Get the free Certificate of Exemption – Agar 2024/25 Form 2

Get, Create, Make and Sign certificate of exemption agar

How to edit certificate of exemption agar online

Uncompromising security for your PDF editing and eSignature needs

How to fill out certificate of exemption agar

How to fill out certificate of exemption agar

Who needs certificate of exemption agar?

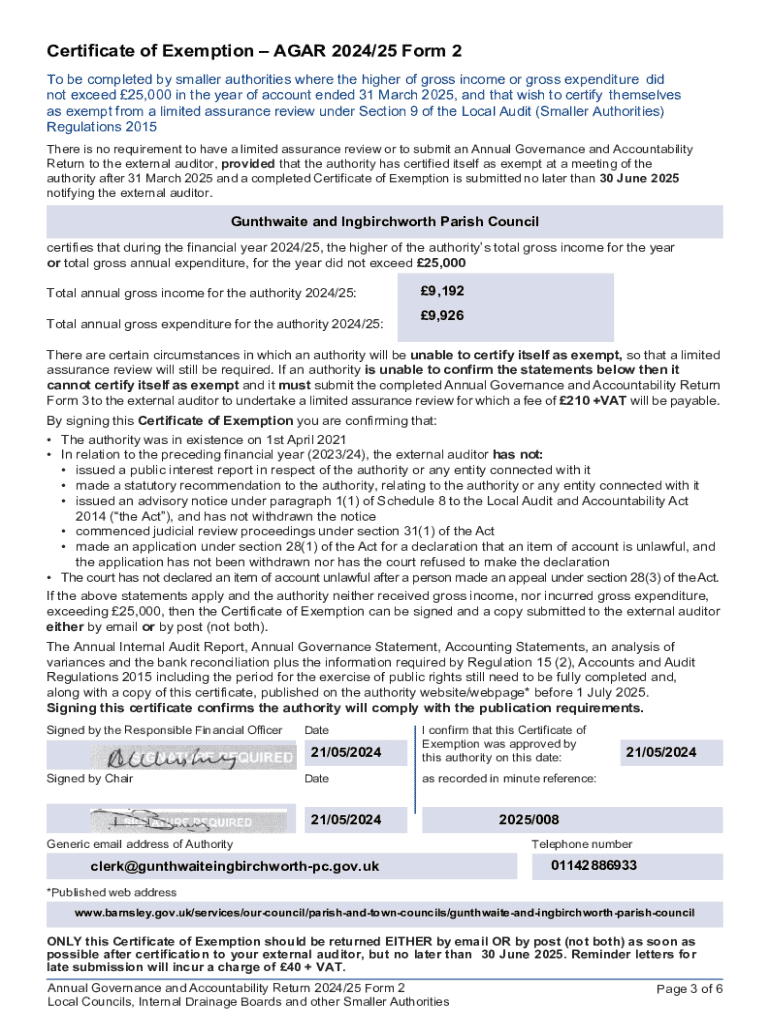

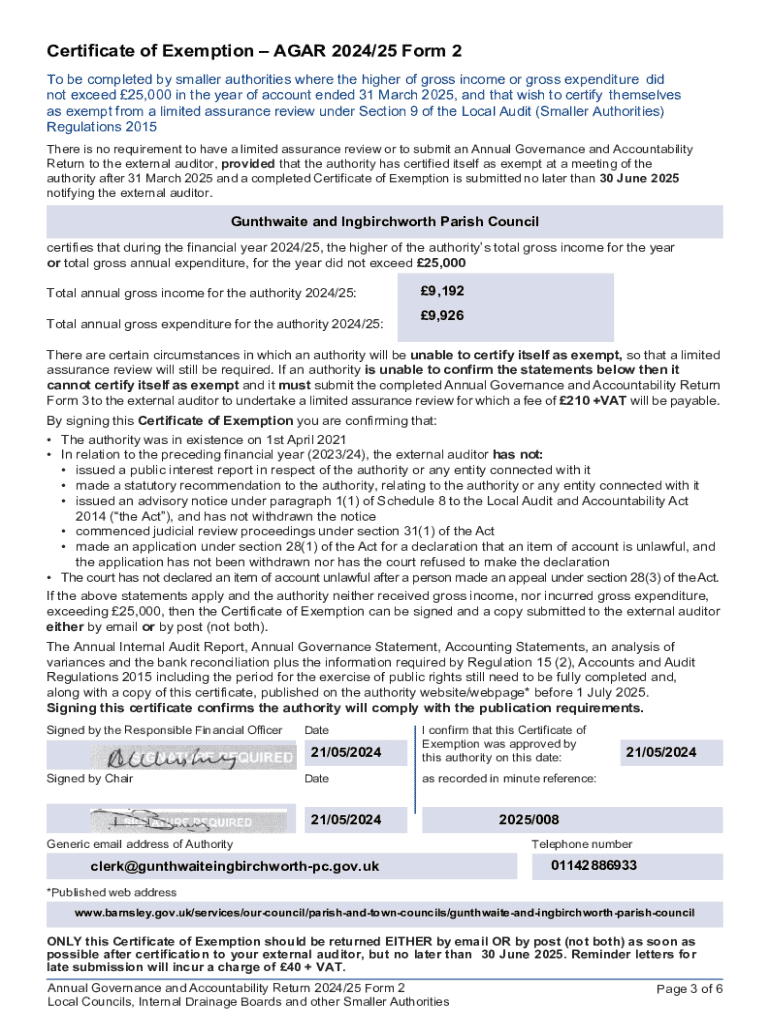

Understanding the Certificate of Exemption AGAR Form

What is the Certificate of Exemption AGAR Form?

The Certificate of Exemption AGAR Form is an essential document required for certain financial reporting contexts within the United Kingdom, primarily for smaller local authorities and community bodies. This form acts as a declaration that an organization meets the criteria for exemption from a more detailed and rigorous audit process as mandated by local government regulations. By submitting this form, entities confirm their eligibility to report their finances in a simplified manner, thereby streamlining compliance efforts.

Importance of the AGAR Form in financial reporting

The AGAR Form is crucial for maintaining transparency and accountability in public financial management. It allows eligible organizations to submit their income and expenditure in a concise format while ensuring adherence to governance standards. The proper use of this form promotes trust among stakeholders, including taxpayers and local community members, by evidencing responsible financial management. Additionally, this form helps in identifying organizations that do not exceed the financial thresholds defined by regulatory bodies, aiding in appropriate financial supervision.

Who needs to use the Certificate of Exemption?

Typically, the Certificate of Exemption AGAR Form is intended for smaller entities, such as parish councils, community groups, or trusts, whose income does not surpass the set thresholds. If your organization’s gross income or total expenditure exceeds £25,000 in a financial year, you will likely need to complete the full AGAR rather than the exemption form. It is advisable for organizations to assess their financial situation annually to determine eligibility for exemption.

Key features of the AGAR Form

The AGAR Form includes various components that facilitate a structured approach to financial reporting. Understanding these key features can help organizations accurately complete the necessary sections without confusion. The form comprises a cover page, various numbered sections addressing different financial aspects, and accompanying notes that provide essential insights.

Breakdown of the AGAR Form structure

