Get the free Form 8-k

Get, Create, Make and Sign form 8-k

How to edit form 8-k online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 8-k

How to fill out form 8-k

Who needs form 8-k?

How to Fill Out Form 8-K Using pdfFiller

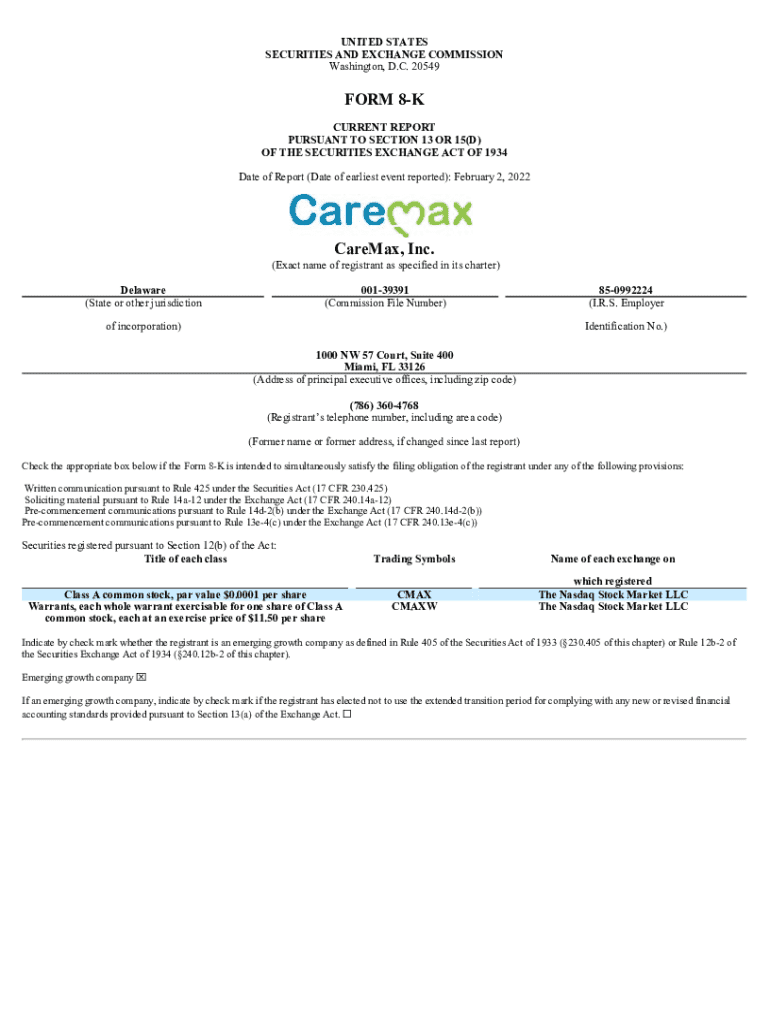

Understanding Form 8-K

Form 8-K is a crucial document that public companies must file with the U.S. Securities and Exchange Commission (SEC) to keep investors informed about significant corporate events. This form serves as a way to disclose to shareholders any important developments that occur between the regular quarterly and annual reporting periods, ensuring timely communication.

The importance of Form 8-K cannot be overstated; it not only provides transparency but also plays a vital role in maintaining investor trust. This disclosure is essential for holding companies accountable and ensuring all stakeholders, including investors and analysts, are kept updated on key business changes.

Historical context of Form 8-K

First introduced in 1934 by the SEC, Form 8-K has undergone numerous changes to adapt to the shifting landscape of corporate governance and shareholder rights. The initial purpose of the form was to require timely reporting of significant corporate events, a need that has become even more pronounced in today's fast-paced financial environment.

Over the years, the SEC has refined the requirements of Form 8-K, including the establishment of specific items that must be reported, such as mergers and acquisitions, executive changes, and financial restatements. These regulatory adjustments have ensured that Form 8-K remains relevant in safeguarding investors' interests.

When is Form 8-K required?

