Get the free Certificate of Exemption -agar 2024/25 Form 2

Get, Create, Make and Sign certificate of exemption -agar

How to edit certificate of exemption -agar online

Uncompromising security for your PDF editing and eSignature needs

How to fill out certificate of exemption -agar

How to fill out certificate of exemption -agar

Who needs certificate of exemption -agar?

Certificate of exemption - Acknowledgment form: A comprehensive guide

Understanding the certificate of exemption

A certificate of exemption serves as a critical document allowing individuals and businesses to avoid certain taxes or fees under specific circumstances. This certificate ensures compliance with relevant laws while economically benefiting those eligible for exemptions. Its significance cannot be understated, as it often plays a vital role in financial planning and operational efficiency.

The primary purpose of a certificate of exemption is to prevent the imposition of unnecessary financial burdens. For businesses, it facilitates operations by confidently sourcing goods or services without the added cost of tax, enhancing their competitive edge. Individuals, too, seek exemption to safeguard their finances, especially when engaging with non-profit organizations or participating in community services.

Types of exemption certificates

There are various types of exemption certificates available, each tailored to specific circumstances. Understanding the differences is essential for maximizing use and compliance with state laws. The most common categories involve sales tax and use tax exemptions, primarily aimed at purchasing goods without the burden of taxation. Non-profit organizations frequently utilize these to engage with suppliers and vendors efficiently.

Each state has particular criteria and processes for issuing exemption certificates. Therefore, knowing the state-specific exemption programs becomes crucial for ensuring compliance and acceptance of the certificates. Variations may include the necessary documentation or application processes, so individuals and businesses should familiarize themselves with their state guidelines to avoid unnecessary challenges.

Key components of the acknowledgment form

The acknowledgment form associated with the certificate of exemption includes essential sections that facilitate a clear understanding of the applicant and the exemption sought. Typically, the application includes critical facets such as the applicant's name, contact information, and the organization they represent, along with pertinent details about the goods or services for which exemption is being requested.

Moreover, applicants must justify their request for exemption by providing adequate reasons, alongside supporting documents that validate eligibility. This documentation is vital in ensuring that the request aligns with state regulations and strengthens the application against potential scrutiny.

Step-by-step guide to completing the acknowledgment form

When preparing to complete the acknowledgment form for the certificate of exemption, it’s crucial to gather all necessary information beforehand. Begin by listing the required details you need to fill in such as names, addresses, and descriptions of goods or services. This preliminary step mitigates the likelihood of errors during completion, which is essential for smooth processing.

Once you have compiled the necessary information, filling out the form correctly follows. Pay particular attention to each section as accuracy is paramount. Utilizing clear and precise language when outlining the exemption purpose enhances the likelihood of approval and assures the reviewer of your understanding of the exemption process.

Submitting your certificate of exemption form

Submitting the completed acknowledgment form involves a straightforward process, yet requires attention to detail to ensure successful acceptance. Many states offer online submission portals that simplify the process, enabling users to submit without mailing physical documents. If opting for a hard copy submission, adhere to the specific mailing addresses provided by your state to avoid delays.

After submission, it’s crucial to follow up to check the status of your certificate. This involves reviewing communications from the relevant authority and potentially contacting them if a significant amount of time has passed without feedback. Knowing what to expect post-submission can alleviate anxiety and ensure you remain informed throughout the process.

Frequently asked questions (FAQs)

As users engage with the certificate of exemption - acknowledgment form, a number of questions frequently arise. For instance, applicants often wonder what recourse exists in the event their exemption request is denied. Common reasons include inadequate documentation or failure to meet specific state criteria. However, there are defined steps for appealing decisions, providing individuals with a pathway to recourse if their application does not initially succeed.

Another common inquiry concerns the geographical validity of exemption certificates. Each state has its own rules governing acceptance, meaning that a certificate obtained in one state may not automatically apply in another. Understanding these intricacies ensures that users maximize the effectiveness of their exemption certificates, maintaining compliance across state lines.

Common issues and troubleshooting

While utilizing online tools to fill out and submit the certificate of exemption form, users may encounter various technical challenges. Issues like document format compatibility or connectivity errors can derail the process. If you're using online platforms like pdfFiller, familiarize yourself with their resources for overcoming common fill-out issues to streamline your experience.

Furthermore, understanding common reasons for state-specific rejections can help in preemptively addressing potential problems. Investigating why forms get rejected and how to remedy common issues ensures better preparation for all users seeking exemptions.

Supporting resources and tools

For individuals and businesses navigating the certificate of exemption process, leveraging interactive tools available on platforms such as pdfFiller can facilitate efficient document creation and management. Utilizing these tools not only simplifies the form-filling process but can also drastically reduce the time spent on administrative tasks related to exemptions.

Additionally, linking to various forms and external resources provides a more comprehensive understanding of participatory processes related to tax exemptions. Keeping an eye on available resources will allow users to stay informed and up-to-date on any changes to exemption policies.

User testimonials and success stories

The experience of users navigating the certificate of exemption process often leads to transformative results. Real-life examples illustrate how utilizing services like pdfFiller can save time and enhance efficiency when dealing with documentation. Testimonials frequently highlight how intuitive interfaces help make the otherwise arduous task of paperwork significantly more manageable.

Through these successes, many individuals and teams have shared stories of reduced stress and quicker responses from state authorities, validating the importance of utilizing robust digital tools for such administrative processes. Assessing these experiences can inspire confidence in those facing the certification process for the first time.

Quick links and navigation

Providing easy access to related forms and resources is critical for ensuring users can navigate the complexities of exemption certificates smoothly. Many platforms, including pdfFiller, offer shortcuts to other relevant documentation and tools, making the process far less cumbersome.

