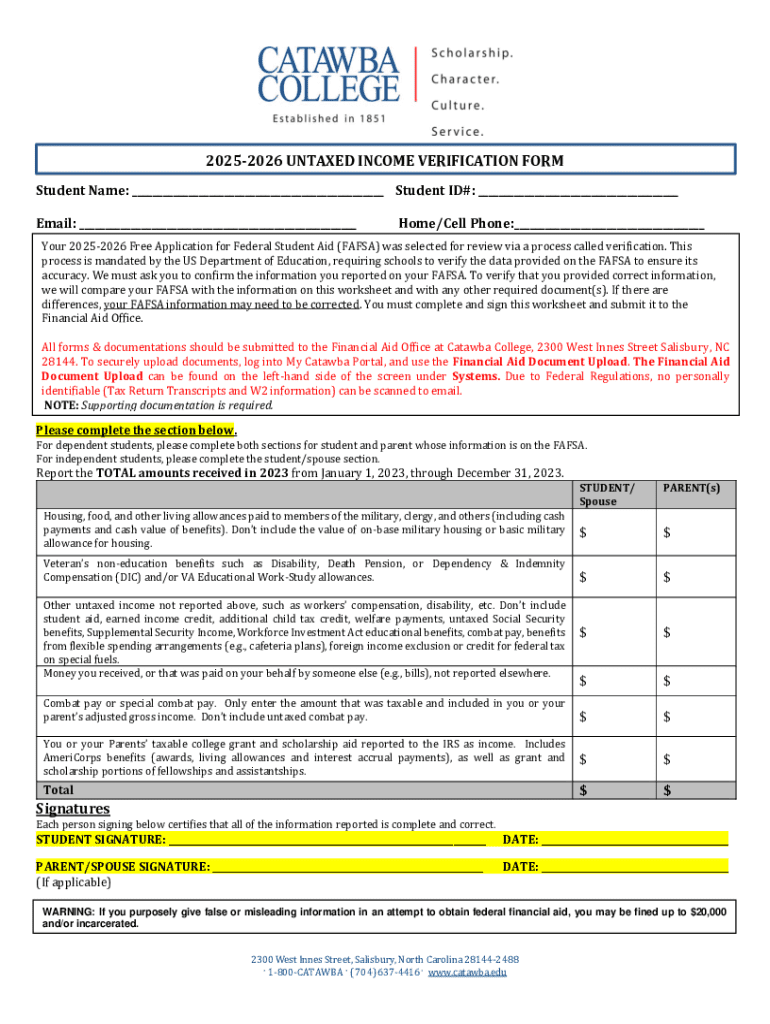

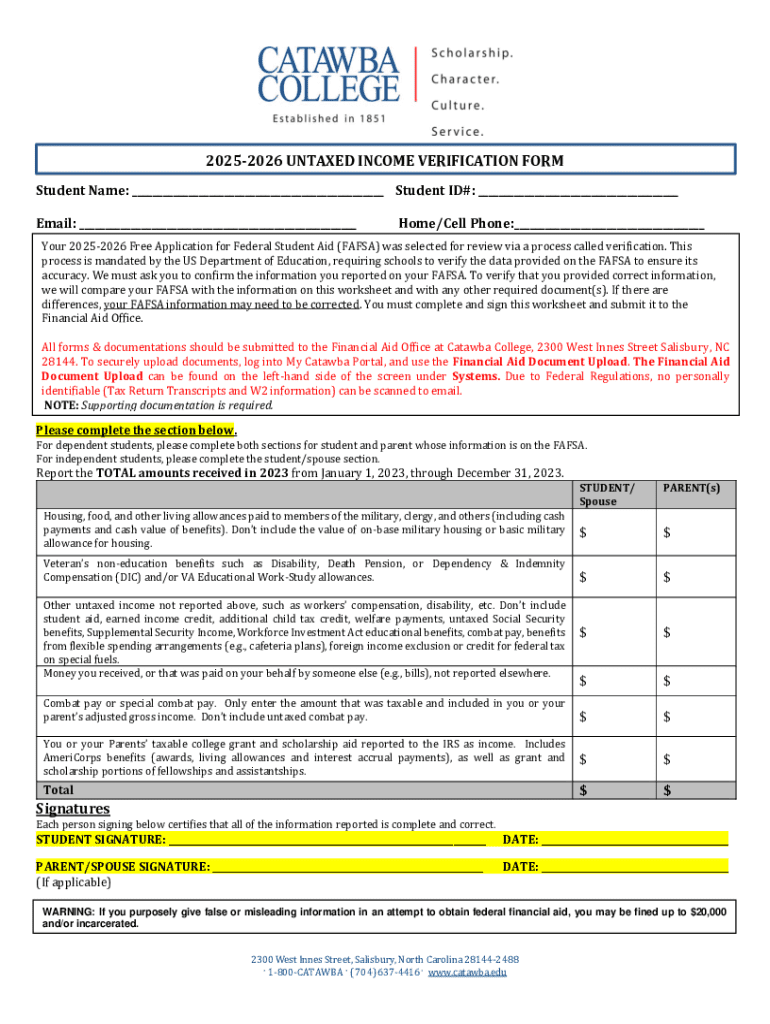

Get the free 2025-2026 Untaxed Income Verification Form

Get, Create, Make and Sign 2025-2026 untaxed income verification

How to edit 2025-2026 untaxed income verification online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2025-2026 untaxed income verification

How to fill out 2025-2026 untaxed income verification

Who needs 2025-2026 untaxed income verification?

