Sample Escrow Agreement Template Form: A Comprehensive Guide

Understanding escrow agreements: A key component in transactions

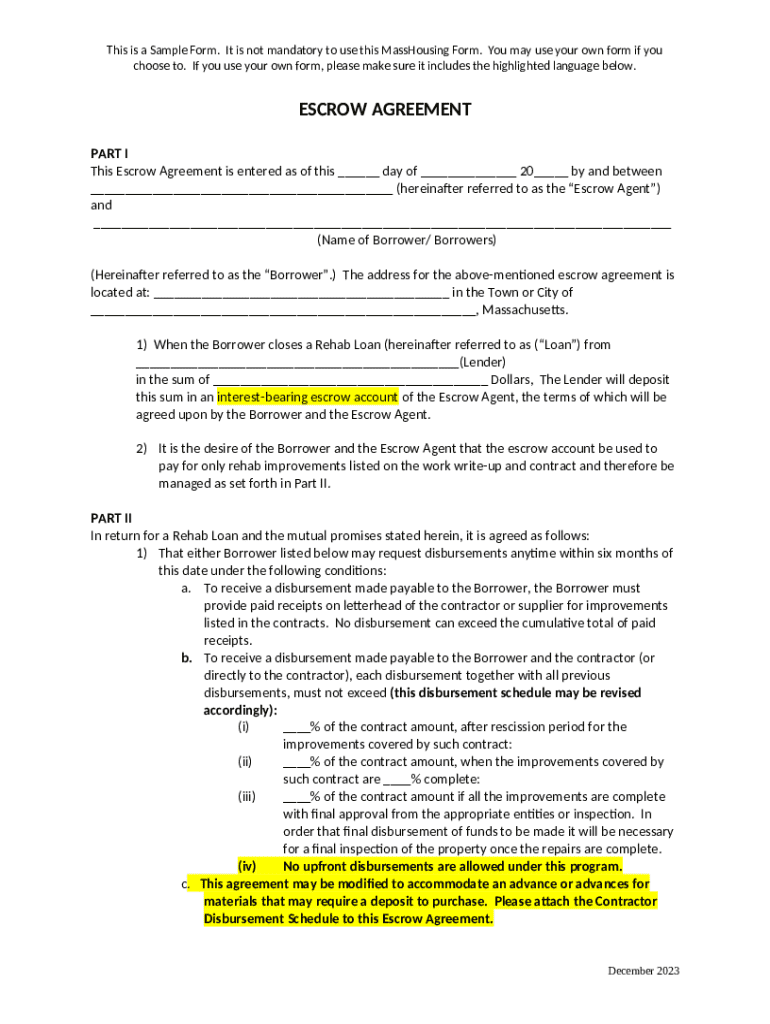

An escrow agreement is a legally binding arrangement whereby a third party, known as the escrow agent, holds funds or assets on behalf of two parties during a transaction. This agreement is crucial in various financial transactions, including real estate deals, mergers, and online sales, as it ensures that both parties fulfill their obligations before the funds or assets are released.

The importance of escrow cannot be overstated. By holding funds in a neutral account, an escrow agreement protects buyers and sellers from potential fraud or breach of contract. If either party fails to meet the agreed-upon conditions, the escrow agent is responsible for ensuring that the funds are returned to the original party, thereby reducing the risk involved.

Ensures transparency and fairness in transactions.

Provides a structured process for releasing funds.

Offers a safeguard against financial disputes.

Detailed breakdown of the escrow agreement template

A well-crafted escrow agreement template includes several essential sections that define the roles and responsibilities of all parties involved. Understanding these components will help you effectively navigate the agreement.

Identify the buyer, seller, and escrow agent involved.

Clearly state the assets or funds being held in escrow.

Outline the actions the escrow agent must take, including holding funds and disbursing them at the appropriate time.

Specify what conditions must be met for the funds or assets to be released.

Detail any fees that the escrow agent will charge for their services.

When reading a sample agreement, pay close attention to these key sections. Each component plays a vital role in ensuring clarity and reducing misunderstandings among the parties involved.

Step-by-step guide to completing the escrow agreement template

Filling out an escrow agreement template requires careful attention to detail. To begin, gather all necessary information and documentation related to the transaction. This could include identification details for all parties, information about the escrow property, and any specific instructions agreed upon.

As you fill in each section, ensure that the information is accurate and detailed. Avoid vague descriptions and be specific about the roles and expectations of each party. For instance, when describing the escrow property, include relevant identifiers such as property addresses or asset serial numbers.

Double-check that names and details are spelled correctly.

Clarify responsibilities to prevent misunderstandings later.

Specify the exact conditions for the release of funds.

Common pitfalls include omitting critical details or misinterpreting legal jargon. To avoid these issues, consider having the completed agreement reviewed by a legal professional.

