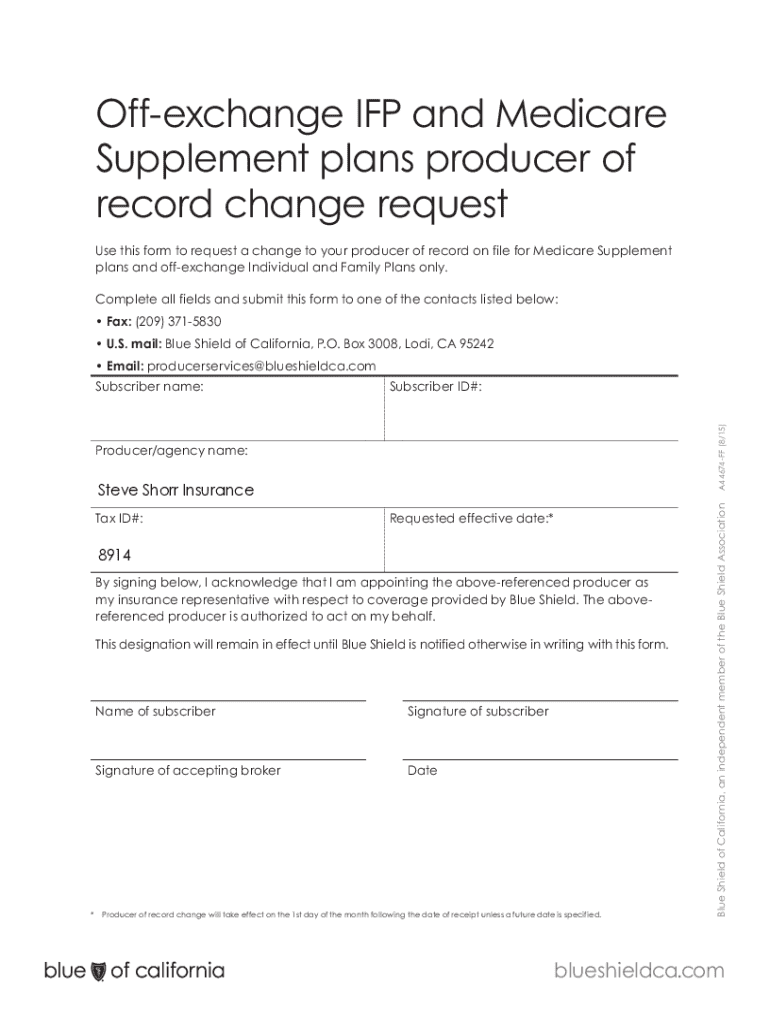

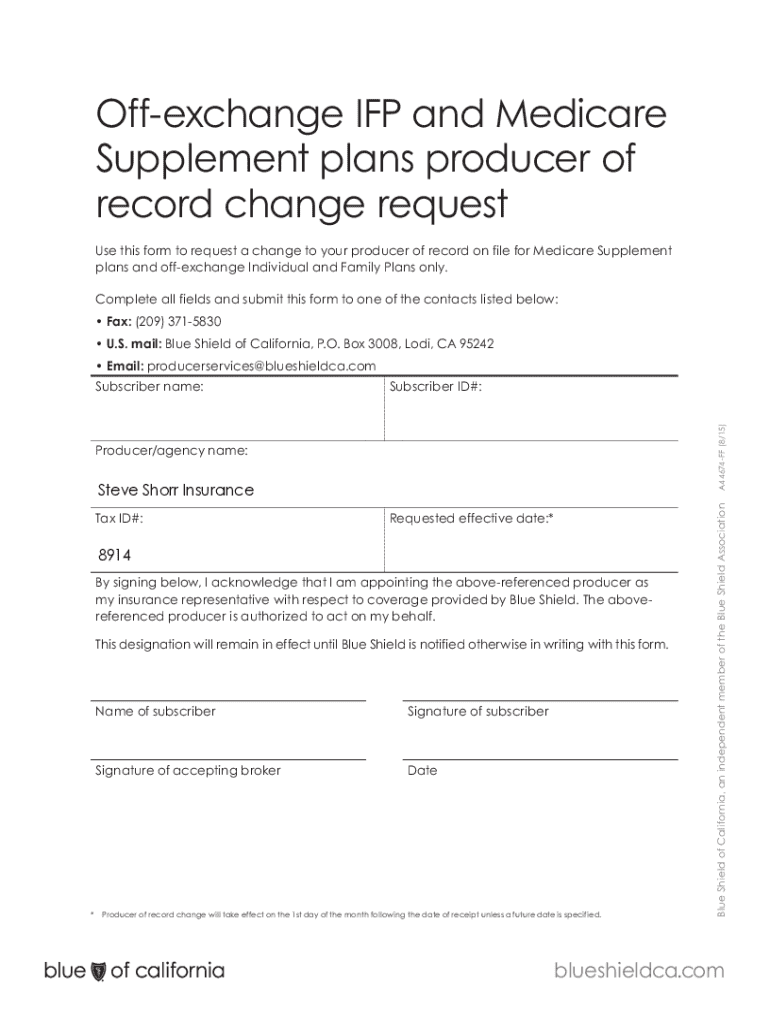

Get the free Off-exchange Ifp and Medicare Supplement Plans Producer of Record Change Request

Get, Create, Make and Sign off-exchange ifp and medicare

How to edit off-exchange ifp and medicare online

Uncompromising security for your PDF editing and eSignature needs

How to fill out off-exchange ifp and medicare

How to fill out off-exchange ifp and medicare

Who needs off-exchange ifp and medicare?

