Get the free Calpers Supplemental Income 457 Plan

Get, Create, Make and Sign calpers supplemental income 457

How to edit calpers supplemental income 457 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out calpers supplemental income 457

How to fill out calpers supplemental income 457

Who needs calpers supplemental income 457?

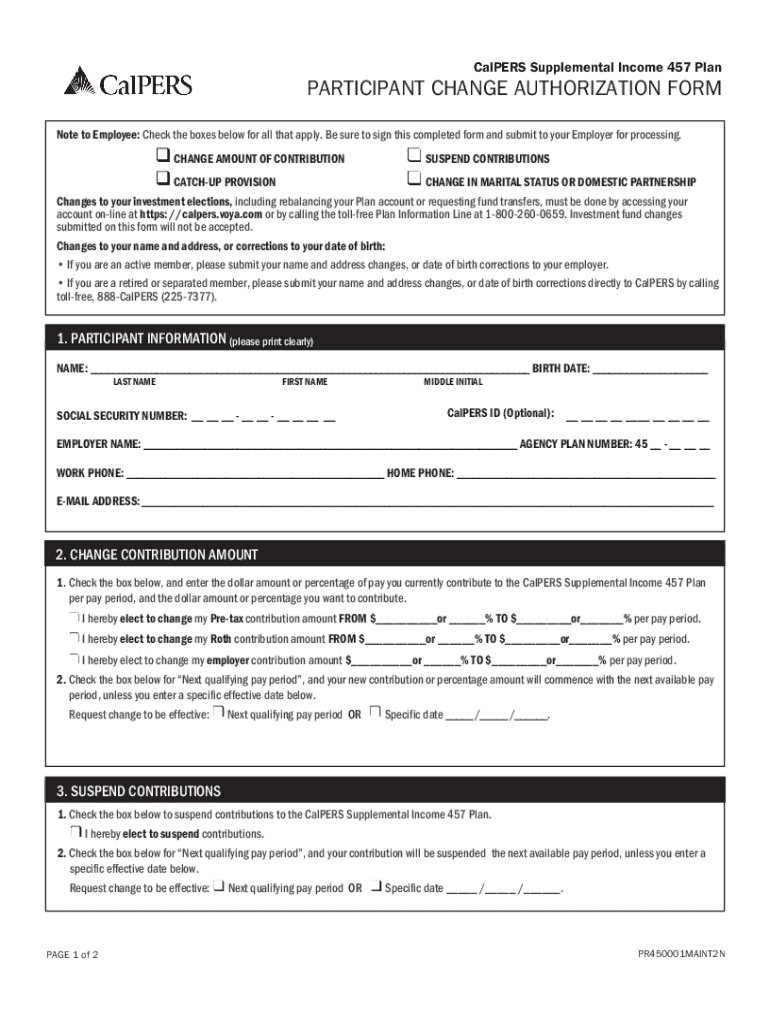

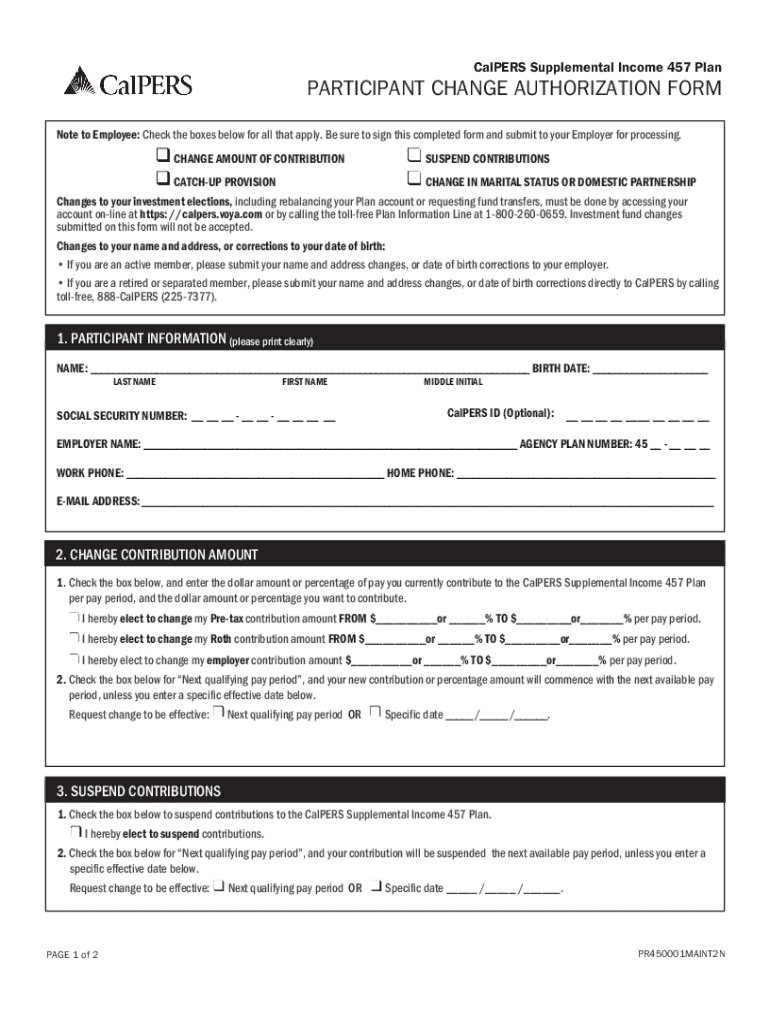

Understanding the CalPERS Supplemental Income 457 Form

Understanding the CalPERS Supplemental Income 457 Plan

The CalPERS Supplemental Income 457 Plan is designed to offer additional retirement savings options for California public employees. This plan is particularly beneficial as it allows individuals to contribute pre-tax dollars, effectively reducing their taxable income while saving for retirement.

Eligibility for participant enrollment in the CalPERS 457 Plan includes any California public employee who is a member of the California Public Employees' Retirement System. This plan specifically aims at those looking to supplement their pension retirement income, thereby contributing to a more secure financial future.

Importance of the 457 Form

The CalPERS Supplemental Income 457 Form serves a crucial role in the enrollment process. This form provides the framework needed to facilitate contributions and manage personal accounts effectively. Individuals must complete this form accurately to comply with tax regulations and ensure their contribution is processed correctly by CalPERS.

It’s essential to distinguish the CalPERS 457 Form from other retirement-related documents. While the 457 plan is a supplemental option, it works alongside other pension plans available to California public employees, specifically tailored to enhance retirement income.

How to access the CalPERS Supplemental Income 457 Form

Accessing the CalPERS Supplemental Income 457 Form can be done seamlessly online through the CalPERS official website. To locate the form, navigate to the ‘Forms’ section, where you’ll find various retirement forms, including the 457 plan form.

Here's a step-by-step guide for downloading the form directly from the website:

Alternatively, pdfFiller offers a user-friendly interface to access, fill, and manage your forms. Utilizing pdfFiller can enhance your experience in handling the form with its powerful document management features.

Filling out the CalPERS 457 Form: A step-by-step guide

Before filling out the CalPERS Supplemental Income 457 Form, it’s essential to pre-fill by gathering the required information. Common financial terms that may come into play include 'employee contributions', 'beneficiary', and 'copayment'. Familiarizing yourself with these terms can streamline the completion process.

Now, let’s walk through each section of the form in detail:

To avoid delays in processing, it’s crucial to ensure that all information is accurate and complete. Double-check your entries and consult with a financial advisor if necessary.

Editing and customizing the 457 form with pdfFiller

