Get the free 2025 Indiana Residential Rebate Application

Get, Create, Make and Sign 2025 indiana residential rebate

Editing 2025 indiana residential rebate online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2025 indiana residential rebate

How to fill out 2025 indiana residential rebate

Who needs 2025 indiana residential rebate?

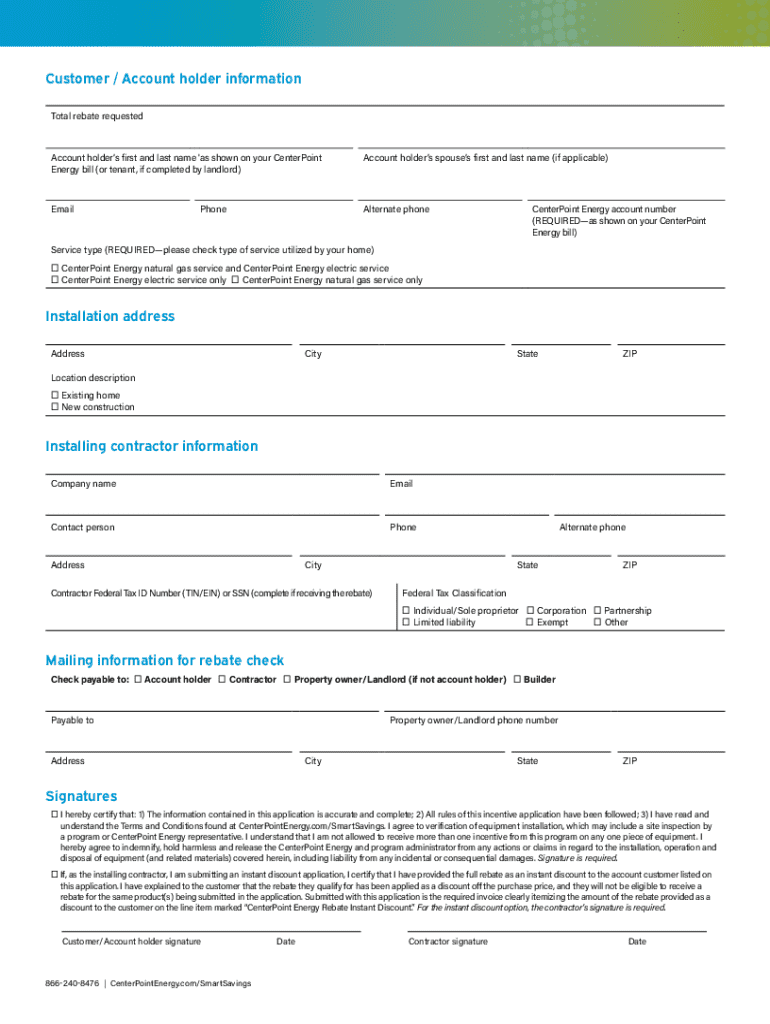

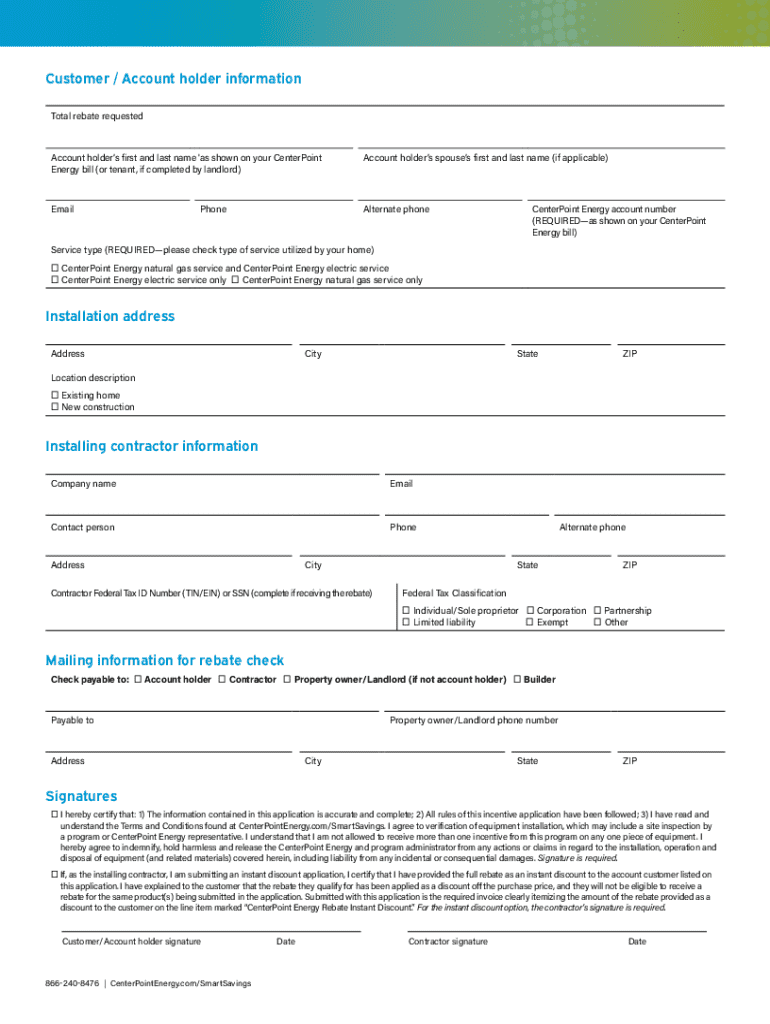

Navigating the 2025 Indiana Residential Rebate Form

Overview of the 2025 Indiana Residential Rebate Form

The 2025 Indiana Residential Rebate Form is a crucial document for homeowners looking to take advantage of energy efficiency rebates offered by the state of Indiana. This rebate program aims to incentivize homeowners to make energy-efficient upgrades to their homes, reducing energy consumption and lowering utility bills. By leveraging this rebate, property owners can significantly offset the costs associated with energy improvements, making it more affordable to implement sustainable practices in their residences.

Utilizing the 2025 Indiana Residential Rebate Form not only helps improve the efficiency of homes throughout Indiana but also promotes environmental sustainability. Homeowners who participate can enjoy key benefits including financial savings, potential increases in property value through energy-efficient upgrades, and participation in state-wide efforts to reduce carbon emissions. In addition, the rebate process is designed to be straightforward, guiding homeowners in claiming their entitled rebates without undue complexity.

Eligibility criteria

To qualify for the 2025 Indiana Residential Rebate Form, homeowners must meet specific eligibility criteria. The primary requirement is homeownership; applicants must own the home where the energy upgrades are being implemented. Moreover, there are income limits established by the state to ensure that the program is accessible to a broad range of homeowners, particularly those with lower to moderate incomes. Income verification is generally required during the application process.

Furthermore, applicants must provide evidence of having made qualifying energy efficiency upgrades. These upgrades often include the installation of Energy Star appliances, high-efficiency heating and cooling systems, or enhanced insulation. Homeowners should ensure their improvements are documented and comply with the state’s guidelines for rebate eligibility. Other factors such as geographic location and the type of residential structure can also influence eligibility, making it essential for applicants to review the specific requirements set forth for their circumstances.

Key dates and deadlines