Interactive tools for customizing your escrow agreement

pdfFiller offers a range of interactive tools that enhance your ability to customize escrow agreements efficiently. Users can edit documents directly within the platform, adjusting text and formatting as required to suit specific transaction needs.

Templates come with interactive elements, such as fillable fields, dropdown menus, and checkboxes, allowing you to input important information without hassle. This feature is particularly beneficial for users who might not be familiar with legal terminology, as it simplifies the process of filling out documents.

Editable text fields for entering details.

Dropdown menus for selecting options quickly.

Other customizable elements enhancing user experience.

Utilizing these interactive tools not only saves time but also ensures that your document meets all necessary legal standards.

Managing your escrow agreement: From editing to signing

Once you have filled out your escrow agreement, managing the document becomes crucial. pdfFiller's online platform facilitates easy editing, allowing adjustments to be made as necessary without starting from scratch each time.

When it is time to sign the document, pdfFiller simplifies the e-signing process. Users can complete their signatures electronically and save the document securely in the cloud. This feature is beneficial for teams, as it allows multiple stakeholders to review and sign the document seamlessly.

Edit documents at any time before finalizing.

Use the eSign feature for fast, secure signing.

Collaborate with team members by sharing access.

Following best practices for document management ensures that your escrow agreement remains accessible and organized throughout the transaction process.

Escrow agreement considerations: What you need to know

The nuances of escrow agreements extend beyond simple mechanics. It's vital to understand the implications of entering into an escrow agreement, including any potential liabilities that may arise. For example, if there are issues or disputes, one party might be held accountable for fees, costs, or damages.

To protect yourself, consider indemnifying the escrow agent from certain liabilities. This clause ensures that if any disputes arise, the escrow agent is not held responsible for releasing funds. Additionally, be aware of the governing laws that may affect your escrow agreement, which can vary by location and the specific terms of the transaction.

Familiarize yourself with local laws regulating escrow agreements.

Consider including indemnity clauses to protect the escrow agent.

Understand your financial obligations thoroughly.

Related templates that you may find helpful

Navigating financial transactions often requires multiple documents. Alongside the sample escrow agreement template form, you may find several related templates beneficial. These documents can streamline the transaction process for various situations.

Details the terms of a purchase between buyer and seller.

Outlines the terms of leasing property.

Defines the particulars of a sale, including items and payment terms.

Understanding the differences between these templates can help ensure that all facets of your transaction are covered, providing a comprehensive approach to legal documentation.

Frequently asked questions (FAQ) about escrow agreements

Questions frequently arise regarding escrow agreements, given their complexity. Here are some common inquiries to clarify the purpose and process.

It refers to placing funds or assets into an escrow account until conditions of the agreement are satisfied.

It serves to protect all parties during a transaction by ensuring that neither party gains an unfair advantage.

The escrow agent typically holds the funds until the dispute is resolved through negotiation or legal action.

Typically, the party requesting the escrow service pays the fees, but this can vary and should be specified in the agreement.

Real-life scenarios: Understanding escrow applications

Escrow agreements are employed across various scenarios, enhancing the security and efficiency of transactions. For instance, in real estate, funds are often placed in escrow during the sale of a property to ensure that the buyer receives the title after payment, and the seller is compensated appropriately.

However, escrow applications are not without challenges. One case involved a property transaction where the buyer backed out due to financing issues, causing stress for the seller. In this scenario, the escrow agent was able to mediate discussions and return funds, demonstrating the effectiveness of an escrow arrangement.

Property transactions ensure buyer and seller protection.

Online sales require secure payment methods to prevent fraud.

Complex business mergers often utilize escrow to manage substantial assets.

Best practices for using an escrow agreement template

Utilizing an escrow agreement template effectively requires a thoughtful approach. For first-time users, it's essential to familiarize yourself with the structure of the document and its implications. Consulte a legal professional before finalizing any agreements, as they can provide insights tailored to your specific situation and jurisdiction.

When reviewing your escrow agreement, ensure that all parties understand their obligations, fees are clearly defined, and the conditions for releasing funds are specific. Addressing these elements upfront can prevent complications later in the process.

Thoroughly review terms before signing.

Consider legal advice to avoid pitfalls.

Clarify fees and payment responsibilities.

Final thoughts on using the sample escrow agreement template

The convenience of online access to document creation tools like those offered by pdfFiller cannot be understated. Whether you’re drafting your first agreement or managing multiple documents, pdfFiller empowers users to seamlessly edit PDFs, eSign, collaborate, and manage documents from a single, cloud-based platform.

By leveraging the sample escrow agreement template form available on pdfFiller, users can navigate their transactions with greater confidence and security. This platform not only enhances efficiency but also ensures that no detail is overlooked in the documentation process, ultimately leading to smoother transactions for all parties involved.