The AGAR Form is structured as follows:

Essential information required

Filling out the AGAR Form necessitates several key pieces of information, which include the financial year for which the declaration is made and the organization’s contact data. Specifically, organizations need to ensure they provide their full name, address, and the period covered by the financial reporting to maintain compliance.

Step-by-step guide to completing the Certificate of Exemption AGAR Form

Completing the Certificate of Exemption AGAR Form requires careful preparation. Before diving into the filling process, gather all necessary documentation and previous financial statements. This preparation will streamline your process and improve accuracy.

Pre-filling preparation: documentation needed

Ensure you have easy access to documents covering previous financial years, bank statements, records of income and expenditure, and notes on significant transactions. A well-organized financial record will simplify the process of completing the AGAR Form.

Detailed instructions for each section

Common questions when filling out the form

It is common to encounter uncertainties when filling out the AGAR Form. Here are frequently asked questions (FAQs) that can assist individuals and teams as they complete the process effectively.

Editing and managing your AGAR Form with pdfFiller

pdfFiller simplifies the process of editing the Certificate of Exemption AGAR Form by offering an intuitive online platform. Users can efficiently create, edit, and manage their documents from any device, facilitating accessibility and convenience.

Accessing and editing your form online

To get started, upload your AGAR Form directly from your device to pdfFiller. The platform allows you to import documents in various formats, ensuring compatibility and ease of use. Additionally, you can leverage customizable templates, which enhance efficiency by providing a pre-structured layout for your inputs.

Utilizing pdfFiller’s editing tools

Once your form is uploaded, pdfFiller’s robust editing tools allow you to add text, annotations, and even signatures seamlessly. This capability reduces the effort required to go back and forth with physical paperwork while providing legal weight through e-signatures. Users can also track changes and collaborate with team members, enhancing teamwork and reducing errors.

Signing and securing the Certificate of Exemption AGAR Form

Signing the Certificate of Exemption AGAR Form is a critical step in ensuring its legitimacy. Electronic signatures provided through platforms like pdfFiller are legally binding and simplify the signatory process, enabling faster submissions and confirmations.

