Get the free Fppc Form 700

Get, Create, Make and Sign fppc form 700

How to edit fppc form 700 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out fppc form 700

How to fill out fppc form 700

Who needs fppc form 700?

FPPC Form 700: A Comprehensive Guide to Filing and Managing Your Statement of Economic Interests

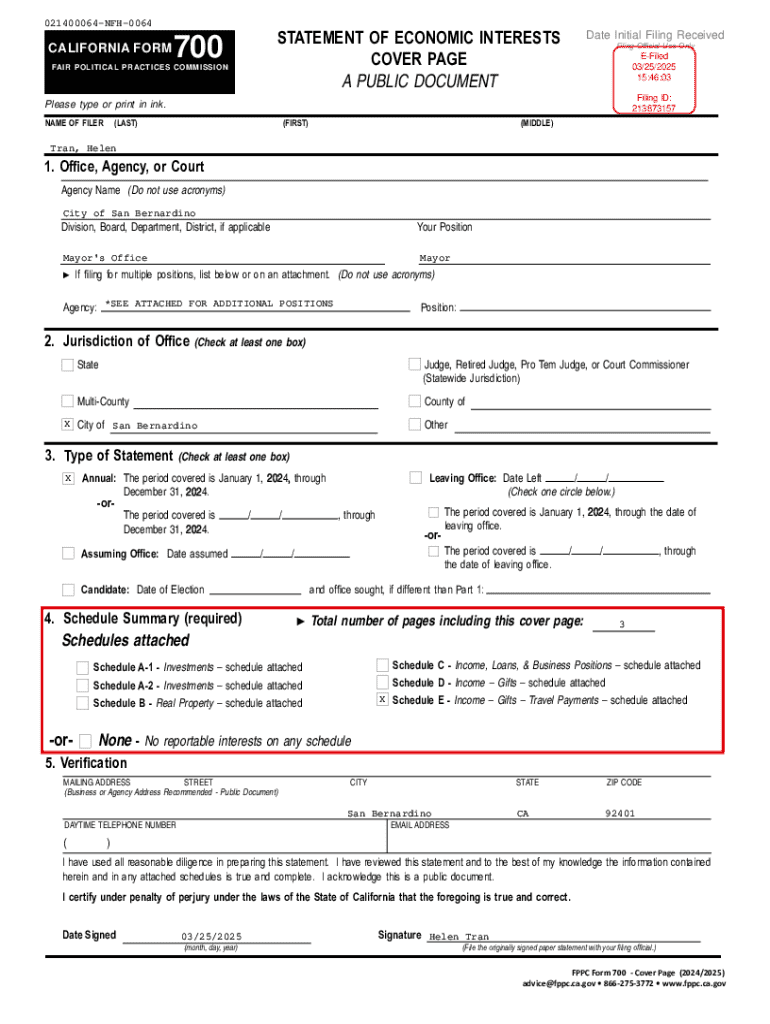

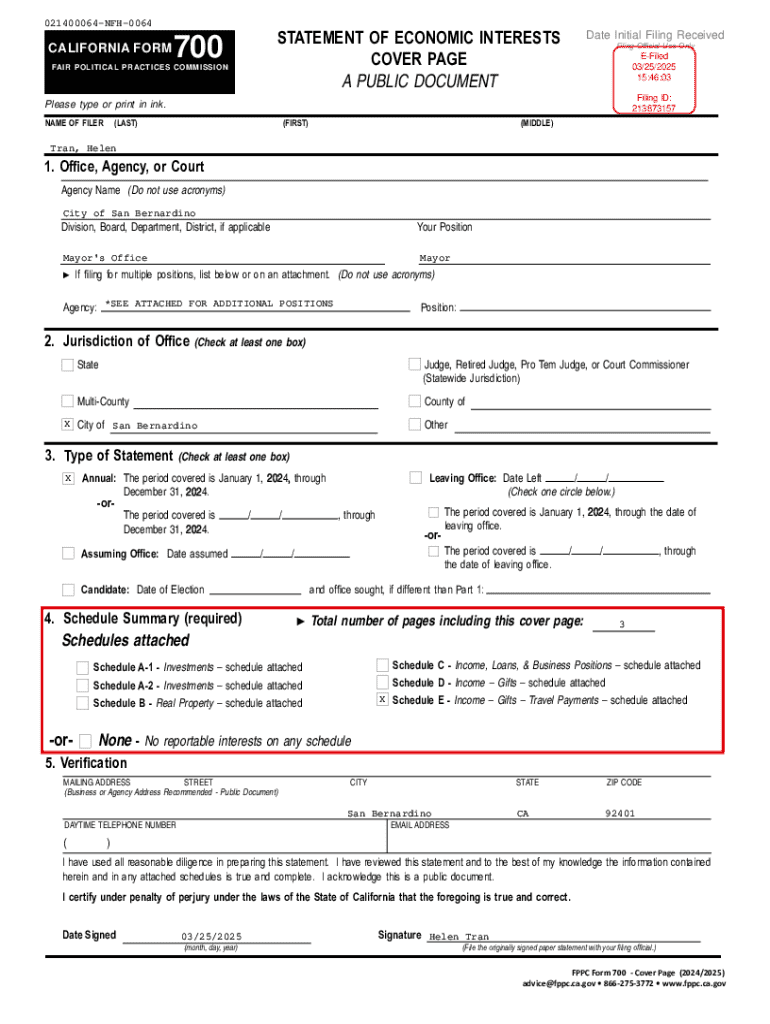

Understanding FPPC Form 700

FPPC Form 700, known as the Statement of Economic Interests, serves a critical role in upholding transparency and accountability among public officials in California. This document ensures that individuals in decision-making positions disclose their financial interests, helping to mitigate conflicts of interest and maintain public trust.