Utilizing a centralized resource for navigating essential subforms ensures that users do not have to search extensively for various records. This comprehensive approach streamlines operations for individuals and teams while simultaneously providing information essential for informed decision-making.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit certificate of exemption -agar from Google Drive?

Can I create an electronic signature for the certificate of exemption -agar in Chrome?

How can I fill out certificate of exemption -agar on an iOS device?

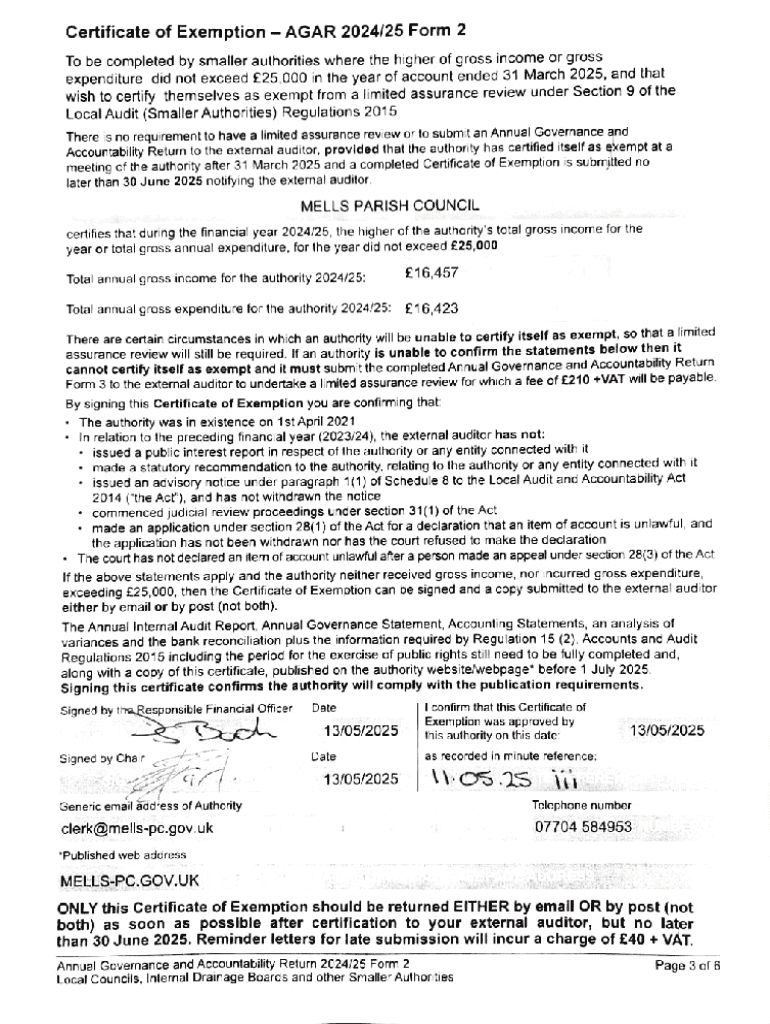

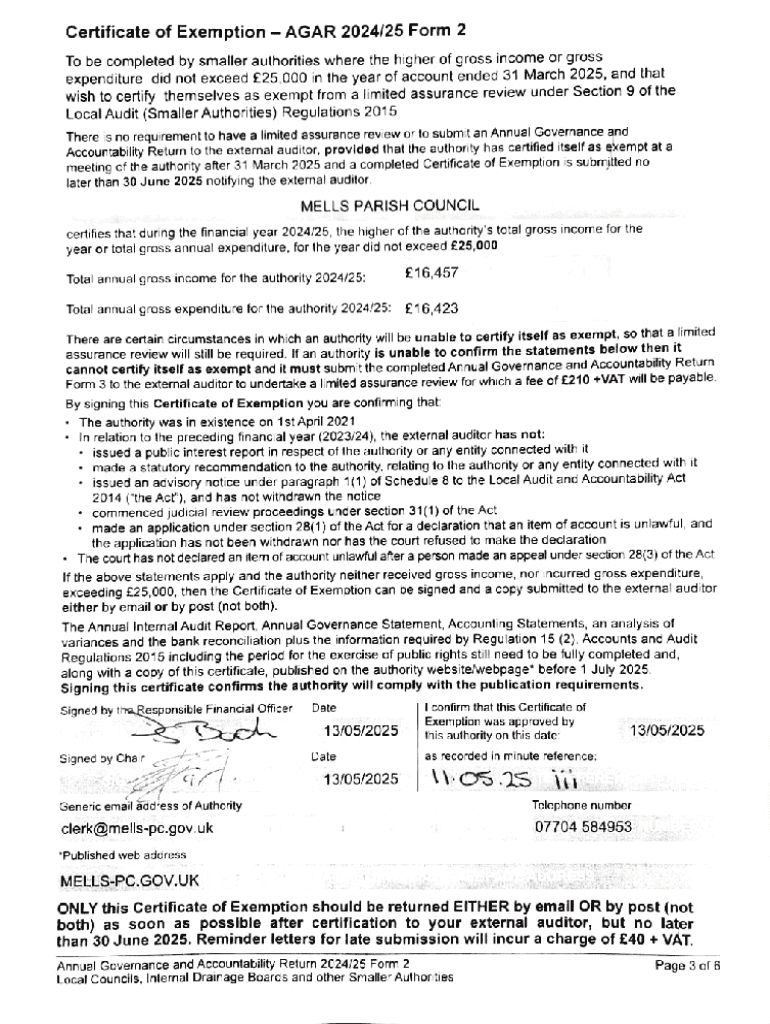

What is certificate of exemption -agar?

Who is required to file certificate of exemption -agar?

How to fill out certificate of exemption -agar?

What is the purpose of certificate of exemption -agar?

What information must be reported on certificate of exemption -agar?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.