Get the free Arizona Form 165pa-x

Get, Create, Make and Sign arizona form 165pa-x

Editing arizona form 165pa-x online

Uncompromising security for your PDF editing and eSignature needs

How to fill out arizona form 165pa-x

How to fill out arizona form 165pa-x

Who needs arizona form 165pa-x?

Comprehensive Guide to Arizona Form 165PA-

Overview of Arizona Form 165PA-

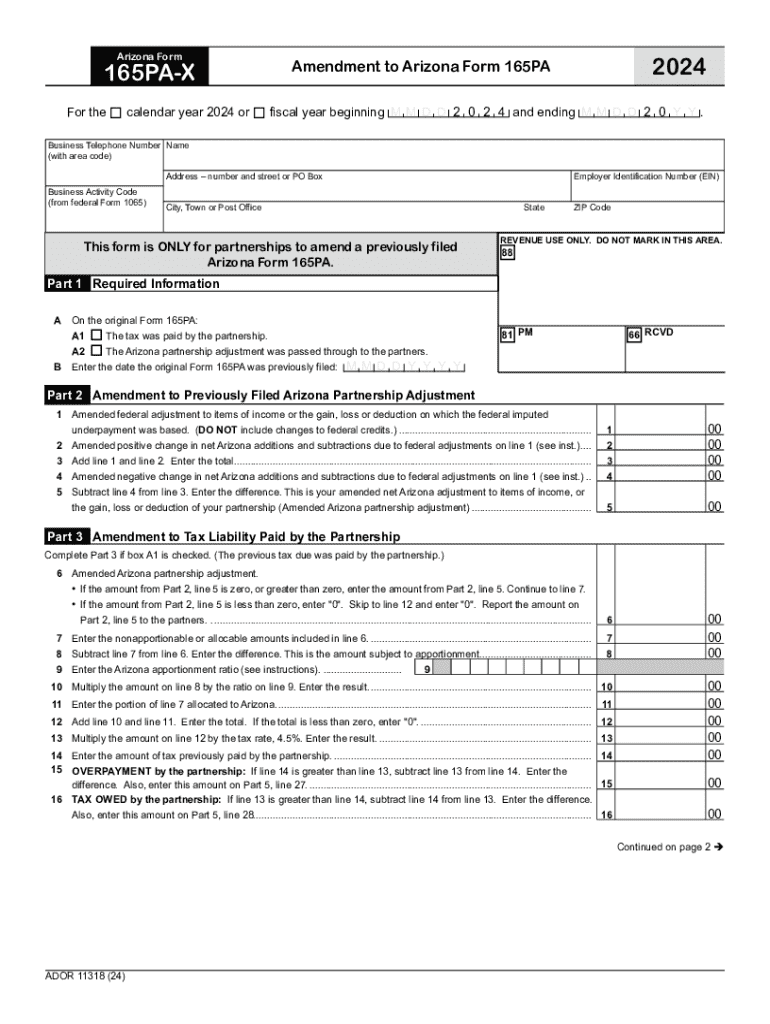

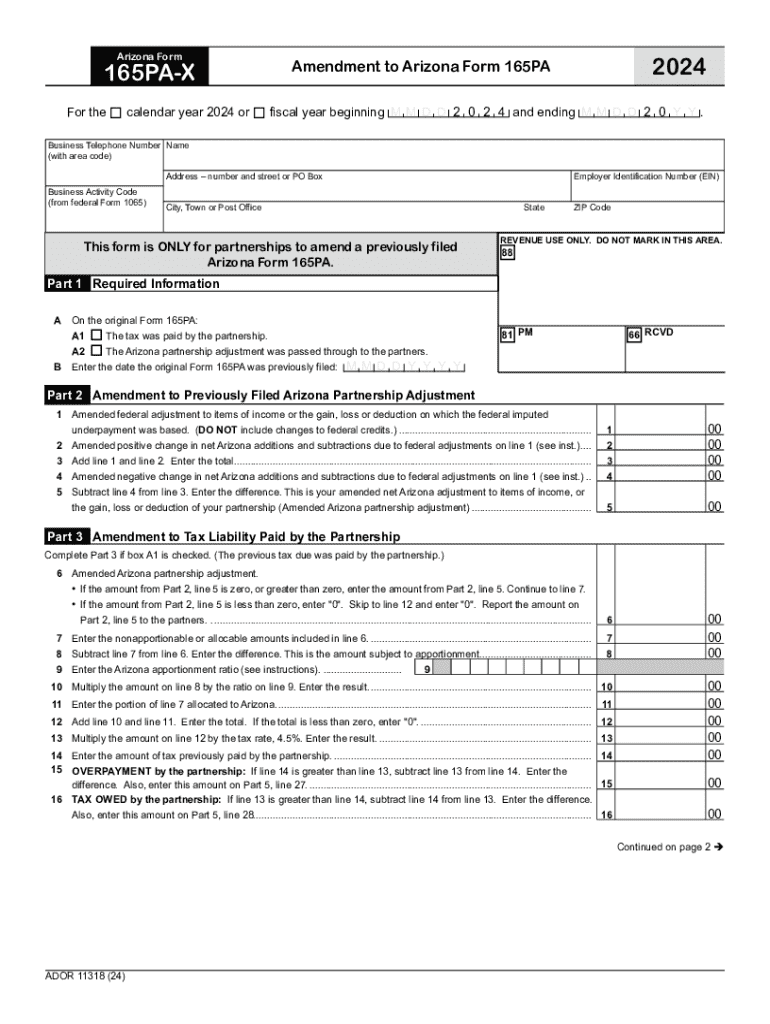

Arizona Form 165PA-X, also known as ADOR11318, is a critical document designed for partnerships operating in the state of Arizona. This form is utilized for amending a partnership's income tax return, making it vital for maintaining compliance with state tax laws. As partnerships are distinct entities for tax purposes, filing Form 165PA-X correctly is essential to ensure that all partners report their income accurately.

The form allows partnerships to correct previous submissions, which is essential for addressing any discrepancies or changes in partnership details, income, deductions, and credits. Understanding the significance of this form is crucial for any partnership wishing to avoid penalties and ensure proper reporting.

Purpose and importance of the form

The primary purpose of Arizona Form 165PA-X is to facilitate corrections to previously filed partnership returns. This may include rectifying errors made in income reporting, amendments to partner ownership percentages, or changes in deductions that could significantly affect the tax liability of the partnership and its individual members. Filing this form allows partnerships to maintain an accurate record with the Arizona Department of Revenue, which is imperative for compliance and avoiding potential audits or penalties.

Who should use Arizona Form 165PA-?

Arizona Form 165PA-X should be used by partnerships that need to amend their previously submitted Form 165 (the original tax return). This includes limited partnerships, general partnerships, and any other forms of partnership recognized by the state of Arizona. If errors were noted after the original filing, or if the partnership's situation has changed, this form provides the avenue for necessary adjustments.

Key changes in the latest version

The latest version of Arizona Form 165PA-X has introduced a few noteworthy changes, primarily aimed at streamlining the amendment process and making compliance more straightforward for partnerships. These changes often include updated language for clarity, minor adjustments in the required information sections, and the incorporation of new guidelines based on recent tax law changes. As tax regulations can shift, it's vital for filers to stay current with these updates to minimize errors.

Detailed steps for completing Arizona Form 165PA-

Filling out Arizona Form 165PA-X requires careful attention to detail. Ensure you have all necessary information before beginning. The completed form reflects accurate data and the changes being made in your partnership's tax filing.

Required information

To complete Form 165PA-X, the following information is essential:

