Get the free Amendment Number 5

Get, Create, Make and Sign amendment number 5

How to edit amendment number 5 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out amendment number 5

How to fill out amendment number 5

Who needs amendment number 5?

Comprehensive Guide to the Amendment Number 5 Form

Understanding the Amendment Number 5 Form

The Amendment Number 5 Form plays a critical role in property tax reassessment processes, allowing homeowners to amend their previous tax exemption requests. This form specifically targets individuals seeking adjustments to their property tax liabilities after significant changes, thereby facilitating a more accurate reflection of their current financial obligations.

The significance of the Amendment Number 5 Form extends beyond mere paperwork; it is a vital tool that ensures homeowners benefit fairly from property tax exemptions. Accurate completion of this form can lead to substantial savings, making it an essential document for property owners.

Navigating the document creation process

Accessing the Amendment Number 5 Form can be seamlessly achieved through pdfFiller's user-friendly platform. Simply search for the Amendment Number 5 template, and you’ll have the necessary document at your fingertips. This eliminates the traditional hassles associated with locating and downloading forms from various government websites.

Choosing the right template is crucial. pdfFiller offers a well-structured Amendment Number 5 form, ensuring you have all fields needed for accurate submission. The benefits of utilizing a digital form over a traditional paper form are numerous—from ecological sustainability to the efficiency of real-time editing and eSigning that pdfFiller offers.

Step-by-step instructions for filling out the form

Before you begin filling out the Amendment Number 5 Form, it’s vital to gather the necessary information and documentation. This includes your property tax identification number, current property tax statement, and any previous exemption awards you seek to amend.

Carefully examine each section of the form for clarity. Here is a detailed guide through the various sections of your Amendment Number 5 Form.

Common mistakes to avoid while filling out the form include leaving fields blank, misidentifying your property, failing to provide supporting documentation, and not double-checking your entries for accuracy.

Editing and customizing the Amendment Number 5 form

pdfFiller’s editing tools make it convenient to craft the perfect Amendment Number 5 Form. You can add text, images, or signatures directly onto the form. Furthermore, utilizing templates for customization allows you to tailor the form to your specific needs, providing a greater sense of ownership over the content.

The process for making corrections is user-friendly. You can simply access the document, select the fields to edit, and make adjustments as needed. Once you’re satisfied with the form, saving and sharing it is straightforward, facilitating easy collaboration with any stakeholders.

Signing the Amendment Number 5 form

The process of signing your Amendment Number 5 Form has become remarkably streamlined. With eSigning offerings through pdfFiller, you can digitally sign your document in minutes, eliminating the need for physical signatures, printing, or scanning.

It's essential to understand that electronic signatures hold the same legal validity as traditional handwritten signatures, making them a secure option for document handling. By following the simple steps outlined in pdfFiller, you can complete this part of the process efficiently.

Collaborating with others on the Amendment Number 5 form

pdfFiller facilitates efficient collaboration by enabling users to share the Amendment Number 5 Form easily with team members or other stakeholders. This feature ensures everyone involved can access the same document, adding comments or providing feedback in one centralized location.

Tracking changes and updates within the document is also intuitive. You can view the history of modifications made to the form, allowing for better oversight and ensuring smooth communication among all parties.

Submitting the Amendment Number 5 form

All submissions of the Amendment Number 5 Form must follow specific guidelines. Understanding the proper channels for submission is critical—you’ll need to know where and how to submit your form based on your local regulations. Additionally, noting any deadlines is essential to ensure your application is considered.

After submission, confirming receipt of your form is advisable. Most agencies offer a confirmation email or notification, assuring you that your amendment is in process.

Managing your completed form

Once you’ve submitted your Amendment Number 5 Form, managing your documentation becomes just as important as the completion process. pdfFiller offers cloud storage solutions that allow you to organize your documents easily, making it simple to retrieve your Amendment Number 5 Form whenever you need it.

Understanding your rights and responsibilities after submission also involves being aware of how the amendment process operates in your jurisdiction. Staying informed can help ease your worries post-submission and ensure you are prepared for any follow-up communications.

