Get the free Form S-8 Registration Statement

Get, Create, Make and Sign form s-8 registration statement

How to edit form s-8 registration statement online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form s-8 registration statement

How to fill out form s-8 registration statement

Who needs form s-8 registration statement?

Understanding Form S-8 Registration Statement Form

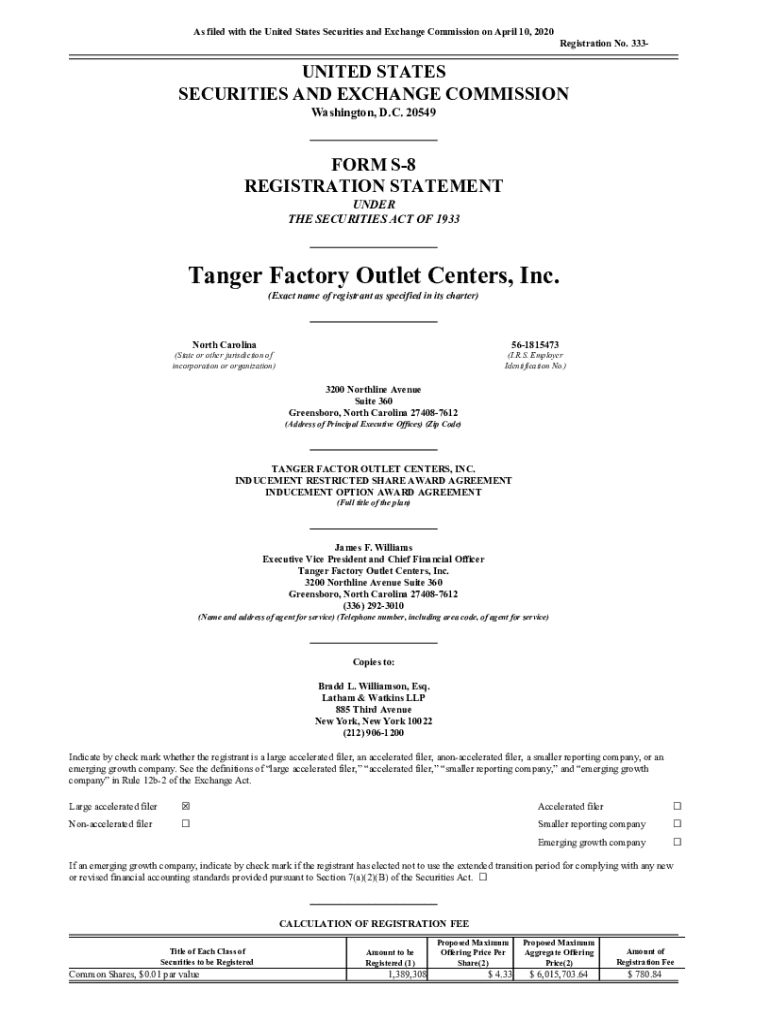

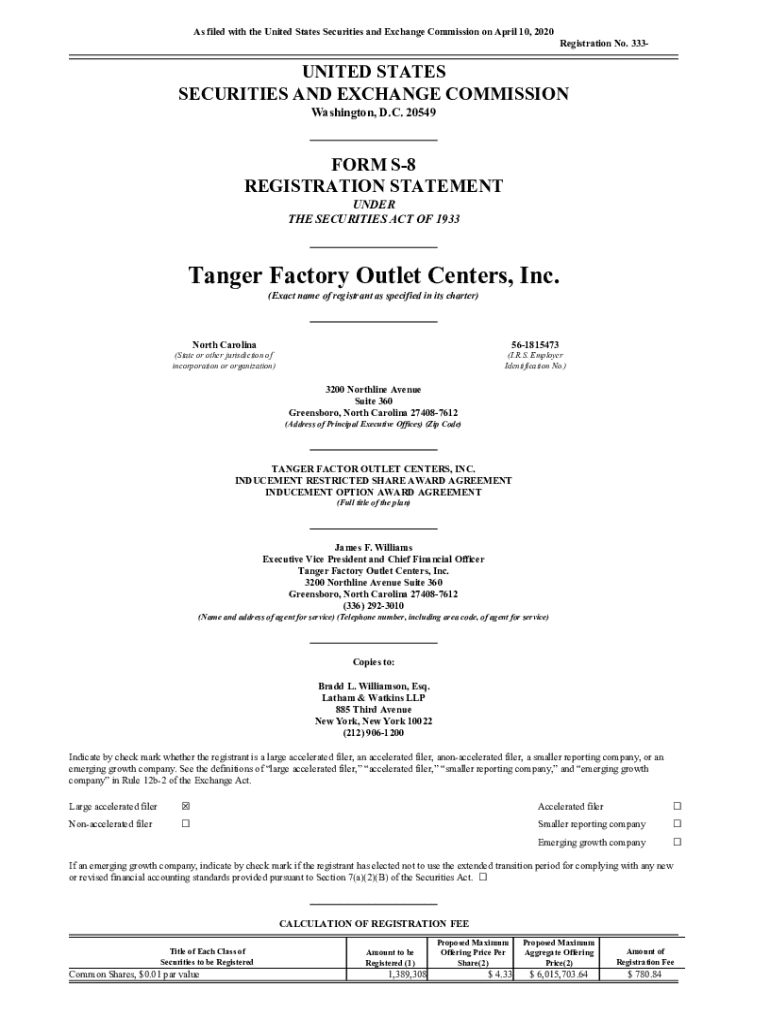

What is Form S-8?

Form S-8 serves as a registration statement for securities offered under employee benefit plans. Primarily utilized by publicly traded companies, its main purpose is to register the securities that are offered through employee benefit plans, such as stock options, retirement plans, and additional forms of equity compensation. This form simplifies the process of offering securities to employees without needing to go through a more comprehensive registration process required for public offerings.

The importance of Form S-8 lies in its facilitation of employee engagement and retention. By providing employees with stock options or participation in the company's equity, companies can not only align their interests with the company but also boost motivation and retention rates. Regulatory compliance surrounding Form S-8 is crucial, as it shows adherence to SEC regulations, which govern how publicly traded companies must disclose their offerings and other related information.

Key components of a Form S-8 registration statement

A complete Form S-8 registration statement comprises several critical components. At its core is a detailed description of the securities being offered, which can include stock options, deferred compensation, or shares allotted under various plans. Companies must provide in-depth eligibility criteria that outline who can partake in these benefits, ensuring clarity and compliance with SEC rules.

