Get the free Insurance Verification Form

Get, Create, Make and Sign insurance verification form

Editing insurance verification form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out insurance verification form

How to fill out insurance verification form

Who needs insurance verification form?

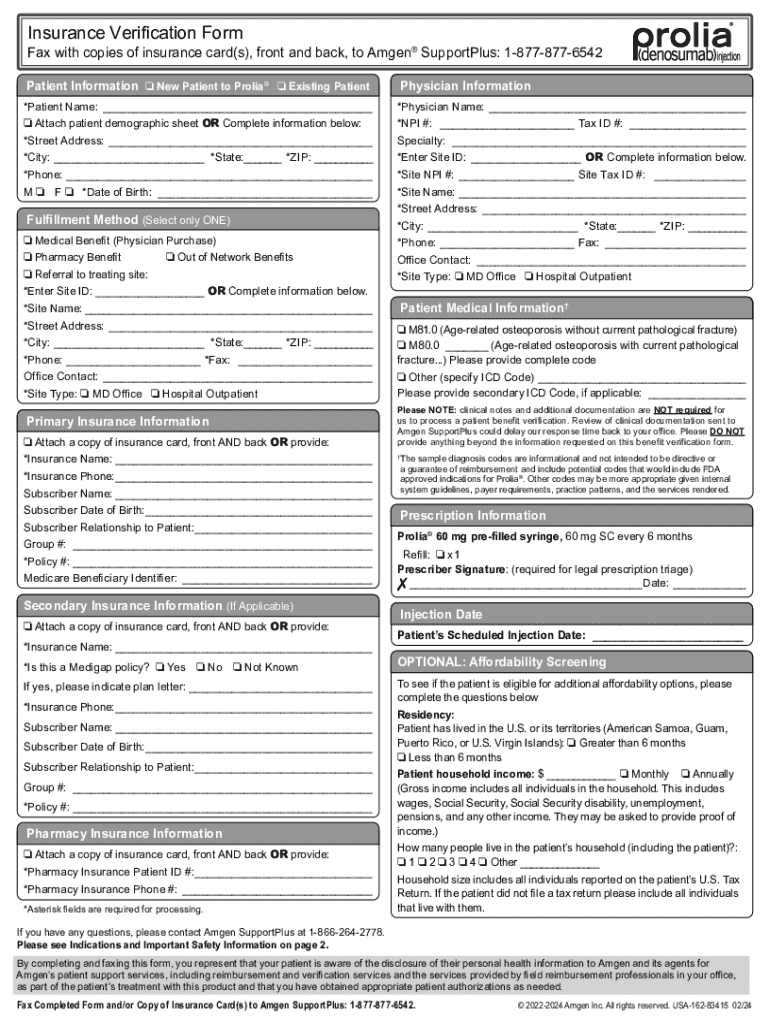

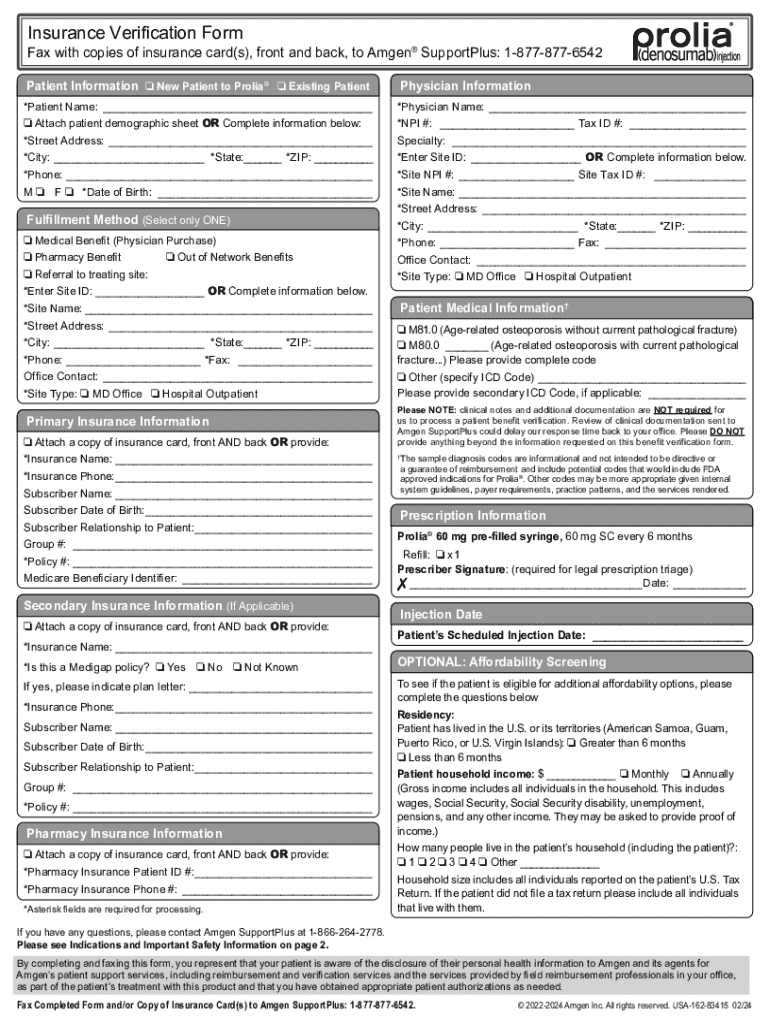

A Comprehensive Guide to the Insurance Verification Form

Understanding the Insurance Verification Form

An insurance verification form is a critical document used across various sectors to confirm the validity of an individual’s insurance coverage. Its primary purpose is to ensure that any treatment, service, or transaction is executed with the assurance that appropriate coverage is in place. In sectors like healthcare, automotive, and housing, having an accurate verification form can streamline processes, minimize delays, and enhance financial accountability.

