Get the free SEPA Direct Debit Mandate: Automatic Payment of Taxes ...

Get, Create, Make and Sign sepa direct debit mandate

Editing sepa direct debit mandate online

Uncompromising security for your PDF editing and eSignature needs

How to fill out sepa direct debit mandate

How to fill out sepa direct debit mandate

Who needs sepa direct debit mandate?

A complete guide to the SEPA Direct Debit Mandate Form

Understanding the SEPA Direct Debit Mandate

SEPA, or the Single Euro Payments Area, is an initiative aimed at simplifying bank transfers across Europe. The SEPA Direct Debit is a popular payment method where a person authorizes a company or organization to withdraw funds directly from their bank account on a predetermined schedule. This payment method provides notable advantages, such as reducing the administrative burden of manually processing payments and ensuring timely transactions.

One of the key benefits of using SEPA Direct Debit is the convenience of automation. Once set up, payments are made automatically, enabling businesses to manage their cash flow more effectively. It is especially beneficial for recurring invoices, like subscription services or utility bills, allowing consumers to avoid missed payments or late fees. Moreover, the cross-border functionality under SEPA ensures that transactions can occur seamlessly between participating countries, eliminating challenges faced during international payments.

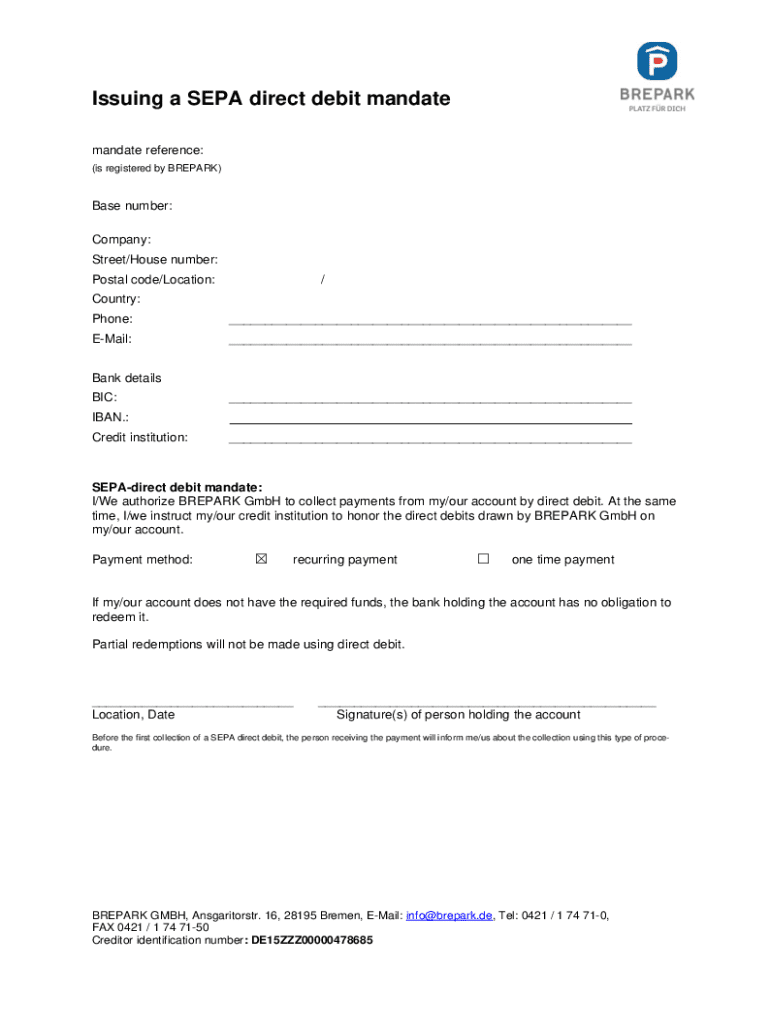

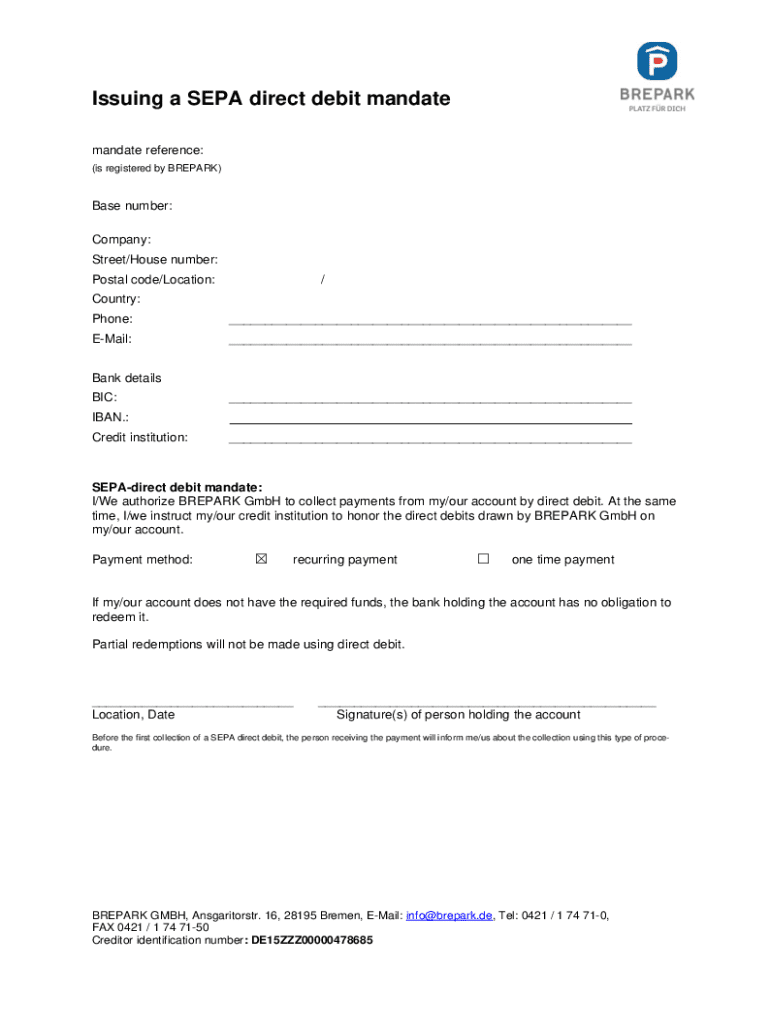

Components of a SEPA Direct Debit Mandate Form

A SEPA Direct Debit Mandate Form is composed of several crucial components. Firstly, it requires essential information about both the payer and the payee. The payer's details include their full name, residential address, and banking information, such as the International Bank Account Number (IBAN). On the other hand, the payee's details should also cover their name, address, and their bank details, specifically the IBAN and Business Identifier Code (BIC).

Another important feature is the Mandate Reference Number. This unique identifier is vital for tracking purposes and helps both parties verify the mandate's validity. Furthermore, the mandate form must be signed and dated by the payer. This signature is a declaration of consent, confirming that the payer agrees to the terms of the direct debit, thus ensuring all transactions are authorized.

How to fill out the SEPA Direct Debit Mandate Form

Filling out a SEPA Direct Debit Mandate Form may initially seem daunting, but it can be simplified. Here’s a step-by-step guide to help you through the process:

Editing and customizing your SEPA Direct Debit Mandate Form

Oftentimes, businesses may wish to customize their SEPA Direct Debit Mandate Form to reflect their branding. Platforms like pdfFiller provide an excellent solution for editing these documents. With an easy-to-use interface, users can quickly make changes, insert logos, or update payment terms as needed. Using pdfFiller’s robust editing tools, you can effectively personalize your form to align with your organization's branding and professional aesthetic.

Additionally, if there are any changes in the payer's or payee's details, existing mandates can be revised efficiently. Returning to the previously saved document on pdfFiller allows for updating details, ensuring that the document reflects the current agreement without having to start from scratch.

Where to submit your SEPA Direct Debit Mandate Form