The importance of eSigning your form

eSigning adds a level of authenticity and accountability to the document. Without a valid signature, the form may be subject to rejection, resulting in delays and potential complications regarding filing compliance. pdfFiller supports eSigning, ensuring your documents are recognized and accepted by relevant authorities.

How to eSign with pdfFiller

To eSign with pdfFiller, simply navigate to the signature section on your document, where you can select an existing eSignature or create a new one. This feature allows for personalized touches, such as handwriting mimicry or text-based signatures, further enhancing user experience.

Ensuring document security and GDPR compliance

When handling sensitive financial documents, adhering to security protocols is paramount. pdfFiller guarantees a high level of security, protecting your data and ensuring compliance with GDPR regulations, which is crucial for safeguarding client and organizational information throughout the documentation process.

Navigating the submission process

After completing the Certificate of Exemption AGAR Form, the next step is to ensure proper submission. Knowing where and how to submit your form effectively avoids penalties and late submissions.

Where to submit your completed form

Typically, the completed AGAR Form should be submitted to the local audit authority or relevant governing body in your area. It's critical to double-check submission guidelines specific to your locality to ensure regulatory compliance.

Important deadlines for submission

Deadline adherence is key. Local authorities often set specific periods within which the AGAR Form must be filed. Generally, organizations must submit their documentation within a specific timeframe following the end of the financial year, usually by September 30th for most entities. Always review local regulations to confirm exact dates.

Tracking your submission progress

Post-submission, it is wise to track your submission progress. Most local authorities provide systems for tracking the status of submitted forms, enabling proactive management and follow-up if necessary.

Troubleshooting common issues

Despite careful preparation, common issues can arise when completing the AGAR Form. It’s critical to be aware of these potential pitfalls and know how to address them effectively.

Common mistakes when filling out the AGAR Form

Many organizations overlook key details such as signing the form or double-checking figures before submission. Mistakes in income or expenditure totals can lead to delays or the need for corrections. To minimize these issues, always employ a review process to catch errors early.

How to correct errors after submission

If you realize an error after submission, contact your local audit authority immediately. Many organizations have protocol in place for such situations, allowing for amendments to be made to your submission.

Contacting support for assistance

If you encounter persistent issues, don't hesitate to reach out for help. Most local authorities and community bodies provide contact numbers and email addresses specifically for inquiries related to AGAR submissions. Furthermore, assistance from pdfFiller's support team can provide valuable insights during your document management process.

Special considerations and updates

As regulatory landscapes evolve, remaining informed about changes affecting the Certificate of Exemption AGAR Form is essential. Organizations should take proactive steps to ensure compliance with updates, which may impact submission processes or thresholds.

Recent changes to the AGAR requirements

Recent years have seen updates to financial reporting requirements, including changes to income thresholds and what constitutes an eligible organization. It is wise to stay abreast of these developments through reputable sources such as local government or professional organizations focused on financial governance.

Resources for staying updated on forms and regulations

Engaging with several resources, including local authority websites, financial management training organizations, and dedicated forums, can help organizations remain updated on pertinent regulations and best practices related to AGAR forms.

Tips for future submissions

For smoother future submissions, consider maintaining ongoing financial documentation throughout the year and training team members involved in the process. A well-prepared team can significantly impact the accuracy and efficiency of AGAR Form completions.

Community and support resources

Engaging with community forums or support groups that focus on local government finance can be beneficial. Connecting with others who are also navigating the AGAR Form process can offer shared insights, tips, and approaches to common challenges.

Engaging with others who file the AGAR Form

Collaboration can significantly enhance your understanding of the AGAR Form. Participating in discussions or forums can provide alternative viewpoints and recommendations on various aspects of the form and completion process.

Forums and networking opportunities

Look for local workshops, webinars, or online webinars focused on financial reporting for local governments or community bodies. These networking opportunities can facilitate connections with experienced practitioners who have valuable insights to share.

Contact information for personal assistance

In need of additional support? Reach out to local municipal offices or community financial governance bodies for more information. Furthermore, pdfFiller's customer support team is readily available to assist with navigating document creation and management, ensuring you have the resources at your disposal.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my certificate of exemption agar directly from Gmail?

How do I edit certificate of exemption agar online?

How do I edit certificate of exemption agar straight from my smartphone?

What is certificate of exemption agar?

Who is required to file certificate of exemption agar?

How to fill out certificate of exemption agar?

What is the purpose of certificate of exemption agar?

What information must be reported on certificate of exemption agar?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.