Get the free Tax-Advantaged Equity Funds

Get, Create, Make and Sign tax-advantaged equity funds

Editing tax-advantaged equity funds online

Uncompromising security for your PDF editing and eSignature needs

How to fill out tax-advantaged equity funds

How to fill out tax-advantaged equity funds

Who needs tax-advantaged equity funds?

Navigating Tax-Advantaged Equity Funds Form

Understanding tax-advantaged equity funds

Tax-advantaged equity funds offer investors a unique opportunity to grow their wealth while minimizing their tax liability. Defined as investment vehicles that allow the deferred taxation of certain income or gains, these funds are essential for both individual and institutional investors aiming for long-term financial growth. Their primary purpose is to provide a structure through which investors can capitalize on equity market performance while enjoying significant tax benefits.

Key benefits of tax-advantaged investments include tax deferral, reduced taxable income, and potentially lower capital gains taxes. Furthermore, these funds can contribute toward retirement savings, with plans like Roth IRAs and 401(k)s exemplifying how tax-advantaged accounts operate. Investors may also enjoy capital appreciation without the immediate tax consequences that would accompany traditional investment accounts.

Importance of proper documentation

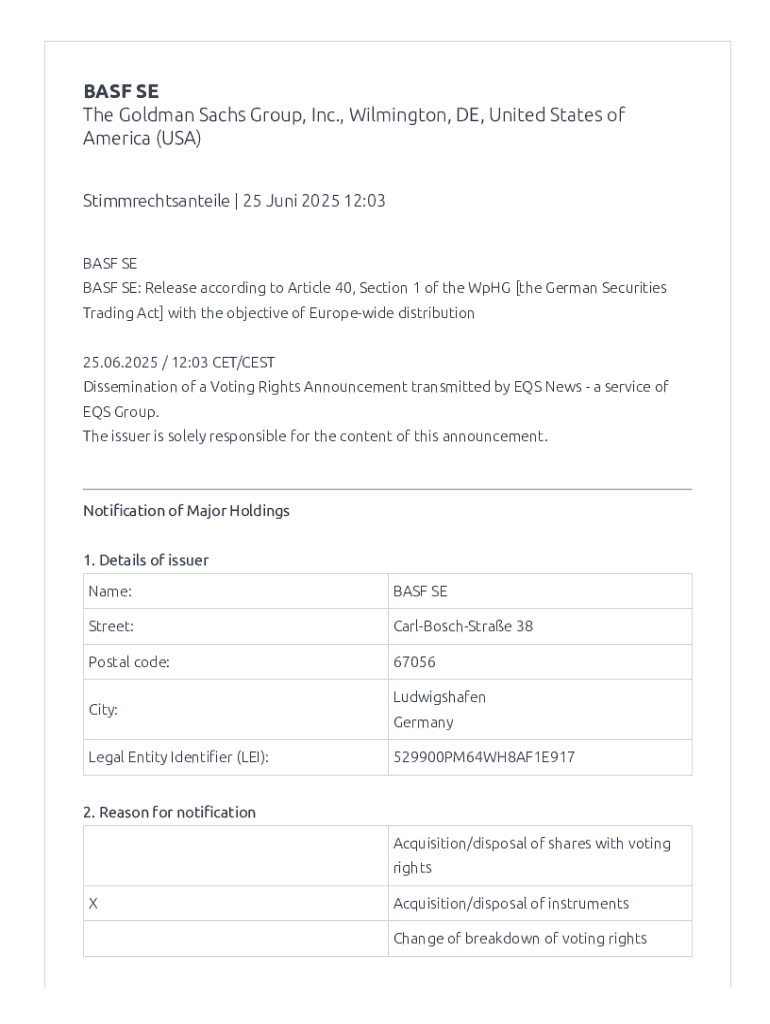

Accurate documentation is critical when submitting your tax-advantaged equity funds form. The IRS and other regulatory bodies require precise information for processing tax returns, including income levels, investment amounts, and personal details. Missing or incorrect details can lead to significant financial consequences, including fines or prolonged audits.

Common pitfalls include missed deadlines, incomplete forms, or failing to report all sources of income accurately. Furthermore, neglecting to document transactions adequately can raise flags with tax authorities. Inaccurate forms may also create legal implications, resulting in penalties that could outweigh the potential tax benefits associated with your investments.

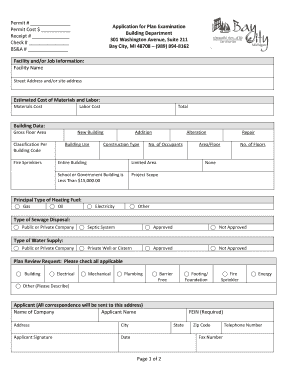

Detailed guide to the tax-advantaged equity funds form

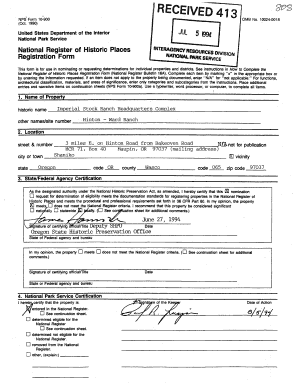

Filling out the tax-advantaged equity funds form requires careful attention to detail. The form typically includes three key sections: personal information, income and tax details, and fund selection and allocation. Each part is essential in ensuring that your investments are correctly reported and eligible for tax advantages.

Step-by-step instructions for completing each section

Section 1 requires your personal data, including your contact information and identifying numbers. Ensure accuracy here as this is foundational for further steps in the process.