Off-exchange IFP and Medicare form: A Comprehensive Guide

Understanding health insurance options

Navigating the world of health insurance begins with understanding key terminologies and structures. Health insurance marketplaces are platforms that allow consumers to compare and purchase health plans. Here, you can often find both on-exchange and off-exchange options. On-exchange plans are those sold through state or federal marketplaces, while off-exchange plans are available directly from insurance companies or agents.

Individual and Family Plans (IFPs) are specific insurance products designed for individuals and families who do not receive employer-sponsored insurance. These plans can cover a variety of medical services, ensuring that users have access to healthcare when needed. Understanding these basic concepts lays the groundwork for distinguishing between different health insurance options.

Distinguishing between on-exchange and off-exchange health insurance

On-exchange health insurance refers to plans offered through state or federal marketplaces where individuals can apply for premium tax credits and cost-sharing reductions based on their income. This not only promotes affordability but also aids in ensuring that coverage is accessible to a larger segment of the population.

On the other hand, off-exchange health insurance is not sold on these marketplaces. Instead, these private plans can often be more flexible and come with a wider variety of choices. Here are some key differences between the two:

The advantages of off-exchange coverage can be particularly beneficial for those who may not qualify for subsidies or who prefer a more tailored approach to their healthcare needs.

The off-exchange Individual and Family Plans (IFP)

Off-exchange IFPs present numerous benefits for consumers. One of the most significant advantages is the flexibility in plan choices. Users can select plans that best suit their needs without the limitations often imposed by on-exchange plans, such as specific metal tiers.

Additionally, off-exchange plans allow for customization. Clients can select varying levels of coverage—be it minimal catastrophic plans or more comprehensive options—to align with their health requirements and budget. The eligibility criteria for these plans generally include age, residency, and in some cases, income thresholds, making them accessible to a broad population segment.

Navigating the Medicare landscape

Medicare is a federal program designed primarily for individuals aged 65 and older, though younger individuals with disabilities may also qualify. It consists of several parts: Part A covers hospital insurance, Part B covers medical insurance, Part C includes Medicare Advantage plans, and Part D provides prescription drug coverage.

Understanding how off-exchange plans interact with Medicare is essential for proper healthcare management. Coordination of benefits is crucial, particularly to ensure that both Medicare and off-exchange IFPs work harmoniously together. Enrollment considerations arise when individuals who qualify for both Medicare and off-exchange coverage must select the most beneficial combination of plans tailored to their needs.

Filling out the off-exchange IFP and Medicare form

Completing an off-exchange IFP and Medicare form can seem daunting, but it can be a straightforward process with the right information. Here's a step-by-step guide to filling out your application:

Common pitfalls to avoid include missing documents or misrepresenting income information, which can lead to complications in approval. Tips for gathering documentation include keeping up-to-date records and seeking assistance when needed.

Managing your documents with pdfFiller

When dealing with essential forms like the off-exchange IFP and Medicare form, using platforms like pdfFiller can significantly streamline your experience. pdfFiller allows you to upload and edit your forms easily, ensuring formatting and content are precise. Furthermore, eSigning your application can be done simply and securely directly through the platform.

Collaborating with family or financial advisors becomes effortless using pdfFiller's sharing and editing features. Importantly, the platform ensures that your sensitive information remains secure and easily accessible, allowing for innovative management of your documents without compromising personal data.

Frequently asked questions (FAQs)

When considering off-exchange IFPs and Medicare forms, individuals often have critical questions. For instance, how do I know if I qualify for off-exchange plans? Generally, if you are not receiving subsidies or your income does not match the qualifications for on-exchange health plans, you can apply for off-exchange plans.

Additional inquiries might arise regarding switching from on-exchange to off-exchange coverage. It's essential to understand that while you can switch plans, it can involve specific enrollment periods and eligibility checks, making timely action crucial. Questions about submission deadlines and approval timelines are also common, and it's always advisable to check with your chosen providers for detailed information.

Important reminders for off-exchange coverage applicants

When applying for off-exchange coverage, being aware of key deadlines for enrollment and renewals is essential. Missing an enrollment window can delay your access to necessary healthcare services. After submitting your application, expect to receive confirmation and further instructions regarding your coverage and any potential next steps.

For new clients, premium payment reminders must be maintained to ensure that your coverage becomes effective. Keeping a calendar or setting alerts can help manage these important timelines efficiently.

Quick tips for a smooth application process

Here are some best practices to ensure your application process is as smooth as possible: accuracy is crucial, so verify your personal information before you submit any forms. Engaging directly with support teams or platforms like pdfFiller can clarify confusing aspects of the application process, providing guidance that can prove invaluable.

Additionally, remember to keep copies of all documents and confirmations. This can provide peace of mind and serve as a reference should any inquiries arise during processing.

Additional resources and support

For assistance with your application, there are numerous resources available. Many health insurance companies provide online support options, including live chats and help centers dedicated to addressing specific issues related to off-exchange IFPs and Medicare forms.

You can also contact customer service teams via phone or email. Exploring helpful websites and tools designed for health insurance research is advisable to stay informed about your options and rights regarding coverage.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my off-exchange ifp and medicare directly from Gmail?

Can I create an electronic signature for signing my off-exchange ifp and medicare in Gmail?

How do I edit off-exchange ifp and medicare on an Android device?

What is off-exchange ifp and medicare?

Who is required to file off-exchange ifp and medicare?

How to fill out off-exchange ifp and medicare?

What is the purpose of off-exchange ifp and medicare?

What information must be reported on off-exchange ifp and medicare?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.