Get the free Pension Restart Application

Get, Create, Make and Sign pension restart application

How to edit pension restart application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out pension restart application

How to fill out pension restart application

Who needs pension restart application?

Complete Guide to the Pension Restart Application Form

Understanding the pension restart application process

The pension restart application process refers to the formal steps an individual must undertake to reactivate their pension benefits after a period of inactivity or suspension. Understanding this process is crucial as it directly impacts one's financial stability in retirement.

Navigating the pension restart application requires familiarity with specific terms and jargon, such as 'pension scheme', 'eligibility criteria', and 'restart options'. Knowing these terms enhances your ability to interact successfully with the necessary documentation and bodies managing pension disbursements.

What you need to restart your pension

Before jumping into the pension restart application, it's vital to ensure that you meet the eligibility criteria. Generally, factors like age, length of service, and contributions made play a role in whether you can process this application.

Step-by-step guide to filling out the pension restart application form

Filling out the pension restart application form doesn't have to be daunting. Following a structured approach can streamline your effort and ensure everything is filled out correctly.

Common questions about the pension restart application

During the pension restart application process, individuals frequently encounter queries regarding documentation and procedures.

Interactive tools for managing your pension restart

Using platforms such as pdfFiller can greatly enhance your ability to manage the pension restart application process. With its user-friendly features, you can easily edit, sign, and collaborate on documents, avoiding unnecessary delays.

Important considerations when restarting your pension

Restarting your pension comes with several considerations that can have long-term implications. It's vital to assess how restarting your pension will affect your tax situation and any existing benefits.

Understanding the rules of your specific pension scheme is also key. Each scheme operates under different regulations and limitations, and if ignored, this can lead to undesired outcomes.

Troubleshooting and FAQs

As with any application process, complications may arise. Familiarity with common troubleshooting steps can save you time and avoid frustrations.

Managing your pension post-restart

Once your pension is successfully restarted, consistent management becomes crucial. Regularly monitoring your pension payments and contributions ensures that your financial future remains secure.

Downloading the pension restart application form

Accessing the pension restart application form is straightforward. You can easily download it directly from pdfFiller's website or request a physical copy depending on your preference.

The value of using pdfFiller for your pension needs

Utilizing pdfFiller not only simplifies the pension restart application process but also provides a robust platform for comprehensive document management. Its features cater to those seeking efficiency in managing essential forms related to pensions.

Additional tools and resources within pdfFiller

Besides the pension restart application form, pdfFiller provides a variety of related forms and templates for seamless pension management. Exploring these resources can enhance your financial planning and documentation strategy.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute pension restart application online?

How do I complete pension restart application on an iOS device?

How do I complete pension restart application on an Android device?

What is pension restart application?

Who is required to file pension restart application?

How to fill out pension restart application?

What is the purpose of pension restart application?

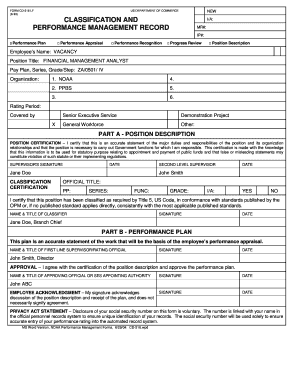

What information must be reported on pension restart application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.