Understanding the timeline for the 2025 Indiana Residential Rebate Form application process is essential for a successful submission. The application period generally opens at the beginning of the year, and homeowners should be aware of specific deadlines for submitting their forms. Typically, completed applications must be submitted within a designated period after the energy upgrades are completed, often within six months.

For 2025, important dates include the opening of the rebate application portal, which is often announced in late December of the previous year, and the closing date, typically falling at the end of the year. Homeowners are encouraged to keep abreast of any announcements regarding extensions or renewals of the rebate program in case they miss the initial deadline. Regularly checking official state websites or local government announcements can ensure that homeowners do not miss crucial submission windows.

Step-by-step guide to completing the rebate form

Completing the 2025 Indiana Residential Rebate Form can seem daunting, but taking it step-by-step simplifies the process. Here’s how to do it efficiently.

Frequently asked questions (FAQs)

Navigating the specifics of the rebate form can lead to various queries. Below are some common FAQs that can provide clarity.

Additional resources and tools

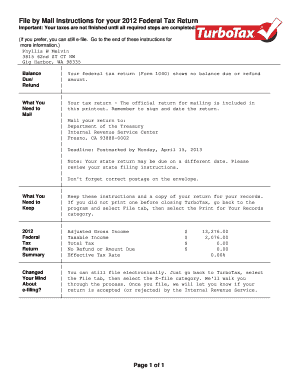

Using document management tools can further enhance your experience while navigating the rebate application. pdfFiller offers an intuitive platform where users can manage their documents seamlessly.

Some of the tools available through pdfFiller include secure document editing and signing options, as well as collaboration features that allow multiple users to work on applications concurrently. These tools are designed to facilitate a smooth process, ensuring that all required documentation is in place before submission.

Contact information for assistance

Having access to support is essential during the application process. Homeowners can reach out for assistance through several channels.

Tips for maximizing your rebate experience

To ensure you get the most out of your application for the 2025 Indiana Residential Rebate Form, consider these tips.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit 2025 indiana residential rebate online?

How do I edit 2025 indiana residential rebate on an Android device?

How do I fill out 2025 indiana residential rebate on an Android device?

What is 2025 indiana residential rebate?

Who is required to file 2025 indiana residential rebate?

How to fill out 2025 indiana residential rebate?

What is the purpose of 2025 indiana residential rebate?

What information must be reported on 2025 indiana residential rebate?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.