Get the free Disclosure Form

Get, Create, Make and Sign disclosure form

How to edit disclosure form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out disclosure form

How to fill out disclosure form

Who needs disclosure form?

A comprehensive guide to disclosure forms

Understanding disclosure forms

A disclosure form is a document that provides essential information and required disclosures about a particular subject, often serving as a means of transparency in various business and legal transactions. These forms are crucial in ensuring all parties involved are aware of specific facts, risks, or obligations associated with a transaction.

The importance of disclosure forms cannot be overstated, as they play a vital role in protecting both parties, enhancing communication, and preventing misunderstandings. In many industries, they are not just recommended; they are required by law to ensure compliance with regulatory standards.

Types of disclosure forms

Disclosure forms come in various types, tailored to meet the specific needs of different sectors. Understanding these forms can help you navigate your obligations and ensure you are equipped with the necessary information.

Personal disclosure forms

Personal disclosure forms typically collect information related to an individual's history or health status. They are primarily used in the realm of employment and background checks, where employers require candidates to disclose past employment, criminal records, or financial information.

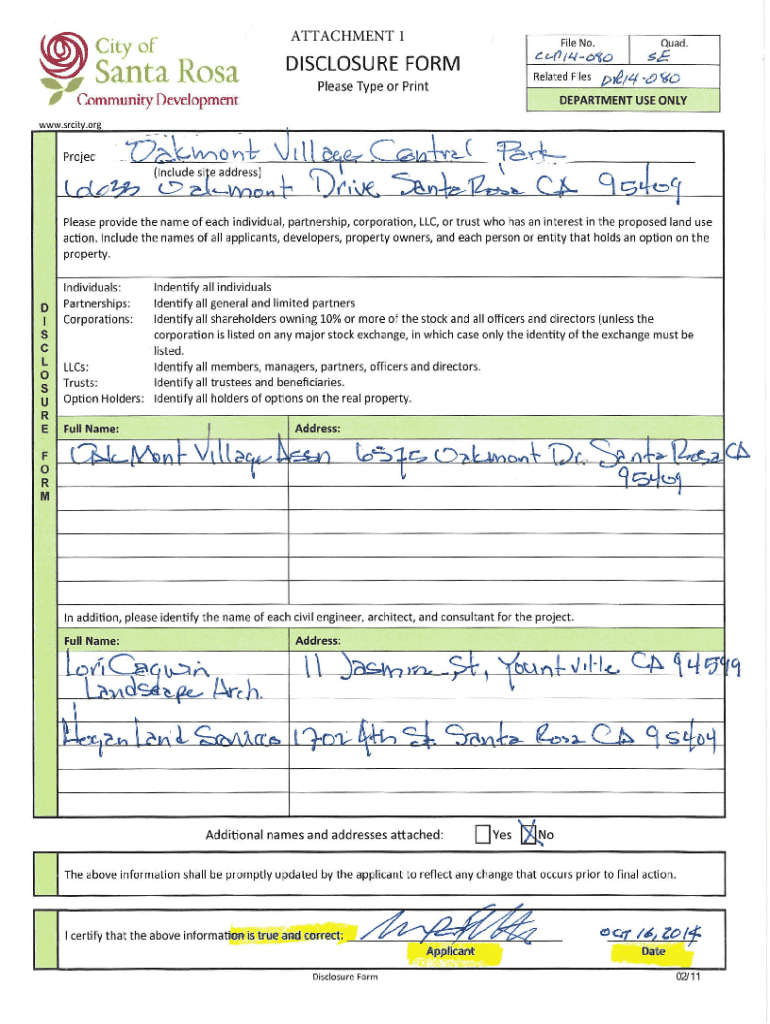

Real estate disclosure forms

In real estate transactions, both buyers and sellers have specific disclosure requirements. Buyers often receive information about property conditions that may affect their decision, which could include home inspection reports detailing issues such as electrical problems or plumbing defects.

Financial disclosure forms

Financial disclosure forms are critical in contexts such as loans and credit applications, where lenders require borrowers to disclose their income, debts, and assets. This information allows lenders to evaluate risk effectively.

Key components of a disclosure form

A well-structured disclosure form contains several essential components that ensure clarity and completeness. It's necessary to provide the correct information to avoid potential disputes later on.

The foundational elements typically include personal identification details, such as the name, address, and contact information of the person or entity required to disclose information. The form should clearly outline the nature of the disclosure, specifying what information is being shared. This improves transparency and ensures that both parties understand what is being disclosed.

Furthermore, signatures and acknowledgments are crucial, as they confirm that all parties agree to the terms and information in the disclosure form. Finally, privacy and confidentiality statements protect sensitive information and ensure compliance with relevant privacy laws.

