IRS website or specific resources like pdfFiller. Users can not only download the form but also find detailed instructions on how to fill it out appropriately. This ease of access simplifies the often daunting process of navigating tax-related documentation.

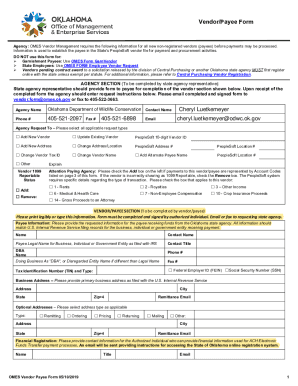

In addition to downloading, pdfFiller users can take advantage of advanced tools to fill out, edit, and eSign the SS-008 Form. This cloud-based platform gives you the ability to work directly on documents, allowing for seamless collaboration and management from any location.

Step-by-step instructions for filling out the SS-008 Form

Filling out the SS-008 Form requires attention to detail and understanding specific sections that guide the classification process. Starting with Part I, users should enter general information including names, addresses, and the tax identification numbers of both the worker and the firm.

Part II focuses on behavioral control, outlining the extent to which the employer can direct what work is done and how it should be performed. Understanding the key indicators such as training requirements and how the work is executed is crucial for the accurate completion of this section.

Moving to Part III, the financial control section assesses who has the right to control the economic aspects of the work relationship. Financial factors include how the worker is paid, whether expenses are reimbursed, and any opportunities for profit or loss. Lastly, Part IV wants to clarify the underlying relationship criteria, considering benefits, permanency, and the intention of both parties.

For service providers and salespersons, Section V emphasizes special considerations for those contractors, including how they represent the firm and their contractual agreements.

Understanding IRS determination of classification

Understanding how the IRS determines classification is key to successfully filing the SS-008 Form. The IRS uses a common law test, evaluating multiple factors to reach a conclusion on whether a worker qualifies as an employee or an independent contractor. This process underscores the significance of control, both behavioral and financial, in establishing the worker's operational status.

Factors notably influencing worker status include autonomy in decision-making and the extent of training required by the employer. Workers who operate independently with minimal supervision are generally deemed independent contractors, while those relying heavily on direction and training from the employer are classified as employees.

Frequently asked questions about IRS classifications include queries about overtime eligibility, tax responsibilities, and liability roles. Understanding these classifications not only benefits compliance but also fosters informed employment practices.

The filing process for the SS-008 Form

Filing the SS-008 Form requires following specific procedures to ensure the IRS receives the document correctly. The first step includes completing the form accurately and ensuring all necessary supporting materials are attached.

For online submissions, using platforms such as pdfFiller simplifies this process, allowing users to eFile directly. Alternatively, for those opting to mail in the completed form, careful attention must be paid to postage, accurate addresses, and any required additional documentation.

Important filing tips include reviewing the form thoroughly for errors and ensuring that all information is up to date. Follow-up is essential after filing; users should monitor any notification from the IRS regarding their submission status.

Timelines and outcomes

After filing the SS-008 Form, it is natural to want to understand the timelines involved in receiving a determination from the IRS. Depending on the volume of requests and the specifics of the case, processing times can vary. Typically, one can expect a response within 30 days, though longer durations are possible due to complexity or backlogs.

What happens following the submission? The IRS will conduct a review of the information provided and issue a determination. Outcomes may include a clear classification, requests for additional information, or rejection based on insufficient details. Therefore, it's important to be prepared for possible next steps and to remain responsive to any follow-up inquiries.

Implications of worker classification

Worker classification holds significant implications for all parties involved. Legal ramifications can arise from improper classification, leading to potential lawsuits and tax obligations resulting from unpaid taxes. Understanding these classifications assists in navigating both compliance issues and the broader landscape of worker rights.

The key differences between independent contractors and employees wrap around aspects like tax withholding, benefits eligibility, and liability responsibilities. Independent contractors typically bear their own tax burden, while employees have legal protections and benefits that businesses must provide.

If a misclassification occurs, there are options available. Businesses can address this proactively by making necessary adjustments and ensuring compliance moving forward, and protecting themselves from potential audits by the IRS.

Related resources and tools

As users engage with the SS-008 Form, various interactive tools can enhance document management and contribute to effective workflows. pdfFiller offers resourceful solutions that streamline the process of creating, editing, and managing documents, all in one place.

In addition to managing the SS-008 Form, users might find value in exploring additional guides, such as those focused on transitioning a contractor to an employee or effectively managing payment for international contractors. Understanding these topics can further empower users to navigate diverse work relationships and compliance intricacies.

Conclusion: Making the most of the SS-008 Form with pdfFiller

The SS-008 Form is more than just a document; it represents a critical component in the ongoing dialogue between workers and employers regarding classification and tax responsibilities. By leveraging tools available through pdfFiller, users can simplify their form management, ensuring compliance while fostering seamless collaboration.

Enhancing your experience with the SS-008 Form through pdfFiller empowers you with the resources needed to tackle complex document challenges easily. Collectively, these insights aim to promote better understanding and utilization of vital resources, driving efficiency in tax administration and workforce management.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify ss-008 without leaving Google Drive?

Can I sign the ss-008 electronically in Chrome?

How do I fill out ss-008 on an Android device?

What is ss-008?

Who is required to file ss-008?

How to fill out ss-008?

What is the purpose of ss-008?

What information must be reported on ss-008?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.