Get the free Cboe Exchange, Inc. Volume Aggregation for Frequent ...

Get, Create, Make and Sign cboe exchange inc volume

How to edit cboe exchange inc volume online

Uncompromising security for your PDF editing and eSignature needs

How to fill out cboe exchange inc volume

How to fill out cboe exchange inc volume

Who needs cboe exchange inc volume?

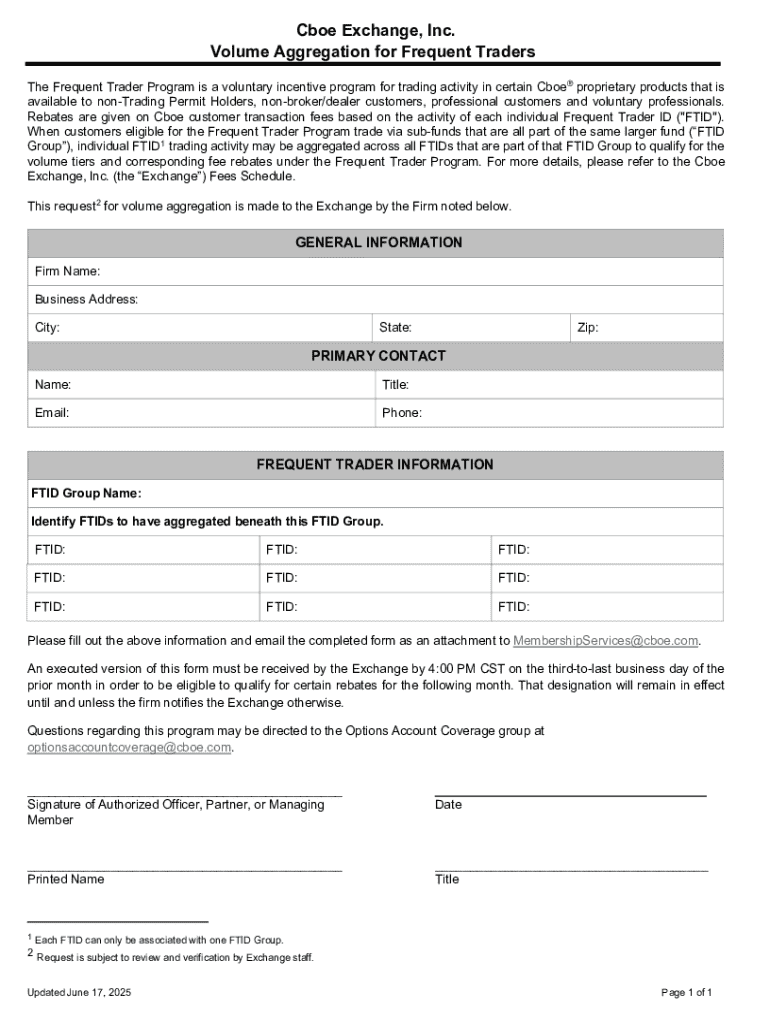

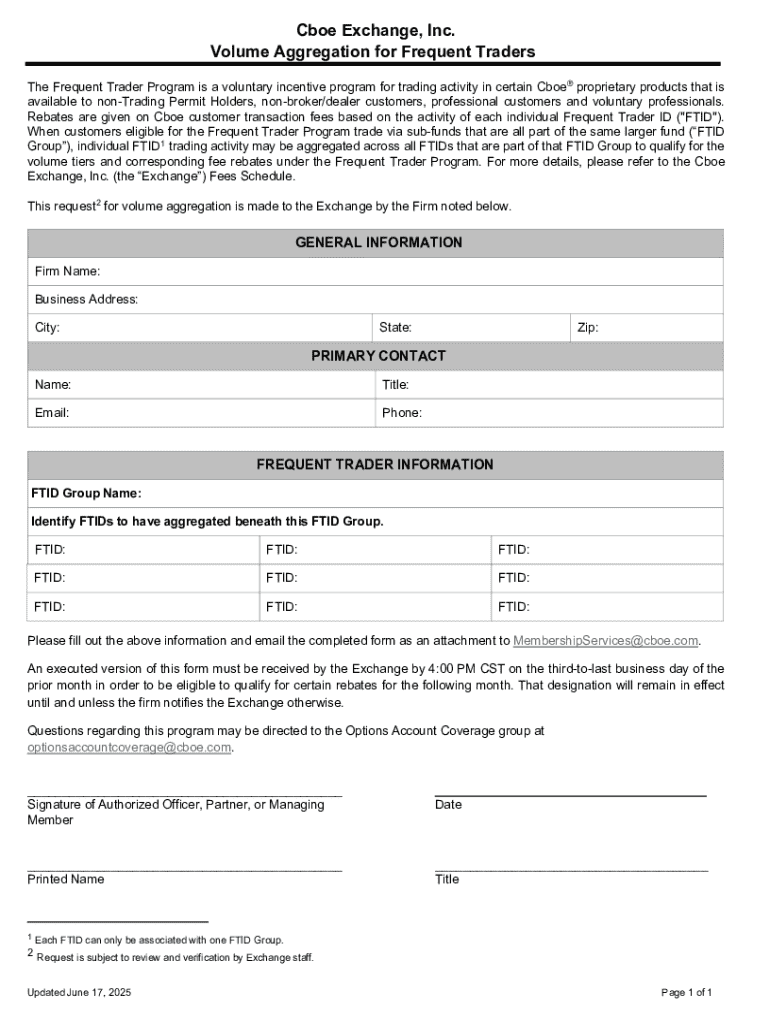

Understanding CBOE Exchange Inc Volume Form

Understanding CBOE Exchange

The Chicago Board Options Exchange (CBOE) is a pivotal institution in the global financial markets, having been established in 1973 as the first marketplace for trading standardized options. Over the decades, CBOE has played a crucial role in not only serving institutional investors but also individual traders by providing access to a wide range of products including equity options, index options, and exchange-traded products (ETPs). Through innovative offerings such as the CBOE Volatility Index (VIX), CBOE has significantly influenced hedging strategies and market dynamics.

Trading volume data is vital in understanding market performance and trends. Volume refers to the number of shares or contracts traded in a security or market during a given period. A high trading volume generally indicates a high level of activity and interest, providing critical insights into market liquidity. Investors often analyze volume data to gauge market sentiment and confirm trends, making it an essential component of trading strategies.

CBOE Exchange Inc Volume Form Explained

The CBOE Exchange Inc Volume Form is a document used to report trading volumes and other relevant data to the CBOE for regulatory and operational purposes. This form is crucial for maintaining accurate records that reflect trading activities, compliance, and financial reporting. Notably, any entity involved in trading options on the CBOE, including brokers, institutional investors, and trading firms, is required to complete this form, ensuring all relevant trading information is captured.

Key components of the CBOE Volume Form include sections that require specific details about trading volumes, dates of transactions, and types of products traded. Each section mandates accurate data entry to ensure compliance with CBOE regulations. Errors in this form can cause significant consequences ranging from penalties to misrepresentation of trading activities, which can impact an entity's standing in the marketplace.

Step-by-step guide to filling out the CBOE Exchange Inc Volume Form

Tools and resources for managing volume data

In managing volume data efficiently, interactive tools offer immense value. pdfFiller provides functionalities for editing and electronically signing the CBOE Volume Form, making collaboration seamless. Teams can work together in real-time, ensuring that data entry is accurate and synchronized across all users without the hassles of back-and-forth email chains.

In addition to pdfFiller, various software solutions are available for document management. Some options may offer specific advantages such as automated data entry and tracking features, while others might excel at providing a user-friendly interface. Evaluating these tools requires assessing the pros and cons based on team size, volume of data, and specific reporting needs.

Insights on trading volume analysis

