Get the free Drought Carry-on Finance Loan Application Form

Get, Create, Make and Sign drought carry-on finance loan

How to edit drought carry-on finance loan online

Uncompromising security for your PDF editing and eSignature needs

How to fill out drought carry-on finance loan

How to fill out drought carry-on finance loan

Who needs drought carry-on finance loan?

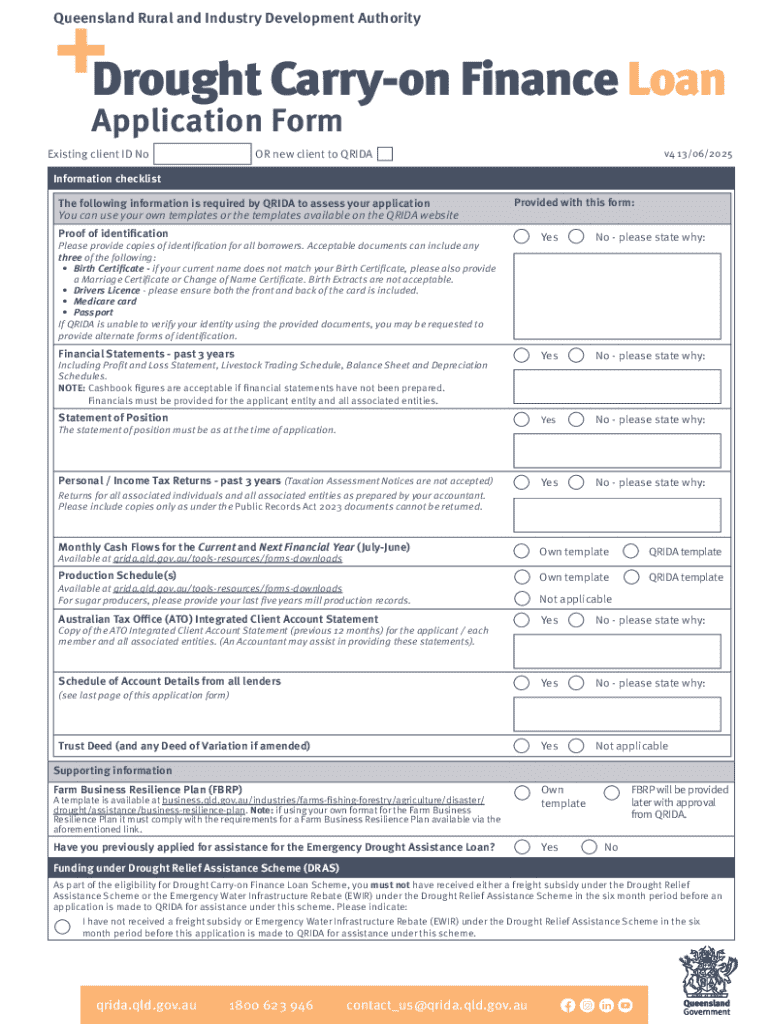

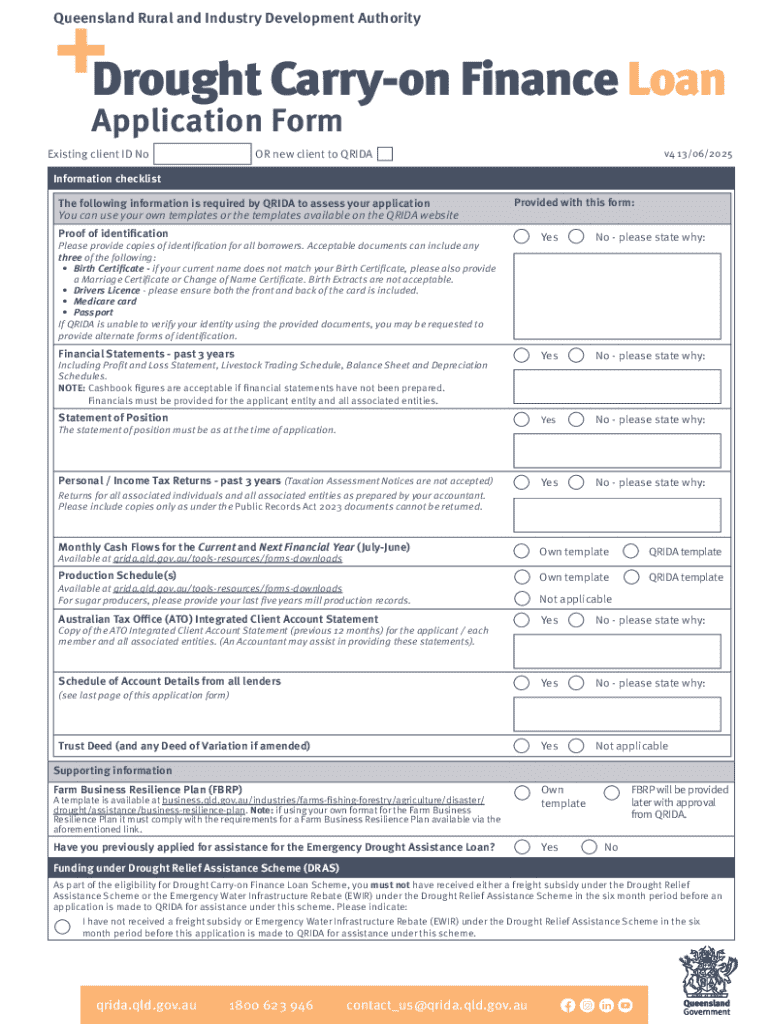

Understanding the Drought Carry-on Finance Loan Form

Overview of the Drought Carry-on Finance Loan

The Drought Carry-on Finance Loan is a financial solution designed to assist primary producers facing the brunt of severe drought conditions. Given the significant impacts that droughts can have on farming operations, this loan aims to provide support for maintaining viability and sustainability during tough times. The loan's purpose is to furnish farmers and agribusinesses with the necessary funds to manage operational costs, purchase inputs, and ultimately preserve their business health until conditions improve.

This loan is crucial for the agricultural sector as many producers depend heavily on their crops and livestock for income. Key features of the Drought Carry-on Finance Loan include varying loan amounts that can readily be accessed, typically ranging from small sums for immediate necessities to larger amounts for more extensive operational needs. Repayment terms are structured to offer flexibility, allowing borrowers to manage payments in a manner that aligns with their anticipated cash flows.

Who can apply for the Drought Carry-on Finance Loan?

Eligibility for the Drought Carry-on Finance Loan primarily extends to individuals and businesses categorized as primary producers. To qualify, applicants must demonstrate that the drought has significantly impacted their agricultural operations, necessitating financial support to continue functioning. Specific requirements often include proof of farming operations, agricultural production history, and an assessment of the financial impact of the drought on the business.