The form also needs specific information, including identifying details about the company submitting the form, such as its name, type of business, and fiscal year-end date. Additionally, a description of the plan under which securities will be offered must be comprehensive; it should explain the purpose, key features, and conditions governing the plan. Legal opinions and various exhibits that support the registration statement are also necessary to streamline the review and approval process.

Understanding the Form S-8 timeline

The timeline for preparing and filing a Form S-8 is vital for companies looking to maintain regulatory compliance and effectively manage employee benefit offerings. Generally, the preparation phase involves gathering the necessary information and documentation, which can take several weeks depending on the complexity of the plan. Once all information is collated, the actual filing with the SEC can occur, but key deadlines must be adhered to for timely submission.

Following the submission, companies must monitor compliance and be prepared to respond to any SEC inquiries or requirements for additional information. Staying aware of deadlines for annual reports and updates related to employee offerings is also crucial, as non-compliance can expose the company to legal and financial ramifications.

Considerations for filing a Form S-8

When preparing to file a Form S-8, there are several considerations companies should keep in mind. First, the financial reporting implications can be significant. Companies must assess how offering these securities will impact their financial statements and ensure that all necessary disclosures are accurate and complete. This not only helps in managing investor relations but also aids in satisfying regulatory scrutiny.

Legal considerations also come into play, especially concerning the obligations of disclosure. Companies should be cautious about what information is shared and ensure all legal requirements are met to avoid potential liabilities. Incorrect filings can lead to penalties, and it is essential to ensure that all information provided in the Form S-8 is accurate and reflective of the current business environment.