Section 2 focuses on financial details, where you must articulate your income sources and projected tax rates for the upcoming year. Clear documentation of this information helps justify your tax-advantaged status.

Section 3, dealing with signatures and submission, must be completed with great care. Ensure that all required signatures are collected, as incomplete submission may lead to processing delays.

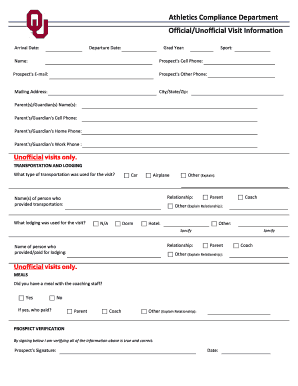

Interactive tools for form management

Leveraging technology can significantly ease the process of managing your tax-advantaged equity funds form. Tools like pdfFiller offer a suite of interactive features that streamline this workflow. From editing tools that allow quick modifications to collaborative features that let multiple team members contribute to a single document, the platform simplifies complex forms.

Additionally, tracking changes and comments ensures clarity among collaborators. Utilizing pdfFiller's eSigning features enables quick approvals, meeting compliance requirements without significant delays. These functionalities not only enhance the user experience but also contribute to more efficient documentation processes.

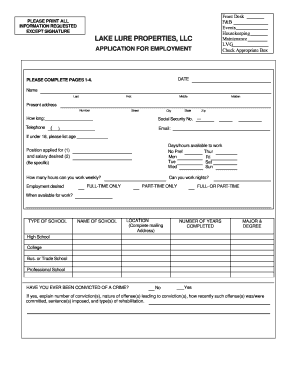

Best practices for managing your tax-advantaged equity funds form

Managing your tax-advantaged equity funds form effectively requires diligent record-keeping. It’s important to retain copies of submitted forms along with all related documentation, including receipts, tax statements, and correspondence with financial advisors or institutions. Organized records can prove invaluable should you face audits or need to reference previous submissions.

Timelines for submission should be diligently followed; typically, you should aim to file your form well before tax deadlines to handle any unexpected complications. Setting reminders and alerts using platforms like pdfFiller can help manage these timelines efficiently. Keeping a proactive approach ensures that you won't miss critical dates, thereby maximizing the benefits of your investments.

Maximizing your investment with tax-advantaged funds

To truly capitalize on your investments through tax-advantaged equity funds, adopt a strategic approach to selection. Different funds have varying risk profiles, and understanding market trends is essential in choosing the right investment. Factors such as the fund’s historical performance, management style, and exposure to different sectors can all influence your returns.

Consider both long-term and short-term tax implications as you invest. Long-term holding often results in lower capital gains tax, while short-term investments might incur higher rates. Additionally, staying abreast of market trends can help investors make informed decisions. Adjusting your portfolio in response to these trends can enhance returns and further leverage the benefits of tax-advantaged growth.

Troubleshooting common issues

Even with careful attention, issues can arise when filling out your tax-advantaged equity funds form. Common problems include misfilled sections, where information might be inaccurately interpreted or completed. To correct mistakes, always follow up promptly, and refer to official guides to understand the correct procedures.

Understanding your localized tax codes and requirements is vital. Depending on your jurisdiction, regulations may vary significantly. If confusion arises, seeking professional help or advice can provide clarity. Certified tax consultants or financial advisors can offer tailored assistance, ensuring that your submission adheres to applicable laws.

Success stories: How tax-advantaged equity funds transform investments

Numerous individuals and businesses have experienced remarkable growth through tax-advantaged equity funds. In our first case study, we explore the journey of an individual investor who leveraged a Roth IRA for gradual wealth accumulation. By focusing on growth stocks within this framework, the investor transformed a moderate annual contribution into a robust retirement portfolio.

In another case study, a family-owned business utilized tax-advantaged funds to reinvest profits back into the company, enhancing operational efficiency while benefiting from tax deferrals. Testimonials from users of pdfFiller highlight how accessible tools can demystify investment paperwork, enabling strategic decisions that lead to successful outcomes. These narratives underscore the potential of tax-advantaged strategies in shaping future financial landscapes.

Questions and answers about tax-advantaged equity funds form

As you navigate the complexities of the tax-advantaged equity funds form, you may have questions about specific processes or requirements. Frequently asked questions include clarifications on eligibility criteria, the types of acceptable withdrawal, and potential restrictions. Understanding these elements is essential for maximizing the benefits of your financial decisions.

For real-time assistance, platforms like pdfFiller provide access to live support through chat tools. Quick responses from knowledgeable agents can alleviate concerns and answer lingering questions, helping to guide users through the intricacies of the form completion process efficiently.

Next steps: Moving beyond the form

Completing the tax-advantaged equity funds form is just the beginning of your investment journey. After submission, consider exploring advanced investment strategies that may further refine your financial portfolio. Strategies like asset allocation, diversification, and reviewing performance metrics are effective ways to enhance your investment potential.

Continuous learning is also critical; staying current with tax regulations and financing trends may open new avenues for investment. Platforms like pdfFiller offer additional features that simplify ongoing documentation needs, making it easier to adjust your strategies efficiently based on your evolving financial landscape.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my tax-advantaged equity funds in Gmail?

How do I fill out tax-advantaged equity funds using my mobile device?

How do I edit tax-advantaged equity funds on an Android device?

What is tax-advantaged equity funds?

Who is required to file tax-advantaged equity funds?

How to fill out tax-advantaged equity funds?

What is the purpose of tax-advantaged equity funds?

What information must be reported on tax-advantaged equity funds?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.