Get the free Significant Financial Interest Disclosure Form

Get, Create, Make and Sign significant financial interest disclosure

Editing significant financial interest disclosure online

Uncompromising security for your PDF editing and eSignature needs

How to fill out significant financial interest disclosure

How to fill out significant financial interest disclosure

Who needs significant financial interest disclosure?

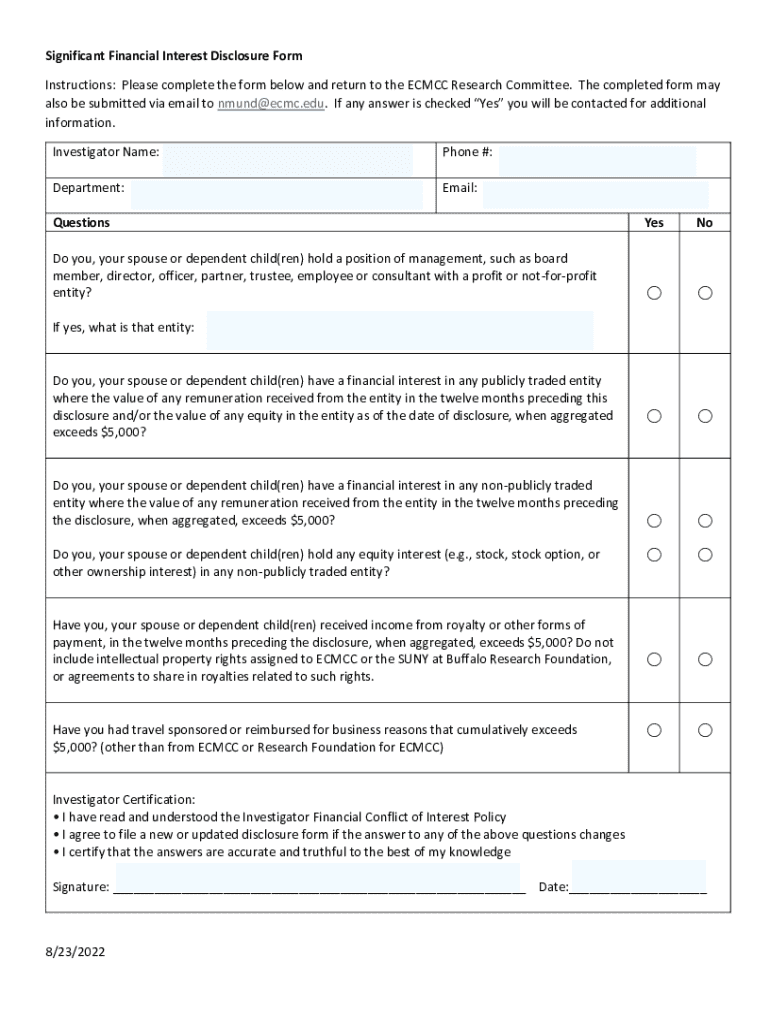

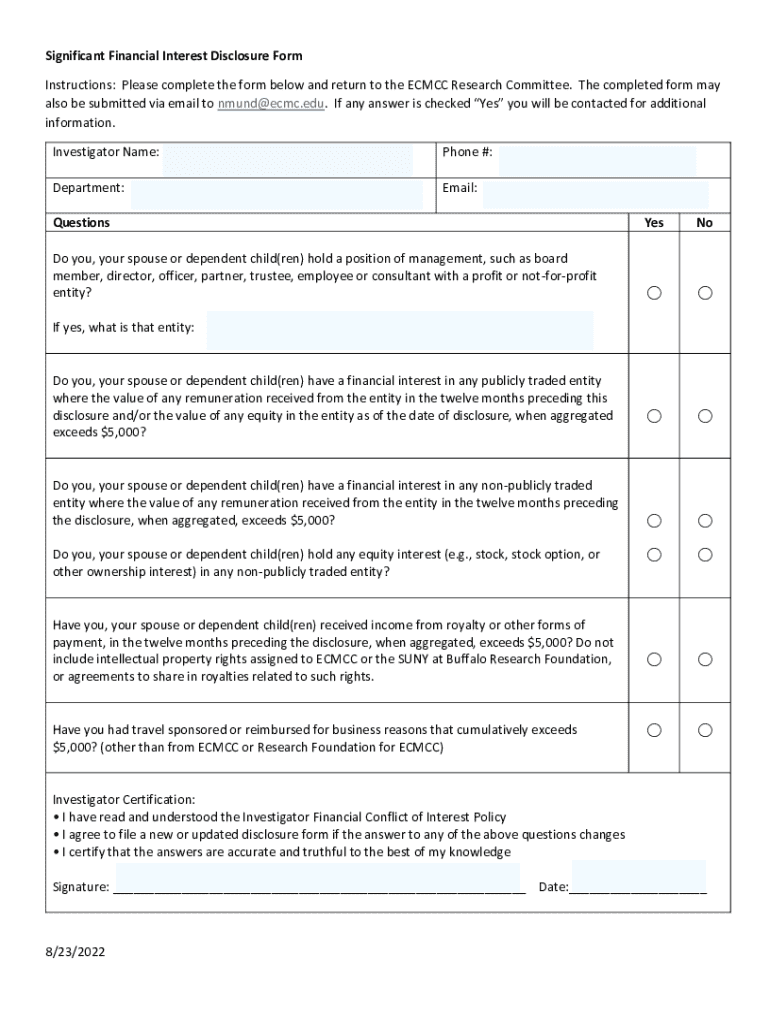

Understanding the Significant Financial Interest Disclosure Form

Understanding significant financial interests

Significant Financial Interests (SFIs) refer to financial interests that could influence an individual's research activities. These interests might spark questions regarding objectivity and the integrity of research findings. SFIs include equity in public and private companies, intellectual property rights, and financial contributions received in the previous year. The critical aspect to consider is how these financial interests could affect research outcomes, especially in cases where the research is funded by federal grants.

The importance of SFIs in research and grant applications cannot be overstated. Institutions require this disclosure to ensure transparency and maintain public trust in research integrity. Furthermore, regulatory bodies like the National Institutes of Health (NIH) and the U.S. Department of Health and Human Services have set strict guidelines governing these disclosures. Adhering to these regulations not only provides a safeguard for the institution but also protects the interests of researchers and participants alike.

Who must complete a significant financial interest disclosure form?