Step-by-step instructions for filling out the form

Following are the detailed step-by-step instructions for filling out Arizona Form 165PA-X:

Common mistakes to avoid

To avoid common pitfalls when completing the Arizona Form 165PA-X, ensure to:

Best practices for completing the form accurately

To complete Arizona Form 165PA-X efficiently and accurately, implement the following best practices:

Interpreting key sections of Arizona Form 165PA-

An essential part of the amendment process involves understanding the key sections within Arizona Form 165PA-X. Each section holds significance in the overall amendment process and understanding them will streamline your filing experience.

Breakdown of tax computation

The tax computation section is where you’ll indicate the adjustments being made to the original tax return. This involves recalculating income, deductions, and credits as necessary. Ensure that your calculations are precise and reflect the intended changes. Any discrepancies here may result in delays or compliance issues.

Understanding amendment procedures

Once the form has been completed, the amendment procedures dictate how you can submit it. Understanding these procedures is key to avoiding potential processing delays. This typically includes filing deadlines and whether to email or mail in the document.

Special considerations for partnerships

Partnerships face specific considerations when amending tax returns. Compliance with both state and federal regulations is mandatory, and accurately reflecting changes in income and fluctuation in partnership ownership is crucial. Additionally, changes such as partner retirements, death, or new partner additions must be documented effectively.

Downloading and accessing Arizona Form 165PA-

Accessing Arizona Form 165PA-X is straightforward. Partnerships can download the form directly from the Arizona Department of Revenue's official website or through authorized tax preparation platforms.

Where to access the form

To access Arizona Form 165PA-X, visit the Arizona Department of Revenue's website or utilize the comprehensive resources available through pdfFiller.

Download instructions for Arizona Form 165PA-

To download the form, follow these easy steps:

Tips for printing and saving the document

When handling the Arizona Form 165PA-X, proper printing and saving practices are essential. Always use a good quality printer to ensure all details are clear, and save multiple copies in different formats to avoid data loss. Storing a digital version will allow for easier access and future amendments if needed.

Interactive tools and resources

Utilizing interactive tools can greatly enhance the ability to complete Arizona Form 165PA-X. Many online resources are available to assist users in understanding the nuances involved in filing.

Form-filling Q&A tool

The pdfFiller platform offers a form-filling Q&A tool that can assist individuals by answering common queries related to Arizona Form 165PA-X. This tool can help to clarify doubts and ensure that all necessary details are accurately addressed.

