Get the free 2021 Tax Rate Calculation Worksheet

Get, Create, Make and Sign 2021 tax rate calculation

How to edit 2021 tax rate calculation online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2021 tax rate calculation

How to fill out 2021 tax rate calculation

Who needs 2021 tax rate calculation?

2021 Tax Rate Calculation Form - How-to Guide

Understanding the 2021 tax rate calculation form

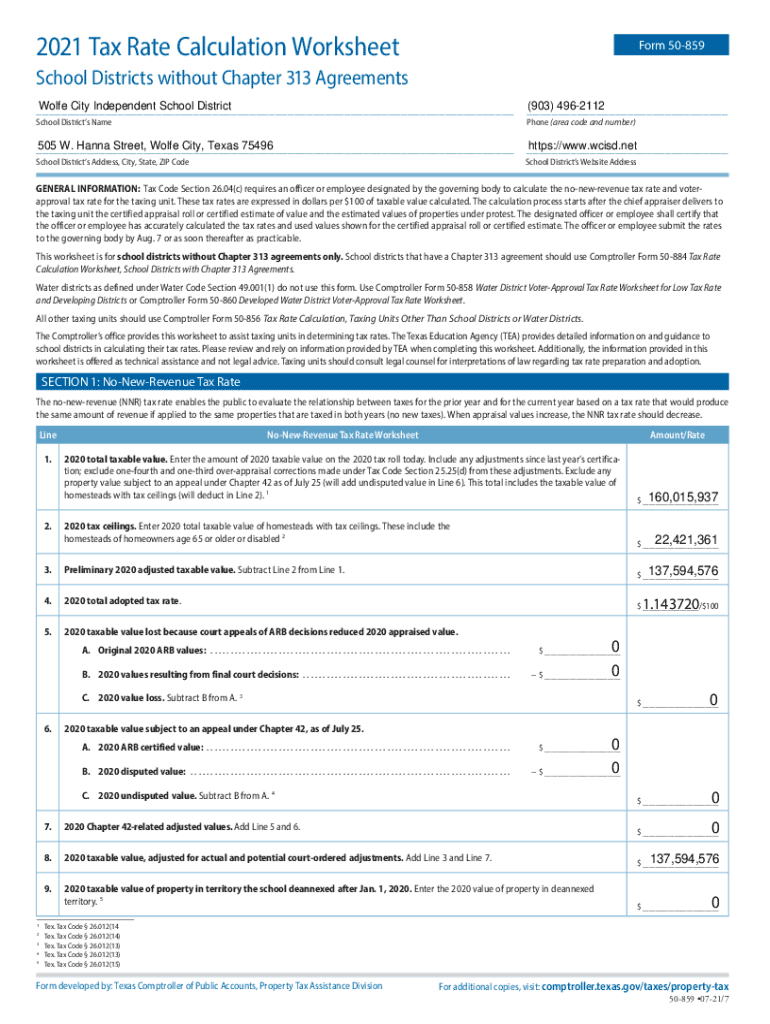

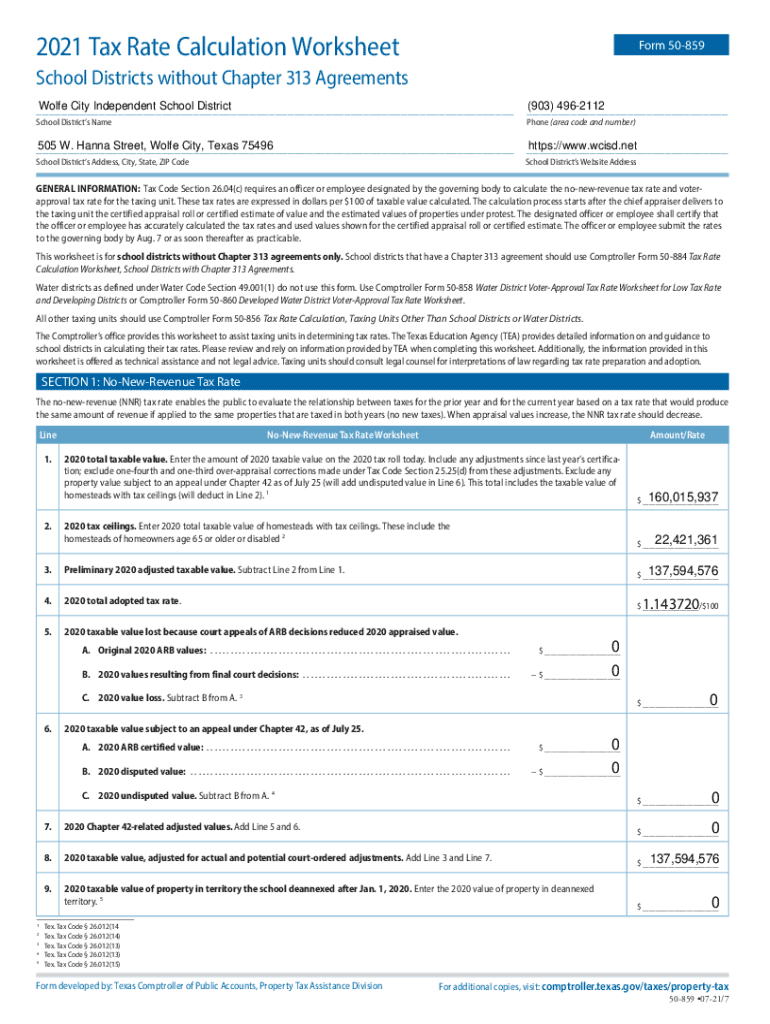

The 2021 tax rate calculation form is an essential document that allows taxpayers to determine their tax liabilities based on their annual income and applicable deductions. This form is vital during tax season, as it provides a structured approach to calculating how much one owes to the government or what refunds they may receive. Understanding its components is crucial for both individuals and teams to streamline their tax filing process.

As part of the broader tax filing process, the 2021 tax rate calculation form not only aids in ensuring compliance with tax laws but also helps taxpayers optimize their financial standing by identifying potential deductions and credits. This overview serves as a foundation for effectively navigating the more detailed sections of this guide.

Navigating the 2021 tax rate tables

Understanding the tax brackets for 2021 is crucial for accurately completing your tax return. The federal individual income tax brackets for 2021 range from 10% to 37%, depending on the taxpayer’s income level and filing status.

Corporate tax rates in 2021 remain at a flat rate of 21%, established under the Tax Cuts and Jobs Act. This simplicity allows businesses to calculate their tax obligations with consistency.

Utilizing the tax rate calculator

To simplify your calculations, the interactive 2021 tax rate calculator is an invaluable tool. This online resource allows individuals and teams to quickly ascertain their tax liability based on input variables. Here is a step-by-step guide on how to use this calculator effectively.

The calculator also allows you to compare different scenarios—such as changes in income or deductions—giving you insights into how these variables can impact your tax bill.

Key tax deductions and credits

The standard deduction for 2021 is $12,550 for single filers and $25,100 for married couples filing jointly, a significant increase from the previous year. This deduction is pivotal because it reduces your taxable income, thus lowering your overall tax bill. Understanding how to maximize this deduction is key to effective tax planning.

While personal exemptions have been eliminated, there are still various credits worth noting. Major tax credits include:

Leveraging these deductions and credits effectively can substantially reduce your tax bill, enhancing your financial health as a whole.

Special considerations for the 2021 tax year