Common pitfalls in S-8 filings

Filing a Form S-8 can be a straightforward process if executed meticulously; however, there are common pitfalls that companies often encounter. One major issue is incomplete information and documentation, which can lead to delays in the approval process or even rejection of the filing. Companies must ensure that every required section is thoroughly addressed and accompanied by the necessary exhibits.

Another common mistake is misunderstanding the eligibility requirements for utilizing Form S-8. Companies sometimes erroneously assess who can participate in the benefit plan, leading to potential regulatory issues. Finally, many companies overlook keeping up with regulatory changes that may affect how they complete their filings. Regular updates and staying informed about SEC regulations can help avoid severe complications.

Tools and templates for Form S-8 preparation

Leveraging the right tools can significantly ease the process of preparing a Form S-8. A step-by-step guide using templates can demystify the complex aspects of documentation. Companies can find comprehensive templates specifically designed for Form S-8 that incorporate all necessary sections, thereby ensuring compliance and thoroughness.

Interactive tools for data entry allow users to input information easily, while features enabling collaboration can make the review process more efficient. pdfFiller offers customizable document features that can adapt standard templates to unique business needs, streamlining the entire preparation and submission process.

Managing Form S-8 filings effectively

Effective document management is crucial for maintaining compliance with regulatory requirements post-filing. Strategies for document management should include rigorous version control and maintaining audit trails to track any changes made throughout the process. Companies must ensure that every update to the Form S-8 is logged and accessible for review, which can greatly assist during audits or SEC inquiries.

Additionally, eSigning and collaboration features enable quick review and approval of documents. Always having access to current regulatory changes and guidance ensures that the company remains compliant throughout the tenure of the employee benefit plans. Continuous compliance checks and updates can save companies from potential pitfalls in the future.

Engaging with experts on Form S-8 solutions

Hiring professionals experienced in Form S-8 filings can be invaluable, especially during complex scenarios or when tackling unique company structures. Organizations should assess their needs and when to seek out expert guidance. Engaging in discussions with consultants who specialize in SEC registrations can provide clarity on compliance, filing strategies, and potential pitfalls.

When initiating conversations about S-8 filings, prepare specific questions or concerns, aiming to understand the intricacies of filing processes more thoroughly. Professional services can provide tailored solutions to streamline filings based on company-specific requirements.

Related products and solutions from pdfFiller

pdfFiller offers a robust suite of document creation and management solutions that can enhance the Form S-8 filing process. The platform's unique document features allow users to create, edit, and securely manage necessary forms with ease. Integration with other software platforms further streamlines workflows, enabling data sharing seamlessly across systems.

Moreover, user testimonials and case studies highlight how pdfFiller has simplified the documentation process for various organizations. By leveraging pdfFiller’s capabilities, companies can achieve greater accuracy and efficiency in their Form S-8 preparations and other regulatory filings, ultimately supporting their compliance goals.

Popular content and resources

To enhance your understanding and execution of Form S-8 filings, a variety of resources are available. Links to other related articles and guides can provide deeper insights into specific areas of concern regarding Form S-8, such as compliance strategies, recent regulatory changes, or practical case studies. Frequently asked questions curated by pdfFiller can also serve to address common concerns and provide immediate answers to pressing queries.

Engaging with community discussions and highlights from user forums can uncover various perspectives and solutions experienced by peers navigating similar regulatory landscapes, enriching the resource pool available to every user.

Staying connected with pdfFiller

To remain updated on the latest regulatory changes and insights regarding Form S-8 and other filings, signing up for pdfFiller’s newsletter can be highly beneficial. This provides a continual flow of useful information delivered directly to users, ensuring they are always current with requirements and best practices.

Engagement through social media channels allows users to tap into ongoing tips and resources, making it easier to navigate the sometimes complex landscape of regulatory filings. For more personalized assistance or inquiries, having contact information readily available ensures that support is just a message away.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find form s-8 registration statement?

How do I edit form s-8 registration statement on an iOS device?

How do I complete form s-8 registration statement on an iOS device?

What is form s-8 registration statement?

Who is required to file form s-8 registration statement?

How to fill out form s-8 registration statement?

What is the purpose of form s-8 registration statement?

What information must be reported on form s-8 registration statement?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.