Comprehensive Guide to the 2 Untaxed Income Verification Form

Understanding the untaxed income verification form

The 2 untaxed income verification form plays a crucial role in financial aid processes. This form is required to provide clarity on income not reported on tax returns, which can significantly impact a student's eligibility for various forms of financial assistance, including federal aid. Financial aid offices utilize this data to gauge a family’s financial situation, thus ensuring that assistance is allocated fairly and appropriately.

Completing the untaxed income verification form is essential for students and families who may not realize the extent of income that must be reported beyond their tax documents. This can include sources like child support, unemployment benefits, or any other untaxed income. Understanding who needs to complete the form is also fundamental. Typically, it is required for students who are applying for federal financial aid as well as their parents or spouses who may have untaxed incomes.

Key components of the 2 untaxed income verification form

To effectively complete the untaxed income verification form, it is crucial to understand its key components. The form requires detailed information about various income sources while also asking for personal identification details to link the data accurately to the applicant's financial aid profile.

The significance of each section cannot be overlooked. For example, accurately reporting income earned by parent(s) or the student/spouse is vital in determining eligibility for need-based financial aid. Understanding what needs to be reported ensures maximum aid potential.

Step-by-step guide to completing the form

Successfully completing the 2 untaxed income verification form involves thorough preparation and accuracy in reporting information. Before beginning, gather necessary documentation to support your claims about untaxed income.

Once you have the required documents, follow these filling instructions: 1. **Identifying Information:** Insert your name, Social Security number, and other personal identifiers in the specified areas. 2. **Detailed Reporting:** This involves providing a comprehensive account of all sources of untaxed income. Be it child support received or any workers' compensation, each source must be reported accurately, ensuring that no income is overlooked.

One common mistake includes underreporting or failing to report certain untaxed incomes, which can lead to severe ramifications in terms of financial aid eligibility. Such errors can cause delays or even denial of aid, so double-checking each section is advised.

Interactive tools and resources for form completion

Utilizing tools like pdfFiller can streamline the process of completing the 2 untaxed income verification form. You can fill out the form online using advanced document editing features, enabling adjustments in real time without needing to print anything.

Furthermore, pdfFiller offers eSignature capabilities, allowing users to sign off on their documents quickly and securely, ensuring timely submission of the form without the hassle of printing and scanning.

Frequently asked questions (FAQs)

Understanding the intricacies of the 2 untaxed income verification form may prompt several questions. For instance, you may wonder what to do if you don’t have all the information ready. In such cases, it is advisable to collect as much data as possible and initiate your form completion while noting the sections you need to revisit later.

Additionally, institutions may follow up with requests for additional information or clarification, thus preparing for potential queries from them can smoothen the process.

Troubleshooting common issues

Form rejections can create unnecessary stress during an already busy financial aid season. If your 2 untaxed income verification form is rejected, it is imperative to understand the reasons behind the rejection. Common issues revolve around missing signatures, incomplete sections, or discrepancies in reported income.

In cases where problems persist, make sure to keep clear documentation of your efforts to resolve issues. This can be beneficial should you need to appeal a financial aid decision.

Navigating the financial aid process after submission

Once the 2 untaxed income verification form is submitted, you may wonder about the subsequent steps. The financial aid office will review the provided information and assess it against your overall application.

Ensuring your readiness for these interactions can help mitigate delays in receiving your financial aid package, thus facilitating your educational journey.

Additional considerations

When considering the implications of the 2 untaxed income verification form, it's essential to recognize how untaxed income can influence long-term financial planning. Families should assess their budget and resources while understanding varying income types.

Utilizing resources for financial assistance and guidance can facilitate overall clarity. Accessing up-to-date information regarding financial aid will empower families to proceed confidently with their educational investment.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send 2025-2026 untaxed income verification for eSignature?

Can I create an eSignature for the 2025-2026 untaxed income verification in Gmail?

Can I edit 2025-2026 untaxed income verification on an iOS device?

What is 2025-2026 untaxed income verification?

Who is required to file 2025-2026 untaxed income verification?

How to fill out 2025-2026 untaxed income verification?

What is the purpose of 2025-2026 untaxed income verification?

What information must be reported on 2025-2026 untaxed income verification?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.