Various stakeholders are obliged to complete a significant financial interest disclosure form, primarily to uphold the integrity of research. This group is inclusive of researchers, faculty, staff, collaborators, and consultants engaged in research activities. Each person's financial interests should be disclosed to avoid any perception of bias. Furthermore, it's essential to communicate these interests clearly to comply with institutional policies.

However, certain special cases may warrant exemptions from disclosing. For example, individuals who hold minimal affiliations, such as those with no direct involvement in funded research or less than $5,000 in equity interests, may not need to submit the form. Understanding who qualifies for exemptions ensures that the disclosure process remains streamlined while upholding compliance.

What do you need to disclose?

When filling out a significant financial interest disclosure form, it’s important to understand the different categories of financial interests that must be reported. Equity interests in publicly traded companies, interests in privately held firms, intellectual property rights, and gifts or other financial benefits can all fall under significant financial interests. Each category presents a unique scenario that could pose a conflict of interest.

Specific examples of disclosable interests can include owning stock in a pharmaceutical company while overseeing a clinical trial related to their product. Moreover, receiving consulting fees for advising on a project that you are also researching could also constitute a significant financial interest. Recognizing and reporting such interests is crucial to avoid conflicts that may compromise the credibility of the research.

When is disclosure required?

Disclosure requirements begin before any research proposal is submitted. This pre-award disclosure is crucial for ensuring that no potential conflicts arise that could compromise the integrity of the research. Furthermore, ongoing disclosures throughout the research project are equally important to maintain transparency with funding bodies and institutional policies.