After completing the SEPA Direct Debit Mandate Form, knowing where to submit it is essential. Users have multiple submission options depending on their bank's policies. Generally, the most straightforward method is to submit the form directly to your bank branch. However, many banks now allow for electronic submissions, enhancing convenience for tech-savvy customers.

To ensure your mandate has been successfully recognized and activated, it's advisable to seek confirmation from your bank. This can often be done through online banking services where you can access the status of your mandates. Keeping communication open with your bank can proactively prevent issues when payments are automatically withdrawn.

Managing your SEPA Direct Debit Mandate

Once you have submitted your SEPA Direct Debit Mandate, managing ongoing transactions becomes essential. Regularly monitoring your bank account for direct debit payments can help ensure accuracy in amounts and schedules. Many banking apps now provide access to transaction histories, enabling users to keep track of withdrawals easily and identify any discrepancies promptly.

In case you need to cancel or revoke your mandate, it's important to act quickly. To do so, contact your bank and follow their specified procedures, often involving providing the old mandate information and possibly signing another form for confirmation. Keeping documentation of your initial mandate and any cancellation requests can safeguard against future misunderstandings. Proper management ensures that your finances remain under control, safeguarding against unauthorized or unwanted withdrawals.

Common issues and how to resolve them

Managing a SEPA Direct Debit Mandate does come with its set of challenges. Occasionally, you may experience payment failures, which can be frustrating. If a payment fails, the first course of action is to review your bank account for available funds or verify that the details on the mandate form were correct. If the problem persists, reaching out to your bank's customer service is the best approach to find a solution.

Moreover, there are frequently asked questions regarding the legality and functioning of SEPA Direct Debits. Users often inquire about how to dispute a transaction or revoke consent for a mandate. Understanding your rights and the bank's procedures for handling such disputes is vital to ensure that you can resolve issues efficiently.

Using pdfFiller for ongoing document management

Utilizing a cloud-based solution like pdfFiller grants users numerous advantages in managing documents such as the SEPA Direct Debit Mandate Form. One of the significant benefits is document accessibility; users can access their forms from anywhere, whether at home or in an office setting, ensuring that you always have your important documents at hand.

Additionally, pdfFiller facilitates team collaboration, allowing multiple members to view, edit, or comment on documents in real-time. Tips for storing and sharing your SEPA Direct Debit Mandate Form through pdfFiller include utilizing secure links or sending invites to collaborators within your organization, ensuring everyone has the most up-to-date version of the document is crucial for seamless operational processes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute sepa direct debit mandate online?

How do I edit sepa direct debit mandate in Chrome?

How do I edit sepa direct debit mandate on an Android device?

What is sepa direct debit mandate?

Who is required to file sepa direct debit mandate?

How to fill out sepa direct debit mandate?

What is the purpose of sepa direct debit mandate?

What information must be reported on sepa direct debit mandate?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.