Documentation is vital for a successful application. Applicants will typically need to provide financial statements, tax returns, and any correspondence related to loss of income due to drought. It's also essential for different agricultural sectors — such as cropping, livestock, or horticulture — to understand that considerations may vary based on industry-specific challenges.

Benefits of the Drought Carry-on Finance Loan

The Drought Carry-on Finance Loan offers substantial financial relief during adverse and challenging conditions. One of the most significant benefits is the ability to manage operational costs effectively, allowing producers to stay afloat without resorting to drastic measures that could harm their long-term business viability. The loan enables flexibility in addressing immediate financial gaps, such as purchasing feed, maintaining equipment, or covering labor costs that might otherwise threaten the operations.

Comparatively, this loan stands out against other financing options available for drought relief due to its specialized focus on agricultural producers. Unlike general commercial loans, which may not consider the unique circumstances of drought-affected businesses, the Drought Carry-on Finance Loan is tailored for specific agricultural needs, making it an invaluable resource for many.

Step-by-step application process

Understanding the QRIDA decision-making process

The Queensland Rural Industry Development Authority (QRIDA) plays a critical role in reviewing applications for the Drought Carry-on Finance Loan. During the application review, QRIDA considers numerous factors, including the severity of the drought's impact, the viability of the applicant's business, and the adequacy of the documentation provided. Understanding these aspects can give applicants a clearer picture of what to expect in terms of approval chances.