The significance of this form cannot be understated; it serves as a safeguard for service providers against claims denials and fosters transparent communication between all parties involved. In healthcare, for example, billing may depend significantly on verifying insurance to ensure that claims are processed correctly. Similarly, in housing and automotive scenarios, obtaining proper verification is equally pivotal.

Key components of the insurance verification form

Filling out an insurance verification form may initially seem straightforward, but careful attention is essential to include all needed information accurately. Basic components usually comprise the individual’s name, contact details, date of birth, and insurance policy information, including policy numbers and coverage types. Specific sections of the form often detail whether the insurance is primary or secondary, providing clarity on how claims will be processed.

In addition to this essential personal and insurance information, several forms may require additional documentation. This might include copies of insurance cards, identification, and other relevant materials to ensure the verification process proceeds without hiccups.

Types of insurance verification forms

The utilization of various types of insurance verification forms highlights the diversity in the nature of insurance needs across different industries. Each type serves a distinct purpose, ensuring that relevant parties have the assurance they need.

Healthcare insurance verification form

In the healthcare sector, an insurance verification form is crucial for confirming coverage prior to treatment. Common usages include doctor visits, procedures, surgeries, and diagnostic tests. Healthcare providers typically require this verification to determine the extent of coverage, which plays a vital role in managing expenditures and avoiding unexpected costs. To obtain a healthcare verification form, patients generally need to request it directly from their healthcare provider or complete it via online portals provided by their insurance companies.

Automotive insurance verification form

Automotive insurance verification is often needed in scenarios such as accident claims, rental car transactions, or when purchasing a vehicle. In these cases, an insurance verification form acts as proof that the individual holds valid car insurance. Service providers may necessitate this verification to mitigate risks associated with financial losses in case of accidents or damages.

Rental housing insurance verification form

For individuals seeking rental housing, an insurance verification form is often required by landlords or property managers. This documentation assures landlords that potential tenants have the necessary renter’s insurance, protecting both parties in case of damages or liabilities. The typical information required generally includes the tenant's details, policy number, and coverage period.

Filling out the insurance verification form

Completing an insurance verification form doesn’t have to be a daunting task. With a systematic approach, it can be managed efficiently. Start by collecting essential documents such as your insurance card, personal identification, and any prior correspondence with your insurance carrier. This preparation can streamline the process significantly.

As you fill out the form, pay close attention to each section. You’ll typically start with your personal information, where accuracy matters. It's followed by providing your insurance policy number and coverage details. Ensure that every piece of information is triple-checked against existing documents to avoid common pitfalls such as typos or outdated information.

Interactive tools and features

Digital solutions can augment the efficiency of managing an insurance verification form with tools like pdfFiller. With pdfFiller, users can easily fill out, edit, and sign forms online, eliminating the inconveniences associated with traditional paperwork. The platform provides editing features that allow for adding text, checkboxes, or notes, enhancing the clarity of the form.

Moreover, collaboration is effortless with pdfFiller, as multiple team members can work on submissions concurrently. This makes the platform ideal for businesses or organizations that require collective input on documents.

The benefits of using a cloud-based document solution

Utilizing a cloud-based document solution further boosts convenience. Users can access their insurance verification forms from anywhere, making it highly beneficial for those who are often on the go. The storage features ensure that sensitive information remains secure while allowing for quick retrieval when needed. Additionally, real-time updates and revisions facilitate peace of mind, knowing your documents are always up-to-date.

Common scenarios and when to use the verification form

Different situations call for the use of an insurance verification form, and recognizing these scenarios can help streamline various processes. For instance, in healthcare, hospitals often require verification is completed before treatment, particularly in emergency cases where immediate medical attention is necessary.

Similarly, in the automotive realm, scenarios such as validating coverage for rentals or filing collision claims demand timely verification. In rental housing, the importance of verification intensifies during lease applications, where landlords seek assurance of a tenant’s insurance to mitigate any potential liabilities.

Examples and templates

To assist users in understanding how to fill out an insurance verification form accurately, pdfFiller provides access to sample forms. These fillable templates can guide users as they navigate through the required information. An example fillable form often includes sections clearly annotated to indicate what information belongs where, preventing confusion.

Besides generic forms, various industry-specific variations exist. Users can find templates tailored to healthcare, automotive, and housing sectors, ensuring relevance to their individual needs.

Managing your completed insurance verification form

Once the insurance verification form is completed, understanding how to manage it is vital for effective document handling. Submitting your form properly involves knowing your options, whether it be through email, physical mail, or the online portals associated with your insurance provider. Whichever channel chosen, it’s advisable to keep copies of your submissions for personal records.

Post-submission, being proactive is beneficial. Users should have a clear understanding of what to expect after submitting their forms, including potential follow-up timelines. If confirmation of the verification status isn’t received within the expected time frame, reaching out to the respective service provider can provide clarity.

Conclusion reminders and user engagement

Being informed about the intricacies of an insurance verification form is essential for anyone needing to use it for medical, automotive, or housing purposes. Users are encouraged to provide feedback on their experiences with forms on pdfFiller to facilitate continuous improvement of the service.

Furthermore, tips for securely storing completed forms can help safeguard sensitive personal data. Users interested in innovative document solutions are invited to explore pdfFiller’s homepage to discover a wealth of additional resources and templates that can enhance their document management experience.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the insurance verification form in Chrome?

How can I edit insurance verification form on a smartphone?

How do I complete insurance verification form on an Android device?

What is insurance verification form?

Who is required to file insurance verification form?

How to fill out insurance verification form?

What is the purpose of insurance verification form?

What information must be reported on insurance verification form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.