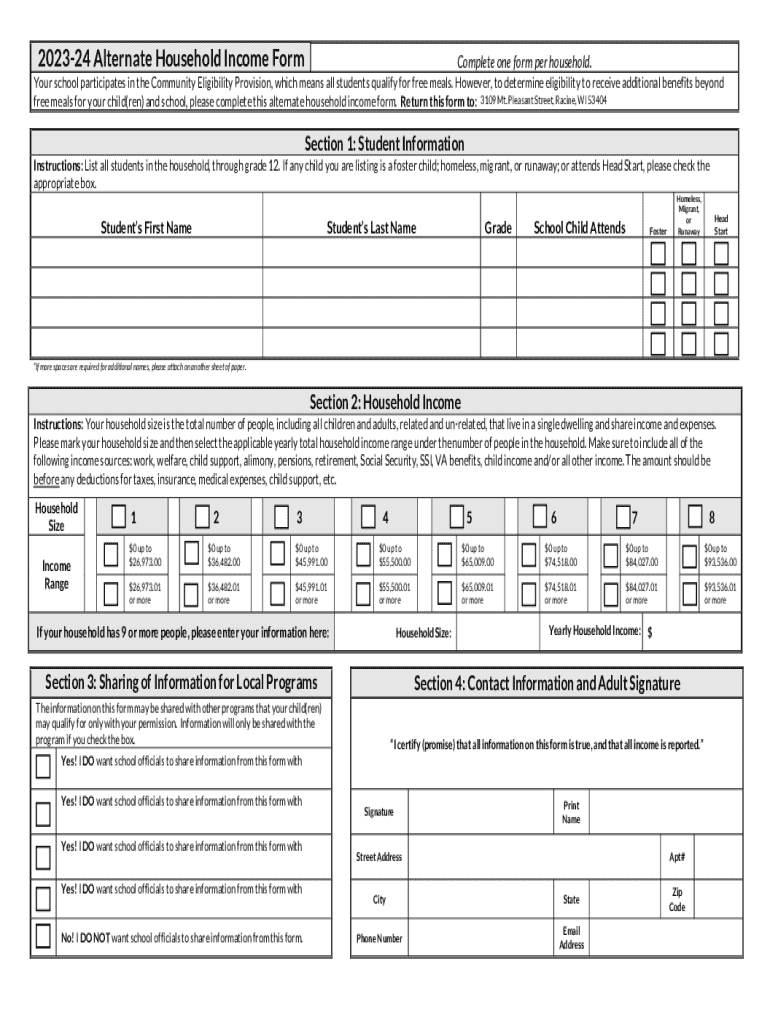

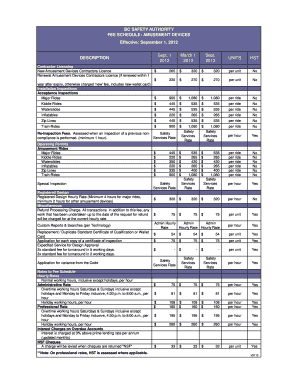

Get the free 2023-24 Alternate Household Income Form

Get, Create, Make and Sign 2023-24 alternate household income

Editing 2023-24 alternate household income online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2023-24 alternate household income

How to fill out 2023-24 alternate household income

Who needs 2023-24 alternate household income?