Typically, the timeline for the decision-making process varies; however, applicants can generally expect communication within a few weeks of submission. Should your loan application be approved, QRIDA will provide detailed next steps regarding fund disbursement. Conversely, if denied, applicants can seek feedback to identify any shortcomings in their application and reapply in the future.

Frequently asked questions

Many potential applicants have queries regarding the Drought Carry-on Finance Loan, particularly in terms of eligibility. Typically, applicants must be primary producers registered to operate within Australia, and specific limits on loan amounts exist. Processing delays may occur during peak application periods, so it's essential to apply early to avoid financial crunches.

In instances where applications are unsuccessful, options for appeal may be available. Potential applicants may also want to seek advice on ensuring they submit a robust application that meets all the necessary criteria. It can be beneficial to connect with local agricultural representatives who can assist with the application process.

Client stories: Success with the Drought Carry-on Finance Loan

Numerous businesses have accessed the Drought Carry-on Finance Loan and have shared positive testimonials regarding the aid received. For example, the Jones Family Farm in Queensland reported that the loan allowed them to purchase emergency feed for their livestock, which prevented a total loss of their cattle due to drought conditions. Stories like these highlight the loan's critical role in preserving livelihoods during dire circumstances.

Another beneficiary, Smith Orchards, utilized the funding to keep their staff employed during peak harvest, ensuring a smoother transition as weather conditions improved. These narratives showcase how the Drought Carry-on Finance Loan can truly make a difference, not just in terms of immediate financial support but in strengthening community resilience in agricultural sectors.

Interactive tools available on pdfFiller

pdfFiller stands at the forefront of document management by providing a suite of interactive tools tailored for the Drought Carry-on Finance Loan. Users can conveniently fill out and edit the loan form using intuitive tools designed for ease of use. With eSigning capabilities, applicants can finalize their forms quickly and securely, helping to expedite the approval process.

Collaboration features also encourage teams to work together seamlessly when applying for loans. This capability allows multiple contributors to review, edit, and finalize documents effectively, ensuring no aspect of the application is overlooked.

Additional considerations

As the landscape of agricultural support evolves, primary producers should stay informed of potential changes to the Drought Carry-on Finance Loan availability and terms. Monitoring updates from relevant authorities is essential, as adjustments to financial programs could impact eligibility and repayment structures.

Additionally, maintaining connections with local agricultural organizations can provide access to vital networking opportunities and resources. Collaborating with peers can foster a community of support during challenging times, enabling producers to share insights, approaches to resilience, and forward-thinking strategies.

Get in touch

For personalized assistance regarding the Drought Carry-on Finance Loan, contacting customer support can provide clarity and direction. Available resources can guide potential applicants through the intricacies of the process, ensuring they have the best possible chance of securing the financial support needed.

Individuals can also schedule consultations for tailored guidance to suit their unique situations. Staying connected through our various platforms allows users to receive continuous updates and valuable insights related to agricultural support.

Related information on drought assistance programs

Beyond the Drought Carry-on Finance Loan, other financial support options exist for drought-affected communities. These additional resources may include grants, subsidies, and community support programs that aim to alleviate financial burdens. Access to state and federal resources remains crucial, as they can help guide producers through various assistance programs available.

Workshops and informational sessions tailored for farmers provide further insights into available support mechanisms. Engaging in these events allows producers to learn about navigating through challenging times while leveraging multiple resources effectively.

Acknowledgement of country

We acknowledge the traditional custodians of the land on which we operate, and we respect their enduring connection to the environment and agriculture. As we navigate the challenges posed by drought and work towards sustainability, we recognize and honor their contributions throughout the centuries.

Quick links

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find drought carry-on finance loan?

How do I make changes in drought carry-on finance loan?

How do I fill out drought carry-on finance loan on an Android device?

What is drought carry-on finance loan?

Who is required to file drought carry-on finance loan?

How to fill out drought carry-on finance loan?

What is the purpose of drought carry-on finance loan?

What information must be reported on drought carry-on finance loan?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.