Get the free Confidential Financial Questionnaire

Get, Create, Make and Sign confidential financial questionnaire

How to edit confidential financial questionnaire online

Uncompromising security for your PDF editing and eSignature needs

How to fill out confidential financial questionnaire

How to fill out confidential financial questionnaire

Who needs confidential financial questionnaire?

Everything You Need to Know About the Confidential Financial Questionnaire Form

Understanding the purpose of a confidential financial questionnaire

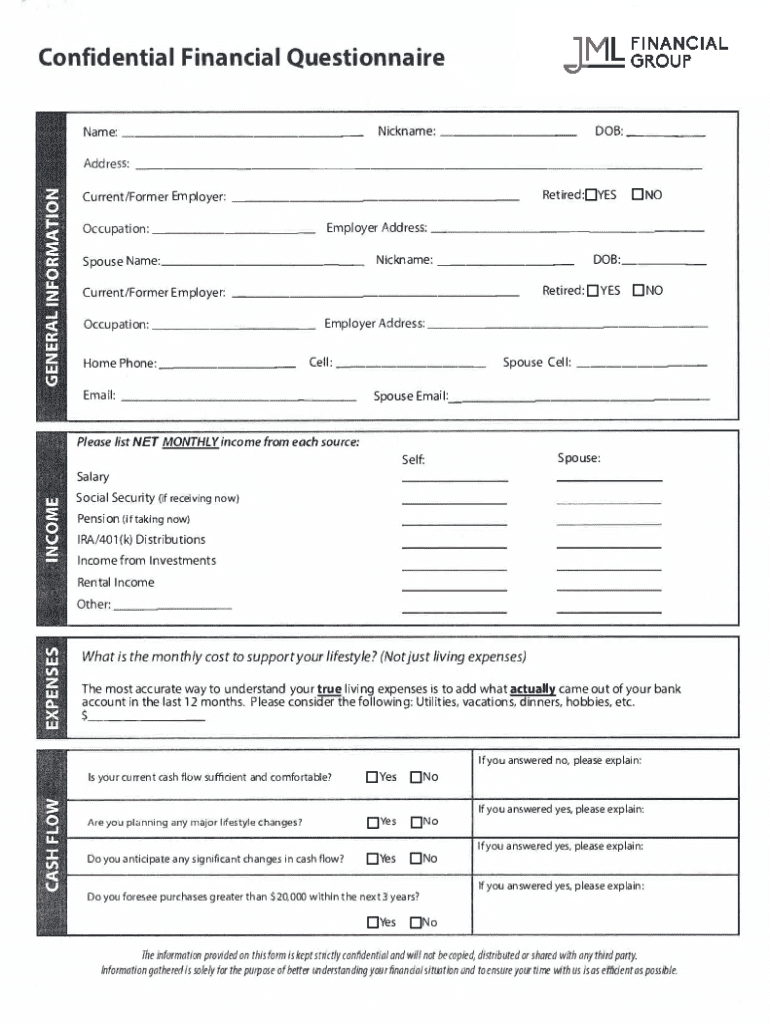

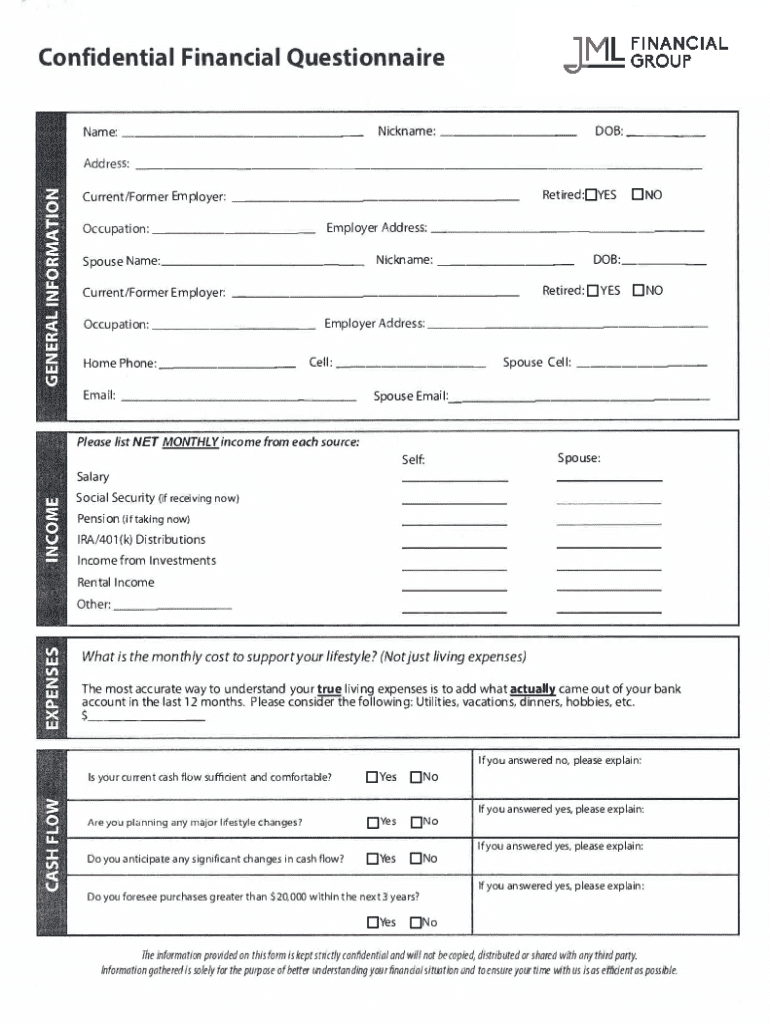

A confidential financial questionnaire is a crucial document that allows individuals and financial professionals to gather essential information about a person's financial situation. Its primary purpose is to facilitate effective financial planning by providing a comprehensive overview of an individual's income, assets, liabilities, and expenses while ensuring that sensitive information is protected. Financial confidentiality is paramount, as clients need to trust that their financial data will not be disclosed without their consent.