Frequently asked questions (FAQs)

Several common questions about the Amendment Number 5 Form arise frequently among users. For instance, homeowners often ask about the timeframe for processing amendments, which can vary by jurisdiction, or the types of exemptions that can be amended.

pdfFiller also provides troubleshooting support for those encountering issues. The platform hosts a range of resources where users can find additional assistance for any challenges they may face during the completion, submission, or management of the Amendment Number 5 Form.

Additional insights and tips

Utilizing pdfFiller presents numerous advantages when dealing with the Amendment Number 5 Form. Not only does it streamline the document creation and submission process, but it also enhances usability through features tailored for collaboration and editing.

Best practices for ongoing document management involve regularly reviewing stored forms, and keeping abreast of any amendments to tax laws that may affect exemptions or guidelines regarding your property.

Related forms and templates

Understanding when to use the Amendment Number 5 Form versus other forms available is crucial for property owners. Similar forms include tax exemption applications and reassessment requests that may require different criteria or different submission guidelines.

Understanding these differences can ensure that you utilize the correct documentation for your specific needs, streamlining your property management processes.

Engaging with pdfFiller's community

Engagement with the pdfFiller community provides valuable insight through user testimonials and success stories. Users often share how effective the platform has been in simplifying their document management processes, particularly concerning forms like the Amendment Number 5.

Utilizing pdfFiller’s interactive tools and resources ensures you remain informed about changes to documents and the document management tools available, enhancing your overall efficiency long-term.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify amendment number 5 without leaving Google Drive?

How do I edit amendment number 5 in Chrome?

How do I fill out amendment number 5 using my mobile device?

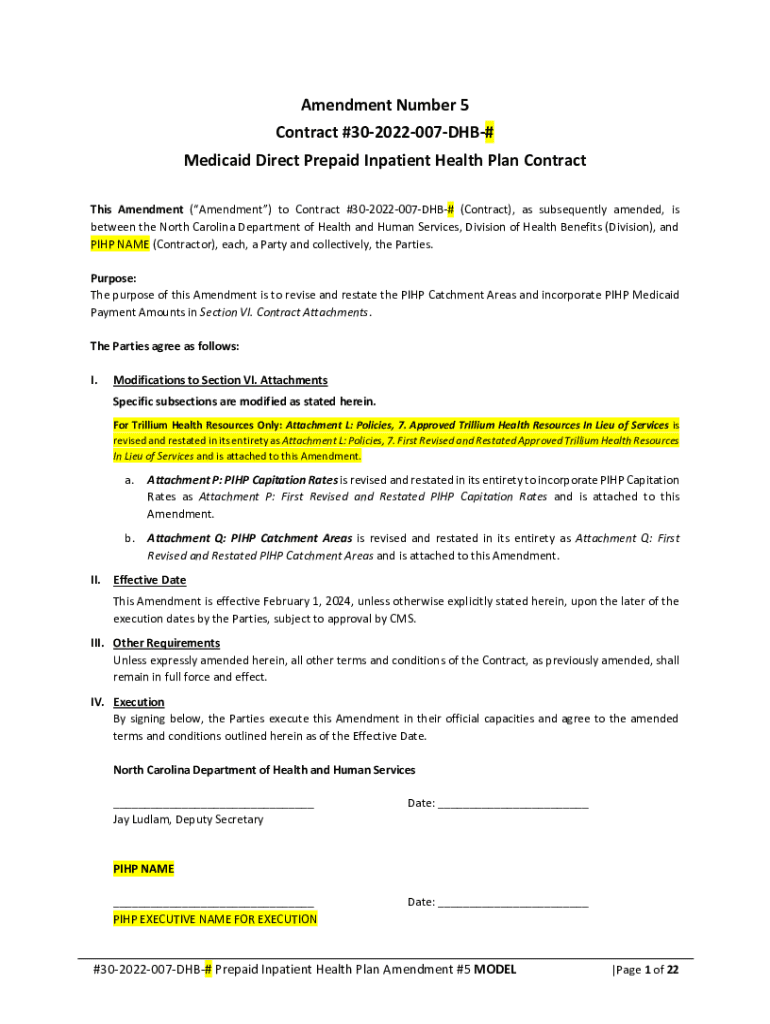

What is amendment number 5?

Who is required to file amendment number 5?

How to fill out amendment number 5?

What is the purpose of amendment number 5?

What information must be reported on amendment number 5?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.