Companies must file Form 8-K upon the occurrence of certain significant events. These triggers can include a variety of corporate changes such as mergers, acquisitions, or even bankruptcy. Any situation that could materially affect investors' decisions generally requires a filing.

In addition to major corporate events, changes in management — for instance, the departure of a key executive or the appointment of new leadership — must also be reported. Financial restatements and other significant updates that could influence stock prices or investor perception are vital disclosures that necessitate Form 8-K filings.

Components of Form 8-K

Form 8-K encompasses several pivotal sections that need to be completed accurately. Each of these sections is designed to capture critical information regarding the event being reported. This ensures that all key details are disclosed to the public in accordance with SEC regulations.

Key sections of the Form 8-K include the header, where the company name and SEC file number are entered, and the body, which details the nature of the reportable event. Each item requires specific details to ensure compliant disclosure.

How to access and fill out Form 8-K

Accessing Form 8-K is straightforward, as the official form can be found directly on the SEC's website or through various financial filings databases. However, utilizing convenient tools like pdfFiller can simplify the entire process of filling out this critical document.

To fill out Form 8-K using pdfFiller, follow these steps: First, access the template via the pdfFiller platform. Next, ensure you're familiar with each section of the form and the information required. Completing the form accurately is crucial, so take the time to review the specific items applicable to your situation.

Editing and managing your Form 8-K efficiently

Editing Form 8-K with pdfFiller is simple and efficient. The platform offers various editing tools that allow users to modify their PDF documents swiftly. Whether you need to add, delete, or change content, pdfFiller supports easy adjustments, ensuring your form is not only complete but also fully compliant.

Collaborating on Form 8-K can also be a seamless experience. With pdfFiller’s collaboration features, team members can work together on the document in real-time. Utilize comments to provide feedback and track changes using the version history feature to ensure everyone is on the same page.

Signing and finalizing your Form 8-K

Adding an electronic signature to your Form 8-K is crucial for legal compliance. pdfFiller provides several methods for electronically signing documents, making the process quick and reliable. This step is an essential part of finalizing the filing, confirming that all parties involved agree on the content of the form.

Once signed, the next step involves submitting your Form 8-K electronically. Companies typically use the SEC's EDGAR filing system for this purpose. After submission, tracking the status of your filing is recommended to confirm that it has been received and processed.

Common challenges and solutions

Completing Form 8-K can present several challenges for companies. Common issues include misunderstanding which items require reporting, incorrect details entered on the form, or technical hiccups during the filing process. These issues can lead to delays and compliance risks if not managed properly.

To navigate these challenges, companies should familiarize themselves with the reporting requirements and critically review the details before submission. Engaging legal advisors or compliance experts can provide additional guidance and assurance.

Additional insights on Form 8-K

The benefits of timely and accurate Form 8-K filings are significant. Not only do they promote transparency, but they also enhance a company's credibility with investors and regulatory authorities. The quicker a company communicates important changes, the more potential it has to maintain investor trust and confidence.

Looking ahead, the landscape of Form 8-K reporting may evolve further. Changes in regulations and reporting practices are expected, potentially emphasizing even more on the need for digital and efficient filing systems. Companies that proactively adapt to these changes will likely gain an advantage.

Frequently asked questions (FAQs)

Understanding the nuances of Form 8-K can be daunting for filers. Common queries often arise regarding filing deadlines and the specific information that needs to be disclosed. It's essential to clarify these points to avoid any compliance issues.

Handling sensitive or private information within the Form 8-K is another area of concern. Companies are advised to consult legal counsel to navigate the complexities of disclosure regulations. By doing so, they can safeguard their interests while adhering to legal requirements.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my form 8-k in Gmail?

Can I create an electronic signature for signing my form 8-k in Gmail?

Can I edit form 8-k on an Android device?

What is form 8-k?

Who is required to file form 8-k?

How to fill out form 8-k?

What is the purpose of form 8-k?

What information must be reported on form 8-k?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.