Comprehensive guide to the 2023-24 alternate household income form

Understanding the 2023-24 alternate household income form

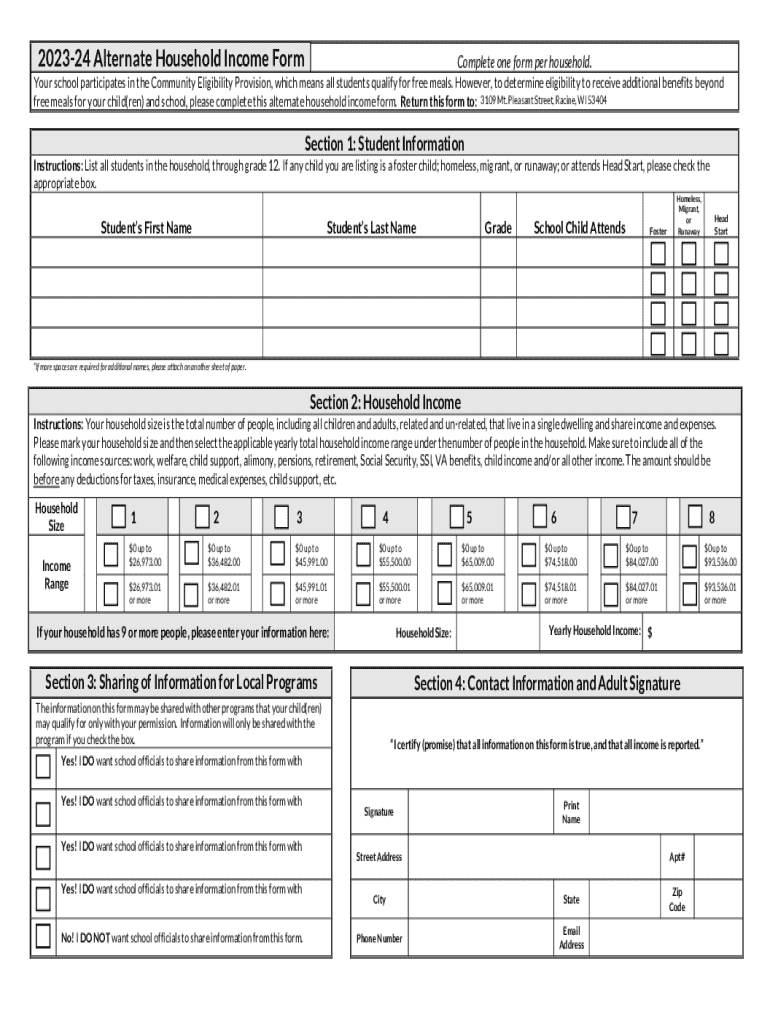

The 2023-24 Alternate Household Income Form plays a crucial role in determining eligibility for various programs, including school meal assistance and financial aid. This form provides institutions with a clear snapshot of a household's income, allowing them to assess the need for support effectively. Accurately completing this form is not just a bureaucratic necessity; it is a fundamental step towards ensuring that families receive the assistance they need.

Household income documentation serves as a backbone for programs aimed at aiding low-income families. By submitting the 2023-24 alternate household income form, families can justify their qualifications for services that can significantly enhance their quality of life. Furthermore, consistently and thoroughly completing the form demonstrates a commitment to transparency, allowing for smoother verification processes.

Eligibility criteria for submitting the form

Determining who needs to fill out the 2023-24 alternate household income form is straightforward. Primarily, households seeking public assistance, children enrolling in school meal programs, or families applying for financial aid must submit this important document. Understanding the specific income thresholds required for submission is critical, as they dictate the eligibility for aid and support programs.

Different programs have varying criteria for eligibility. Generally, if a family's income falls below a certain percentage of the median household income for their area, they qualify to submit the form. This requirement ensures that assistance reaches those who need it most, creating a safety net for disadvantaged families. Situations like unemployment, reduced work hours, or significant changes in income due to health issues are valid reasons that necessitate the filing of this form.

Step-by-step instructions for completing the form

Completing the 2023-24 alternate household income form is a process that, when approached step by step, becomes more manageable. The first essential step is gathering all necessary information. This includes compiling relevant documents such as income statements and tax returns, and creating a list of all household members who contribute to or depend on the household income.

Next, when filling out the income sections, it is vital to provide a complete breakdown of all sources of income, including wages, benefits, and any other financial contributions. Special considerations exist for military households, which may have unique circumstances regarding income, such as combat pay or housing allowances. Accurate reporting of these figures ensures a clearer understanding of household needs.

Finally, reviewing and validating the information before submission cannot be overstated. Common mistakes, such as misreported income or missing signatures, can delay the processing of assistance applications. Double-checking details ensures that the form is not only compliant but fully reflects the household's financial situation.

Editing and managing your completed form

Once the 2023-24 alternate household income form is completed, managing it effectively is key to ensuring it remains current and accurate. One of the most user-friendly tools available for this purpose is pdfFiller. You can easily upload your form to pdfFiller's platform to make edits as necessary, whether it be correcting information or updating figures as income fluctuates.

pdfFiller also provides features for electronically signing the form, making it even easier to formalize your submissions. With options for creating secure e-signatures, users can quickly proceed with signing their documents without needing to print anything out. For added convenience, it also offers secure storage options, ensuring that your submitted forms are kept safe and accessible at all times.

FAQs regarding the alternate household income form

Having questions about the 2023-24 alternate household income form is common, especially for first-time filers. One frequently asked question is why it's necessary to complete the form if children are already receiving free meals. While it may seem redundant, the form is crucial for ensuring continued support and updates in financial circumstances.

Another common inquiry pertains to the submission of the form for multiple children in the same household. Yes, the form can be used for all eligible children, simplifying the process for families with several dependents. Additionally, when it comes to reporting fluctuating income, it is advisable to provide an average range rather than precise figures, ensuring a fair representation of household finances.

Additional guidance for common situations

Complex family structures can create unique challenges when reporting income for the 2023-24 alternate household income form. For blended families or significant income variations, it's crucial to include all relevant income sources while explaining any irregularities clearly. This ensures that authorities reviewing the form grasp your financial situation in its entirety.

Military families, in particular, may face unique situations regarding income reporting. Combat pay, special allowances, and even the transition to civilian life can affect earnings. It’s advisable for military households to consult resources specific to their circumstances to ensure accurate and fair representation of their income when completing the form.

Contact information for support

If you encounter questions or difficulties while completing the 2023-24 alternate household income form, several resources are available for support. The pdfFiller platform offers customer service features and community support options for users needing assistance with their forms.

In addition to pdfFiller’s customer service, you can access local agencies or community support groups that may provide additional guidance and assistance. Engaging with these resources can ensure that you understand every aspect of the form and help you complete it accurately and efficiently.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my 2023-24 alternate household income in Gmail?

How do I edit 2023-24 alternate household income on an iOS device?

How can I fill out 2023-24 alternate household income on an iOS device?

What is 2023-24 alternate household income?

Who is required to file 2023-24 alternate household income?

How to fill out 2023-24 alternate household income?

What is the purpose of 2023-24 alternate household income?

What information must be reported on 2023-24 alternate household income?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.