How to fill out a disclosure form

Filling out a disclosure form correctly is essential to ensure compliance and protect your interests. Here’s a step-by-step guide to help you through the process.

Start by gathering all necessary information related to the disclosure. For instance, if you are completing a health disclosure, you would need your medical history and insurance details. Once you have this information, begin the process by filling out the form, paying close attention to detail.

It's important to follow best practices throughout the process. Be precise in your responses and double-check for accuracy. Common errors to avoid include omitting vital information or providing inaccurate details. After filling out the form, ensure that you review it before submitting your signed version.

Utilize tools like pdfFiller for editing and signing. These PDF tools can allow for efficient completion of disclosure forms, enabling you to collaborate with others seamlessly.

Common challenges in disclosure forms

Completing disclosure forms can sometimes be fraught with challenges. One significant issue is the misinterpretation of requirements. Individuals and businesses may not fully understand what information is required, which can lead to incomplete forms and potential legal issues.

Misrepresentation risks also pose a challenge. This occurs when individuals provide inaccurate information intentionally or not, which can have severe consequences, including legal action. Therefore, it is paramount to address and correct any mistakes as soon as possible, ensuring that all information is accurate and compliant.

Best practices for managing disclosure forms

Managing disclosure forms efficiently is key to minimizing risks and enhancing operational workflows. Start by organizing and storing these forms properly, ensuring they are easily accessible when needed. Implementing a systematic filing system can streamline operations and aid in compliance checks.

Collaborating with team members using platforms like pdfFiller enhances transparency and communication. It allows everyone to work on the same document simultaneously, enabling real-time updates and discussions. Monitoring compliance and regularly updating your forms is also crucial to ensure adherence to changing regulations.

Specialized disclosure forms across industries

Different industries have specific needs regarding disclosure forms, emphasizing the necessity for accuracy and compliance. In real estate, accurate disclosures not only protect the interests of buyers and sellers but also comply with local laws that mandate detailed property information.

In the health sector, HIPAA regulations underscore the importance of confidentiality in patient disclosure forms. This ensures that sensitive health information is shared responsibly. The financial services sector also tailors disclosure forms to meet consumer needs, emphasizing clarity in investment and asset disclosures.

FAQs about disclosure forms

Understanding disclosure forms can lead to questions, particularly regarding obligations and processes. One common query is, 'What happens if I don’t complete a disclosure form?' Failure to complete the required form can result in delays or even legal issues, depending on the situation.

Another common concern is, 'How often do I need to update my disclosure?' The answer largely depends on changes in the information that requires disclosure. Regularly reviewing your obligations is key. Lastly, individuals often worry about mistakes, asking, 'What if I make a mistake on my disclosure form?' In this case, it is essential to correct the error promptly and communicate it to the relevant parties to mitigate any potential problems.

Case studies and examples

Observing successful practices in using disclosure forms can provide invaluable insights. One notable case in real estate involved a seller who provided comprehensive and transparent property disclosures. This not only speeded up the sale process but also built trust with potential buyers.

Conversely, a case study involving a financial institution revealed that lack of proper disclosures led to customer confusion and dissatisfaction. Their failures emphasized the need for precise disclosures that outline fees, terms, and potential risks clearly.

Getting help with your disclosure form

When navigating the complexities of disclosure forms, it’s wise to seek assistance when needed. Resources such as pdfFiller's customer support can offer guidance on using tools effectively and completing forms accurately.

In some cases, seeking professional legal advice may be the best route to ensure compliance and minimize liabilities—especially in industries with stringent regulations.

Additional tools for disclosure forms

Using interactive tools can significantly enhance the process of managing disclosure forms. Platforms like pdfFiller offer various features, enabling easy editing and signing of PDF documents without the hassle of printing and scanning.

Users can easily access templates, allowing for quick customization of disclosure forms to meet specific needs. Furthermore, integration with other document management systems can streamline workflows, improving overall efficiency.

Recent updates and changes in disclosure form policies

Staying informed about the latest legislation affecting disclosure forms is vital for compliance. Recent updates may change the information required or how it must be presented. As regulations evolve, organizations must adapt to these changes, ensuring their disclosure forms are up-to-date.

Monitoring changes not only helps in compliance but also in maintaining credibility with clients and customers. Subscribing to industry newsletters or participating in relevant training can keep you abreast of significant updates affecting your industry.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute disclosure form online?

How can I edit disclosure form on a smartphone?

Can I edit disclosure form on an iOS device?

What is disclosure form?

Who is required to file disclosure form?

How to fill out disclosure form?

What is the purpose of disclosure form?

What information must be reported on disclosure form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.