Confidentiality is essential in financial matters, as the information contained in these questionnaires is often sensitive and personal. Unauthorized access can lead to identity theft, financial fraud, and other damaging consequences. Therefore, using a secure platform like pdfFiller not only protects your information but also streamlines the financial planning process for you and your advisors.

Key components of the confidential financial questionnaire

A confidential financial questionnaire typically contains several key components, each designed to capture specific information about your financial situation. Accurate completion is essential to provide financial advisors with the necessary insights to offer tailored advice. Below are the integral sections of a typical questionnaire.

Special considerations

Certain individuals may face unique financial circumstances that require special consideration. These situations can include divorce, the death of a loved one, or facing substantial medical costs. Such scenarios can greatly impact a person’s financial planning and require customized strategies for effective management and planning.

Planning for dependents with special needs adds further complexity. It involves considering future care needs, supporting long-term stability, and ensuring adequate financial resources are allocated. Whether it's adjusting insurance policies or creating trust funds, these tailored financial strategies are crucial to secure a stable financial future.

Filling out the confidential financial questionnaire

Completing a confidential financial questionnaire can seem daunting but can be efficiently managed by breaking it down into actionable steps. First, gather all necessary documents, such as your pay stubs, tax returns, and bank statements. This preparation helps generate accurate information and reduces the likelihood of errors.

Next, structure your financial information. Consider creating a timeline for completing each section if you're feeling overwhelmed. By pacing yourself, you're more likely to provide thorough and accurate responses. Each component should be approached with attention to detail—accurately filling in personal information is vital since any errors can complicate communication with advisors.

Editing and managing your questionnaire

Once you've filled out your confidential financial questionnaire, managing and editing the document is imperative. Using pdfFiller’s editing tools allows you to adjust sections without losing formatting. This is particularly useful when an advisor requires specific changes or additional information not captured initially. Effective collaboration with financial advisors is enhanced by using a platform that supports real-time editing and document sharing.

Tagging important sections or adding notes within the document can help highlight key areas that need special attention during meetings with financial advisors. Additionally, version control is crucial; keeping track of changes and updates ensures both you and your advisor are always on the same page, allowing for informed discussions.

eSigning your confidential financial questionnaire

Signing your confidential financial questionnaire is an essential step that confirms your acceptance of the provided information. This validated signature becomes a legal acknowledgment of accuracy in the document, which is especially important when dealing with financial institutions. pdfFiller provides an easy eSigning functionality that enhances convenience while maintaining security.

To ensure your signature is secure and legally valid, follow the platform instructions carefully. Typically, you’ll need to verify your identity, draw or upload your signature, and place it in the appropriate section of the document. After signing, you'll receive a confirmation, ensuring that your financial information remains protected.

Storing and sharing your questionnaire

Proper storage and secure sharing of your confidential financial questionnaire are vital to maintaining financial privacy. Using cloud storage solutions allows you to access your document from anywhere while protecting sensitive information with encryption. Ensure that you set appropriate privacy settings when sharing your completed questionnaire with financial professionals.

Understanding data privacy and protection laws is essential, especially as regulations concerning financial information evolve. By being well-versed in these laws, you ensure you're compliant when sharing your information. This due diligence protects you from potential legal issues and fosters trust in your professional relationships.

Frequently asked questions (FAQs)

It is natural to have questions regarding the confidential financial questionnaire form. Frequently asked queries can help clarify any uncertainties about the process. Addressing these FAQs can significantly enhance user confidence and understanding of financial documentation.

Best practices for maintaining financial confidentiality

To protect your financial documents, it's crucial to implement best practices throughout your financial management process. Start by ensuring that you use robust passwords for accounts and documents that contain sensitive information. Regularly update these passwords and avoid using easily identifiable information.

When storing and sharing sensitive information, consider utilizing secure file-sharing systems that offer encryption. This adds an additional layer of protection against unauthorized access and breaches. Familiarize yourself with your rights under data protection laws to ensure you're empowered to protect your information.

Complementary tools and resources

pdfFiller offers various interactive tools designed to support enhanced financial management, making the creation and management of documents seamless and efficient. With features such as built-in templates and workflows, users can create customized financial documents tailored to their specific needs.

In addition to the questionnaire, pdfFiller integrates with popular personal finance management software, allowing users to sync their financial data easily. This interoperability simplifies tracking financial progress and adapting to changes in financial goals.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my confidential financial questionnaire directly from Gmail?

How do I fill out the confidential financial questionnaire form on my smartphone?

How do I fill out confidential financial questionnaire on an Android device?

What is confidential financial questionnaire?

Who is required to file confidential financial questionnaire?

How to fill out confidential financial questionnaire?

What is the purpose of confidential financial questionnaire?

What information must be reported on confidential financial questionnaire?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.