Several changes have impacted the 2021 tax year relative to the previous years, mainly due to the ongoing effects of the COVID-19 pandemic. The American Rescue Plan Act introduced stimulus payments and enhanced unemployment benefits, which must be accounted for when calculating taxable income.

Common pitfalls include failing to report stimulus payments correctly and overlooking changes in tax legislation that can directly affect deductibility. Taxpayers should be cautious and double-check all entries to avoid costly mistakes.

Frequently asked questions (FAQs)

Filling out the 2021 tax rate calculation form can be challenging. Here are some common questions and answers.

Your rights and obligations as a taxpayer

As a taxpayer, understanding your rights is essential when dealing with the IRS. You have the right to be informed, to challenge the IRS’s position, and to appeal if you disagree with a tax decision.

It’s critical for taxpayers to familiarize themselves with these rights to ensure their interests are protected throughout the tax process. Knowing how to file an appeal can also be beneficial when disputes arise.

Leveraging pdfFiller for your 2021 tax form needs

pdfFiller provides a robust platform tailored for tax documentation management. Users can effortlessly edit PDFs, electronically sign forms, and collaborate with teams, all from a cloud-based solution.

Features of pdfFiller include:

Accessing the 2021 tax rate calculation form through pdfFiller simplifies the organization of your documents and records, promoting a streamlined tax filing experience.

Upcoming changes and planning for 2022 and beyond

As tax laws evolve, it's crucial to stay informed about upcoming changes that may affect your future tax filings. Preliminary discussions surrounding the revisions to deductions and credits for the 2022 tax year highlight the need for strategic planning.

Taxpayers should begin reviewing their financial situations and consider adjustments that may maximize their benefits. Utilizing resources like pdfFiller for understanding tax-related changes will empower you to stay proactive in your tax planning.

Related articles and topics for further research

For those interested in broadening their tax knowledge, there are numerous resources available. Exploring previous years' tax forms and calculations will provide insights into trends and changes over time. Additionally, following tax policy developments will keep you well-informed about what to expect in future filings.

Further, engaging with materials focused on financial literacy and tax education empowers individuals and teams to make informed financial decisions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send 2021 tax rate calculation for eSignature?

How do I execute 2021 tax rate calculation online?

How do I fill out 2021 tax rate calculation on an Android device?

What is 2021 tax rate calculation?

Who is required to file 2021 tax rate calculation?

How to fill out 2021 tax rate calculation?

What is the purpose of 2021 tax rate calculation?

What information must be reported on 2021 tax rate calculation?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.