Understanding the Council Tax Property Exemption Form

Understanding council tax exemptions

Council tax is a local taxation system used in England, Wales, and Scotland, which helps to fund local services and infrastructure. It is primarily levied based on the estimated value of a property and varies depending on its location. Understanding the exemptions available under this system is crucial for residents, as it can alleviate financial burdens in specific circumstances.

Council tax exemptions can significantly lessen or even eliminate the tax amount owed by qualifying individuals or properties. They provide an essential resource for those in challenging circumstances, such as students or those living in particular types of occupied properties. To determine eligibility, residents must identify if their situation meets the criteria established by local councils.

Eligibility for council tax exemptions can include various factors, such as age, living circumstances, or whether the property is uninhabitable. Recognizing these criteria is the first step towards potentially easing financial responsibilities and ensuring compliance with local regulations.

Types of council tax exemptions

Council tax exemptions are classified into several categories, each with specific eligibility criteria. Here's an overview of notable exemption classes:

Uninhabitable properties that need substantial repairs.

Properties occupied by care leavers.

Unoccupied properties for a limited period.

Properties occupied exclusively by students.

Properties occupied by persons under the age of 18.

Care homes, nursing homes, and residential homes.

Properties occupied by armed forces members.

Property owned by charities.

Properties occupied by the severely mentally impaired.

Occupied by a person in prison.

Occupied by students living away in another property.

Properties occupied by diplomats.

Properties occupied by a person with a disability.

Properties occupied by care leavers.

Properties used by a religious community.

Properties occupied by a person whose sole residence is in another property.

Properties occupied by a caretaker or warden.

Properties occupied exclusively by a school or college.

Properties exempt based on occupation.

Other specific exemptions.

In addition to these, special circumstances may apply, which could grant exemptions based on unique or unforeseen situations, allowing more flexibility in managing council tax obligations.

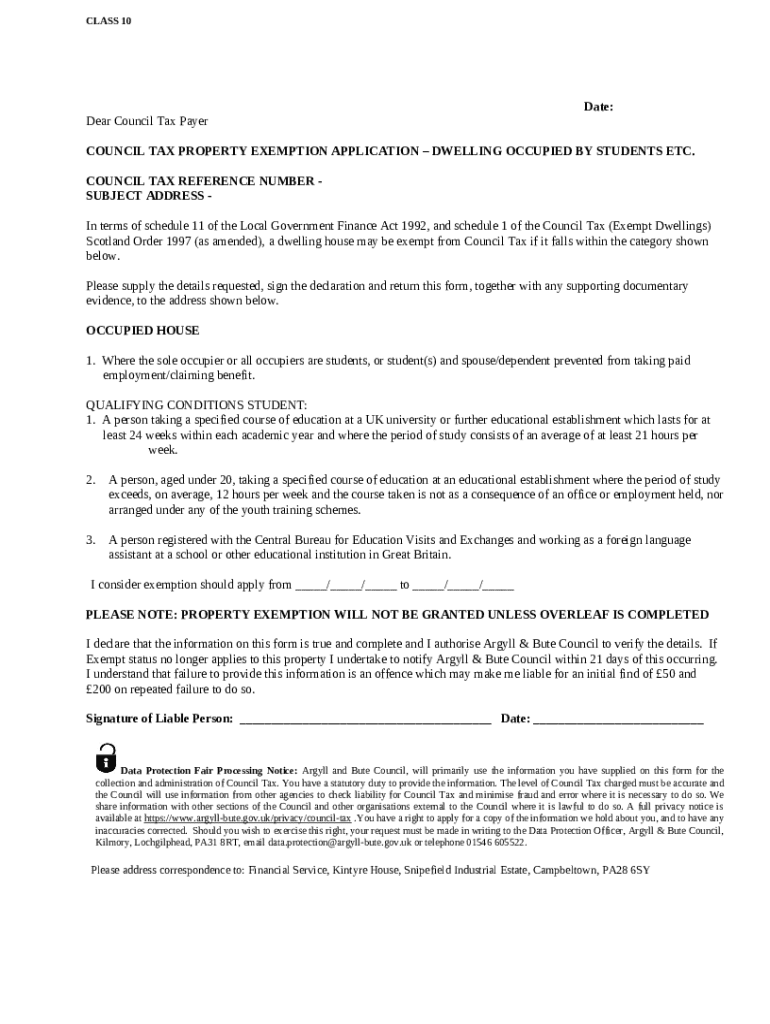

How to apply for council tax property exemption

Applying for a council tax property exemption can be straightforward if you follow the necessary steps. Here's how to navigate the application process effectively.

Gather necessary information including personal details and property specifics.

Fill out the council tax property exemption form accurately, ensuring all fields are completed.

Submit your application to the local council either online or by post.

To ensure a successful application, verify that all required documents are included, and that all the information provided is accurate. Errors or omissions might delay processing or result in denial of the exemption.

Filling out the council tax property exemption form

Completing the council tax property exemption form may seem daunting due to the various fields required. However, approaching the form with an understanding of each section can streamline the process.

Provide your name, address, date of birth, and other identifying details.

Detail the specifics of your property, including its status and ownership.

Attach any relevant documentation that supports your exemption claim.

Common mistakes to avoid include incomplete sections, inaccurate information, or failing to attach necessary documentation. Careful review before submission can save time and increase the likelihood of approval.

Managing your application

After you submit your application for council tax property exemption, it's essential to understand what comes next. Being informed can help you manage this process effectively.

You’ll receive acknowledgment from the council regarding your application and may be informed about processing times.

Councils often have online portals to track the progress of your application.

If your council requests more information, respond promptly to avoid delays.

Staying informed throughout this process can greatly aid in ensuring your exemption is processed successfully and swiftly.

Document management with pdfFiller

Managing and submitting documents online can be simplified with the right tools. pdfFiller presents an ideal solution for handling the council tax property exemption form.

Offers a seamless editing experience and allows users to customize documents according to their needs.

Users can easily edit PDFs, fill forms seamlessly, and ensure they comply with requirements effortlessly.

The platform enables users to eSign documents, ensuring quick and secure submission to councils.

pdfFiller allows teams to collaborate effectively, share documents, and maintain clear communication during the application process.

Utilizing pdfFiller not only streamlines the process but also enhances document security and accessibility so that users can manage their applications from anywhere.

Frequently asked questions

Many individuals may have questions regarding their council tax property exemption applications. Here are some common queries that might arise.

If your application is denied, you may inquire about reasons for denial and consider reapplying with additional information.

You have the right to appeal council decisions, and guidance on this process will be provided with your denial notification.

Exemption eligibility may change, so you must keep abreast of your circumstances and reapply as needed.

Acceptable documents can include proof of student status, ownership documentation, or medical certificates, depending on your exemption category.

These questions provide clarity for those seeking exemptions, fostering understanding and compliance with local guidelines.

Support and resources

Those navigating the council tax property exemption process may need additional support. Here’s where you can find help.

Reach out directly to your local council for specific inquiries or concerns regarding applications.

Your local council website often provides guides, FAQs, and supporting documents related to exemptions.

Explore the official government websites for comprehensive information and updates regarding council tax legislation.

Access to these resources can empower applicants to ensure they are fully informed throughout the exemption process.

Share your experience

Gathering and sharing experiences related to the council tax property exemption process can greatly enhance community knowledge. Users are encouraged to provide feedback on their experiences, whether positive or challenging.

Sharing insights helps to improve the system and empowers others to engage more confidently with the processes involved.

Additionally, taking advantage of document solutions like pdfFiller can streamline the experience for future applicants, leading to more efficient submissions and document management.