Get the free Form 10-k/a

Get, Create, Make and Sign form 10-ka

How to edit form 10-ka online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 10-ka

How to fill out form 10-ka

Who needs form 10-ka?

How to Fill Out Form 10-K

Overview of Form 10-K

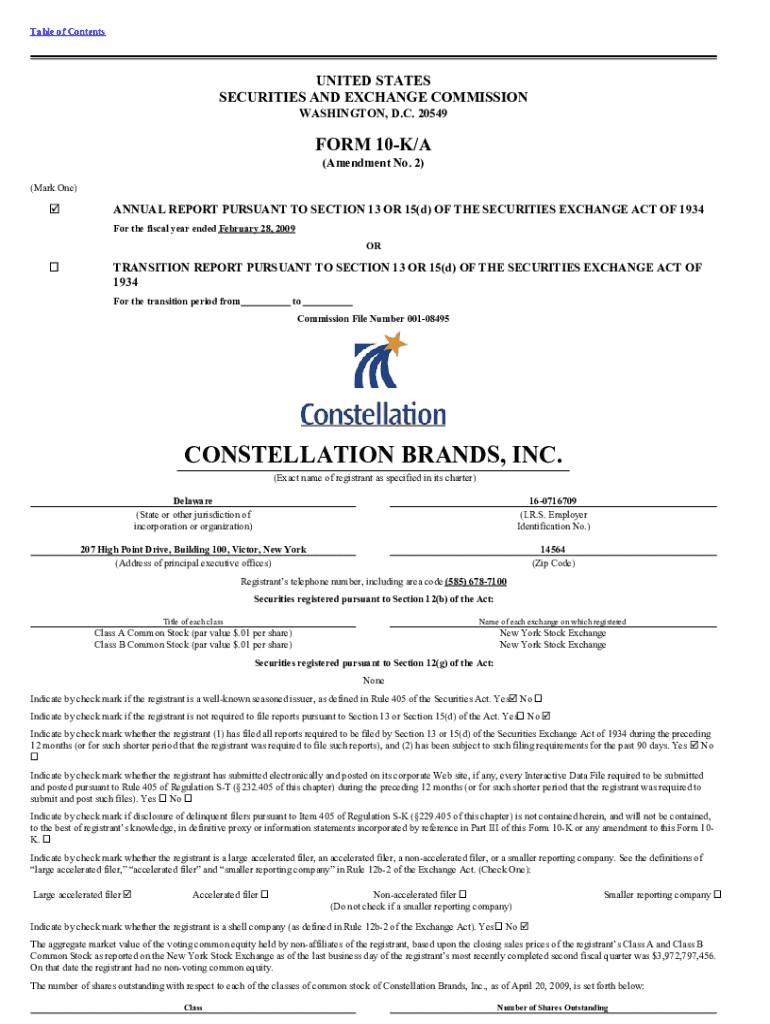

Form 10-K is an annual report filed by publicly traded companies with the U.S. Securities and Exchange Commission (SEC). It provides a comprehensive overview of a company's financial performance, risks, and operational details. Unlike the quarterly Form 10-Q, the 10-K offers a detailed narrative about the company’s business model, financial condition, and future outlook.

The importance of Form 10-K in financial reporting cannot be overstated. This document not only fulfills regulatory obligations but also informs investors about the company’s overall health and strategic direction. Accurate disclosures foster transparency and help stakeholders make informed decisions.

Any company that is publicly listed on a stock exchange must file a Form 10-K. This includes both large and small companies, ensuring that investors have access to vital information regarding the businesses in which they invest.

Contents of Form 10-K

Form 10-K is divided into several parts containing specific information that provides insights into the business's operations and condition. Understanding these sections is crucial for accurate completion.

Filing deadlines for Form 10-K

The deadlines for filing Form 10-K depend on the size of the company. Large Accelerated Filers are required to file within 60 days after the end of their fiscal year, while Accelerated Filers have 75 days, and Non-Accelerated Filers have 90 days. Meeting these deadlines is critical as failure to comply can result in penalties and loss of investor confidence.

Additionally, in certain circumstances such as a merger or acquisition, companies may be granted special accommodations if they demonstrate a valid reason for a delay. Compliance with these deadlines is essential for maintaining credibility in the eyes of investors and regulators.

How to access Form 10-Ks

Accessing Form 10-Ks is straightforward, thanks to the SEC's EDGAR database. Users can visit the EDGAR website and input the company name or stock ticker symbol to find the relevant filings. Once located, Form 10-K can be downloaded and reviewed in PDF format.

Using tools like pdfFiller further enhances the experience, allowing users to efficiently manage, download, and edit 10-K forms. This hassle-free access ensures that stakeholders can stay informed without facing unnecessary obstacles in retrieving critical financial documents.

Completing the Form 10-K

Filling out Form 10-K requires meticulous attention to detail and accurate data collection. Start by gathering all necessary financial information, including balance sheets, income statements, and cash flow statements. It's vital to collaborate with team members to ensure all portions of the form are completed accurately and reflect the company’s actual state.

Using pdfFiller, teams can seamlessly work together through features that allow real-time edits and comments. Whether editing text, signing documents, or attaching additional files, pdfFiller provides a platform for all necessary interactions to occur smoothly.

Reviewing and filing your completed Form 10-K

Before filing your completed Form 10-K, it's essential to conduct a thorough review and perform compliance checks. Consider engaging an accountant or legal advisor to confirm that all disclosures adhere to SEC requirements.

Once you are confident in the accuracy and completeness of your filing, the next step is electronic submission via the SEC's EDGAR system. This process is user-friendly, allowing you to track the status of your filing and receive confirmations upon successful submission.

Post-filing considerations

After submitting your Form 10-K, it is vital to communicate these filings to stakeholders, including investors, analysts, and regulators. A press release or an investor call can be effective means of summarizing key aspects of the filings and addressing any significant shifts in the company's position.

Moreover, understanding investor relations post-submission is essential. Engage with investors to clarify any questions arising from the filings and leverage social media or company websites to maintain open lines of communication.

Resources for further assistance

Various resources can help navigate the complexities of completing Form 10-K. For example, you can find tutorial videos and guides on the SEC website or use pdfFiller's features to simplify the filing process.

Contacting your accountant or legal advisor can also provide personalized guidance, ensuring that all nuances of the form are addressed. Utilizing pdfFiller can enhance document management, allowing you to edit, sign, and circulate the completed forms efficiently.

Interactive tools and features on pdfFiller for Form 10-K

pdfFiller offers several invaluable tools to assist with Form 10-K. One key feature is the digital signature capability, which enables users to sign documents electronically, streamlining the process and reducing paperwork.

In addition, collaboration tools allow for smooth interactions among team members, making it easier to gather feedback and finalize sections. Templates specifically designed for Form 10-K also exist within pdfFiller, further enhancing its practicality for users.

Frequently asked questions about Form 10-K

Many users have questions about the intricacies of filing Form 10-K. Common queries often center around understanding specific sections, filing requirements, and potential penalties for late submissions. Addressing these concerns with clarity is vital for ensuring compliance and effective communication.

Utilizing resources like pdfFiller's customer support can also clarify technical terms and provide useful tips for effectively completing the form. Empowering users with knowledge aids in reducing anxiety associated with filing and enhances overall confidence in handling the complexities of Form 10-K.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in form 10-ka?

Can I create an electronic signature for signing my form 10-ka in Gmail?

Can I edit form 10-ka on an iOS device?

What is form 10-ka?

Who is required to file form 10-ka?

How to fill out form 10-ka?

What is the purpose of form 10-ka?

What information must be reported on form 10-ka?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.