Using pdfFiller to edit your CalPERS 457 Form allows for convenient alterations without the worry of paperwork clutter. The platform lets you upload the downloaded form and make necessary modifications on the go.

With pdfFiller, you can enhance your form by:

This flexibility ensures accuracy and ease in managing your documents remotely.

Submitting the CalPERS Supplemental Income 457 Form

Once the form is filled out, it can be submitted either electronically or via traditional mail. Each method has its benefits, with electronic submissions often being faster and easier.

To submit the form, follow these best practices:

Confirming that your form is processed correctly can help prevent any potential issues with your contributions.

Managing your 457 plan and future updates

After successfully submitting the CalPERS Supplemental Income 457 Form, ongoing management of your account is vital. Regularly tracking your contributions and benefits can provide a clearer picture of your retirement savings.

Understanding any changes or updates to your CalPERS 457 Plan can significantly impact your retirement strategy. Here are steps to effectively manage your account:

Resources for additional support

If you encounter any challenges while completing the CalPERS Supplemental Income 457 Form or managing your plan, reaching out for assistance is crucial. CalPERS provides direct support through their customer service.

Contact points for CalPERS support include:

In addition to direct support, CalPERS offers online tools and calculators to help assess your contributions effectively. Participating in community forums can also provide insights from fellow participants.

FAQs about the CalPERS Supplemental Income 457 Form

Many individuals have questions about the nuances of the CalPERS Supplemental Income 457 Form. Common inquiries revolve around contribution limits, eligibility for various situations, and processes involved in withdrawing funds.

Some frequently asked questions include:

Getting clarity on these subjects aids in making informed decisions surrounding your retirement planning.

Conclusion: Ensuring compliance and maximizing your benefits

Accurate form submission of the CalPERS Supplemental Income 457 Form is essential for maximizing your retirement benefits. Keeping up with contributions and regular updates will put you in a better position for retirement.

Stay informed about your rights, contribution options, and the functionality of platforms like pdfFiller, which offer the flexibility and accessibility required to manage and maintain your financial documents efficiently.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my calpers supplemental income 457 in Gmail?

Where do I find calpers supplemental income 457?

How do I execute calpers supplemental income 457 online?

What is calpers supplemental income 457?

Who is required to file calpers supplemental income 457?

How to fill out calpers supplemental income 457?

What is the purpose of calpers supplemental income 457?

What information must be reported on calpers supplemental income 457?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.