Useful templates for related forms

In addition to Form 165PA-X, pdfFiller provides access to various templates of related forms that can streamline the overall process of tax filing for partnerships. These templates are tailored to Arizona's tax laws and can save users time and ensure compliance.

Links to government resources on Arizona tax forms

Access to government resources is crucial in assisting with tax compliance. The Arizona Department of Revenue's website is a primary source, where users can find guidelines, instructions, and updates relevant to all tax forms including 165PA-X.

Filing Arizona Form 165PA-: What you need to know

Filing Arizona Form 165PA-X involves key considerations that partnerships need to be aware of to ensure successful submission.

Submission methods (online vs. mail)

Arizona Form 165PA-X can typically be submitted electronically or via traditional mail. Electing to file online may expedite processing times as electronic submissions can be processed faster. However, some partnerships may prefer mail submission for record-keeping purposes.

Deadlines for filing

Timeliness is crucial when it comes to submitting Form 165PA-X. The deadline for amendments is generally within three years from the original filing date. Adhering to deadlines can prevent penalties for late submissions.

Fees and associated costs

While there may not be direct fees associated with filing Arizona Form 165PA-X, preparing the necessary documents may incur costs, especially if assistance from a tax professional is sought. Such investments can prove beneficial in ensuring accurate filings.

Tracking the status of your submission

Once submitted, tracking the status of your Form 165PA-X is crucial. Partnerships should keep a record of confirmation from the Arizona Department of Revenue if filed electronically or ensure they have proof of mailing if submitted by mail. Regular follow-ups can help ascertain that the amendment has been processed.

Frequently asked questions about Arizona Form 165PA-

Partnerships often have numerous inquiries regarding the Arizona Form 165PA-X. Below are some of the most common questions that arise during the amendment process.

Common inquiries regarding the form

Several questions frequently arise concerning the use and submission of Arizona Form 165PA-X, such as requirements, amendment limits, and impacts on partner tax obligations. Familiarizing yourself with these can enhance the filing experience.

Clarifications on state tax regulations

Partnerships may also seek clarifications on applicable state tax regulations aligned with form completion. Understanding the unique aspects of Arizona's tax code enables partnerships to ensure compliance and accuracy.

Resources for specific issues or concerns

For specific issues, various resources, including legal guidance, state tax guides, and consultation with tax professionals are advisable. Utilizing these resources better equips partnerships to navigate complications.

State considerations and compliance guidance

Navigating Arizona's state regulations is crucial for any partnership looking to maintain compliance while filing Arizona Form 165PA-X. Understanding local laws provides the foundation for accurate reporting.

Impact of state legislation on partnerships

State legislation often influences partnerships by implementing specific provisions that must be followed for tax purposes. Keeping abreast of changes in tax laws enhances compliance and supports effective collaboration among partners.

Audit risks and how to mitigate them

Partnerships should be wary of potential audit risks that may arise from inaccuracies in submissions. Maintaining thorough documentation, ensuring accuracy in partner details, and timely submissions can significantly mitigate these risks.

Record-keeping best practices for partnerships

Effective record-keeping is essential for partnerships, involving the maintenance of financial records, communication logs, and versions of all tax filings. Following best practices ensures that all partnership activities remain transparent and compliant.

Related forms and documentation

Alongside Arizona Form 165PA-X, there are several related forms and documentation that partnerships may encounter during the filing process.

Overview of other relevant Arizona tax forms

Partnerships should be aware of related forms such as the Arizona Form 165 and the Arizona Form 140, each serving distinct purposes in tax compliance. Familiarity with these forms can enhance the overall understanding of partnership tax filings.

Links to additional documents for filing amendments

Resources for additional documents can be found on the Arizona Department of Revenue's website, providing guidance for each of the necessary steps in filing amendments.

Cross-reference with IRS forms for federal compliance

Understanding how Arizona Form 165PA-X ties into IRS requirements is crucial. Partnerships need to ensure compliance not just with state laws but also with federal tax regulations, making it indispensable to cross-reference information from relevant IRS forms.

Educational resources and articles

Partnerships can benefit from various educational resources that provide insights into Arizona tax law and effective filing strategies.

Recent developments in Arizona tax law

Regular updates from tax authorities regarding changes to Arizona tax law impact partnerships significantly. Staying informed on these developments aids in maintaining compliance and enhancing accurate filings.

Expert opinions and strategies on form completion

Leverage insights from tax professionals that offer strategies and best practices for completing Arizona Form 165PA-X. This expert guidance can make a notable difference in achieving optimal compliance.

Case studies and practical examples

Reviewing case studies can provide practical examples of different scenarios partnerships have faced while filing Form 165PA-X. Analyzing these cases enables partnerships to learn from others' experiences.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send arizona form 165pa-x for eSignature?

How do I make edits in arizona form 165pa-x without leaving Chrome?

Can I create an electronic signature for the arizona form 165pa-x in Chrome?

What is arizona form 165pa-x?

Who is required to file arizona form 165pa-x?

How to fill out arizona form 165pa-x?

What is the purpose of arizona form 165pa-x?

What information must be reported on arizona form 165pa-x?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.