Analyzing trading volume trends through historical data offers crucial insights into market behavior. For example, volume spikes can signify a shift in sentiment, often preceding significant price movements. By examining case studies, such as those following major economic announcements or market events, traders can learn to identify patterns that may affect their trading strategies, enhancing decision-making processes.

Compliance and regulatory considerations

Compliance with regulatory requirements regarding volume reporting is imperative for all entities trading on the CBOE. Regulatory bodies such as the Securities and Exchange Commission (SEC) oversee these requirements, ensuring that markets operate fairly and transparently. Failure to comply can lead to severe consequences, including fines, sanctions, or further scrutiny by regulatory bodies, underscoring the importance of accurate volume reporting.

Common questions and misconceptions

One common question regarding the CBOE Volume Form is about the frequency of updates. Changes may occur annually or as needed to reflect new reporting standards or regulatory amendments. Additionally, many believe there are significant differences between volume forms used across various exchanges; while formats may vary, most serve the same fundamental purpose of ensuring transparency and accuracy in trading volumes.

Case studies: Successful volume management

Analyzing effective volume reporting practices illustrates how critical accurate data entry and management can be. For instance, a financial firm that diligently maintained organized volume records was able to identify discrepancies quickly during audits, avoiding regulatory fines. Conversely, another institution faced reputational damage due to significant volume reporting errors that went uncorrected. These case studies highlight the importance of implementing sound reporting practices and ensuring staff is trained in proper data management.

Future developments in volume reporting

The financial technology landscape is witnessing rapid innovations, significantly impacting volume tracking and reporting processes. Developments such as artificial intelligence (AI) and blockchain technology promise enhanced accuracy in reporting and real-time analytics. Regulatory requirements are also expected to evolve, particularly in response to technological advancements and market changes, which could lead to stricter compliance protocols in the future.

Leveraging volume data for strategic decisions

Volume data is a powerful asset for shaping trading strategies. When teams effectively utilize volumes in conjunction with market analysis, they can make informed decisions that enhance their trading approach. Maintaining an organized database of volume records allows firms to spot trends, correlations, and anomalies that could inform future market engagement. Therefore, it’s essential to view volume reporting not as a mere compliance task but as a strategic tool integral to a firm’s trading philosophy.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my cboe exchange inc volume in Gmail?

Can I sign the cboe exchange inc volume electronically in Chrome?

How do I complete cboe exchange inc volume on an Android device?

What is cboe exchange inc volume?

Who is required to file cboe exchange inc volume?

How to fill out cboe exchange inc volume?

What is the purpose of cboe exchange inc volume?

What information must be reported on cboe exchange inc volume?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.