The legal requirement to file FPPC Form 700 is rooted in California's Political Reform Act of 1974. This act mandates that certain officials, ranging from elected representatives to appointed board members, disclose their economic ties.

Who needs to file Form 700?

The requirements for filing Form 700 extend to various categories of individuals involved in public service. This includes public officials such as state and local elected officials, members of regulatory agencies, and certain employees in public trusts. Board members of informal advisory groups and certain designated employees are also encompassed within this group.

Filing a Form 700: Step-by-Step Instructions

Filing FPPC Form 700 can initially seem daunting, but breaking it down into manageable steps can simplify the process. The first step involves gathering all necessary documents to ensure complete and accurate disclosure.

Common documents to reference include property deeds, investment statements, and records of gifts received. This will provide a complete picture of your economic interests and facilitate accurate reporting.

Completing the Form 700

Next, fill out each section of the form meticulously. The following are crucial components of FPPC Form 700:

To ensure accurate completion, avoid common mistakes like under-reporting or failing to disclose required information. It's crucial to review completed sections thoroughly before submission.

Best practices include keeping a personal record of your financial interests and regularly updating your information to reflect any significant changes.

Amendments and updates to your Form 700

Amending your FPPC Form 700 is a necessary measure when your financial situation changes due to various factors, such as new investments or changes in property ownership. It is essential to stay compliant and transparent after your initial filing.

To submit an amendment, follow these steps: First, acquire the latest version of the form to ensure you’re adhering to any new regulations. Next, clearly indicate that you are amending your previous filing, then complete the updated information accurately.

Documenting changes related to your disclosures is equally important. Keep records of old and new filings as well as all supporting documentation to maintain compliance with state regulations.

Special considerations for consultants and new positions

Consultants and individuals taking on new public roles face unique challenges when filing FPPC Form 700. Specific disclosure requirements necessitate transparency, especially if your consultancy offers services to public agencies. Disclosing any financial interests in companies that may be affected by your consultancy is critical to avoiding conflicts.

Furthermore, promptly reporting any substantial changes in household income or family financial interests is necessary when you assume new positions. This ensures continued adherence to ethical obligations and legal compliance.

Navigating late penalties and non-compliance

Failing to file FPPC Form 700 on time or neglecting to disclose required interests can lead to severe penalties. Understanding the implications of late filings or non-compliance is crucial for all public officials and employees.

The FPPC may impose fines and penalties that can escalate quickly, ranging from minor fines for late filings to substantial fines for willful neglect of responsibilities. Staying aware of filing deadlines is imperative.

If you’ve missed a deadline, be proactive. Quickly prepare your filing and communicate with the FPPC to explain the situation, showing initiative in resolving the oversight.

Clarifying common questions and concerns

Many filers often have questions regarding specific entries on FPPC Form 700, especially around how to report gifts or handle travel expenses. The guidelines can sometimes feel ambiguous, leading to confusion.

Common queries include the thresholds for reporting gifts, how to disclose foreign gifts, and what constitutes significant transactions that require detailed reporting.

Don’t hesitate to reach out to the FPPC for specific details regarding your filing. They can provide guidance tailored to your situation, ensuring you remain compliant.

Utilizing pdfFiller for your FPPC Form 700 needs

pdfFiller presents an ideal solution for individuals and teams seeking to manage their FPPC Form 700 efficiently. With its user-friendly interface, users can quickly complete, edit, and eSign their forms without the hassle of traditional paper processes.

Key features of pdfFiller include interactive tools that guide document completion, enabling users to navigate the nuances of FPPC Form 700 easily. You can also collaborate with team members in real-time, making it a breeze to ensure all necessary disclosures are thorough and accurate.

Utilizing pdfFiller not only expedites the form-filing process but also enhances data security, allowing users to rest assured that their information is safeguarded.

Engaging with the community and staying updated

Active participation in filing communities and forums can significantly aid in navigating the complexities of FPPC Form 700. Engaging with fellow filers allows sharing insights, experiences, and strategies that can ease the filing process.

Additionally, it's essential to remain informed about changes in legislation and filing requirements. By frequently checking official resources, users can adapt their practices to comply with the latest rules and regulations.

Such proactive measures not only keep you compliant but also foster a culture of transparency and accountability within public service.

Innovative features of pdfFiller for document management

In an increasingly digital world, pdfFiller offers a cloud-based solution that modernizes document management. It simplifies workflows and enables collaboration, allowing teams to manage FPPC Form 700 and other documents seamlessly.

With ongoing updates and robust support, users can future-proof their filing processes, adapting to evolving legal requirements and technological advancements. Leveraging the advantages of cloud-based solutions enhances organizational efficiency, making documentation a hassle-free experience.

Utilizing pdfFiller not only ensures compliance with FPPC Form 700 requirements but also enhances overall document management efficiency, allowing public officials and employees to focus on their essential duties.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my fppc form 700 in Gmail?

Where do I find fppc form 700?

How do I complete fppc form 700 on an iOS device?

What is fppc form 700?

Who is required to file fppc form 700?

How to fill out fppc form 700?

What is the purpose of fppc form 700?

What information must be reported on fppc form 700?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.