Each institution typically establishes its own reporting deadlines and compliance timelines. Triggering events, including acquiring a new grant, approaching a specific dollar amount in consulting fees, or establishing new affiliations require immediate disclosure. Staying informed about these timelines is essential to avoid penalties and ensure continued research funding.

How to fill out the significant financial interest disclosure form

Filling out the significant financial interest disclosure form can be straightforward with the right guidance. Start by accessing the form on pdfFiller, where you can easily navigate and fill in the needed information. Key personal details such as your name, position, and department are fundamental, along with a thorough disclosure of financial interests.

While completing the form, it is critical to ensure that all fields are accurately filled. Be meticulous with your financial information, ensuring that all relevant figures are reported. Common pitfalls include omitting interests or failing to report outside compensation. To avoid these, utilize pdfFiller’s interactive tools which offer prompts and tips throughout the form completion process.

Electronic submission of disclosure forms

The convenience of submitting the significant financial interest disclosure form electronically cannot be overstated. Using pdfFiller, you can easily submit completed forms directly from your device, ensuring that all disclosures reach the appropriate institutional offices promptly. This method eliminates the complexities associated with paper submissions.

Cloud-based submission platforms like pdfFiller enhance accessibility and convenience for users. They offer robust security features, protecting sensitive information while allowing easy access to forms when needed. The secure, electronic nature of submissions means that users no longer have to worry about lost paperwork or delays.

How is disclosure information used?

The review process for significant financial interest disclosures is critical to maintaining the integrity of research. Upon receiving the disclosures, institutional review boards (IRBs) and compliance offices evaluate the information to assess compliance with regulations. This review ensures that any potential conflicts of interest are addressed proactively.

The outcomes of these evaluations can vary. In some cases, disclosures may simply be approved, allowing the research to proceed unaffected. However, depending on the nature of the interests disclosed, required management plans may be necessary to mitigate any perceived conflicts. Such management strategies should be developed collaboratively with the institution to ensure alignment with ethical standards.

Strategies for managing disclosed interests

Developing a conflict of interest management plan is pivotal for researchers who have disclosed significant financial interests. Such a plan should outline steps to manage potential conflicts, ensuring that research integrity remains intact. Institutions often provide frameworks and guidance to help researchers navigate these challenging waters effectively.

Ongoing compliance and monitoring resources are essential for managing interests. Engaging with transparency and integrity throughout the research process strengthens public trust and fosters ethical research practices. By actively participating in the conflict management process, researchers can preemptively address any potential issues, thereby safeguarding both their work and their institution.

Interactive tools on pdfFiller

pdfFiller enhances the user experience with a variety of interactive tools that facilitate the completion and management of significant financial interest disclosure forms. Features such as editing capabilities allow users to customize forms according to their specific circumstances while ensuring compliance with institutional guidelines.

Additionally, eSignature capabilities mean that forms can be approved quickly and seamlessly, facilitating faster processing times. Collaborative options allow teams to work together in real-time, enhancing efficiency in completing necessary documents. Overall, these interactive tools significantly simplify the management of disclosures.

Enhancing your document management experience

Transitioning to cloud-based document solutions like pdfFiller offers numerous benefits for managing significant financial interest disclosures. Not only does it provide secure storage solutions, but it also enables users to access their documents from anywhere, fostering productivity and flexibility.

By using pdfFiller's comprehensive document management features, individual researchers and teams can streamline their workflows. The platform’s in-built security measures ensure that sensitive data is protected while enhancing user experience. This means that users can focus on their research without the added stress of managing paper-based documents.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in significant financial interest disclosure?

Can I create an electronic signature for signing my significant financial interest disclosure in Gmail?

Can I edit significant financial interest disclosure on an Android device?

What is significant financial interest disclosure?

Who is required to file significant financial interest disclosure?

How to fill out significant financial interest disclosure?

What is the purpose of significant financial interest disclosure?

What information must be reported on significant financial interest disclosure?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.